Preview: Due May 31 - U.S. April Personal Income and Spending - Core PCE Prices to round down to 0.2%

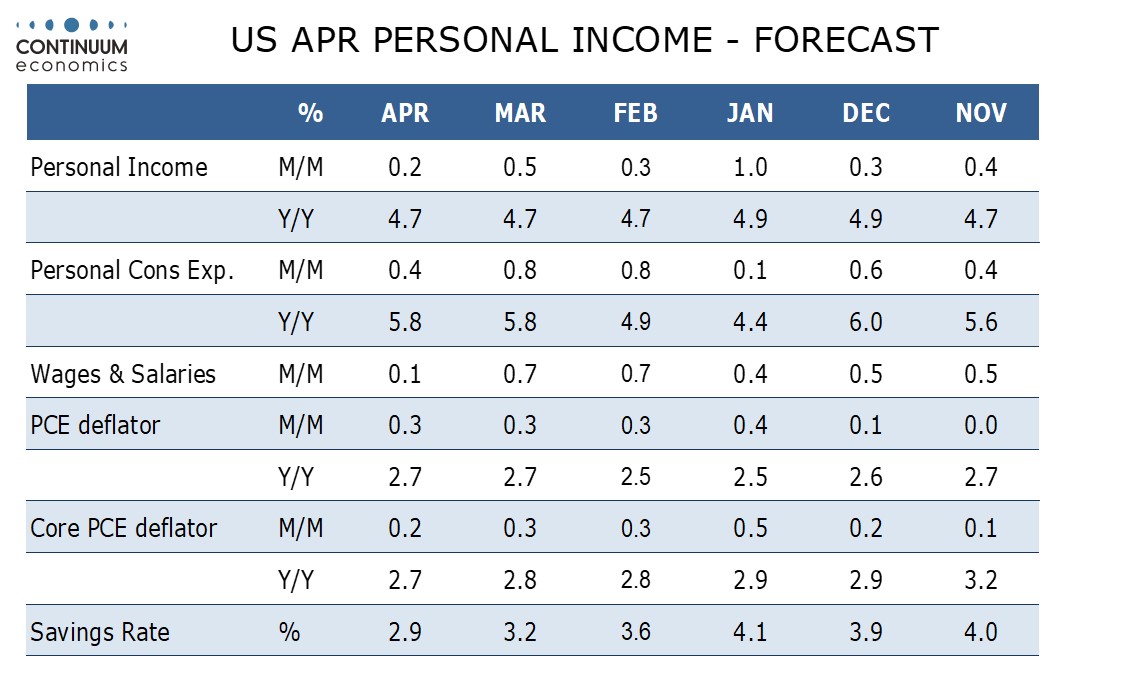

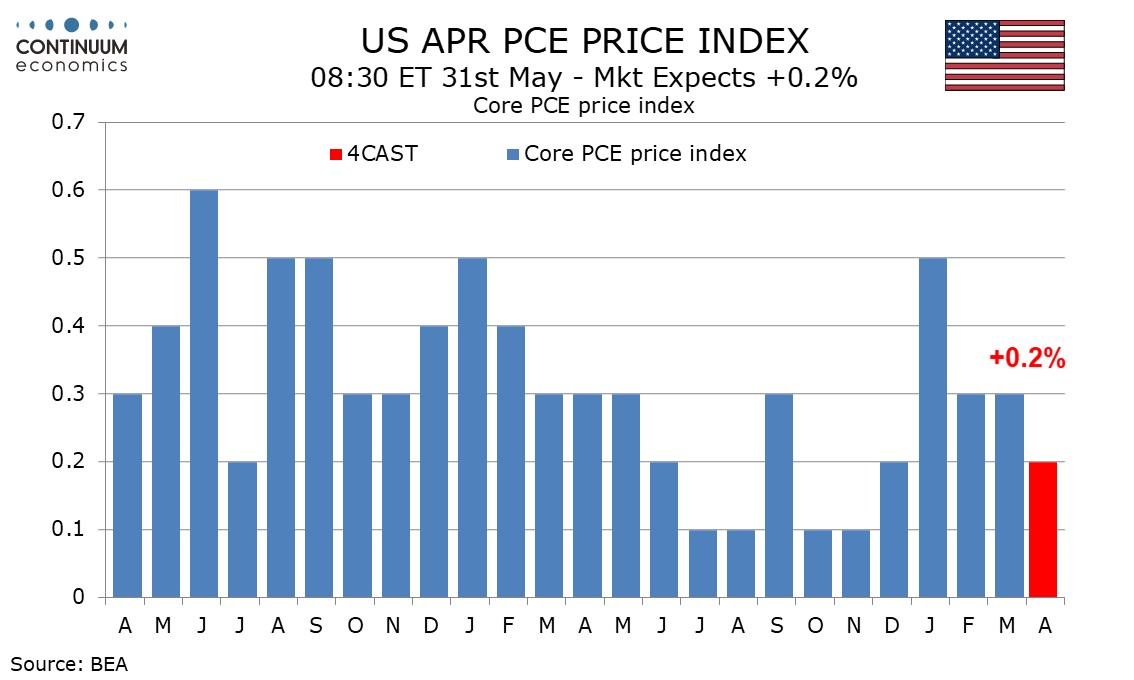

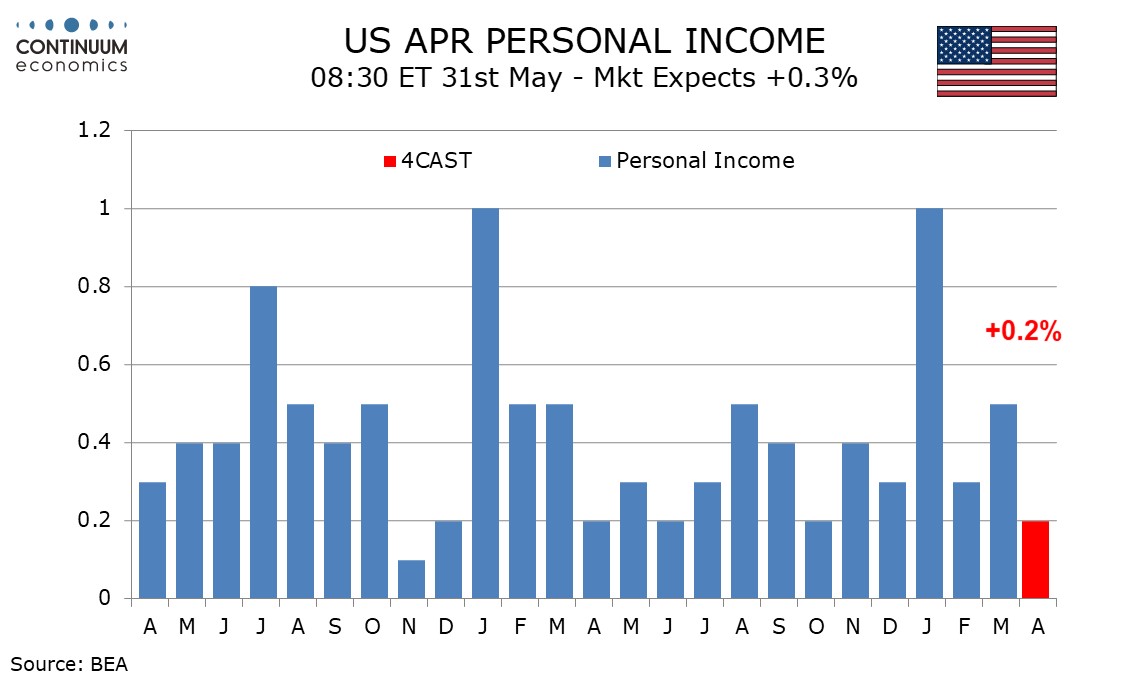

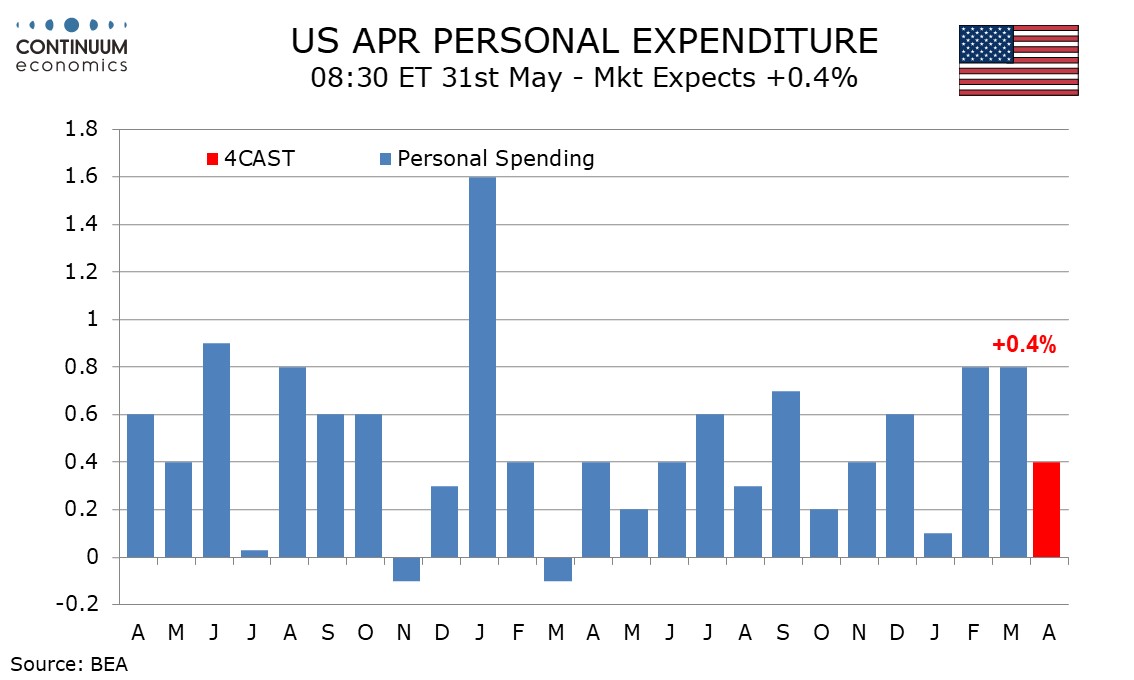

April’s core PCE price index looks set to come in close to 0.25% before rounding, though we expect the index to be rounded down to 0.2%, while overall PCE prices are rounded up to 0.3%. We expect a subdued 0.2% increase in personal income to underperform a 0.4% increase in personal spending.

April’s CPI rose by 0.31% before rounding with the ex food and energy rate at 0.29%. PCE prices tend to underperform CPI and with components of the PPI that contribute to core PCE prices being on the soft side (despite overall PPI surprising to the upside) PCE prices look likely to underperform in April.

This would see yr/yr PCE prices unchanged at 2.7% overall but the core rate slipping to 2.6% from 2.7%, reaching its lowest since March 2021.

Slower payroll and average hourly earnings growth, combined with a dip in the workweek, suggests a subdued 0.1% increase in wages and salaries and with other components of personal income seen maintaining trend we expect a 0.2% rise in overall personal income. We expect stronger tax receipts in April to leave disposable income unchanged, and negative in real terms.

Retail sales were unchanged in April but with industry auto sales looking a little stronger than in the retail report we expect both durables and non-durables spending to rise by 0.2%. We expect a 0.5% rise in services, the slowest since October, to leave overall spending up by 0.4%. Spending continuing to outpace income would see the savings rate slip to 2.9% from 3.2%, reaching its lowest since June 2022. This is a potential restraint on spending going forward.