FX Daily Strategy: APAC, July 9th

NZD risks on the downside on RBNZ unless they turn more hawkish

USD may get more support from FOMC minutes

JPY remains under pressure even though weakness looks overextended

GBP gaining little from perceived benefits from trade deals

NZD risks on the downside on RBNZ unless they turn more hawkish

USD may get more support from FOMC minutes

JPY remains under pressure even though weakness looks overextended

GBP gaining little from perceived benefits from trade deals

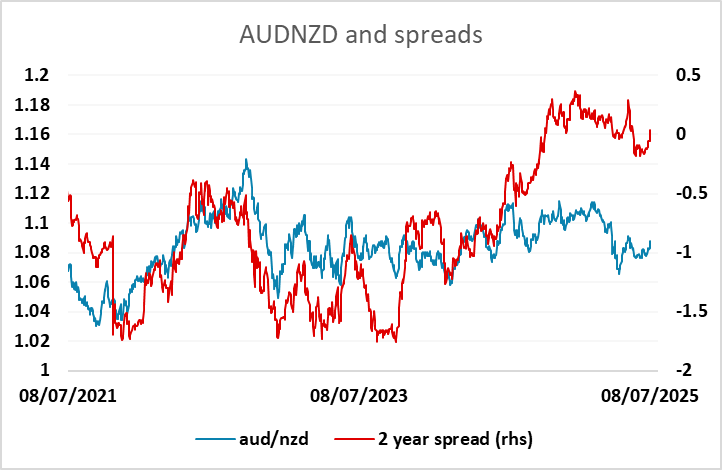

Wednesday is another quiet calendar, with not much other than the RBNZ meeting and the FOMC minutes to demand attention. The RBNZ is not expected to change policy, with a cut priced at around a 20% chance, while there is seen to be around a 65% chance of a cut by the August meeting. The chances of a cut have probably been further reduced after the RBA left rates unchanged on Tuesday, so there won’t be much FX impact if rates are left unchanged unless there is some change in guidance affecting expectations for coming meetings. There are some signs of an improvement in confidence in Q2, as well as higher inflation expectations, so the risks may be towards the RBNZ playing down the chance of an August rate cut. AUD/NZD made some gains on the back of the RBA decision on Tuesday, in the end primarily due to NZD declines, so there may be some potential for a NZD recovery on Wednesday. Having said this, AUD/NZD continues to look cheap relative to yield spreads so we would see limited scope for AUD/NZD losses, and if the RBNZ sounds neutral our bias would be towards further AUD/NZD gains.

The market continues to price 50bps of Fed easing this year with a cut in either September or October and another in December. The market has almost completely eliminated any chance of a July rate cut, and this has helped the USD recovery in the last week or two, with US 2 year yields up 20bps since the end of June. We would expect the minutes to broadly support this move, and if anything to extend the gains, since the vast majority of the dissents from the median “dot” view of 2 more cuts this year is towards fewer rather than more cuts. Seven hawks expect no easing this year, and two expect only one 25bps move. Eight are on the median seeing two 25bps moves, while two doves are looking for three. In practice, the minutes probably won’t have a huge impact, but they are unlikely to reverse the rise in front end US yields we have seen in the last week.

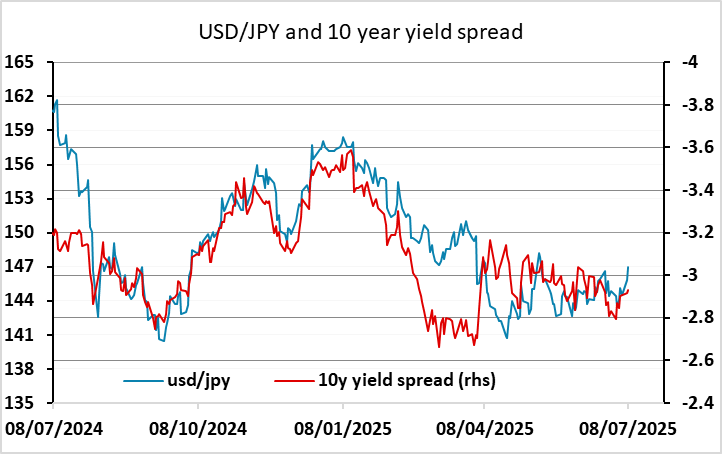

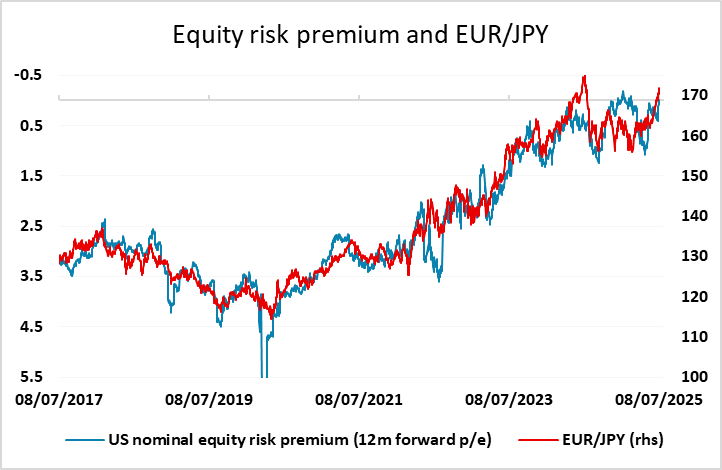

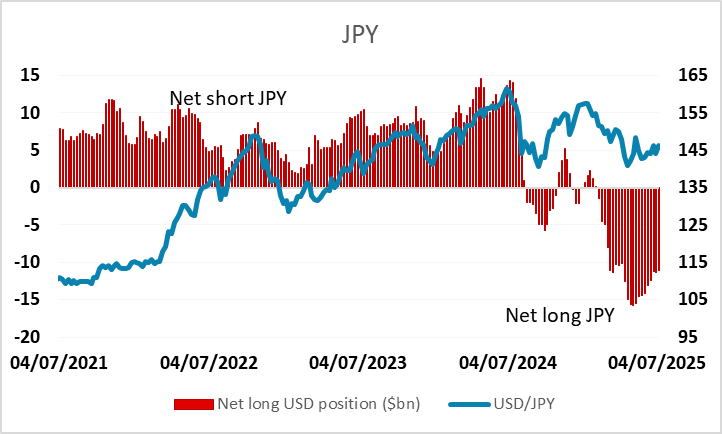

Most of the USD gains over the last couple of weeks have been against the JPY, which has continued to weaken across the board this week. Part of the USD/JPY strength relates to some reduced expectations of Fed easing, but there are a number of JPY negatives at the moment. The prospects of a reduction in US tariffs on Japan look worse than elsewhere, the latest Japanese wage data has been weak, and equities have remained well supported despite the rise in US yields, undermining the JPY on the crosses due to its correlation with equity risk premia. The CFTC data also shows speculative JPY positioning as still being high. While the JPY weakness looks excessive from a fundamental valuation perspective, and we are in a rare seventh consecutive week of EUR/JPY gains, there is currently no obvious reason to expect a reversal, and nothing on the calendar that seems likely to trigger it. Even so, with US equity risk premia approaching the 20 year lows seen in January, some caution on JPY weakness seems advisable.

Net speculative positions in CFTC data

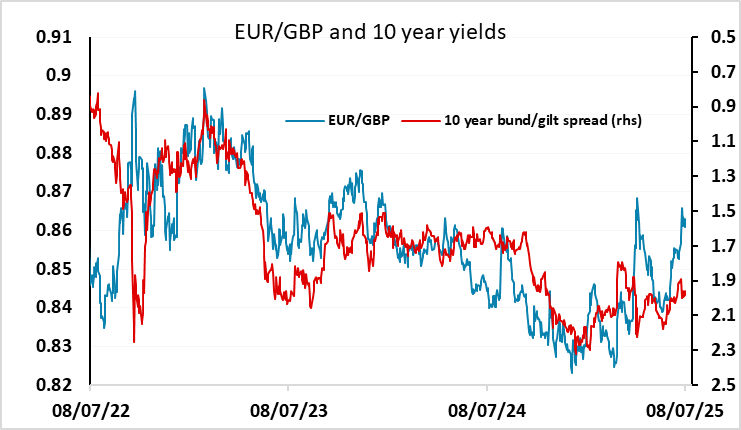

GBP gained some ground against the EUR on Monday but gave it back on Tuesday even though the latest tariff developments look to be in GBP’s favour, with the UK one of the few countries to have already made a (partial) trade deal with the US. But in practice, the exact US tariff policy is likely to be less important for GBP than the performance of the economy and the markets confidence in the government’s fiscal policy, which took a blow when the government failed to pass its welfare reforms. We see more potential GBP weakness on another poor UK monthly GDP number for May on Friday, and expect 0.86 to prove something of a floor for EUR/GBP near term.