FX Daily Strategy: APAC, Oct 31st

EUR still biased lower despite solid data and more upbeat ECB

JPY weakness at extremes but little to halt the trend

FX intervention possible but without it only a turn in equities likely to trigger JPY recovery

Equities likely a driver of FX after tech results

EUR still biased lower despite solid data and more upbeat ECB

JPY weakness at extremes but little to halt the trend

FX intervention possible but without it only a turn in equities likely to trigger JPY recovery

Equities likely a driver of FX after tech results

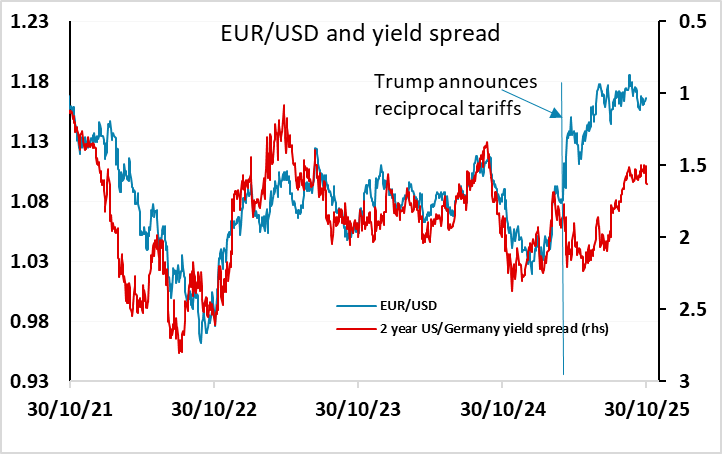

Friday has relatively little on the calendar, with French and Eurozone provisional October CPI data probably the highlight. But after Thursday’s German CPI, which was broadly as expected, it’s unlikely we’ll see anything that will change the market’s perception of the ECB. The ECB’s statement after Thursday’s meeting was slightly more upbeat. The said “the robust labour market, solid private sector balance sheets and the Governing Council’s past interest rate cuts remain important sources of resilience”, but added “the outlook is still uncertain, owing particularly to ongoing global trade disputes and geopolitical tensions”. EUR yields rose very slightly, helped also by the slightly stronger than expected 0.2% q/q rise in Eurozone Q3 GDP, but not enough to offset the general USD strength that followed the FOMC. Yield spreads moved in the USD’s favour, and there is still scope for EUR/USD to move back towards the pre-April relationship with yield spreads, which would suggest substantial downside risks. The 1.1530/40 area represents current support and a break would open downside risks towards the July/August low of 1.14, but we doubt there is sufficient reason for such a significant move at this stage.

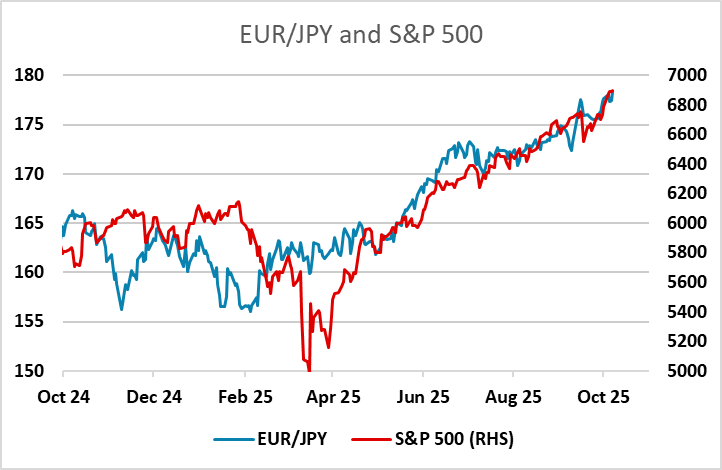

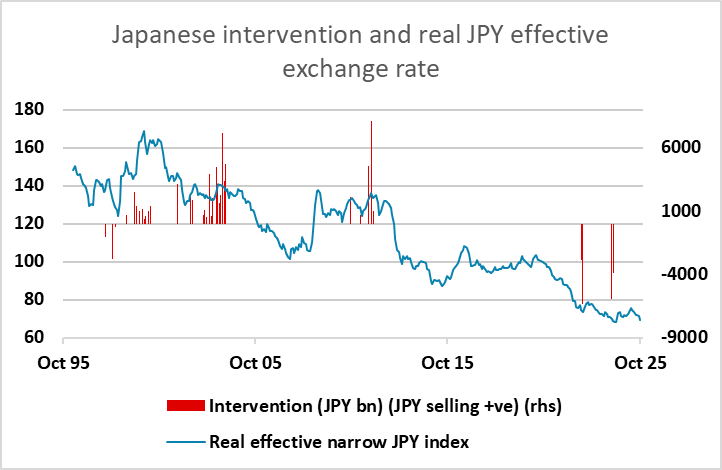

JPY weakness remains a major theme, and remains hard to oppose with the Japanese authorities not putting up a fight against the JPY’s decline. The real exchange rate is now only a little more than 1% above the lows seen in July last year, with new highs in EUR/JPY seen on Thursday. The lack of BoJ tightening is the latest justification of JPY weakness, but it has not really been a yield based story in recent months. On the basis of yield spreads, the JPY should already be substantially stronger due to the decline in US and European yields. Rather, the JPY has tended to weaken with equity strength of late, while the election of a new PM in Takaichi has amplified the weakness, although with very limited policy justification.

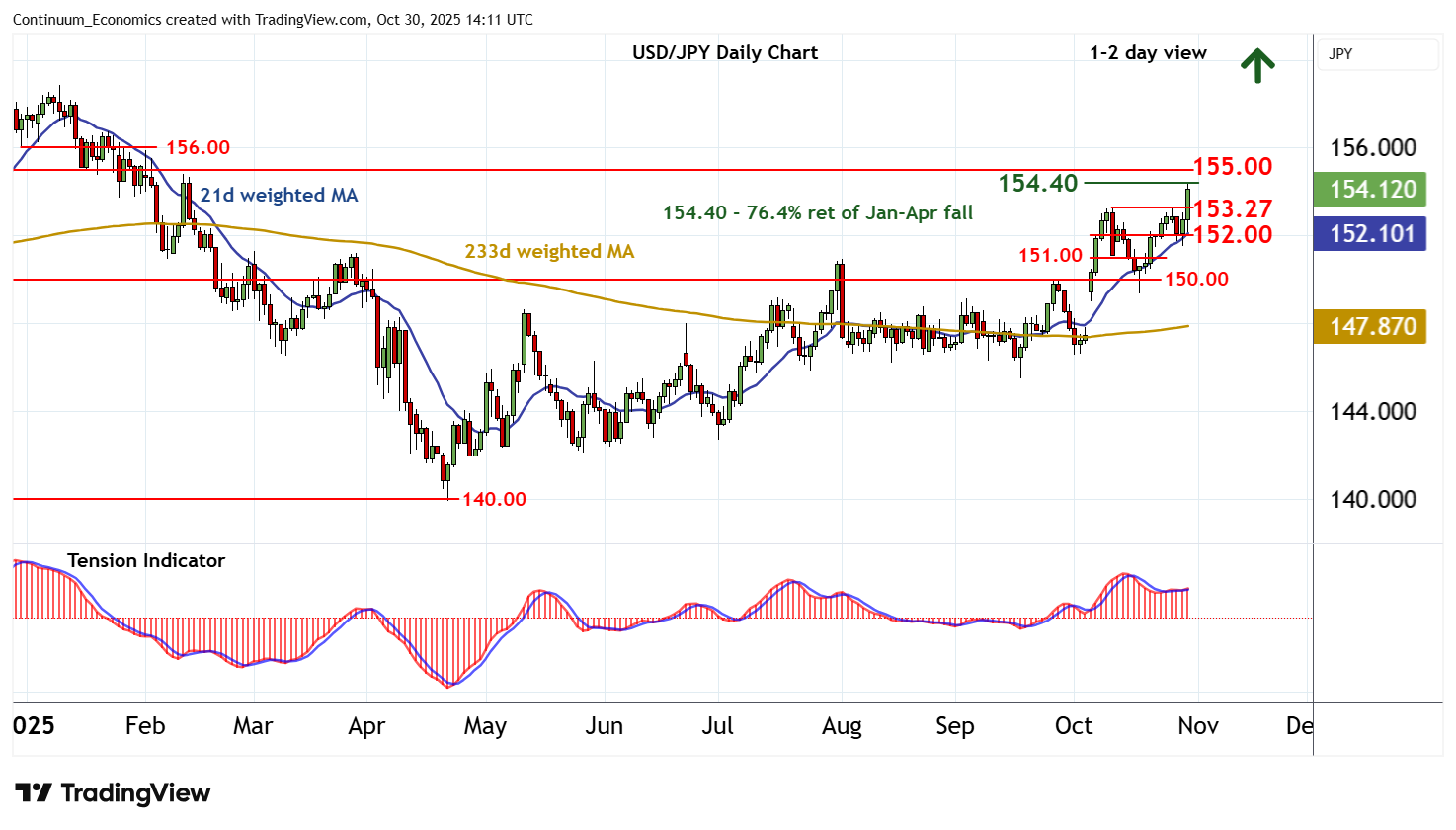

The new Cabinet secretary Kihara has verbally opposed excessive moves and called for FX rates to reflect fundamentals – which is normally seen as expressing opposition to JPY weakness, but the market may need to see more actual intervention to convince them that the new administration truly wants a stronger JPY. Certainly, the last government conducted intervention near current levels, but things may have changed. Nevertheless, we wouldn’t expect the new government to want a weak JPY – this would in the end lead to more BoJ tightening and push up living costs. So intervention is possible, though not currently expected. Without it, equity market weakness looks like the only thing that could turn things around, although in the short run USD/JPY has hit a key retracement level at 154.40 and may hold for now.

Otherwise, Friday looks likely to be quiet, with the performance of the equity market after the results from the tech sector probably the most likely driver for most currencies. In a risk positive mood, the AUD should be the best performer, with the CHF looking more vulnerable with EUR/CHF having rejected a test of 0.92. In a risk negative world, the JPY should outperform.