German Data Review: Inflation Edges up Amid Less Resilient Services and Core Rate?

As we have repeatedly underlined, base effects continue to distort the German HICP/CPI readings, but the March data came in a notch below expectations for a third successive month. Indeed, it fell from 2.7% to a 33-month low of 2.3% in the March HICP data, dominated by a clear fall in food inflation, and in spite of pick-up in services, both affected somewhat by the earlier Easter this year. Indeed, these factors reversed in the April numbers accentuated by a rise in petrol costs. As a result, HICP inflation edged up to 2.4%, a notch above expectations. But data from the various regional CPI numbers do suggest softer services and core rate down around 0.2-0.3% ppt, ie to around 3.0%, although actual core HICP readings are not available at this juncture.

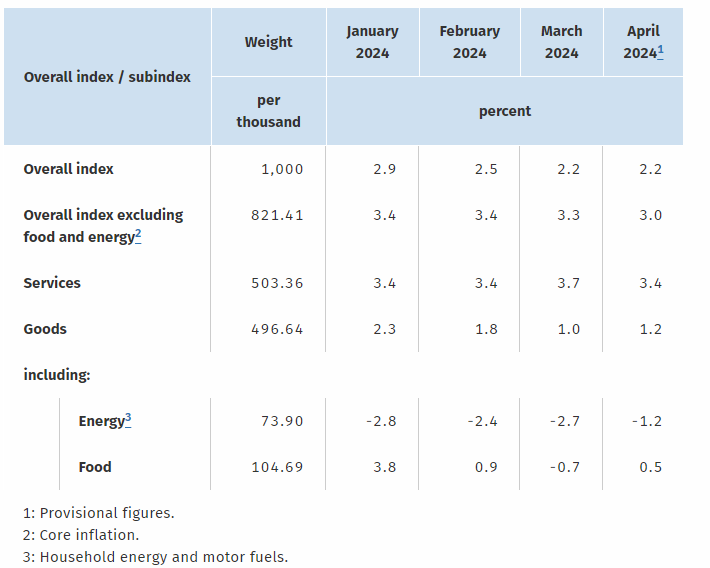

Figure 1: Inflation Mixed But Clearer Core Fall?

Source: German Federal Stats Office – NB data is for the CPI, as HICP details not available

It is unclear to what extent recent services price resilience is due to distortion caused by the early Easter and recent fiscal developments. But adjusted m/m readings once again may suggest that core rate disinflation may have stalled, albeit at a pace still down from previous rates and largely consistent with 2% target and with softer services evidence emerging in these April numbers.

As for those details, regional consumer price inflation was pushed up by a rise in road fuel prices, housing energy bills and food costs. In contrast, a drop in package holiday prices and a more muted rise in transport service costs had a dampening effect. Further rises in fuel costs beckon for May data, where headline inflation is likely to climb to at least 2.7% but where the general downtrend seen of late should resume thereafter with the headline dipping below 2% in late Q3. As for the EZ HICP data (due Apr 3) they too could see an energy induced ump of a notch, but the core rate should fall further, pulled don belatedly by services.