FX Daily Strategy: Asia, January 16th

UK earnings data the focus for GBP markets

GBP risks on the downside given strong starting point and relatively hawkish BoE

Canadian CPI likely to show y/y rise but little change in BoC core measures seen

CAD vulnerable given strong starting point and weak BoC survey

UK earnings data the focus for GBP markets

GBP risks on the downside given strong starting point and relatively hawkish BoE

Canadian CPI likely to show y/y rise but little change in BoC core measures seen

CAD vulnerable given strong starting point and weak BoC survey

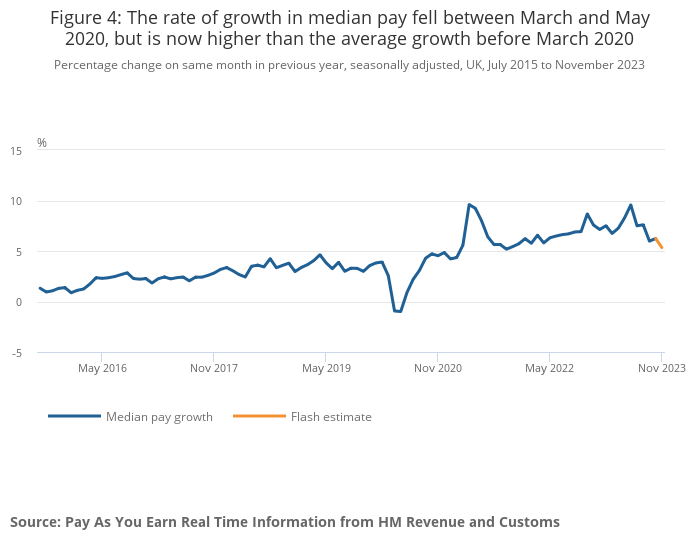

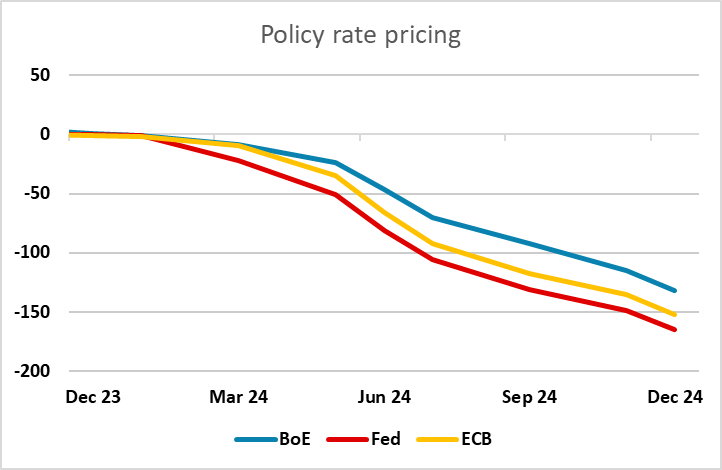

UK labour market data and Canadian CPI are the main calendar items on Tuesday. The UK labour market data is potentially significant because the market is currently assuming a much less dovish policy path from the Bank of England than from then Fed or the ECB. This is due to a combination of factors, including recent relatively strong UK PMIs, the Bank of England’s current bias to tighten and the three BoE MPC members who voted for a rate hike at the last meeting. But from a data perspective the Bank is most focused on the earning and inflation numbers, with the relative strength of the earnings data probably the main factor differentiating the UK from its peers. However, the official ONS earnings data is flawed, and acknowledged to be so by the Bank and the ONS itself. We and the market now take more notice of the HMRC PAYE data, which has a large sample size and is more up to date as a better indicator of pay for payrolled employees. This has shown a much clearer slowdown in recent months than the ONS average earnings data. Nevertheless, the ONS data is expected to show a clearer slowdown this month, and if we see a further slowing in the HMRC data as well, it should be seen as increasing the chances of a more dovish BoE stance.

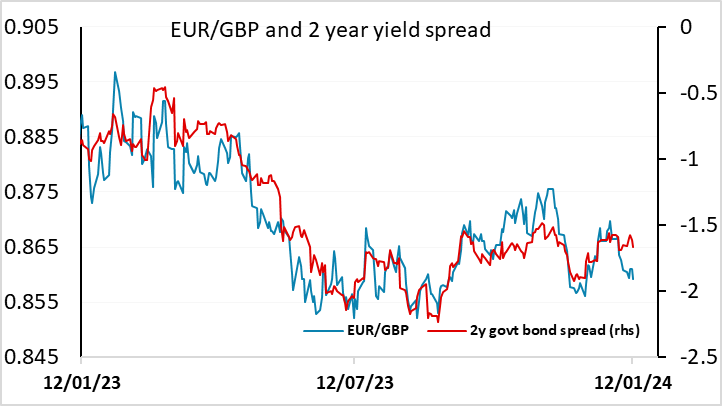

This suggests to us that there are downside risks for GBP, with the data potentially moving yield spreads in the EUR’s favour. On top of this, we are starting from a position where yield spreads already suggest EUR/GBP is lower than normally indicated by the recent correlations. Even if UK yields hold current levels, we would expect EUR/GBP to find support below 0.86 and edge up towards 0.87 in the medium term.

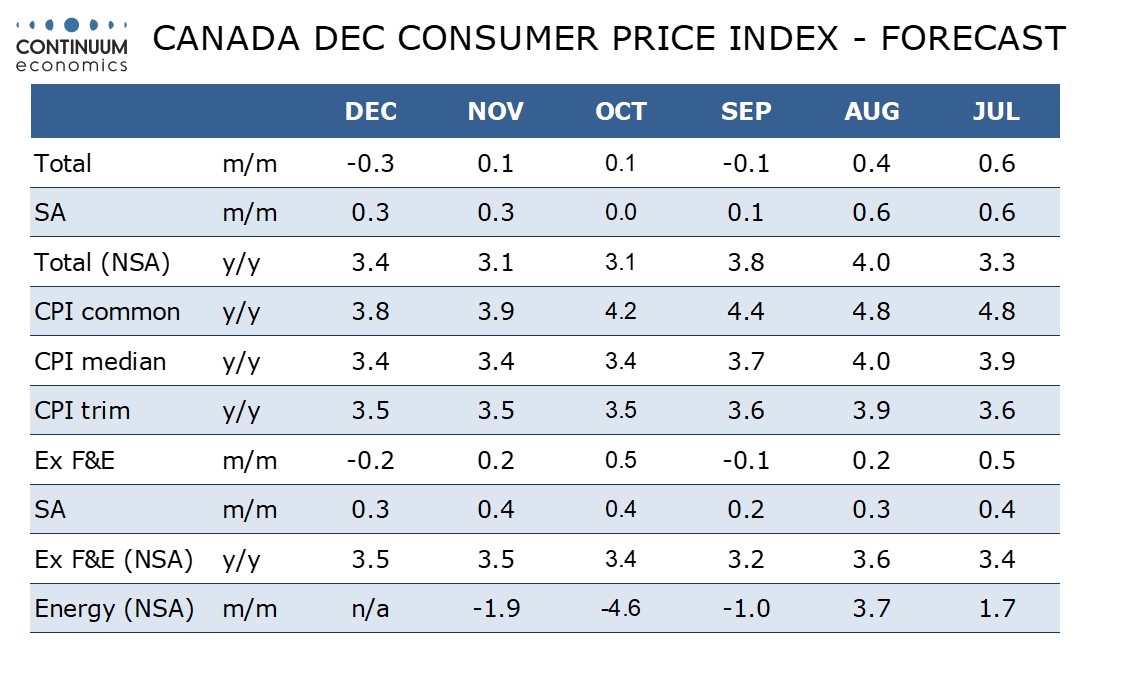

We expect December Canadian CPI to rise to 3.4% yr/yr after two months at 3.1%, and we expect only marginal downward progress in one of the three Bank of Canada core rates, showing that inflation remains stubborn in Canada. We expect the monthly data to show overall CPI down by 0.3% with a 0.2% decline ex food and energy, but these declines will be largely seasonal. The ex food and energy rate is not one of the BoC’s core rates. Here we see a marginal decline in CPI-common to 3.8% yr/yr from 3.9%, but we expect CPI-trim and CPI-median to remain at their paces seen in both October and November at 3.5% and 3.4% respectively.

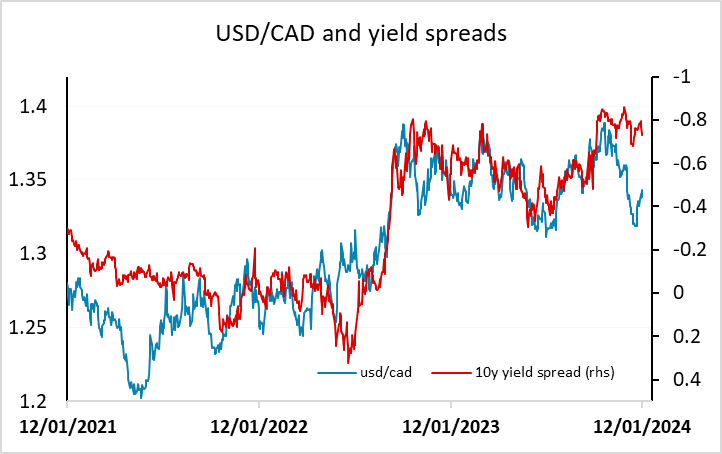

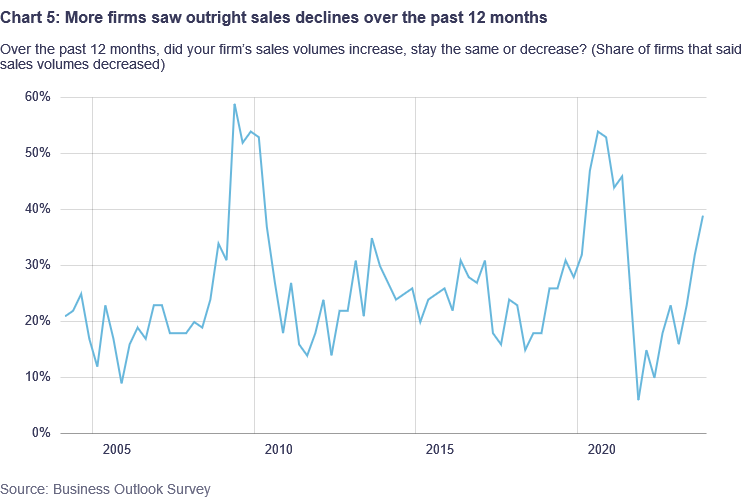

However, much like GBP, the CAD has been outperforming its yield spreads of late, and looks more vulnerable to weak data than strong data. The Bank of Canada’s business survey released on Monday indicated deteriorating conditions and outlook through Q4, with the percentage of firms indicating that their sales had decreased over the last year the highest since the GFC (excluding the pandemic).

So if inflation does undershoot, there is more pressure on the BoC to ease policy. The market is currently only pricing 132bps of easing from the BoC this year – 34bps less than the Fed – so the risks look to be towards more easing and spreads moving in the USD’s favour. With the CAD starting from already strong levels relative to the recent yield spread correlation, the risks look to be on the USD/CAD upside.