German Data Preview (Apr 29): Inflation Drop to Continue Amid Less Resilient Services?

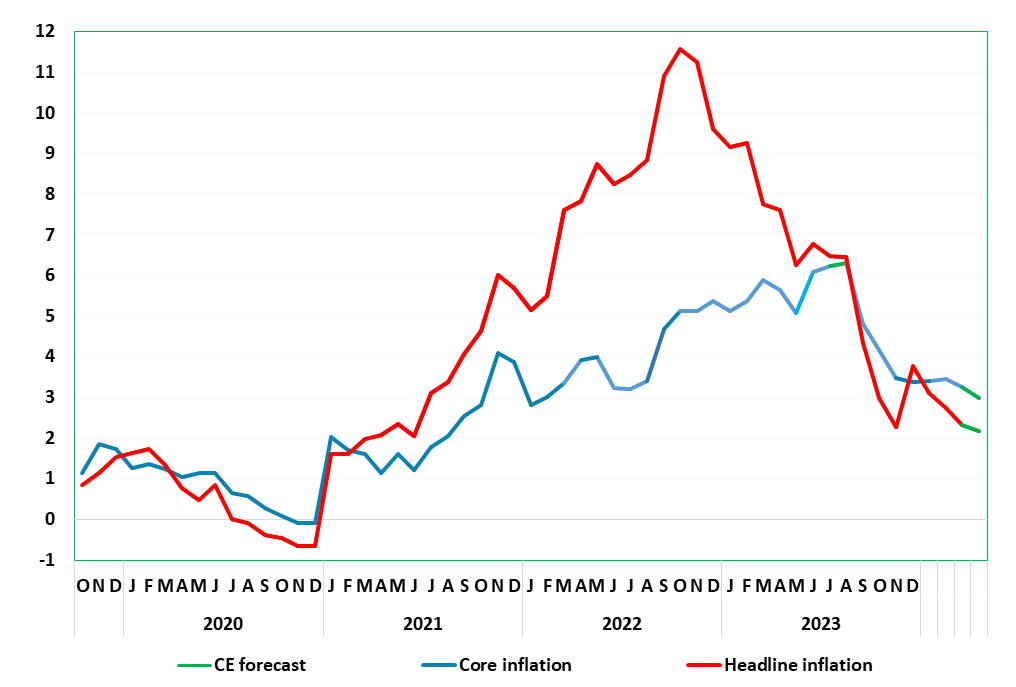

As we have repeatedly underlined, base effects continue to distort the German HICP/CPI readings, but the March data came in a notch below expectations for a third successive month. Indeed, it fell from 2.7% to a 33-month low of 2.3% in the March HICP data, dominated by a clear fall in food inflation, and in spite of pick-up in services, both possibly held up somewhat by the earlier Easter this year. Energy’s impact was marginal, however. As a result, the HICP core rate fell 0.3 ppt to 3.2%, a 23-month low (Figure 1). We see both the headline and core easing a further 0.1 ppt in April data, helped by an unwinding of early Easter distortions and in spite of higher fuel costs.

Figure 1: Inflation Edges Broadly Lower?

Source: German Federal Stats Office

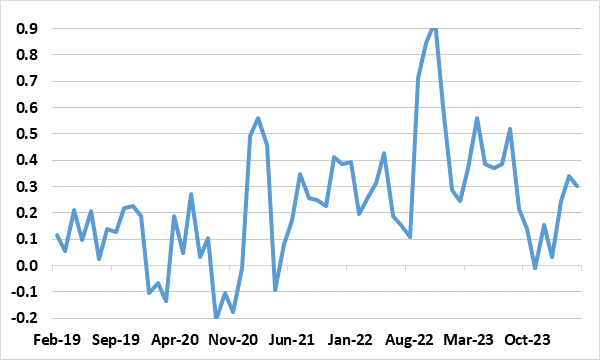

It is unclear to what extent, recent services price resilience is due to distortion caused by the early Easter and recent fiscal developments. But adjusted m/m readings once again may suggest that core rate disinflation may have stalled, albeit at a pace still down from previous rates and largely consistent with 2% target.

In March, energy prices in March were lower 2.9% y/y. But last month was also the first month since February 2015 (-0.1%) in which food prices fell in m/m terms. Food prices were also substantially lower again than the general rate of price increase. We see food inflation softening further, this offsetting a rise in fuel prices but all enough to allow both the headline and core rate to fall a further notch each.

Regardless, while several special factors and much fewer favorable base effects may act to push headline inflation slightly higher again sometime in the next 3-4 months, a general downward trend will still be evident and enough to and inflation is likely to fall below 2% in the second half of 2024, albeit again with month-to-month volatility and with energy-induced unfriendly base effects occurring at end-year.

Figure 2: Adjusted Core Rate No Longer Falling?

Source: German Federal Stats Office, CE, % chg m/m, smoothed