FX Daily Strategy: N America, January 15th

JPY may get a brief reprieve but intervention still likely to be needed

GBP downside risks on GDP

USD firm and unlikely to be derailed by data

JPY may get a brief reprieve but intervention still likely to be needed

GBP downside risks on GDP

USD firm and unlikely to be derailed by data

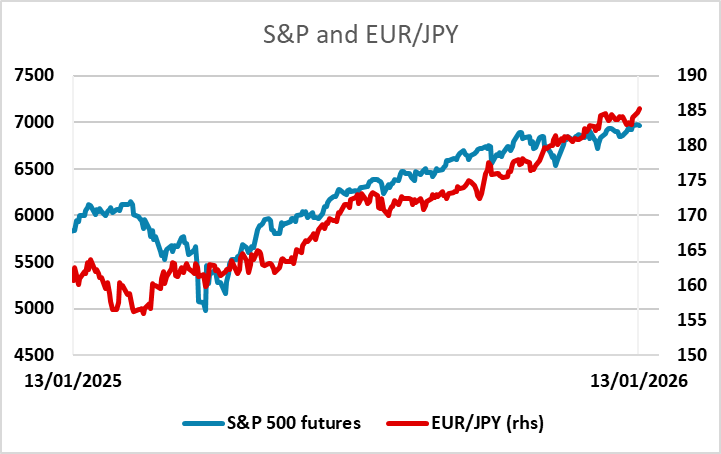

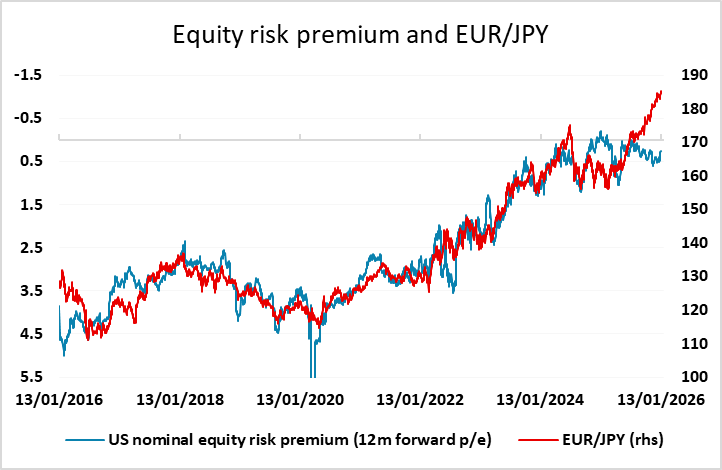

The JPY managed a modest recovery through North American hours on Wednesday, which likely takes the pressure off the BoJ to intervene on Thursday. But recent history suggests this is likely to be a short-lived reprieve. While it is possible that external events like the Iran situation or a Supreme Court ruling on the legality of tariffs have a negative impact on USD/JPY, the last year has shown that the underlying JPY downtrend is unlikely to break without official action. Certainly, the JPY typically will benefit from a weaker equity market, and it is possible we will see that in the short term, as a correction is overdue. But the JPY also typically benefits from narrowing yield spreads in its favour and rising equity risk premia, but has failed to do so in the last year. To turn the trend, the BoJ are likely to have to cap USD/JPY with intervention to change the risk/reward characteristics in the market. All the typical metrics and fundamentals suggests USD/JPY should be lower, so if traders perceive the USD/JPY upside to be capped, we are likely to see a significant correction. But if the BoJ stay out of the market, and correction is likely to be seen as a buying opportunity before too long.

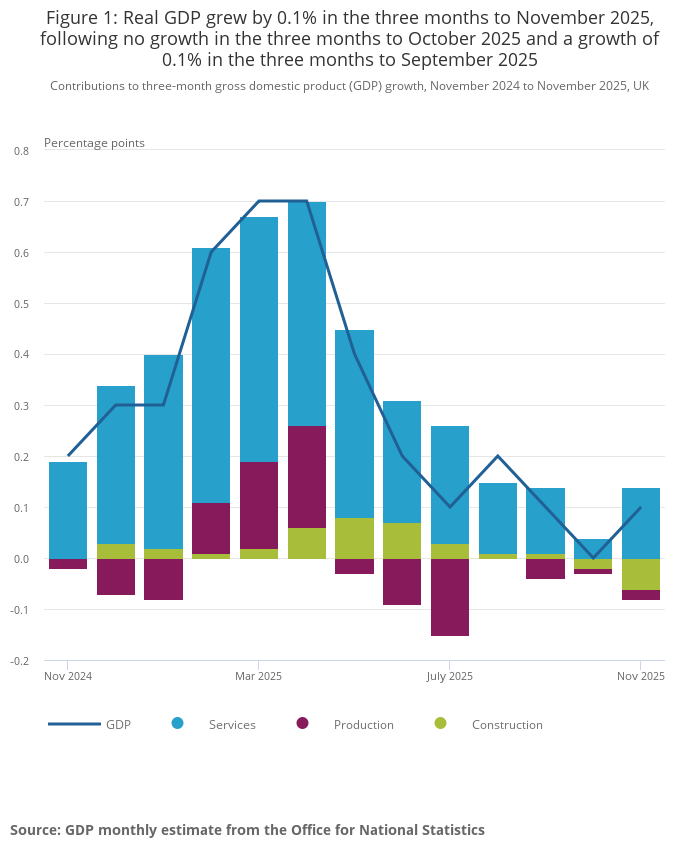

GBP has moved slightly higher following stronger than expected November GDP data, which rose 0.3% m/m against a market consensus of 0.1%. The rise was due to a 0.3% gain in services and a 1.1% gain in industrial output, driven by a 25% increase in car production as JLR plants reopened after a cyberattack. Construction output fell 1.3%, moderating the increase, but the numbers, particularly the services data, suggest the economy is moving along broadly as expected, and will likely douse expectations of any BoE rate cut in the near future. The first cut is currently priced for April (with an 85% probability) and this data will probably not change that significantly. GBP is already somewhat higher than might be expected given current real yield spreads, so the scope for further gains looks quite limited, and we would not expect much progress below 0.8650 in EUR/GBP, but the pound should retain a firm tone through the day.

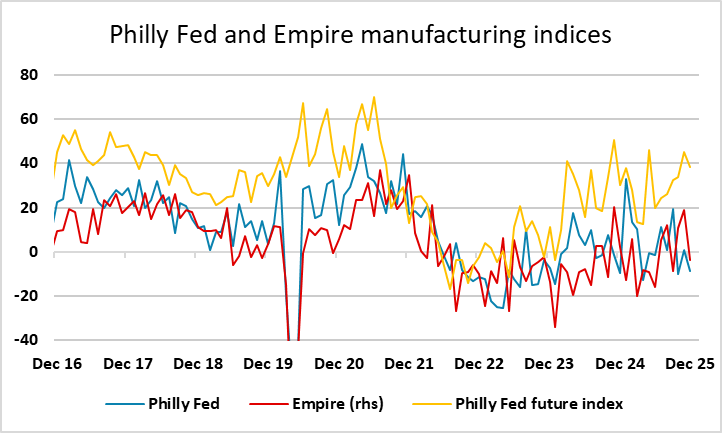

The US has jobless claims and the Philly Fed and Empire manufacturing surveys on Thursday, and these look unlikely to undermine perceptions of a strong US economy in Q4. Other things equal, we would expect the USD to stay firm on the back of this data. There has been no sign of any pick-up in initial claims, and the Philly Fed and Empire surveys have been choppy but fairly neutral, although the Philly Fed future index has been stronger of late, and suggests some upside risks. We doubt the USD’s fortunes on Thursday will be determined by data, with geopolitics likely to be a factor.