FX Weekly Strategy: April 22nd-26th

US yields could edge lower ahead of the FOMC on May 1

EUR/USD upside still looks limited given current spreads

More evidence of recovery in PMI data could trigger some modest USD losses

AUD to focus on CPI with RBA stance in the balance

JPY downside may be restricted by BoJ, but lower US yields needed to trigger a significant correction.

Strategy for the week ahead

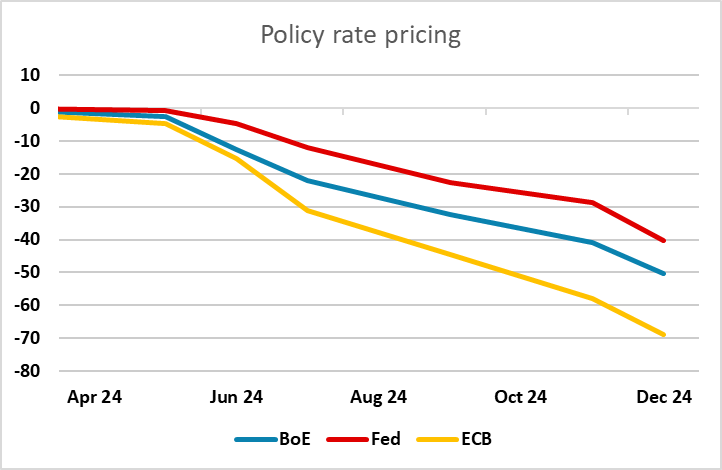

A relatively quiet week in store, with the PMI data providing the main data focus. There is not expected to be much Fed speak ahead of the May 1 meeting next week, so there won’t be a lot of reason for moves in US yields in domestic news. US yields have certainly been the driver of all markets in the last few months. We have gone from pricing in the funds rate at 3.75% at year end 3 months ago to currently pricing it at 5%. The 125bp drop in rate cut expectations this year has been based on some slightly stronger than expected CPI data and solid growth numbers, but the data doesn’t feel as if it has been far enough away from consensus to justify such a large move. In truth, the 6 2024 cuts expected at the beginning of the year was always excessive, but we may now be straying too far the other way. In the run up to the FOMC on May 1, we are unlikely to see rate cut expectations reduced significantly further, so there may be mild downside risks to yields.

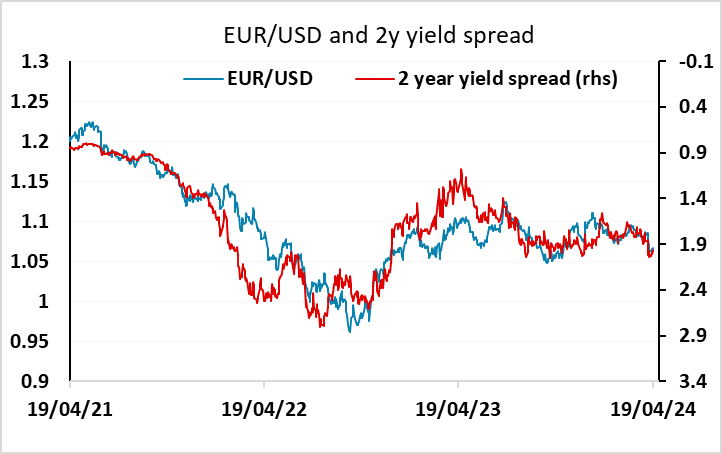

For FX, EUR/USD continued to stick close to the levels suggested by 2 year yield spreads, and while some decline in US yields might lead to a modest rise, Eurozone yields are likely to be dragged lower if US yields come down, so we see little reason for a move above 1.07. There is less reason for EUR yields to rise if US yields rise further, given the more moderate inflation pressure in the Eurozone. The same is probably even more true in the UK. GBP rates are currently priced to come down at a similar slow pace to US rates, but with y/y inflation likely to drop below target in the summer, the risks are now that BoE cuts outpace the Fed.

For this week, the PMI data may determine how the European currencies perform. More evidence of strong recovery would likely prevent any further decline against the USD, and allow some modest recovery. However, weaker data would have more potential to lead to USD gains, particularly in GBP/USD given the current very slow pace of rate cuts priced into the UK curve.

The other data of interest this week is in Australia and Japan. Australian CPI for March and Q1 could determine the direction the market expects from the RBA. While the market has shifted towards a risk of easing this year, this is not yet fully priced, and against the background of a much firmer tone to US rates, it is still possible that rates are held or even raised again. The AUD has been under some pressure due to the rise in US yields, and while we see some scope for US yields to edge a little lower, the risks for the AUD may still be on the downside if CPI data is on the soft side.

The BoJ meeting and Tokyo CPI for April are both due on Friday. The JPY has remained under pressure in the last week with neither the G7 nor the tripartite statement from Japan, the US and South Korea doing much to diminish the downward pressure on the JPY. This continues to be driven mainly by declining market risk premia resulting from the combination of rising US yields and relatively resilient equities. Widening yield differentials also work against the JPY, but spreads have not widened enough to justify the extent of current JPY weakness. The BoJ is unlikely to act at this meeting, but a mention of the JPY in the statement could have an impact. However, we anticipate some softening in Tokyo CPI, which will tend to weigh on the JPY. We would continue to expect some BoJ action if we see simultaneous breaks above 155 in USD/JPY and 165 in EUR/JPY, otherwise they risk a major loss of credibility, so there may be a floor under the JPY in the short run. But lower US yields lok necessary to trigger a more sustained JPY recovery.

Data and events for the week ahead

USA

Fed speakers are likely to be quiet in the run-up to the May 1 meeting, and Monday sees no significant US data. Tuesday sees April’s S and P PMIs, where we expect manufacturing to increase to 53.0 from 51.9 but services to slip to 51.0 from 51.7. We also expect March new home sales to be almost unchanged at 665k from 662k in February. On Wednesday we expect a 2.5% increase in March durable goods orders, with a 0.5% increase ex transport.

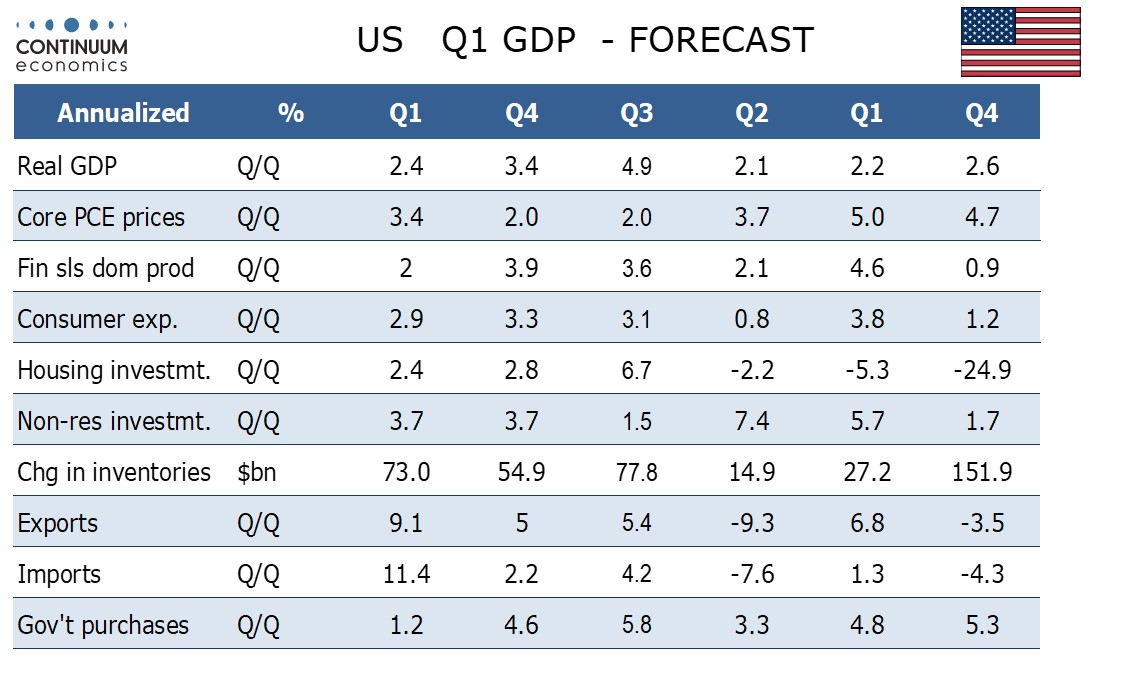

The most significant US data release of the week is probably Thursday’s Q1 GDP, where we expect a slower but still healthy 2.4% annualized gain, with a stronger 3.4% rise in the core PCE price index. At the same time we expect the advance March goods trade deficit to rise to an 11-month high of $91.2bn from $90.3bn. Weekly jobless claims are also due, with March pending home sales following. Friday’s personal income and spending report will be largely old news with Q1 totals set to be released in the GDP report. We expect a 0.5% rise in personal income, a 0.7% rise in personal spending and a 0.3% rise in core PCE prices, slightly less strong than the 0.4% core CPI rise seen for March. Final April Michigan CSI data follows.

Canada

Canada releases February retail sales data on Tuesday. With January’s report a preliminary estimate for a 0.1% increase was made. Bank of Canada minutes from April 10 are also due on Wednesday, and we expect the tone will be quite dovish given recent progress in reducing inflation.

UK

A key week for survey data awaits book-ended by CBI industrial numbers (Mon) and trades figures (Fri). However, as for Tuesday’s flash PMI numbers for April, we (again) see a stable to slightly lower reading. At 52.8 in March, the composite index eased slightly from February's nine-month high of 53.0 but seemingly was still indicative of a solid upturn in private sector business activity. Moreover, output growth broadened out from the service economy to the manufacturing sector in March. Strong input cost pressures persisted in March, especially in the service sector, but it will be key whether there is any further softening in prices charged inflation, led by a slowdown in the service economy.

Public borrowing numbers (Mon) will perhaps provide fewer signs of any undershoot of the OBR budget deficit target, this March update ending the FY. Borrowing for the full-year 2023-24 is seen by the OBR at £114.1 billion, which would be £14.6 billion below last FY. GfK consumer survey data (Fri) may show fresh weakness, a possible reaction to rising market rates. Otherwise, MPC speeches see comments from both sides of the policy spectrum from Pill and Haskell on Tuesday.

Eurozone

Datawise, the main event media-wise are the PMI flashes on Tuesday, where we see a small drop back in the composite having risen to a ten-month high of 50.3 in March, from 49.2 in February and crucially, above the 50.0 no-change mark for the first time since May last year. Equally important will be whether there are more signs easier inflationary pressures. Other business surveys are due, including the German Ifo figure (Wed) where some small further improvement may be in the offing. That may also be the case for the EU consumer confidence numbers (Mon) too, win the ECB consumer expectations survey Fri) adding to household sector insights. These may attract ECB attention with an array of Council speakers due, moist notable arch-hawk Schnabel, with further policy insights possibly coming from the ECB Bulletin (Thu). In this regard, updates money and credit data may also be important, not least after more mixed data seen of late and the warnings if company loan demand slumping from the bank lending survey.

Rest of Western Europe

There are key events in Sweden, with labor market numbers on Wednesday the day after by the Economy Tendency Survey, the latter again likely to be weak. Finally, it is unclear whether any policy insights will come from the SNB AGM in Switzerland (Fri).

Japan

Tokyo CPI and the BoJ Meeting are the most important calendar items for Japan next week on Friday. We expect the BoJ to be on hold for this meeting as CPI continues to move lower. We are only forecasting one more 0.1% hike by June where we see a brief spike from wage growth in CPI, which will cool off for the rest of the year. Tokyo Cpi is also expected to show further moderation but with a slim chance of bump as we need to see the effect of wage growth filtering into the system. Else, we only have PMIs on Tuesday.

Australia

Q1 and monthly CPI on Wednesday will be market moving. Although RBA remains in a spot where hiking and easing are not an option in the coming meeting, a moderation closer to 3% will further trigger speculation in an early cut from the RBA. We also have PPI on Friday.

NZ

Trade Balance on Wednesday and Consumer Confidence on Friday are the only releases from NZ next week.