GBP flows: GBP firmer after stronger than expected earnings data

Average earnings growth remains elevated and limits the chances of June rate cut from the BoE. Scope for EUR/GBP to retest 0.8550

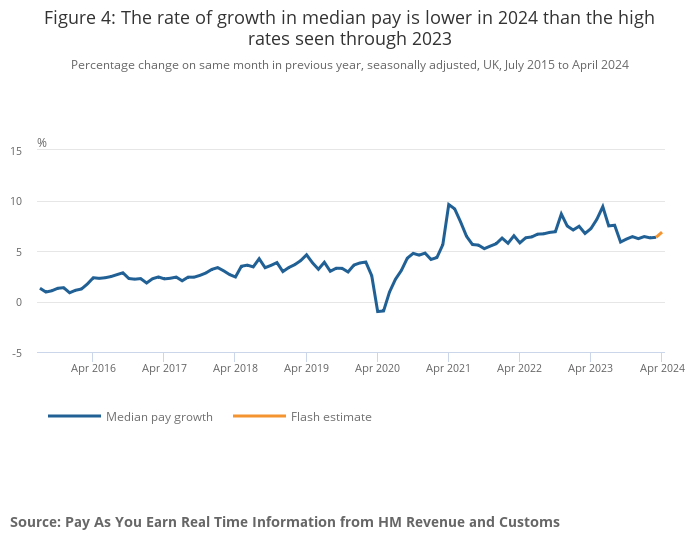

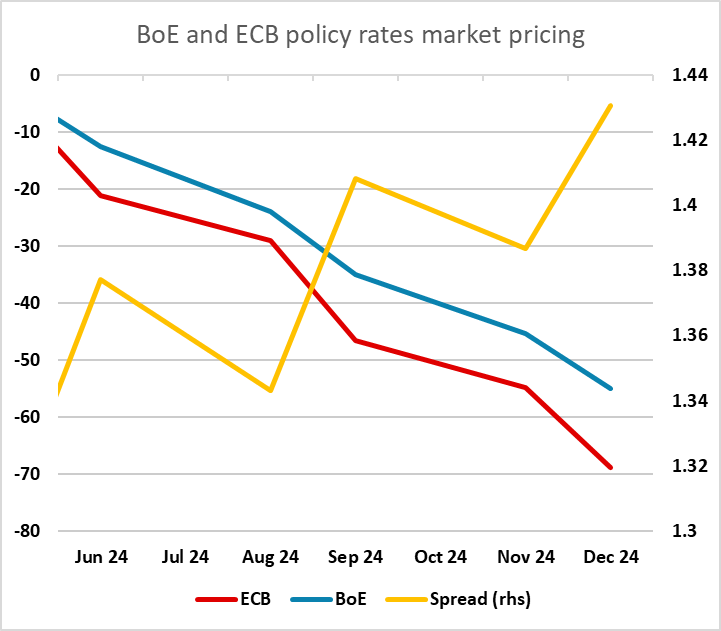

Stronger than expected UK average earnings data have pushed GBP a little higher in early trade. Both the HMRC data and the ONS data showed a stronger than expected earnings number, with the ONS data showing earnings holding at 5.7% y/y in the 3 months to March, while the HMRC data showed a rise in earnings growth to 6.9% y/y in April from 6.4% in March. While there is still weakness in the employment data, with the HMRC data showing a second consecutive decline, and vacancies fall again, the Bank of England MPC are still likely to want to see declines in earnings growth before pulling the trigger on the first rate cut. With the market priced for a June cut as around a 50-50 chance ahead of the data, UK short end yields are likely to rise to largely eliminate the chance of a June cut, and GBP may consequently make further gains.

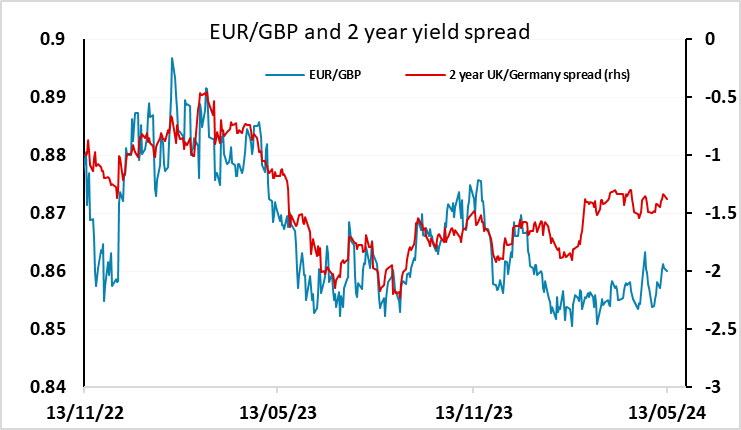

EUR/GBP has been holding close to 0.86 in recent session, but could now fall to 0.8550 as expectations for the ECB and the Bank of England diverge.