FX Weekly Strategy: APAC, March 25th-29th

Market to focus on the aftermath of last week’s central bank meetings

USD/JPY may break to new high after BoJ minutes but break unlikely to be sustained

EUR/USD unlikely to start far from recent ranges

GBP may extend losses as market considers possibility of earlier rate cut

NOK/SEK may gain if Riksbank turns more dovish

Strategy for the week ahead

Market to focus on the aftermath of last week’s central bank meetings

USD/JPY may break to new high after BoJ minutes but break unlikely to be sustained

EUR/USD unlikely to start far from recent ranges

GBP may extend losses as market considers possibility of earlier rate cut

NOK/SEK may gain if Riksbank turns more dovish

It’s a fairly quiet week for data so the market may be driven primarily by further reflections on last week’s central bank decisions. The BoJ minutes on Monday will hopefully provide some further information on the BoJ’s intentions going forward, and this could drive the initial USD/JPY direction. After the BoJ raised rates at their meeting last week USD/JPY moved significantly higher and tested the 24 year high of 151.94 see in October 2022, while EUR/JPY moved to new 16 year highs. The JPY is, of course, even weaker than this in real terms, now reaching new floating era lows.

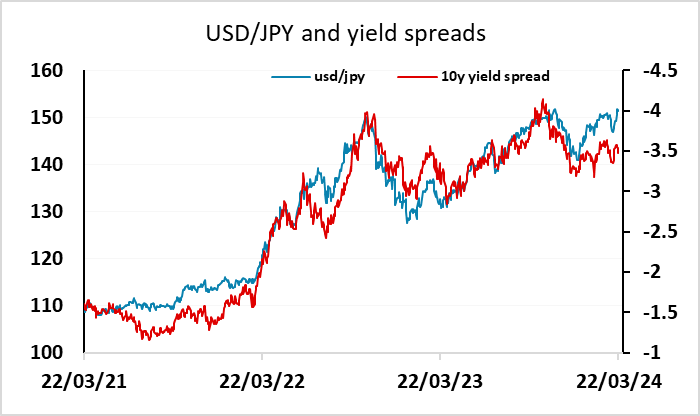

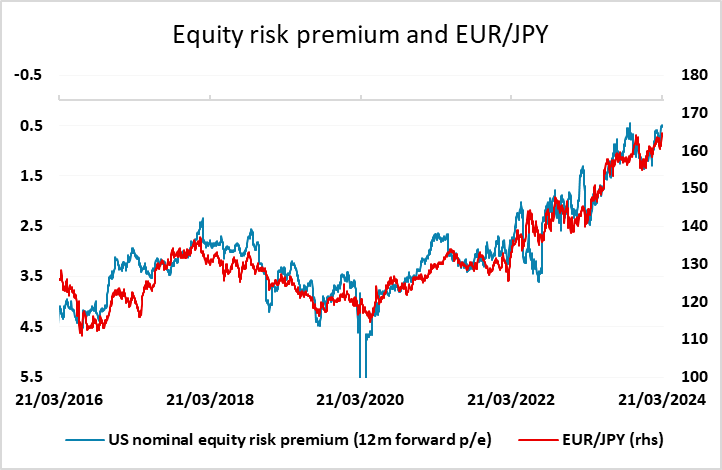

It is superficially somewhat surprising that this weakness came after an unexpected hike in rates from the BoJ, which most would have expected to be JPY positive before the decision. Many have tried to explain the JPY weakness by saying that the guidance from the BoJ was relatively dovish, not indicating any further tightening intentions. But Japanese yield levels are not much changed, and if the market was adjusting its expectations towards easier policy you would expect yields to be lower. The minutes may provide some further information on the BoJ’s intentions, but in the end we doubt there will be much change in market expectations of policy. Furthermore, we doubt that this will be the key driver of USD/JPY, because we don’t believe the JPY weakness after the BoJ hike had much to do with expectations of the BoJ. Indeed, the JPY is weakening even though yield spreads don’t appear to support the current decline, and this seems to be related to the JPY’s status as the funding currency in a risk positive world. The decline in the JPY, particularly on the crosses, has been highly correlated with the decline in equity risk premia in recent years, and the move after the BoJ meeting looks to have been a catch-up to the decline in risk premia that had been seen in the previous week.

Nevertheless, we may see a short term reaction to the BoJ minutes, with the market looking for a break of the 151.94 high and potentially getting it if the minutes fail to indicate any further tightening intentions. But we doubt such a break will hold unless we see further declines in equity risk premia supported by lower yields and/or higher equities. There is also an increasing danger of BoJ/MoF FX intervention at these levels, especially given the lack of yield spread support for further JPY weakness.

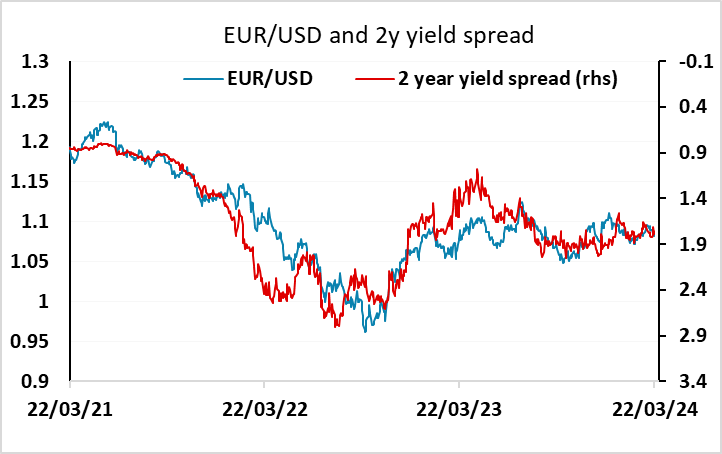

It’s hard to see a great deal of movement in EUR/USD. There isn’t any major data in the US or Europe, and although the USD was firm at the end of last week, yield spreads don’t really suggest scope for a break below 1.08, never mind a test of the low of the year’s range below 1.07.

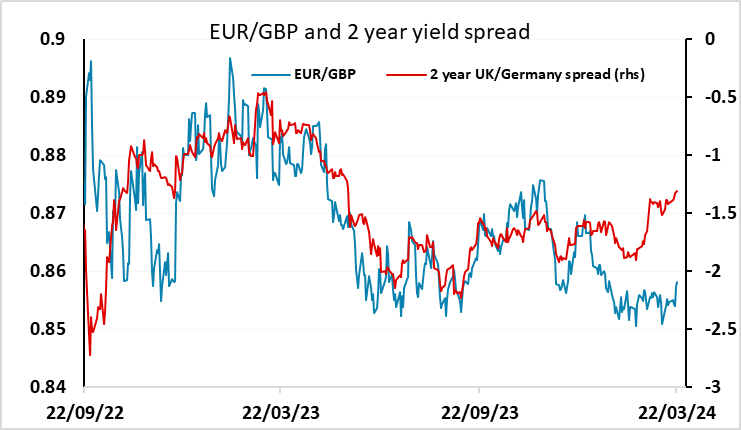

There may also be further reflection on the Bank of England MPC decision and statement. On the face of it, this was in line with expectations, albeit more dovish than the February decision. The 8-1 vote for no change saw the only dissent being for a cut, with the two hawks from February both no calling for no change. But there were also comments from governor Bailey to the press after the meeting suggesting that a cut may be seen even before inflation falls below 2%, as it is expected to do in the summer. The UK money market has priced in a slightly increased chance of a May cut, but even without that there is scope based on the correlation with front end yield spreads for EUR/GBP to move back above 0.86 and head towards the highs of the year near 0.87.

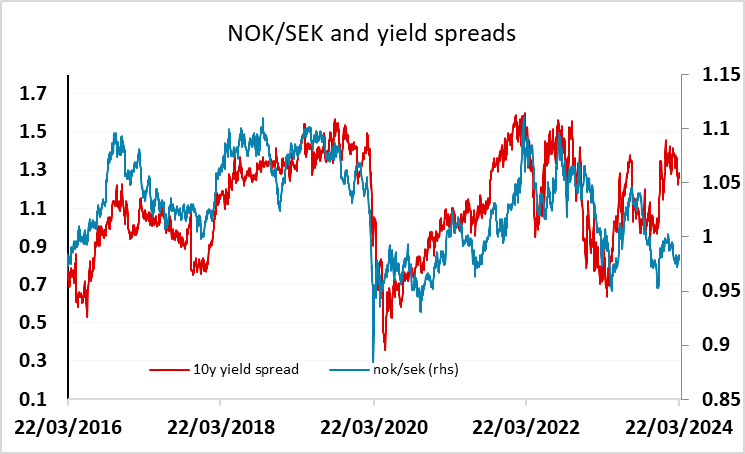

There is one central bank meeting this week, in Sweden. The Riksbank are not expected to produce any change in policy, but may signal potential for an earlier cut than seen at the last meeting. We continue to see scope for a decline in the SEK, primarily against the NOK, with NOK/SEK still trading well below the level suggested by yield spreads. Norges Bank’s decision to leave rate projections nearly unchanged last week should point in that direction if the Riksbank take a more dovish view.

Data and events for the week ahead

USA

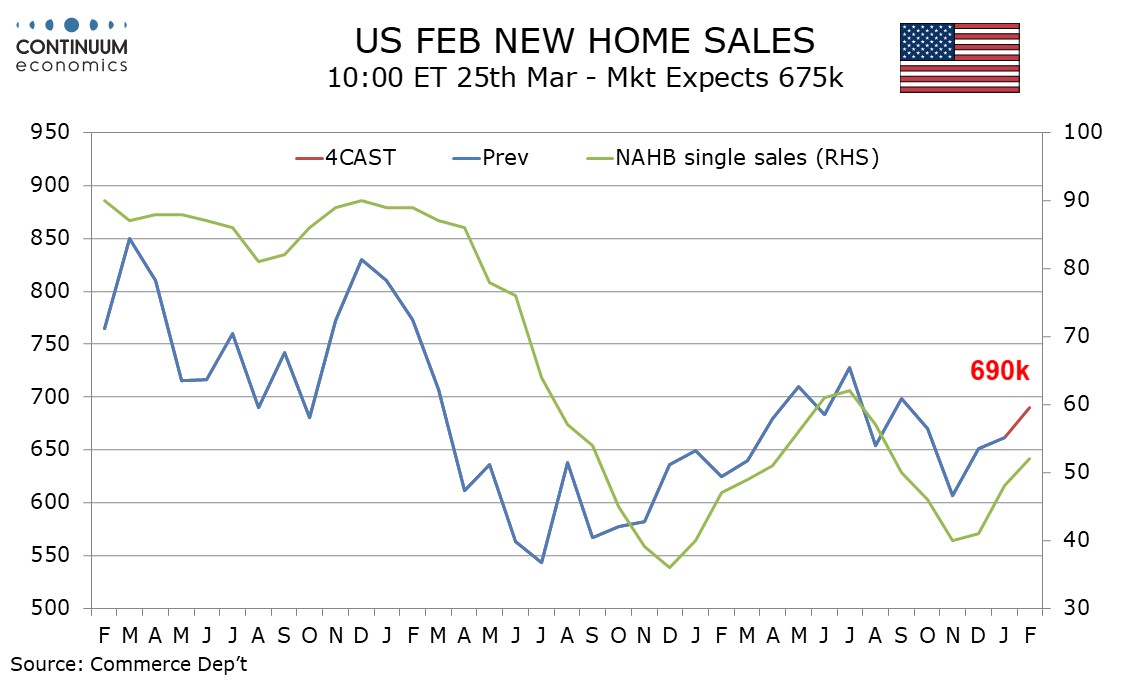

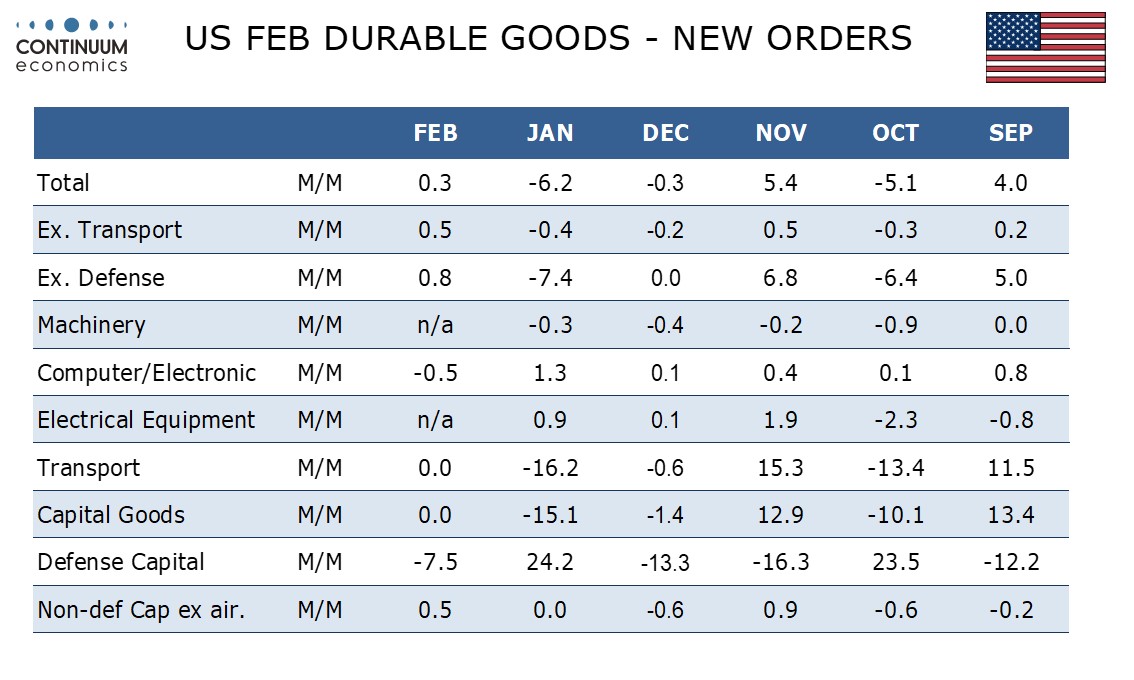

On Monday we expect February new home sales to show a third straight rise, by 4.4% to 690k. Fed’s Bostic is also due to speak. On Tuesday we expect a modest 0.3% rise in February durable goods orders, with a 0.5% rise ex transport. January house price data from the FHFA and S and P Case-Shiller are also due followed by March consumer confidence. On Thursday we expect a final Q4 GDP increase of 3.1% versus a 3.2% preliminary. Weekly jobless claims are also due followed by March’s Chicago PMI, February pending home sales and March’s final Michigan CSI.

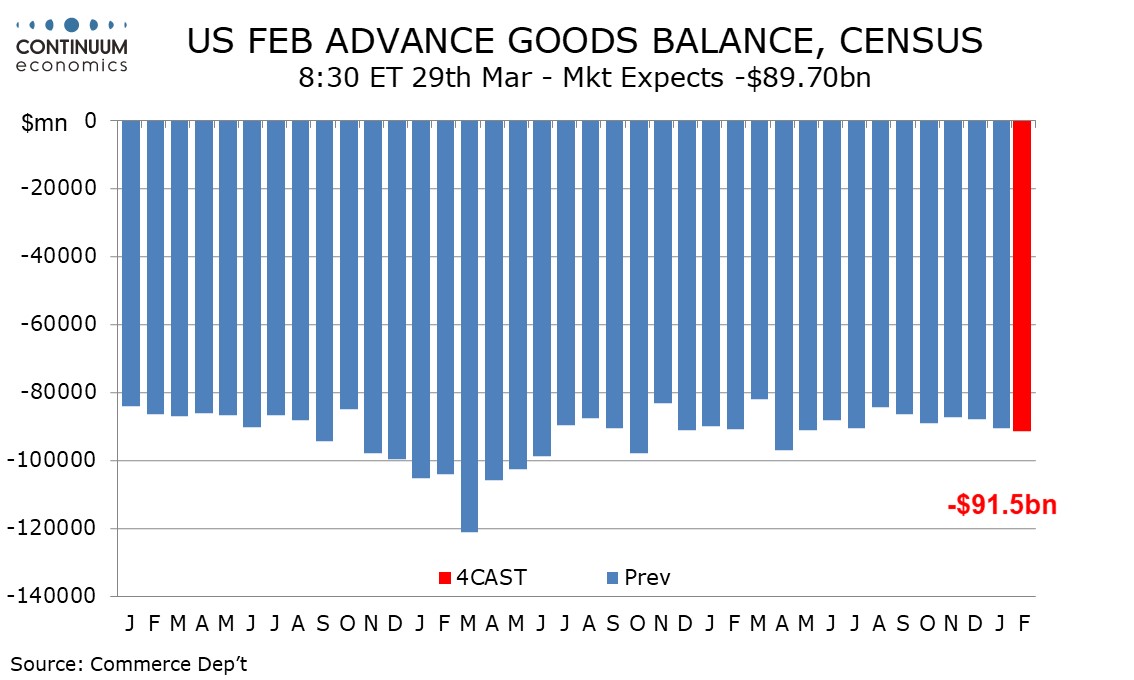

Good Friday sees the week’s most significant data. We expect a 0.3% rise in February’s core PCE price index, slightly below the 0.4% core CPI which was rounded up. We also expect a 0.7% rise in personal spending to significantly outperform a 0.2% rise in personal income. Advance February goods trade data is also due. We expect a third straight increase in the deficit, to $91.5bn from $90.5bn.

Canada

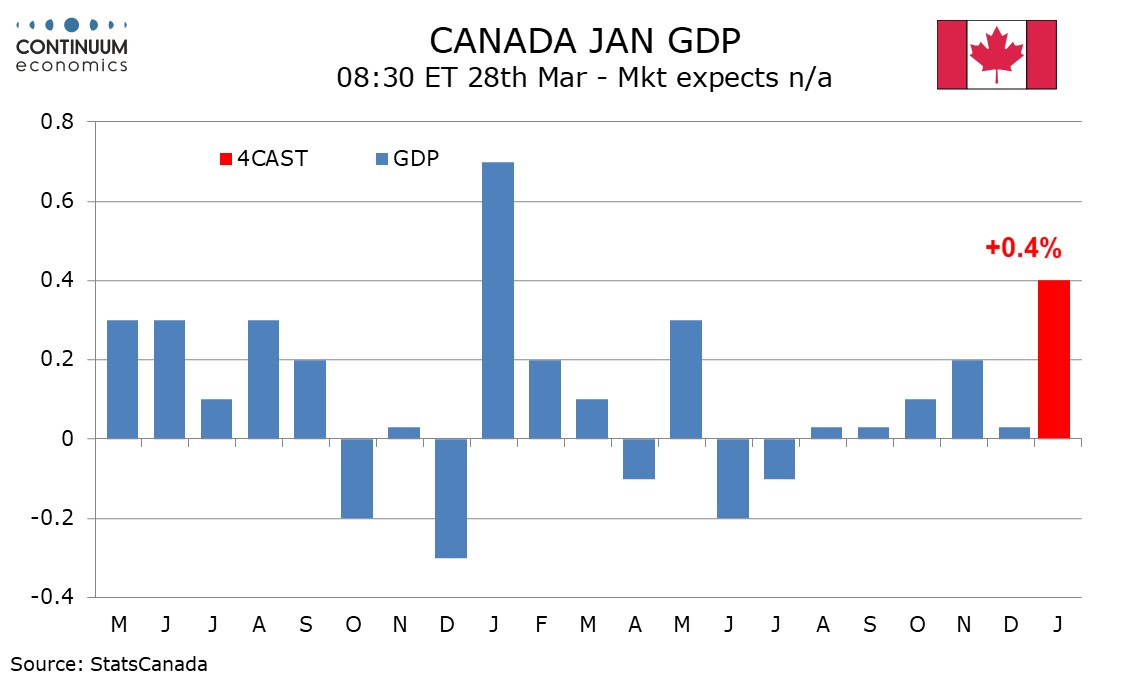

In Canada, Senior Deputy BoC Governor Rogers will speak on Tuesday. January GDP is due on Thursday and we expect a 0.4% increase, in line with a preliminary estimate made with December’s data, assisted by the ending of strike activity.

UK

Revised national account data for Q4 should still imply clear recession in H2 last year while data on the current account released alongside on Thursday may show a fresh deterioration back towards a gap of 4% of GDP. Otherwise, an insight into final policy thinking will come from the BoE releasing FPC minutes on Wednesday.

Eurozone

European Commission survey data (Wed) should be examined all the keener as they have conflicted with the more high-profile, but perhaps less accurate, PMI numbers. But there should also be interest in the ECB-complied money and credit data (Thu) not least after fresh weakness on lending in the last set of numbers. German retail sales data may show more volatility and revisions (Wed) while labor market data may still point to labor hoarding.

Rest of Western Europe

In Sweden, it is ever clearer that the Riksbank has accepted that it can and should make its policy stance less contractionary, at least in conventional terms. Surely this possibility has risen given the further downside inflation surprise seen in February data which undershot Riksbank thinking of CPIF inflation, at 2.5%, by 0.4 ppt and added to signs of clearly softer underlying price dynamics. A June cut has long been our view, the question being whether this is formally flagged by the Riksbank in its updated projection due alongside the almost-certain stable decision due on Mar 27. More likely, the Board may wait to the May 8 verdict to offer any formal signal. Elsewhere, the SNB provides Q4 FX intervention data (Thu) and Switzerland see the monthly KOF survey which may show a further correction back.

Japan

Hopefully BoJ minutes next Monday will give us more clarity or forward guidance for the next step in policy. Tokyo CPI would come in next Thursday, Mar 28. The figure jumped In Feb after a dip in January. We forecast the data to remain above 2% mostly for 2024. We also have retail trade on the same day, so as unemployment rate.

Australia

Monthly CPI on Tuesday, March 26would be most important. It would be interesting to see it below 3% but we doubt that. RBA changed there forward guidance in the last meeting and seems to be one forward guidance away from easing. Retails Sales and Consumer Inflation Expectation on Wednesday, Mar 27.

NZ

Business confidence and outlook On Tuesday, Mar 26. Consumer confidence on Wednesday, Mar 27.