USD flows: USD softer as yields move lower

Declining US yields and negative Nvidia reaction to results put the USD under pressure

The USD is generally lower overnight, falling back with US yields as the market increased its expectation of a September Fed ease, now pricing it as an 89% chance, while remaining nervous about Trump’s plans for the Fed with his attempt to oust governor Lisa Cook ongoing. The Nvidia results also led to some softness in equities which likely helped to suppress US yields. While results were nominally better than expected, concerns about their China business have meant a drop in the share price.

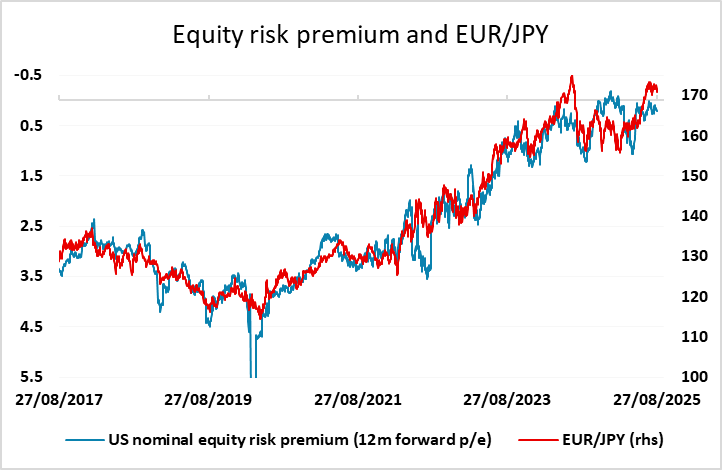

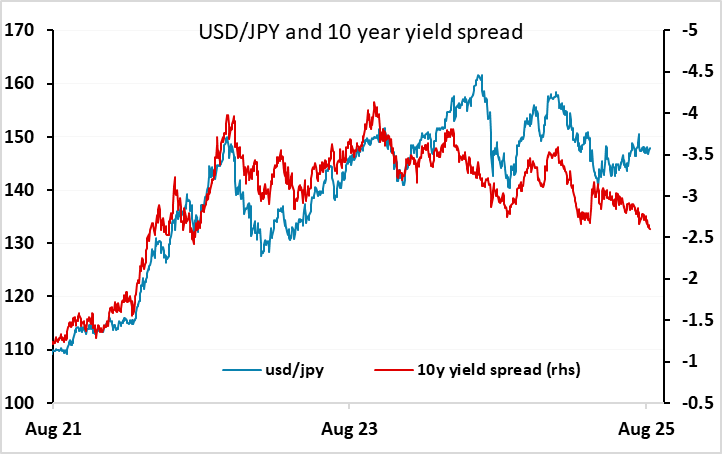

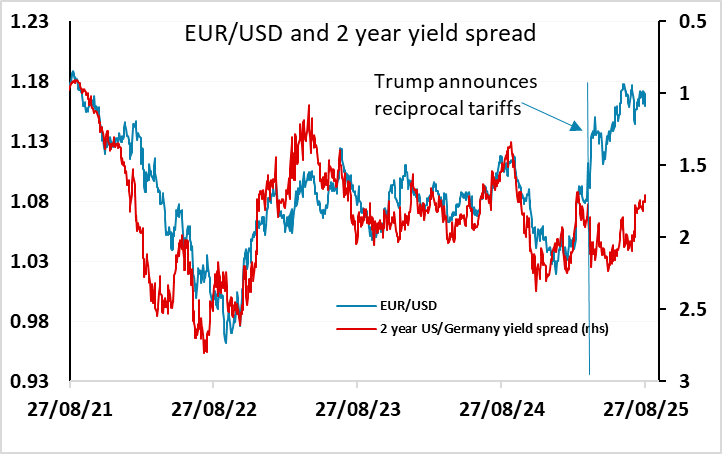

The USD is weaker across the board, but the JPY continues to look to have the most potential to gain, with 10 yar yield spreads now the narrowest for 3 years when USD/JPY was trading in the mid-130s. While spreads with the EUR have also narrowed, EUR/USD has been outperforming yield spreads since April. The decline in yields has also led to a modest rise in the implied equity risk premium, which typically favours the JPY on the crosses.

For today, the US GDP and jobless claims data later will be a focus, but a generally USD negative and risk negative tone may be seen ahead of the numbers.