FX Daily Strategy: N America, April 18th

AUD still vulnerable on higher US yields

Australian employment report could trigger a test lower

JPY weakness and AUD weakness moving in tandem due to rising US yields

BoJ needs to act soon or risk losing credibility

EUR/USD likely to hold the range

AUD still vulnerable on higher US yields

Australian employment report could trigger a test lower

JPY weakness and AUD weakness moving in tandem due to rising US yields

BoJ needs to act soon or risk losing credibility

EUR/USD likely to hold the range

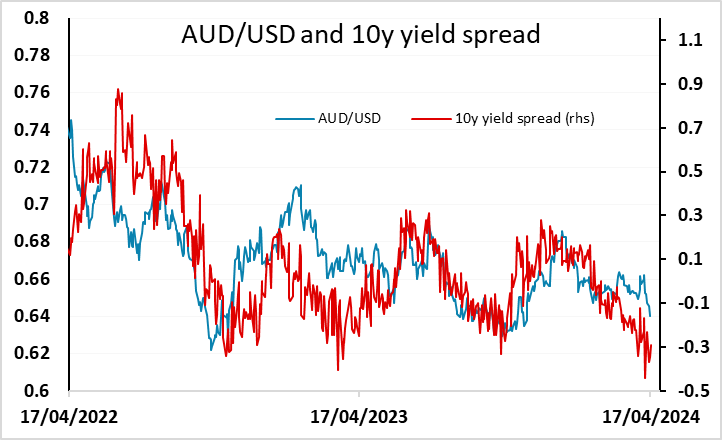

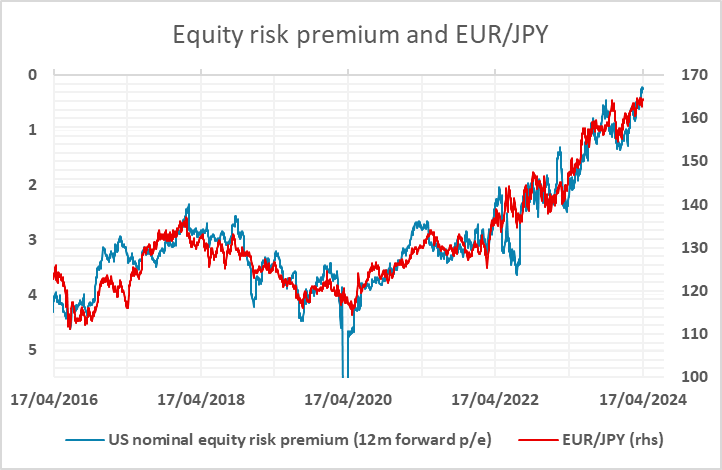

We have the usual set of Thursday data in the US, but nothing of major significance. However, the day starts with the Australian employment report, which will be more closely watched than usual given the weakness of the AUD in the last week. AUD weakness has been a consequence of rising US yields and the impact on equities. We don’t believe that here has been any significant impact from geopolitical concerns. If that were the case, we would expect to see a rise in equity risk premia, but the US equity risk premium has continued to fall as bond yields have risen. However, AUD/USD tends to correlate both with yield spreads and with global and local equity indices. Rising US yields consequently have a double whammy negative effect on the AUD.

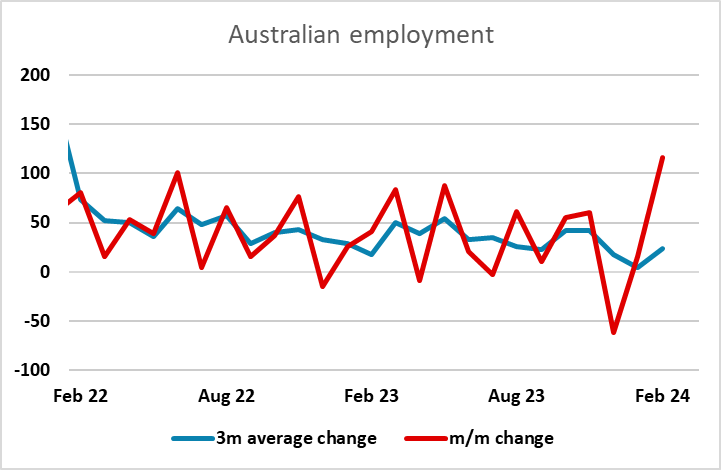

The Australian March labors report is mixed with unemployment rate beating estimate at 3.8% but the headline employment change is negative and the participation rate slipped. The positive side is full time employment increased and the Australia labor market is still tight. We doubt such labor report will support an early cut from RBA.

This can be partially counteracted if the Australian employment numbers are favourable, pushing AUD yields higher. Yields have moved up in the last month, but haven’t quite kept pace with the rise in the US. As it stands, the market is pricing a mild risk of lower AUD rates, with around 15bps of policy rate cuts priced by year end. The February employment data was very strong, but compensates for weaker numbers in the previous two months and the underlying trend has been fairly steady. With yield spreads suggesting some downside risks, it will likely require something above the market consensus of a 7k rise to prevent a further AUD decline. The lows from last October below 0.63 could come under pressure on a negative number, which is quite possible (though fundamentally not particularly significant) given the sharp rise in February.

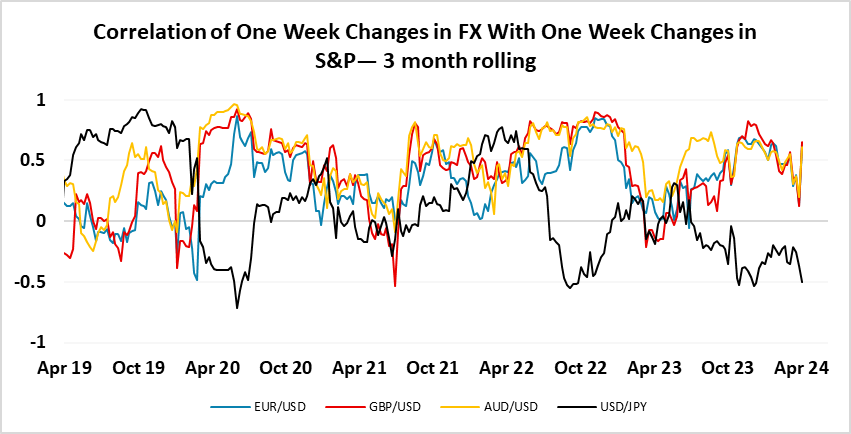

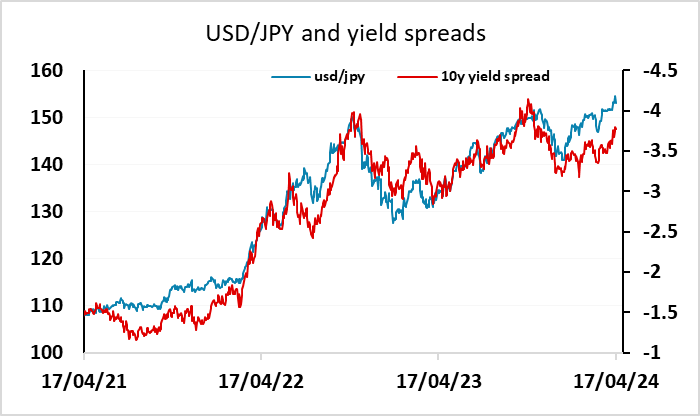

The theme of the week so far has been JPY and AUD weakness, with declines against both the USD and EUR. Rising yields in the US are the prime cause of this. Although the AUD is seen as a risk positive currency and the JPY as a risk negative currency, higher US yields tend to hurt both. Of course they both suffer from yield spread moves against them, but while the AUD tends to weaken when equities fall, the JPY tends to weaken when equity risk premia fall. Higher US yields tends to mean both lower equities and lower risk premia, as the equity decline is not usually sufficient for equity yields to rise as much as bond yields. This has been the case in the latest US yields rise. While equities are lower, equity risk premia have continue to fall, and this is weighing on the JPY on the crosses.

Of course, while widening yield spreads do provide a fundamental reason for JPY weakness, the correlation of JPY weakness with declining equity risk premia is not a fundamental necessity, and doesn’t always hold. But the correlation of JPY crosses with equity risk premia has been very strong in the last 8 years or so, and continues to point to a lower JPY. The problem for the Japanese authorities is that this has led to the JPY hitting its lowest real terms level in the floating era, partly because the market is ignoring the impact of relatively low Japanese inflation on valuation. The protests from Japanese finance minister Suzuki and currency official Kanda have become louder of late, and if they allow the JPY to continue to decline in line with the decline in risk premia, they risk losing credibility. Something therefore has to give, and we would expect some action from the Japanese authorities if we see USD/JPY above 155 and EUR/JPY above 165. Historically, intervention from the BoJ at valuation extremes has been successful, so we would be wary of following the current trend of JPY weakness.

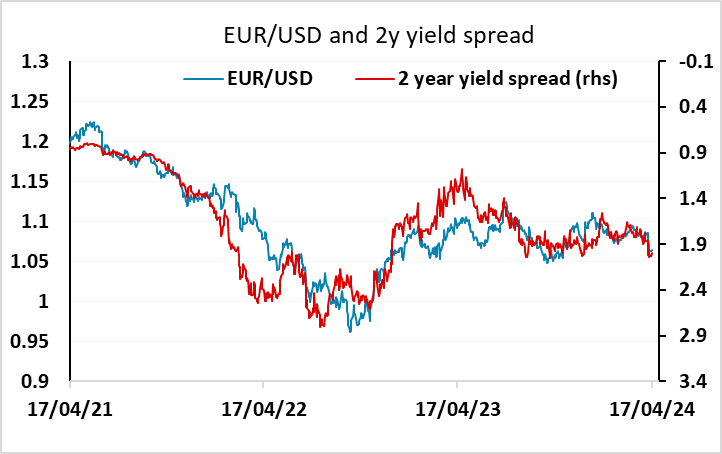

EUR/USD continues to mainly correlate with front end yield spreads and these suggest that we will hold levels in the 1.06-1.07 range for now. We still favour a EUR recovery later in the year, but this is likely to require a return of Fed easing expectations, although as the year goes on, US 2 year yields and spreads should naturally fall as rate cuts in late 2026 start to come into the 2 year tenor.