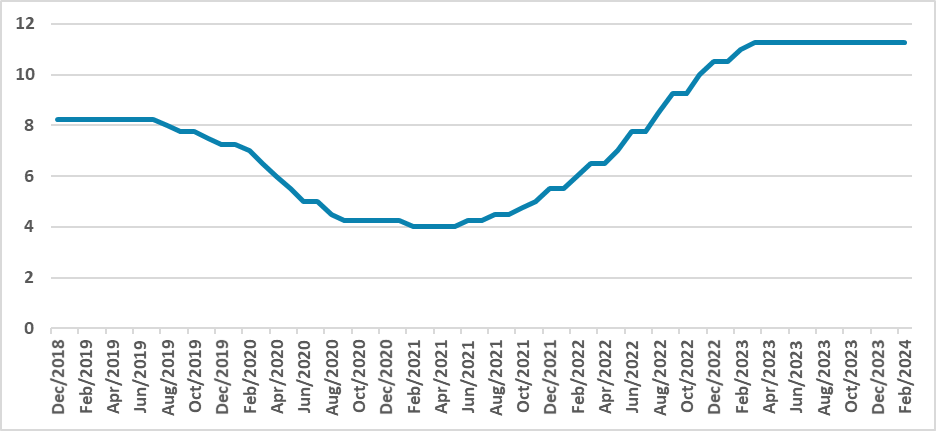

Banxico Review: Policy Rate Kept Stable but Doors Open for a Cut in March

Banxico maintained the policy rate at 11.25%, hinting at a potential cut in March. External rates had minimal impact on Mexico's economy due to the strong peso and interest rate spread. Despite past growth, recent data suggests a deceleration. Banxico remains optimistic amidst inflation, potentially leading to a rate cut discussion focusing on 50bps or 25bps in March.

Figure 1: Mexico’s Policy Rate (%)

Source: INEGI

The Mexico Central Bank (Banxico) has met to decide the policy rate. In a widely expected decision, Banxico has kept the policy rate unchanged at 11.25% and postponed the decision to cut. However, an important tweak in the communique was made. Despite stating that the interest needed to be kept at this level for some time, Banxico stated that the level of the policy rate will be decided according to the available information, which basically leaves the door open for a cut in March.

Regarding the external environment, Banxico stated that Central Banks from the advanced economies have kept their policy rate unchanged. Interestingly, no mention was made of the recent U.S. communique which indicates that rates were going to be kept at this level for a longer period than previously expected. Indeed, external rates have had little influence on Mexico due to the high spread between the interest rate and the resilience of the Mexican Peso, but as the spread begins to narrow in the upcoming months, there is a possibility that Banxico will start monitoring it more closely.

Regarding the domestic economy, Banxico stated that despite registering substantial growth in 2023, the data from the last quarter started to indicate that the Mexican economy is decelerating. The labor market, however, continued to show resilience. On the inflation numbers, Banxico maintained the same view as us, that most of the rise in the January numbers was situated in non-core items and that Core CPI actually fell on an annual basis. They continue to believe that inflation will only converge to the target in the second half of 2025.

The relatively neutral communique in a situation where inflation has accelerated in recent months actually shows optimism from Banxico. We believe now that the situation in which they cut in March is the one with the highest probability. It could only be prevented by a strong acceleration of core CPI in February, which we see as unlikely. Therefore, the discussion will change towards a magnitude of 50bps or 25bps. We will gather more information from the minutes and from the data that will come out, but it is likely that 50bps will be preferred, especially in light of an economy that is decelerating.