FX Daily Strategy: N America, May 17th

USD to stay soft after mildly weaker CPI

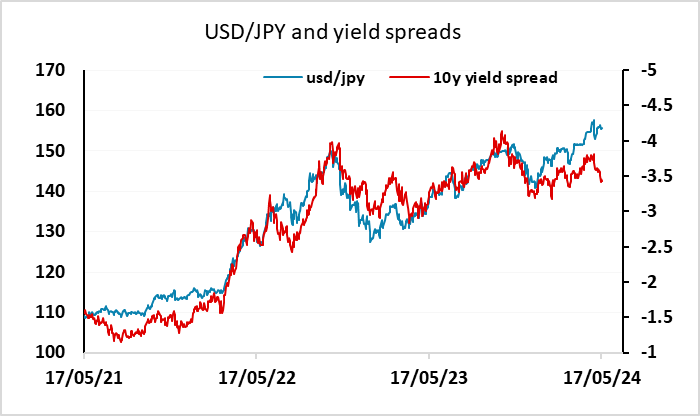

USD/JPY still has most scope for decline

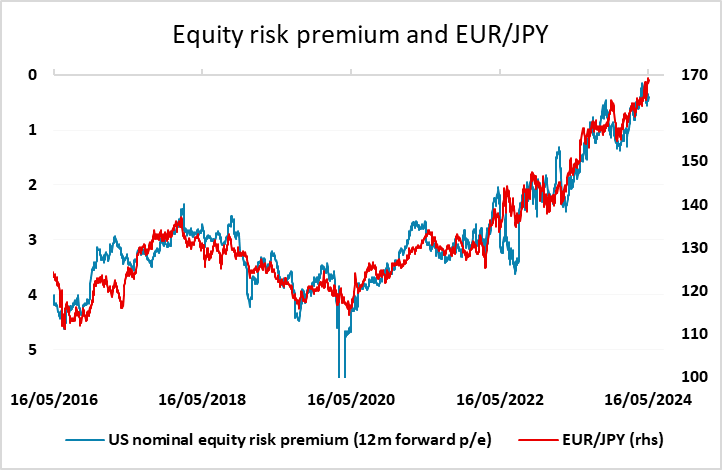

EUR/JPY also looks overstretched

AUD dips on employment data but upside still favoured

USD/JPY still looks too high after a week of spread moves in favour of the JPY

Higher risk premia also suggests scope for EUR/JPY declines

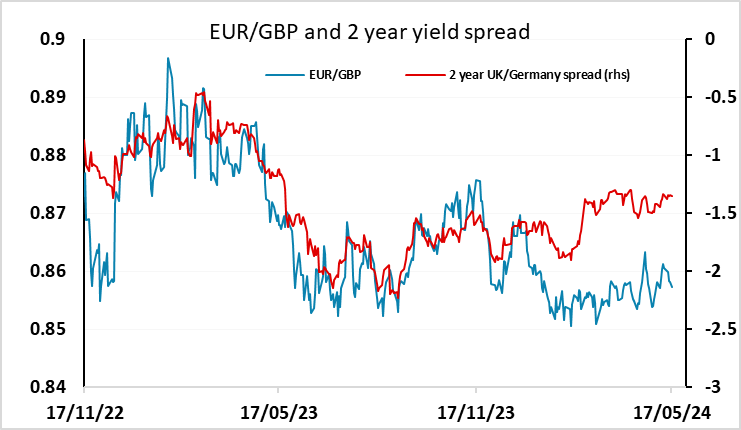

GBP downside still favoured medium term although June rate decision in the balance

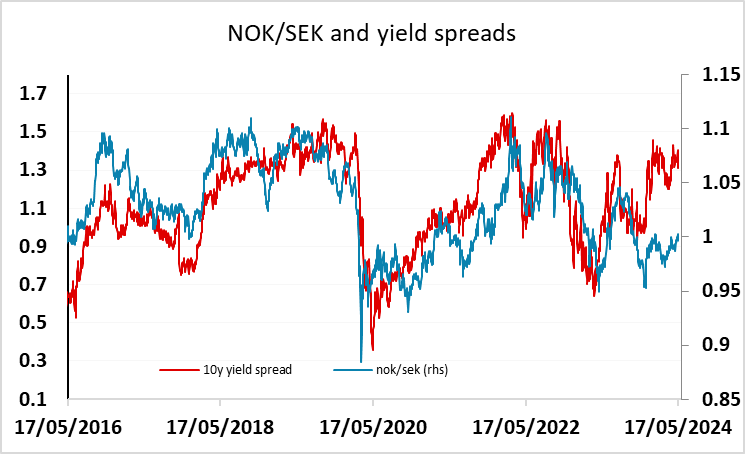

NOK/SEK still has upside scope

A quiet Friday calendar leaves the market to digest the news of the week and adjust the response accordingly. The US data has been on the soft side, only marginally, but nevertheless almost all of it has been weaker. CPI, retail sales, jobless claims and the Philadelphia Fed survey all came out on the weak side of consensus, and US yields are consequently slightly lower. The USD is also generally lower, but more against the riskier currencies than the JPY, as USD/JPY made gains in the early part of the week. The JPY rallied strongly after the CPI data, but fell back on Thursday and EUR/JPY is still higher on the week.

This looks like an anomaly. Yields are not only lower in the US, they are also lower in Europe, Australia and Canada, but are higher in Japan. Yield spreads have consequently moved in the JPY’s favour, while risk premia have risen, which is normally supportive for the JPY on the crosses. While the JPY weakness is to some extent a technical correction to the JPY rally post-intervention, it’s hard to justify further weakness with the fundamental news moving in the JPY’s favour and the Japanese authorities likely to be prepared to intervene again if we see any further significant losses. We see scope for renewed JPY strength in the coming weeks.

GBP has had a choppy week, gaining some ground initially on the UK labour market data that showed stronger than expected average earnings. But gains were quickly reversed as BoE chief economist Pill indicated that rate cuts were possible over the summer in spite of the strength of earnings, as policy would still be restrictive even after a rate cut. However, Pill’s comments don’t necessarily indicate a rate cut will come as early as June, and GBP has edged higher in the latter part of the week. The market prices the June 20 UK MPC decision as close to a 50-50 call, which may hinge on next week’s CPI data, while a cut is priced as a near certainty for the ECB on June 6. We still see the main GBP risks as being to the downside medium term, as in the end the BoE are likely to cut just as much as the ECB, so any dips to 0.8550 may be a buying opportunity.

Elsewhere we has Norwegian CPI and GDP data this week which didn’t justify any change in the Norges Bank stance, and the NOK was slightly higher against the EUR and USD over the week, but little changed against the SEK. Even so, NOK/SEK still looks like the pair where NOK gains look most justified after the Riksbank rate cut last week, with yield spreads pointing towards 1.05. But NOK/SEK gains look most likely to come via NOK strength rather than SEK weakness, with the ECB likely to match Riksbank rate cuts.