FX Daily Strategy: Europe, February 21st

Focus on FOMC minutes and speeches

Risks towards a more hawkish tilt

USD may recovery ground lost on Tuesday

GBP still vulnerable despite upbeat comments from BoE governor Bailey

Focus on FOMC minutes and speeches

Risks towards a more hawkish tilt

USD may recovery ground lost on Tuesday

GBP still vulnerable despite upbeat comments from BoE governor Bailey

Wednesday is another day without a great deal on the calendar. Datawise there is nothing of any real import, so any market moving news is likely to have to come from central bank commentary. The FOMC minutes from the January meeting may therefore be the biggest focus. The meeting saw the Fed moving away from a tightening bias, but the minutes are likely to show no rush towards easing. The minutes are likely to note progress on inflation and resilience in activity. If the latter is seen as a risk to continued progress on inflation it will be significant given the strong payroll and CPI data released since the meeting, so may be taken as a bit hawkish. But with effectively nothing priced in for the March meeting, and the first cut not fully priced in until June, there is limited scope for market reaction. Even so, there are nearly four Fed rate cuts priced for the year, and this could still be reduced to three if the minutes give a hawkish impression. There are also speeches from FOMC members Bostic and Bowman, which may have more potential to impact the market. Bostic, as the more dovish of the two, would have some impact if he indicated less enthusiasm for easing.

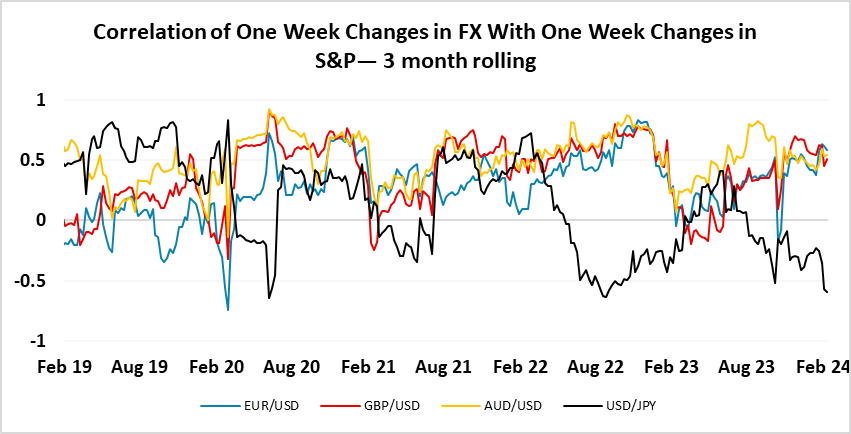

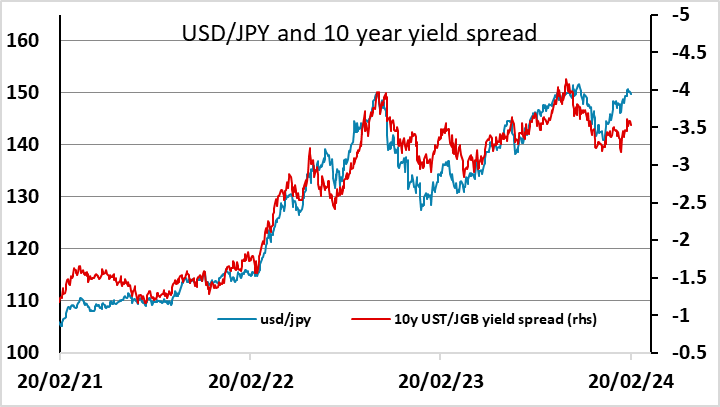

The USD was soft on Tuesday, without an obvious trigger, although low volatility and the underperformance of US equities could be seen as factors, particularly against the riskier currencies. In general, the USD tends to weaken against the riskier currencies when equities do well, but can outperform if US equities outperform. Tuesday saw European equities steady while US equities softened, and that may have helped undermine the USD. If we see US yields rise on Wednesday die to a more hawkish take on the Fed, that could benefit the USD both via yields and via the negative impact on equities. If European yields follow US yields higher, European equity markets are likely to suffer. If they don’t (and they usually do) there will likely be a negative impact on EUR/USD from yield spreads. So the risks may be for the EUR to fall back after the gains seen on Tuesday.

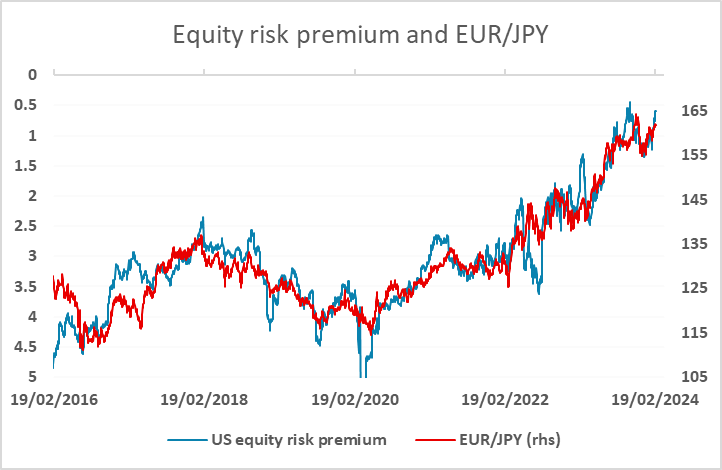

The JPY underperformed in early Tuesday trading, but was recovering by the end of the day and USD/JPY will likely need to see some more gains in US yields if it is to be comfortable above 150. But the JPY continues to struggle against the EUR, with the decline in equity risk premia still underpinning JPY weakness on the crosses. While a rise in US yields could undermine equity markets, it will usually not much help the JPY on the crosses unless equity risk premia also rise (i.e. equity yields rise more than bond yields0. This tends not to be the case when US yields rise, so in the absence of clear negative economic news, we would not expect to see any significant JPY appreciation.

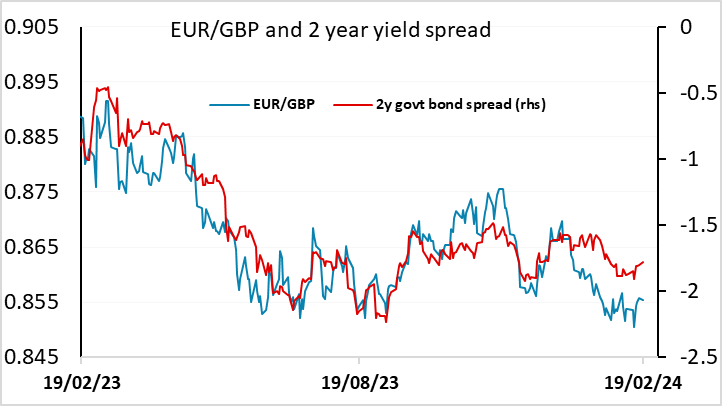

The comments from the Bank of England at Tuesday’s Treasury select committee didn’t have an appreciable impact on GBP, which has come under a little pressure since the weaker than expected CPI and GDP data in the last week. Governor Bailey’s comments were quite upbeat, indicating that he saw signs of an upturn in spite of the decline in GDP in Q4, and EUR/GBP finished the day marginally lower. Even so, the market is pricing in fewer than three BoE rate cuts this year, and that looks to be a downside limit, so with EUR/GBP already underperforming yield spreads, we continues to see the risks as being on the upside.