JPY, EUR flows: JPY higher on more risk negative tone, EUR edging down

JPY benefiting from weakening risk sentiment, stronger CPI. EUR slipping towards the centre of recent range

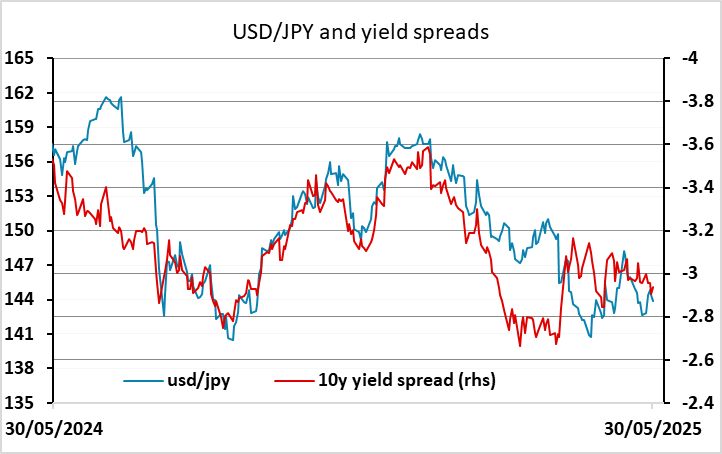

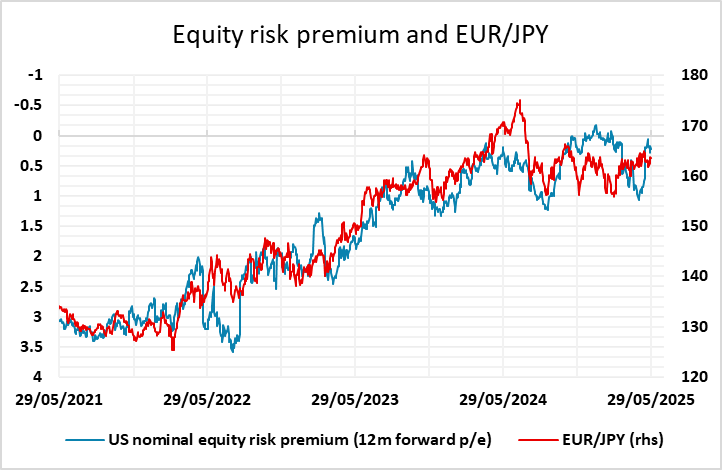

The JPY has advanced overnight helped by another above consensus rise in Tokyo CPI in May and a more negative risk tone due in part to the stalling of US-China trade talks, while the initial reaction to the court decision on tariffs has largely been reversed as the markets anticipate the Trump administration challenging the decision and/or finding a different way to increase tariffs. The calendar is fairly quiet today, but the more negative risk tone seems likely to persist, as it is hard to justify current levels of equities if there is going to be a hit from tariffs, so we would continue to favour JP strength.

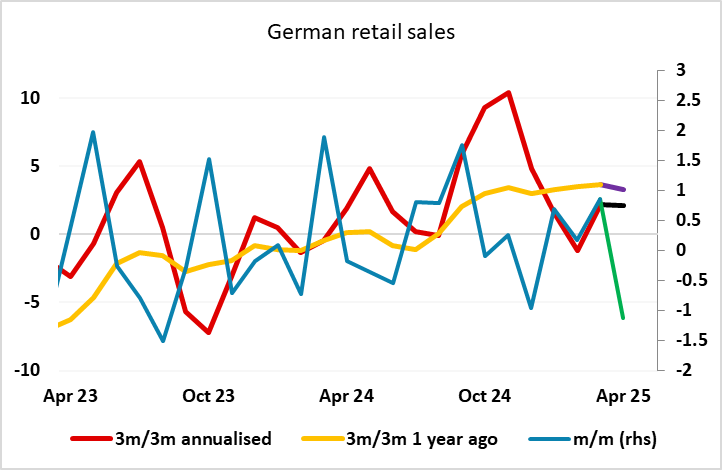

EUR/USD has slipped back overnight and remains stuck in the 1.12-1.14 range that has held for most of the last month. This morning’s German retail sales data were on the weak side of consensus, and may suggest some mild declines towards 1.13, although despite the monthly decline, the underlying trend still looks quite solid.