Japan Outlook: Normalizing Monetary Policy Soon

Bottom Line:

· GDP growth for 2023 has been revised lower to +1.6% as private consumption has been dampened in the second half of 2023 by higher inflation and negative real wage. Sluggish growth should be expected for private consumption in 2024 even when wage hike (to be limited by economic growth in 2024) filters into household balance sheets. Consumption growth in 2025 will remain slow after the post COVID demand wave and potential tightening. The trade Balance will remain solid in 2024 as Japan’s export continue to benefit from a soft JPY, before returning to neutral in 2025. Government spending steadies throughout 2024/25 with Japanese government’s fiscal room being limited.

· We are forecasting a change in forward guidance in Q1 2024 with BoJ justifying their decision to exit ultra-loose monetary policy by wage growth & inflation dynamic. The BoJ would announce they are prepared to bring interest rate to 0% in Q1 before exiting yield curve control. If CPI inflation would be on track for the of BoJ’s forecast, we see the BoJ hiking rates to 0.25% in Q2 2024 to tackle stubborn core inflation.

· Forecast changes: We revised 2023 GDP lower to +1.6% because private consumption contracted in the face of higher inflation. 2024 GDP is also being revised to 0.9% with consumption limited by pace of wage growth. 2023 CPI Inflation forecast is revised higher to +3.3% and 2024 to +1.7% to reflect the changes in inflation dynamics.

Macroeconomic and Policy Dynamics

Japanese headline inflation continues to moderate throughout 2023 as post COVID pent up demand fades and as supply chain disruption dissipates still further. However, the pace of moderation has been on a rocky road for food inflation (record chicken culling on bird flu in H1 2023) and there was a spike of energy prices in Q3 2023 from geopolitical tension in the Middle East which led to a rebound in CPI in the corresponding time interval. Thus, our 2023 inflation forecast is revised higher to +3.3%. Our 2024 inflation forecast are also revised higher to +1.7% when wage hike filters into the economy before returning to low CPI inflation of 0.8% in 2025. Core inflation would be stickier than headline wise. BoJ sees CPI less fresh food to be 2.8% (2024), 1.7% (2025) and CPI ex fresh food & energy be 1.9% (2024), 1.9% (2025). The stubborn core inflation is a key reason for the BoJ to exit ultra-loose monetary policy.

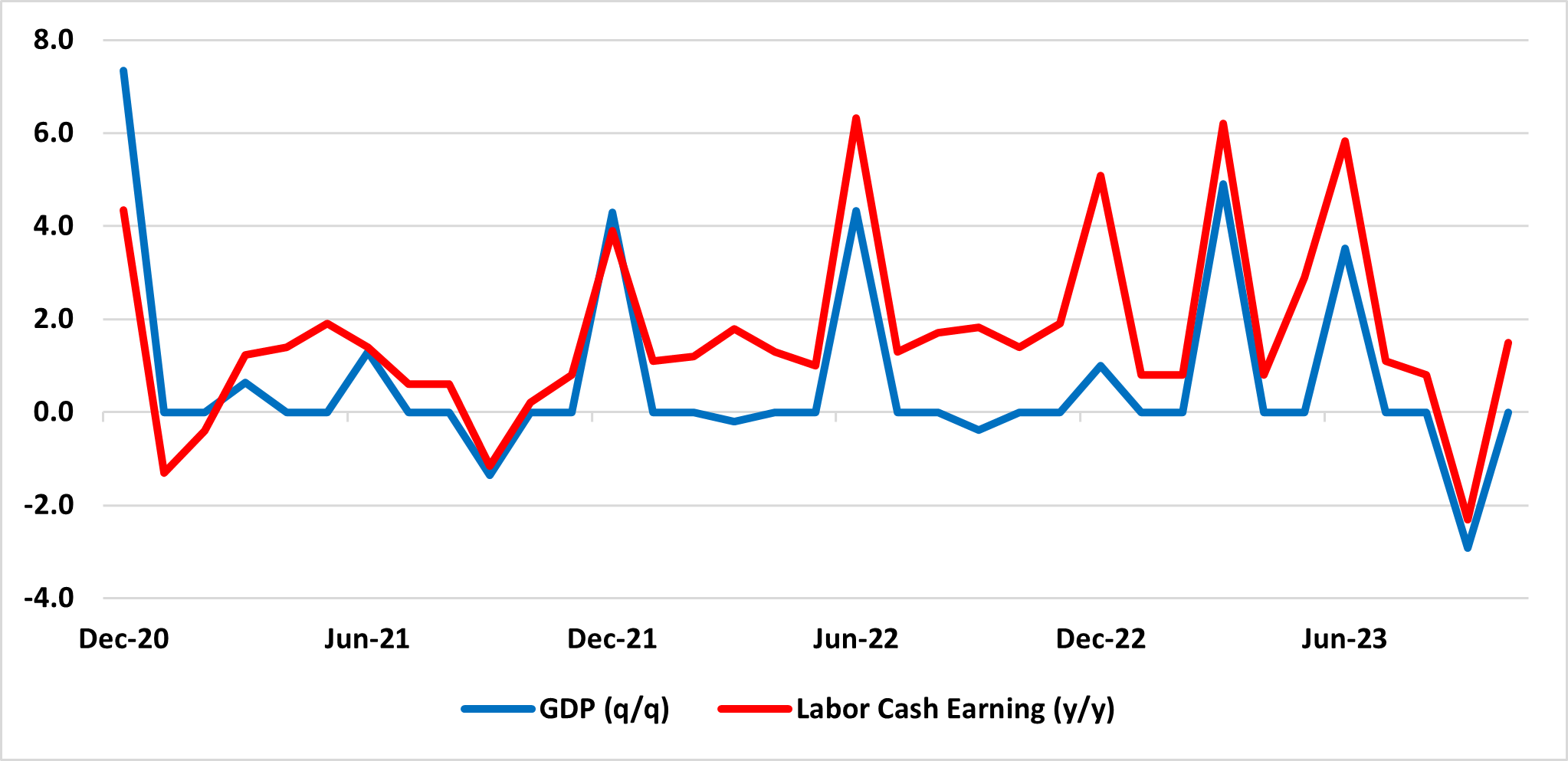

Figure 1: Japan GDP (q/q) and Labor Cash Earning (y/y)

Source: Datastream, Continuum Economics

Dragged by contracting private consumption in the second half of 2023, our forecast for 2023 GDP growth has been revised lower to +1.6%, so as 2024 GDP growth slipping to +0.9% on our moderated wage inflation forecast. 2025 GDP is forecasted to be +1.1% with economic growth normalized. Private consumption is expected to return to modest growth in 2024/25 helped by real wage being closer to positive and household savings being depleted further. Despite historical wage hike being announced, the average labor cash earnings growth for 2023 is just 1.6% (Figure 1). Although, our central forecast sees wage inflation to further pick up and edge closer to 2% in 2024, the pace and magnitude will be limited by economic growth in the same period. We do not expect robust consumption growth unless wage inflation surprises to the upside. Government spending will be steady given the limitation in fiscal space and we are not forecasting another round of stimulus.

GDP growth would be further supported by positive trade balance in a medium run with soft JPY keeping Japanese export attractive. Japanese Export has increased by +2.7% y/y (in real terms) in the first three quarters of 2023 and we forecast export growth to remain above trend in 2024 even when JPY corrects from extreme weakness.

The trade balance has surprised to the upside and was a significant contributor for Japanese growth in 2023. Yet export to China and Asia has fell throughout 2023 while export to U.S. and Europe remain solid, due to the magnitude of JPY weakness against the respective currency and individual performance in corresponding economies. For Japanese trade to grow sustainably, Chinese demand is inevitably an important factor. With Chinese economy slowly recovering, we forecast Japanese export to have a humble +2.1 y/y gain in 2024. The headline trade balance has been prompted up by soft import (-1.6% y/y in real terms from Q1-3 2023) as the weak JPY helps suppress imports.

Private non-residential investment has also grown by +1.8% y/y (in real terms) in the first three quarters of 2023 even when inflationary pressure is steep. With CPI further moderates and corporate tax breaks in 2024/25, investment should continue to grow and supports Japanese economy.

Japanese policymakers had shifted their inflation rhetoric to “trend inflation” (term starts from 6 months to 2 years) possibly achieving the 2% target, which means that the BoJ is acknowledging current inflation is driven by wage and economic growth. BoJ has revised their inflation forecast in October 2023 and sees less fresh food y/y CPI for 2023 to be +2.8% from +2.5%, +2.8% from +1.9% for 2024 and +1.7% from +1.6% for 2025, sees less fresh food & energy y/y CPI for 2023 to be +3.8% from +3.2%, +1.9% from +1.7% for 2024 and +1.9% from +1.8% for 2025. The BoJ seems to have shift their focus towards “core” (less fresh food) CPI to support their intention of policy normalization. The BoJ has privately long viewed the +2% inflation target as a long shot because of the Japanese business culture does not favor passing cost to customers but such pricing behavior is changing in face of high inflation. The revision of inflation forecast is steering BoJ towards their next step in monetary policy in Q1 2024. It seems that Q1 2024 would be the perfect window for BoJ to adjust their monetary policy before major central banks are expected to pivot to policy easing in Q2 2024. The BoJ would first move the policy rate from -0.1% back to 0% then could remove YCC. If wage and inflation dynamics are on track in the coming months, we will see the BoJ to tighten by 25bps in Q2 2024.

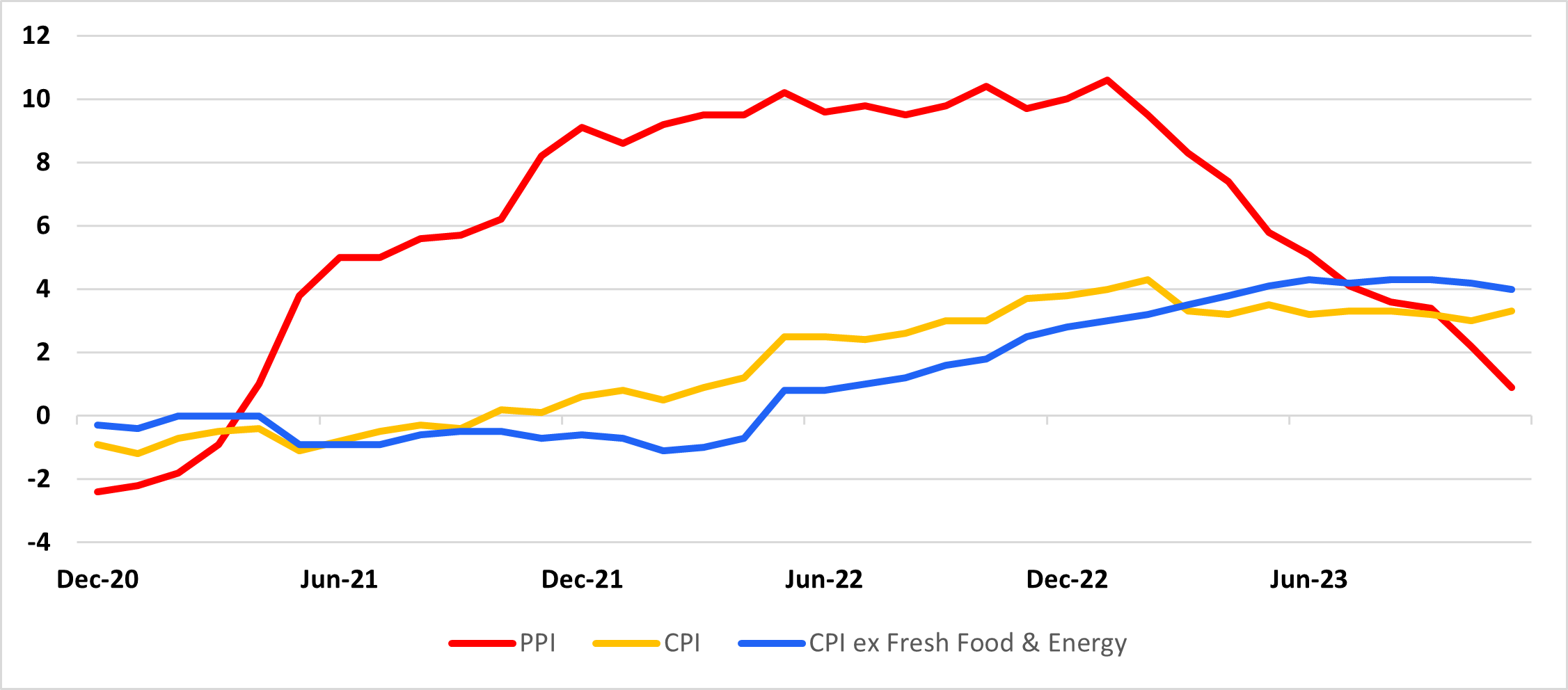

Figure 2: Japan PPI, Headline CPI and ex Fresh Food & Energy CPI

Source: Datastream, Continuum Economics

Albeit headline CPI has been moderating since the beginning of 2023, the pace has been hindered by high food prices and spike in energy price. Fresh food prices remain the biggest inflationary factor, closely followed by other household items and hotel charges. Yet, fresh food prices inflation has moderated and may rotate lower in coming quarters as supply chain restraints eased, the one-off event of culling 16 million birds is unlikely to be repeated and global tightening feeds into the global disinflation (evidence from the falling PPI, Figure 2). The November Tokyo CPI shows us early evidence of -0.9% m/m contraction in food prices with energy prices decreasing m/m. The October National Headline y/y CPI came in at +3.3%, ex food & energy at +4% while ex fresh food came in at +2.9%. And from here on, we forecast CPI to tread lower with both food and energy prices continue to rotate lower until Feb 2024 when we expect energy prices to rebound. In 2024, headline CPI is forecast to be +1.7% as global disinflation takes effect and the pace of wage hike will be hindered by economic growth. By 2025, it is expected headline inflation would revert to the traditional Japanese pace of 0.8% for the BoJ exited loose monetary policy and thus we are below consensus and the BOJ forecast.

Policy Outlook

The BOJ is ready to exit ultra-loose monetary policy after wage negotiation in Q1 2024 for Ueda said the market should forecast their policy shift. The BoJ had removed the cap for 10yr JGB in their Yield Curve Control policy by stating +1% is only a reference rate in October 2023 and we forecast YCC will be removed in Q1 2024, yet in the meantime any spike in JGB yields will be met with intervention from the BoJ as they will not tolerate such behavior. In Ueda’s December 2023 press conference, he highlighted it is more likely to achieve inflation target now but would like to see more support from wage data. The wage/inflation dynamic is the focus for BoJ and they would be waiting for 2024 spring wage negotiation before calibrating monetary policy. We forecast the BoJ would first move interest rate to zero before completely abandoning Yield Curve Control. If the current trajectory of inflation follows BoJ’s play script, we would also see a 25bps tightening in Q2 2024. However, given our view that headline inflation will dip below 2% in Q3 2024 and subsequent CPI forecast to be less than the BOJ projects, we see the BOJ not hiking the policy rate any further in 2024 and 2025.