USD flows: USD offered but FOMC will be key

Current yield spreads suggest furtehr USD losses but FOMC will impact short term sentiment

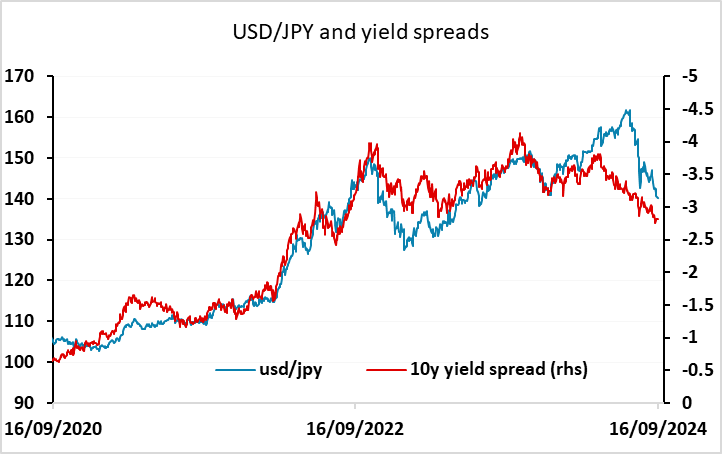

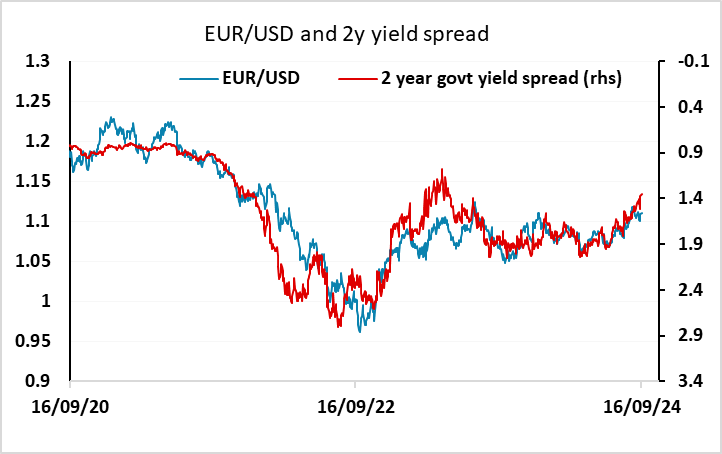

In a week dominated by central bank meetings, Monday is relatively quiet, with no data of much interest. The USD remains under some pressure, with yield spreads still pointing towards further declines. Front end yields have continued to edge lower since the press reports last week suggesting the Fed decision was in the balance between a 25bp and a 50bp cut. USD/JPY has tended to move with 10 year spreads, and these have been pointing sub-140 for some time, while EUR/USD has tended to move with 2 year spreads, and these have been more affected by the recent decline in US front end yields, and now point to 1.12 and above. However, USD losses against the EUR and other riskier currencies will continue to depend on risk sentiment holding steady. Renewed equity declines would likely turn USD sentiment more positive in the short run, and if the Fed only cut 25bps, it is likely to trigger an equity sell off. So although the USD looks vulnerable given current yield spreads, and is likely to suffer further losses in the medium term as the Fed easing cycle progresses, the short term picture will depend on this week’s FOMC decision.

In a week dominated by central bank meetings, Monday is relatively quiet, with no data of much interest. The USD remains under some pressure, with yield spreads still pointing towards further declines. Front end yields have continued to edge lower since the press reports last week suggesting the Fed decision was in the balance between a 25bp and a 50bp cut. USD/JPY has tended to move with 10 year spreads, and these have been pointing sub-140 for some time, while EUR/USD has tended to move with 2 year spreads, and these have been more affected by the recent decline in US front end yields, and now point to 1.12 and above. However, USD losses against the EUR and other riskier currencies will continue to depend on risk sentiment holding steady. Renewed equity declines would likely turn USD sentiment more positive in the short run, and if the Fed only cut 25bps, it is likely to trigger an equity sell off. So although the USD looks vulnerable given current yield spreads, and is likely to suffer further losses in the medium term as the Fed easing cycle progresses, the short term picture will depend on this week’s FOMC decision.