FOMC Minutes from May 1 to Suggest Restrictive for Longer

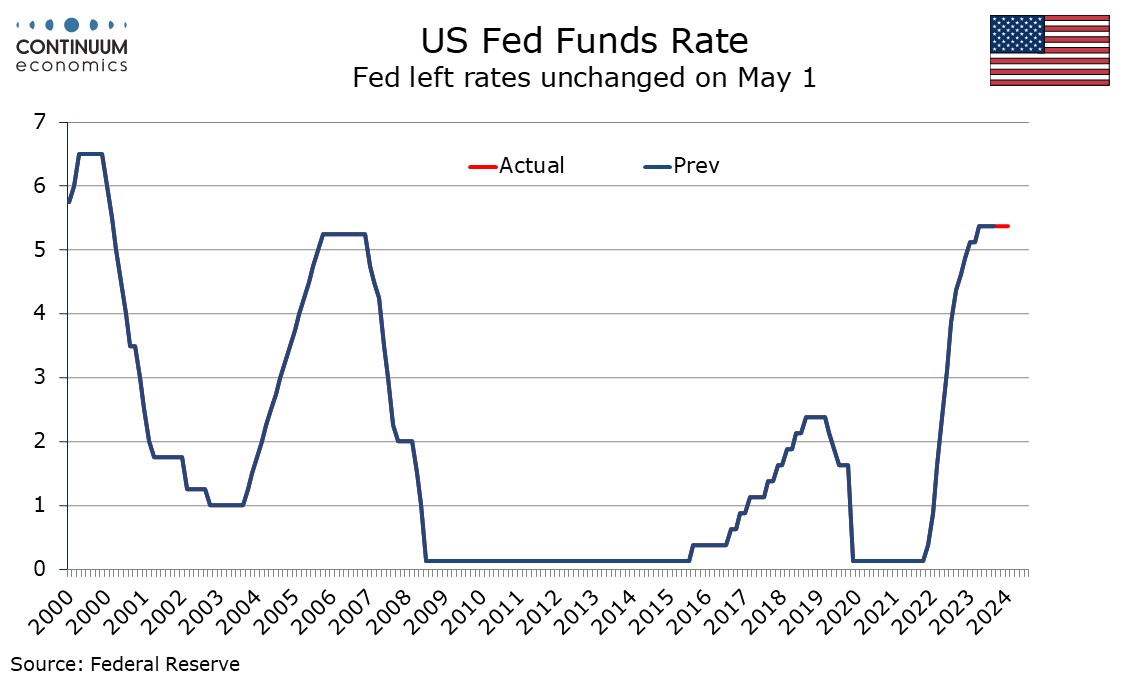

FOMC minutes from May 1 are due on May 22. The minutes are likely to be a more hawkish than those from the March 20 meeting released on April 10, given the strength of data released between the two meetings. Restrictive policy for longer so likely to be the message, but with no clear timetable. Softer data released since May 1 may however have the FOMC feeling slightly less concerned now.

The March minutes showed that participants expected both inflation and the economy to slow, expecting the 2% inflation target to be reached over the medium term. This is still the message being given by Fed speakers though generally with a cautious tone, stressing that recent inflation data has not raised their confidence. The March minutes showed that almost agreed that easing later this year would be appropriate if the economy evolved as expected. This meeting is likely to have a more cautious tone, stressing that the current need is to hold rates steady while giving fewer hints on when easing is likely to start.

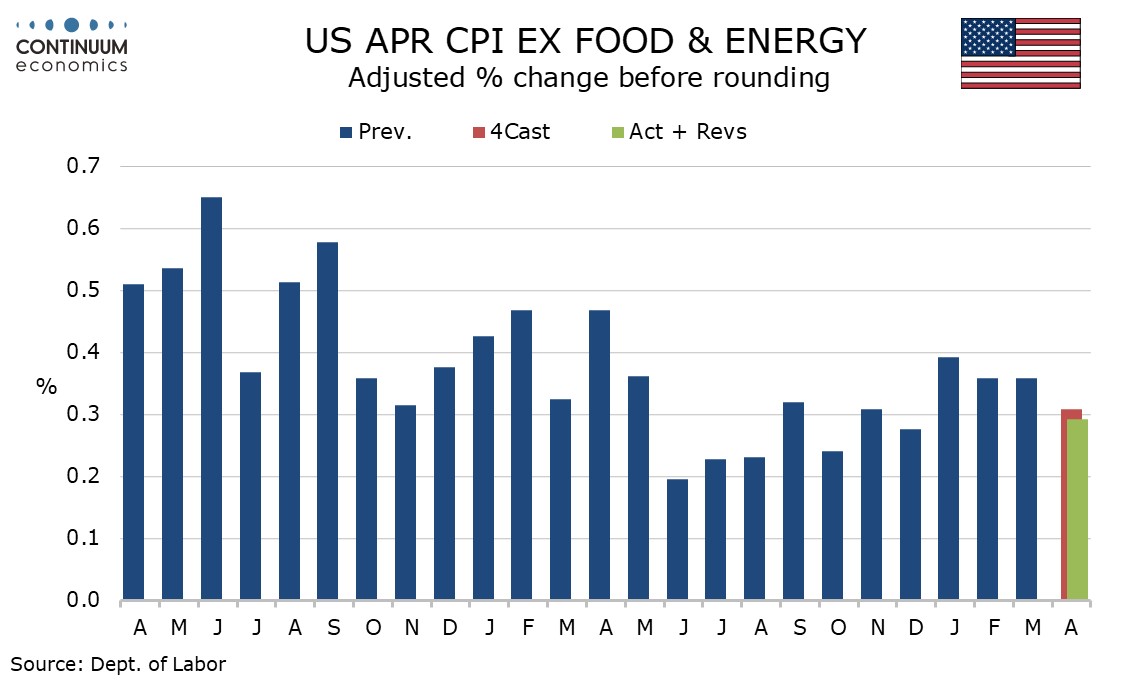

March’s meeting noted the strength of January and February inflation data, some seeing the gains as too broad based to be dismissed as aberrations but other seeing the numbers as potentially inflated by residual seasonality. The strong outcome for March seen between the March and May meetings will not conclusively swing that debate though concerns will have been heightened. Most are likely to agree that the debate will need to be resolved by incoming data. Some may even question the value of the Fed’s dot plot for rates, as these are based on an expectation that inflation will fall on which Fed confidence has been reduced.

A slower 0.3% rise in April’s core CPI after three straight gains of 0.4% provided only limited comfort, though has been welcomed by some Fed speakers, notably Governor Philip Jefferson and even the normally hawkish Cleveland Fed President Loretta Mester. Governor Jerome Powell has also sounded quite moderate, still expecting inflation to fall but with less confidence. The minutes are unlikely to see much discussion of tightening, focusing on the need to keep rates steady until softer data is seen. Inflation data will be key, though Powell at his post-meeting press conference stated an unexpected labor market weakening could warrant a cut, suggesting the downside economic risks of keeping restrictive policy for longer were discussed.

The meeting left rates unchanged with no dissent, and also saw a tapering of Quantitative Tightening announced, with the monthly redemption cap on USTs to be reduced to $25bn from $60bn stating in June, though that fur agency debt and agency mortgage-backed securities was left at $35bn. Some debate on this decision can be expected to be outlined, but few if any are likely to express serous reservations.