FX Weekly Strategy: May 20th-24th

USD to focus on PMIs after recent relative US weakness

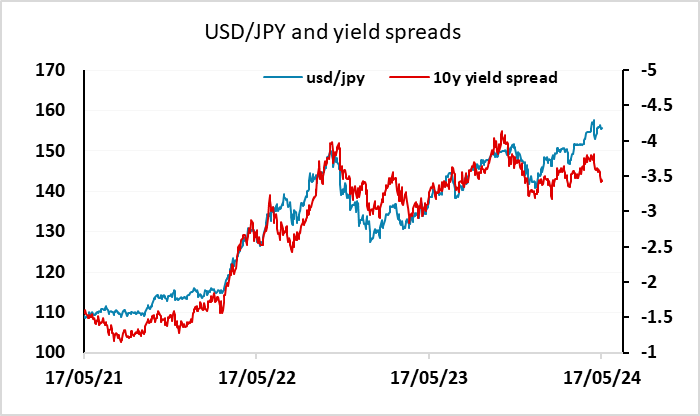

JPY still has the most scope for gains

GBP upside limited as big drop in CPI expected

CAD may soften as CPI could allow BoC rate cut

Strategy for the week ahead

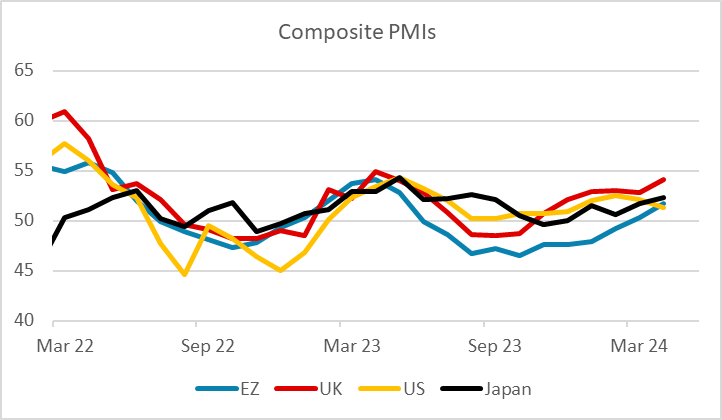

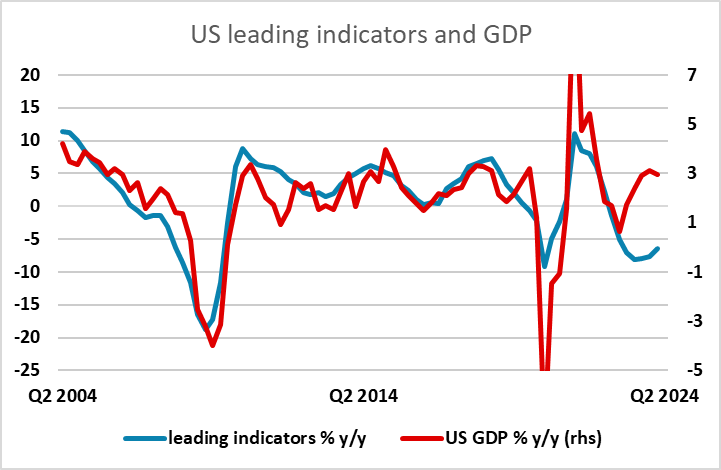

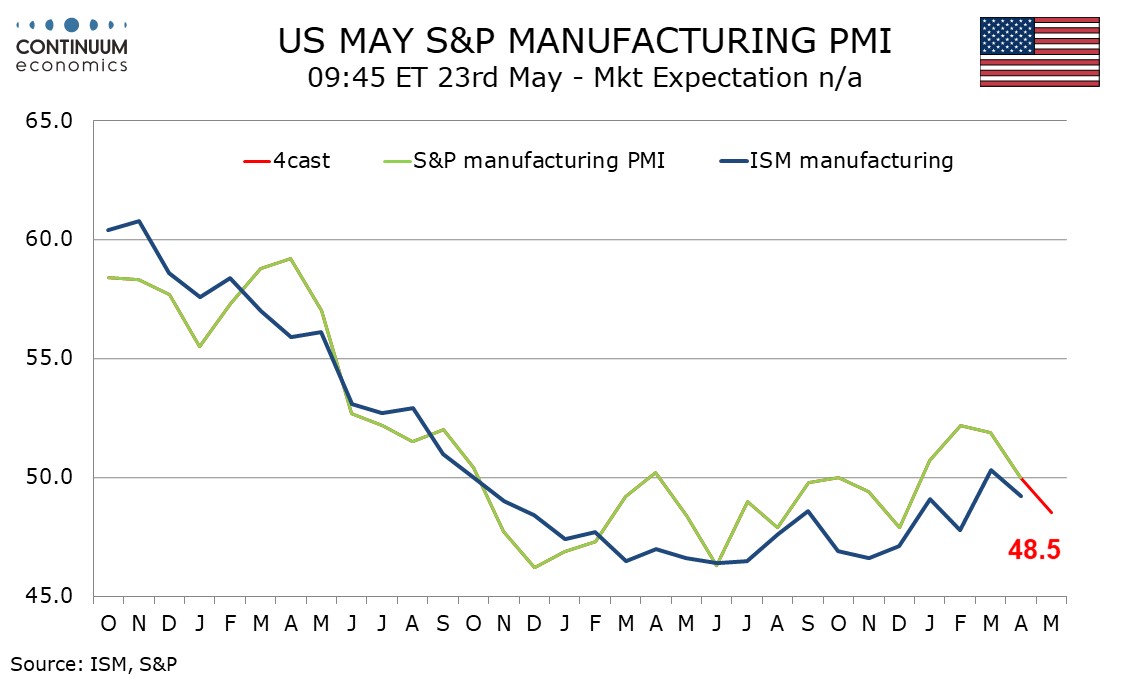

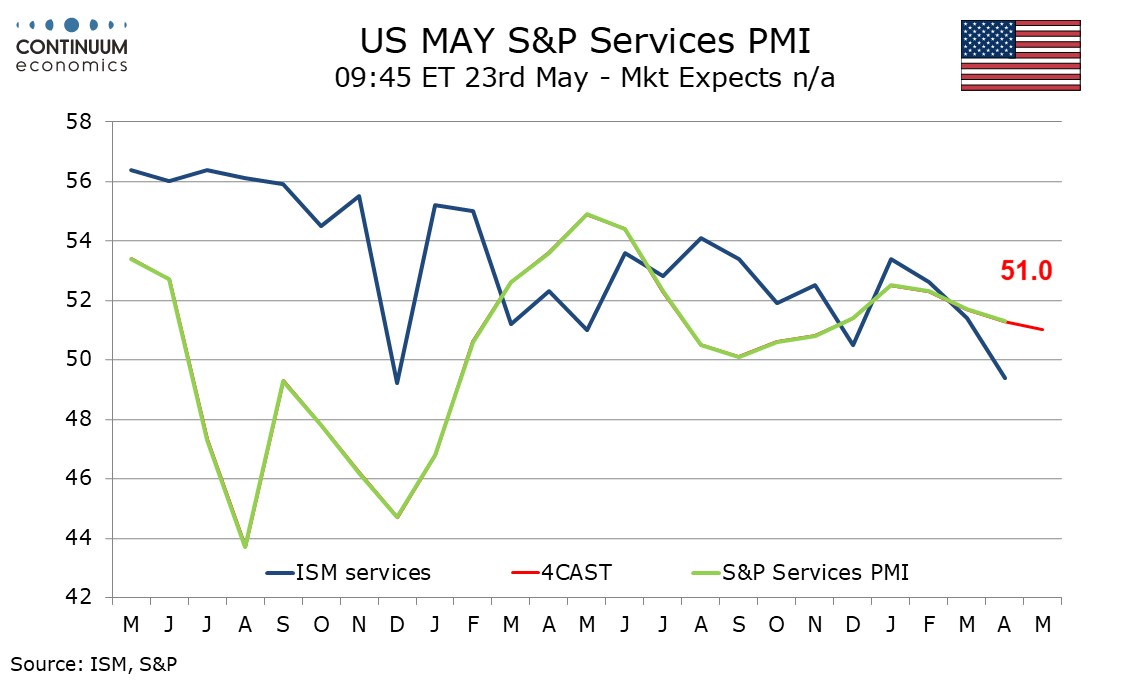

In a relatively quiet week for US data, the focus will be on the CPI data from the UK, Canada and Japan, and the flash PMIs for May. We also have a rate decision form the RBNZ, but this seems unlikely to produce any change. The PMIs may be the most interesting after the April PMIs showed a dip in the US indices, particularly the services index, while the European (and Japanese) indices rose. This goes against the perception of US economic outperformance, and has helped to moderate the strength of the USD in the last few weeks. While the PMI data is far from a perfect indicator of growth, other US indicators have also been on the soft side in the last month, with the decline in US leading indicators in April reported on Friday the latest suggestion of US slowdown.

The May data will therefore be important. If we see a relative recovery in the US composite PMI, we could see a modest USD recovery, although we would still see USD/JPY at these levels to be wildly overvalued and ripe for a decline in line with the yield spread moves of the last week or two. If we see further evidence of relative US weakness, it could be a trigger for more general USD weakness, with the JPY likely to lead the way.

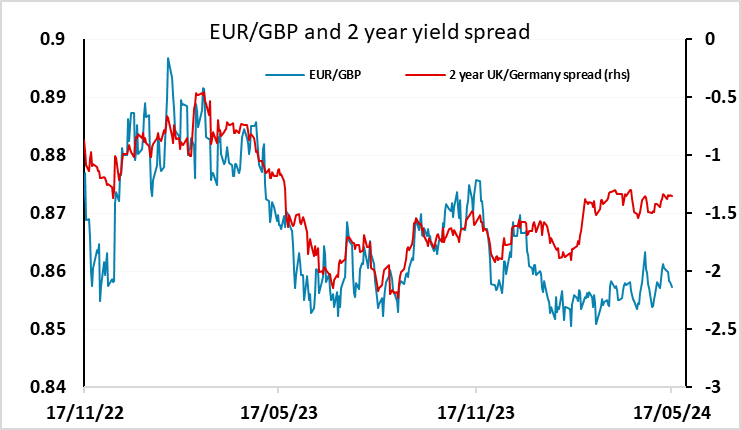

Before the PMI data on Thursday we have UK and Canadian CPI on Wednesday and Tuesday respectively. The UK CPI is now seen as the key piece of data ahead of the UK MPC decision in June, although in reality with a month still to go it is unlikely to be conclusive. As it stands the market is pricing a rate cut as slightly better than a 50-50 chance. BoE chief economist Pill indicated last week that a cut was possible in the summer, noting that policy would still be restrictive even if the BoE cut rates. This initially triggered a GBP decline after an initial rise after strong earnings data in the labour market report, but GBP was firmer by the end of the week. From here, there is still good support below 0.8550 in EUR/GBP, and a big decline in y/y CPI inflation is expected due to base effects, so it will be hard to see the numbers ruling out a rate cut. GBP should consequently struggle to extent last week’s gains unless we see very strong CPI and/or UK PMI.

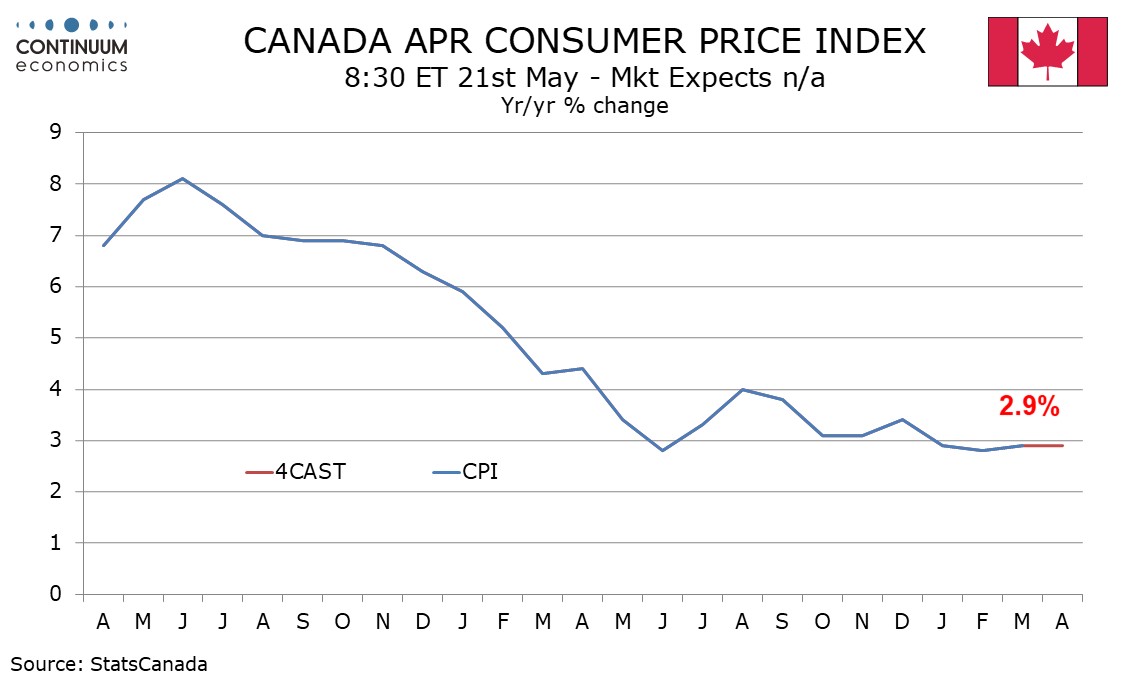

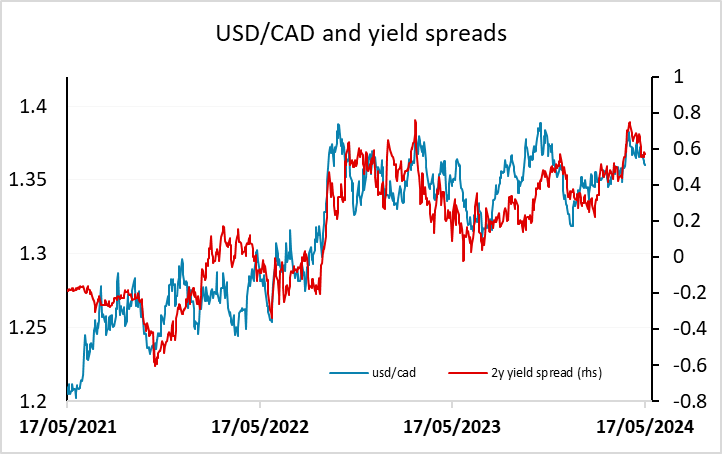

The BoC decision is also seen to be in the balance, although the market is only pricing a cut as around a 30% chance. But the Canadian numbers may be more crucial, as the BoC meeting is only a couple of weeks away on June 5. We see an unchanged y/y rate on CPI which we think may be enough, as long as the BoC’s targeted core rates co-operate, to convince them to cut in June. The risks for the CAD may therefore be slightly on the downside, especially since the CAD has slightly outperformed yield spreads in the last week.

Data and events for the week ahead

USA

It is a quiet week for US data, which may leave focus on Fed speakers. Monday will see weekend comments from Powell digested, while Bostic and Barr are due to speak. Tuesday sees Barkin, Waller and Williams, as well as Bostic and Barr again. On Wednesday we expect April existing home sales to be unchanged at 4.19m. Fed’s Goolsbee will speak and FOMC minutes from May 1 well be released. These are likely to show agreement on a wait and see stance given recent stronger than expected inflation data, leaving uncertainty on when easing will start, but little discussion about tightening.

Thursday’s weekly initial claims will be closely watched given recent hints that trend is starting to rise. Also on Thursday we expect softer S and P PMI indices for May, manufacturing at 48.5 from 50.0 and services at 51.0 from 51.3. We also expect April new home sales to fall to 665k from 693k while Fed’s Bostic is due to speak. On Friday we expect aircraft to lead a 0.8% decline in April durable goods orders though ex transport we expect a modest rise of 0.3%. Final May Michigan CSI data is also due, for which preliminary data was weaker but with higher inflation expectations. Fed’s Waller is also due to speak.

Canada

In Canada April CPI on Tuesday is the key release, which may play a significant part in whether the Bank of Canada decides whether or not to ease on June 5. We expect the overall rate to be unchanged at 2.9% yr/yr, but the recent progress lower in the Bank of Canada’s core rates to continue. March retail sales are due on Friday. A preliminary estimate for unchanged was made with February’s data.

UK

Major data awaits with the April CPI (Wed). Helped by favourable base effects and the drop in the energy cap should mean a decisive and broad fall in the April headline of one ppt to 2.2% and of 0.6 ppt for services, the latter most influencing the MPC hawks’ emphasis on persistent price pressures. We also see the core down 0.8 ppt, this outcome consistent with an m/m adjusted reading back down to more target-consistent 0.2%. Flash PMI data are seen correcting back slightly in the May updates (Thu), this preceded for manufacturing by the CBI survey (Tue). The PMI Composite rose to 54.1 in April, up from 52.8 in March and signalled the fastest expansion of private sector business activity since April 2023, results very much at odds with labor market findings. Public borrowing data (Tue) may show more signs of flagging receipts, alongside lower-than-expected debt interest costs being offset by higher-than-expected spending on subsidies. Finally, retail sales data may succumb (again) to poor weather which was unsettled, wet and dull through April, with another flat to negative m/m reading. Otherwise, more BoE insight with speeches from Governor Bailey (Tue) and recent MPC recruit Breeden (Wed).

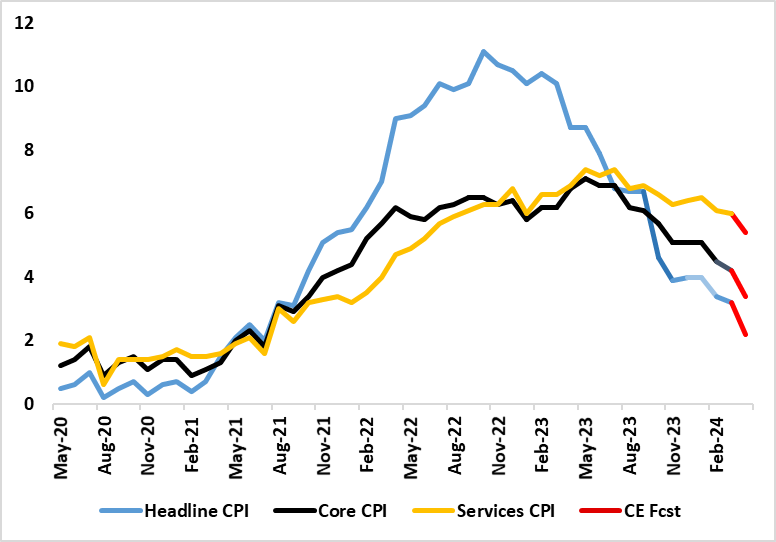

Headline and Core Inflation Drop to Continue as Services Buckle?

Source: ONS, Continuum Economics

Eurozone

Datawise, the main interest will be the PMI flashes on Thursday, where we see a small drop back in the composite having rise in April from 50.3 in March to 51.7, the headline index implying a moderate expansion in total business activity, but one that was nevertheless the sharpest in close to a year, albeit where alternative business surveys paint a less positive story. Equally important will be whether there are more signs easier inflationary pressures. Other business surveys are due, including the French INSEE figure (Fri) where some small further improvement may be in the offing. That may also be the case for the EU consumer confidence numbers (Thu) too, win the ECB consumer expectations survey Fri) adding to household sector insights. These may attract ECB attention with an array of Council speakers due, moist notable arch-hawk Schnabel (Fri).

Rest of Western Europe

There are several Riksbank speeches in Sweden, most notable from Governor Theeden (Wed). This arrives the same day as what may be more fragile labor market numbers.

Japan

National CPI on Friday, May 24 would be the most important release from Japan next week. While CPI continues to tread lower and is expected to remain so in a medium run, a spike cannot be ruled out in the coming months when wage grows. A hotter National CPI could preview strong labor earnings for April. We also have trade balance on Wednesday, May 22. With private consumption still likely restrained, a good trade balance could support Japanese economic growth.

Australia

The RBA minutes will be arriving on Tuesday, May 21 but likely a non-event, given the decision of RBA to remain on hold. There are also some PMIS on Thursday, May 23.

NZ

THE RBNZ Interest Rate Decision came in on Wednesday, May 22. We do not forecast any changes to monetary policy nor inflation forecast as the current inflation dynamics are aligning with RBNZ’s playbook mostly. We also have retails sales on Thursday, May 23 and Trade Balance on Friday, May 24.