FX Daily Strategy: N America, April 23rd

European currencies firme rafter better PMIs...

...but little scope for further gains unless US data is surprisingly weak

GBP may rise further unless chief economist Pill sounds dovish

USD/JPY still playing grandmother’s footsteps with the BoJ

European currencies firme rafter better PMIs...

...but little scope for further gains unless US data is surprisingly weak

GBP may rise further unless chief economist Pill sounds dovish

USD/JPY still playing grandmother’s footsteps with the BoJ

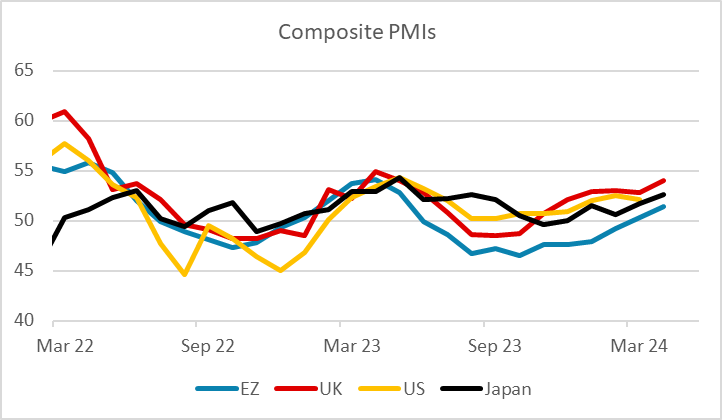

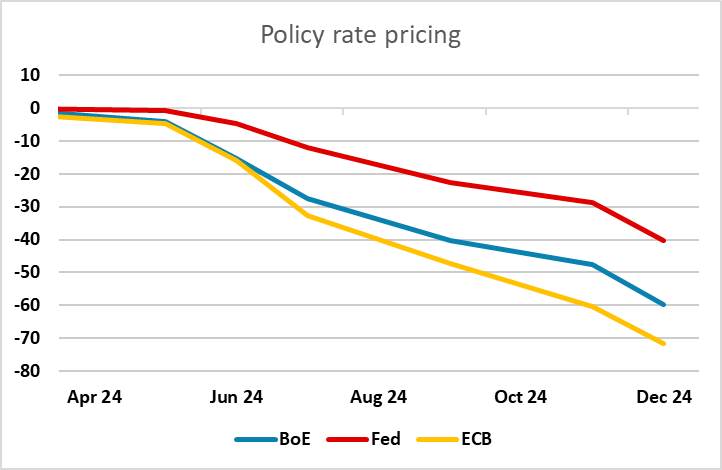

Tuesday is PMI day, and the market consensus was looking for a modest improvement in both the Eurozone and US numbers, with little change in the UK. There is not usually much attention paid to the Australian or Japanese numbers. The European data typically has more impact than the US data, partly because the US remains more focused on the ISM survey. This is even more likely to be the case this time around, as there looks to be more flexibility on market pricing of the ECB and Bank of England than there is on the Fed. It would be a surprise if the PMI data affected Fed thinking, which has been influenced by the recent strong CPI data and it will require evidence from the inflation data to change market perceptions. The US is in any case seen to be achieving solid growth almost regardless of the PMI data, and the first Fed rate cut is now not seen until September, so it will require something radical from PMIs to restore expectations of a July move.

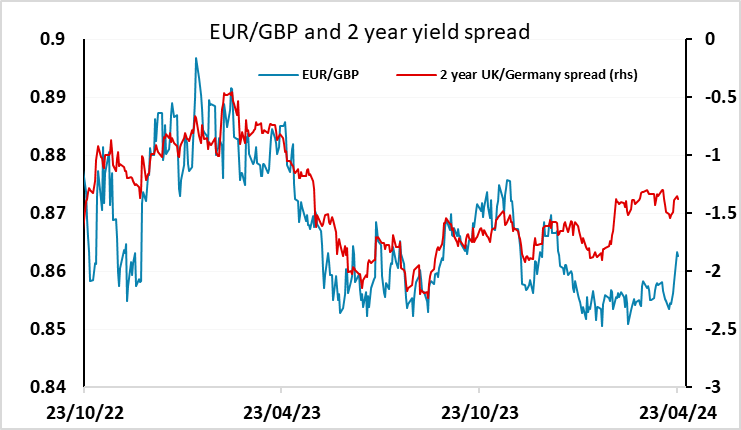

There is more room for impact from the European PMIs because the PMI data is taken more seriously as an indicator of activity, and because both the ECB and the Bank of England rate decisions are seen to be in the balance for June. There is also more uncertainty about whether there is an economic recovery underway in Europe. Today's PMI data is certainly more encouraging on that front, with the composite PMIs rising more strongly than expected, although manufacturing PMIs were weaker. Both the ECB and Bank of England were priced as having around a 60% chance of cutting rates at their respective June meetings ahead of the data, and that hasn't really changed on the numbers, even though we have seen some modest rise in yields further along the curve. The EUR and GBP have risen on the numbers, but the lack of major moves in yields suggests there is unlikely to be much followthrough unelss the US data turns out surprisingly weak.

For the UK, there has been quite a significant rise in rate cut expectations since Friday when MPC member and deputy governor Dave Ramsden indicated a more dovish than expected view. There is a speech due on Tuesday from chief economist Huw Pill, probably the most influential MPC member after governor Bailey. EUR/GBP rose quite significantly on Ramsden’s comments, but after the PMIs the bias is likely to be towards a stronger pound unless Pill is clearly dovish.

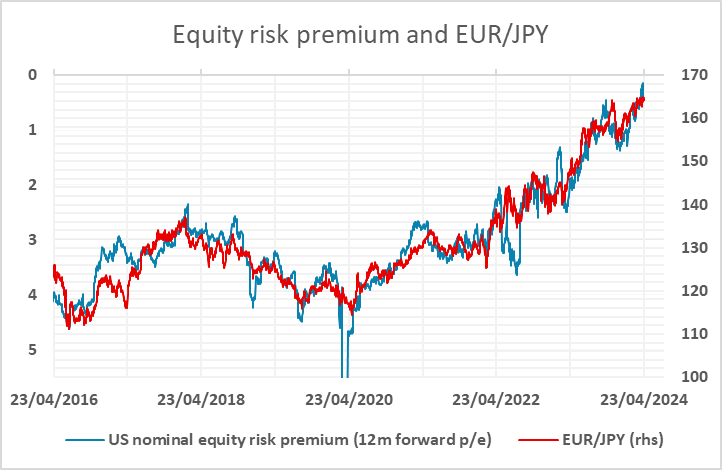

The upward pressure on USD/JPY continued on Monday. For almost the whole of the European session, it traded within 10 pips of the 154.79 34 year high that was hit last week, without quite breaking it, although it did make new highs in the US afternoon and is holding at these levels in Europe, with EUR/JPY also at 16 year highs. This increases the risk of BoJ intervention. As we note in this week’s FX weekly, we doubt that intervention has the capacity to turn the trend, but it could slow things down and wouldn’t come as a big surprise if we see a break above 155. But it will require lower US yields or lower US equities – or both – to turn the trend.