FX Daily Strategy: Europe, May 22nd

NZD jumped on RBNZ's upward OCR revision

GBP risks slightly on the downside on UK CPI

The USD could benefit from more hawkish FOMC minutes

NZD jumped on RBNZ's upward OCR revision

GBP risks slightly on the downside on UK CPI

The USD could benefit from more hawkish FOMC minutes

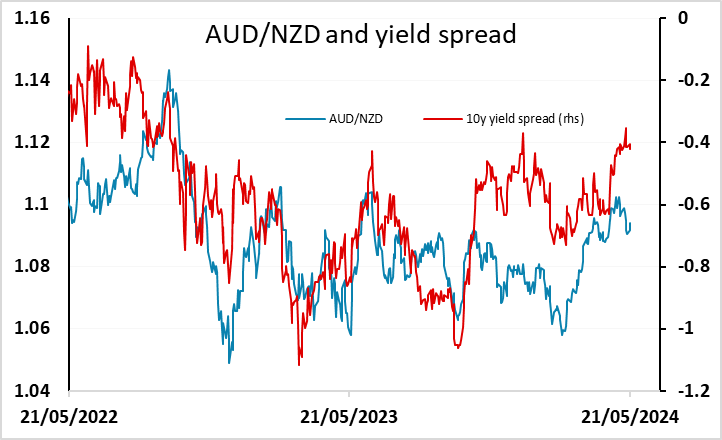

Wednesday has UK CPI and the FOMC minutes as the main market focuses. Before then the RBNZ monetary policy decision will attract some attention, but there is no expectation of any change in policy, with nothing priced in and all forecasters looking for no change. There will nevertheless be some interest in the statement. The market is looking for rate cuts later in the year, with nearly two cuts priced by the end of the year, compared to none in Australia (or just around a 35% chance of one). If this is supported by the statement there is downside risk for the NZD against the AUD, as yield spreads already suggest scope above 1.10.

The RBNZ has decided to keep OCR at 5.5% in the May meeting but the OCR forecast in 2025 has been revised almost 25bps higher. By September 2025, the OCR forecast has been revised almost 25bps higher and around 3% by mid 2027. The revision seems to suggest the RBNZ is not looking for an imminent hike, rather OCR will be staying higher for longer. NZD/USD jumped as a knee-jerk reaction.

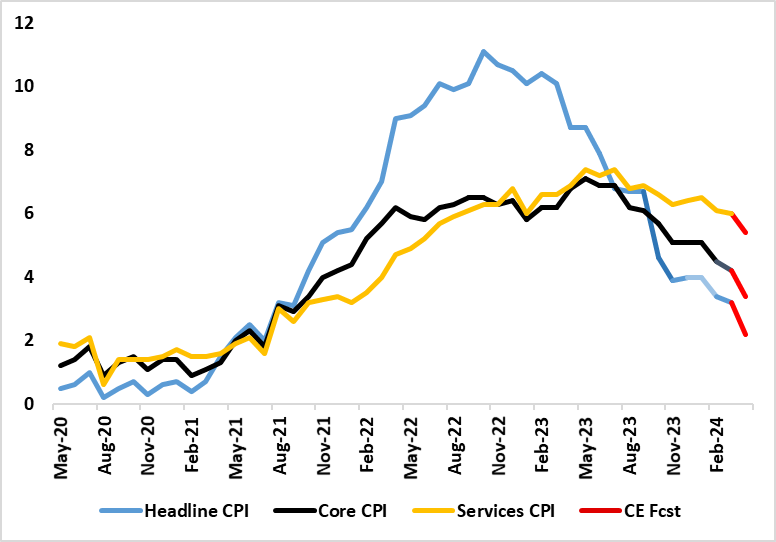

For UK CPI, it is clear that the CPI data are crucial to BoE thinking about the timing of any start to an easing cycle. It is, however unclear what the bar of acceptability is for the MPC in terms of the April CPI. Do they just have to hit the forecasts laid out in the recent Monetary Policy Report, or undershoot? This assessment is made all the more awkward as another set of CPI data are due the day before the next MPC decision. Favourable base effects and the drop in the energy cap should mean a decisive and broad fall in the April headline to 2.2% y/y and a fall of 0.6 ppt for services, the latter having most relevance for the MPC hawks’ concerns about persistent price pressures. We also see the core down 0.8 ppt to 3.4%. Our core forecast is a little below market consensus, while the headline is marginally above.

Headline and Core Inflation Drop to Continue as Services Buckle?

Source: ONS, Continuum Economics

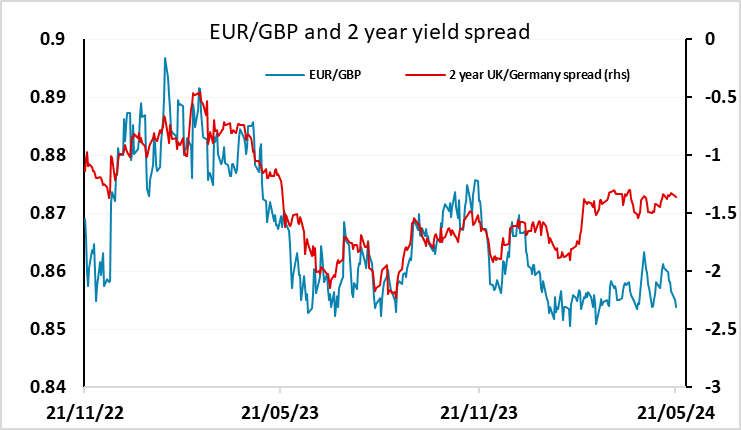

At this stage, the MPC decision is in the balance with forecasters slightly favouring no change (40 to 31 in the latest Reuters survey) while the market prices it as essentially a 50-50 call. This is unlikely to change much on a consensus outcome or indeed on our forecast, which is close to consensus. But if the headline were to drop sub-2% we would expect the market to start to price a rate cut as likely, and GBP to slip lower as a result. At current levels below 0.8550 we see the risks as being mainly on the upside for EUR/GBP.

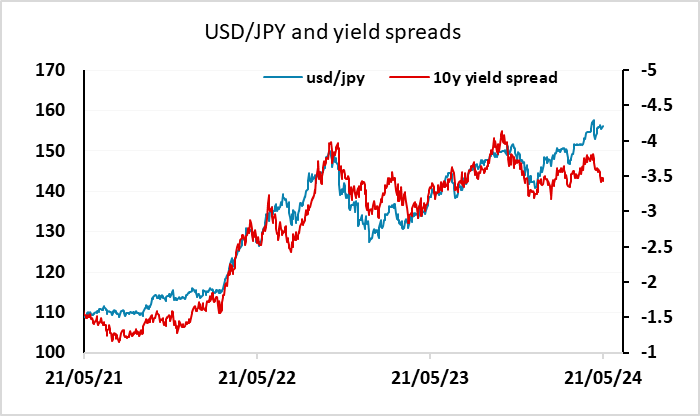

The FOMC minutes are likely to be a more hawkish than those from the March 20 meeting released on April 10, given the strength of data released between the two meetings. Restrictive policy for longer is likely to be the message, but with no clear timetable. Softer data released since May 1 may however have the FOMC feeling slightly less concerned now, so to that extent the minutes have been a little overtaken by events. Even so, the USD may manage some gains on the minutes if they remind the market that the Fed will take some convincing to cut rates by September. But even if the USD does make gains, we suspect they will be short lived, especially against the JPY with USD/JPY likely to be toppy at 157.