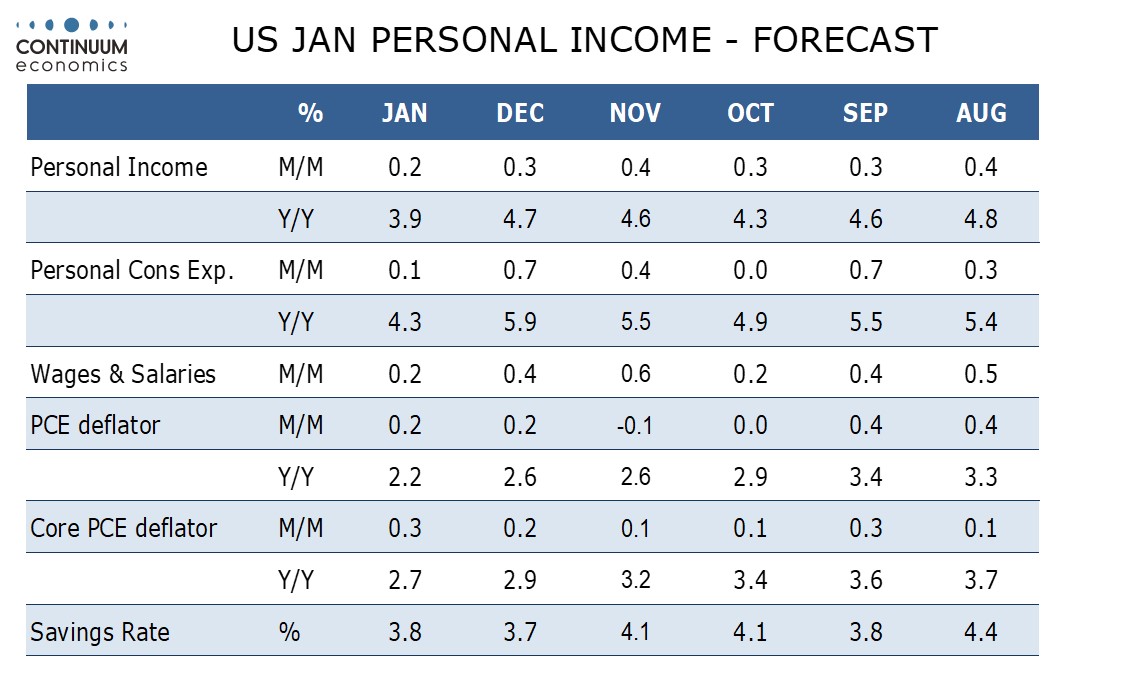

Preview: Due February 29 - U.S. January Personal Income and Spending - Core PCE prices seen stronger, but less so than CPI

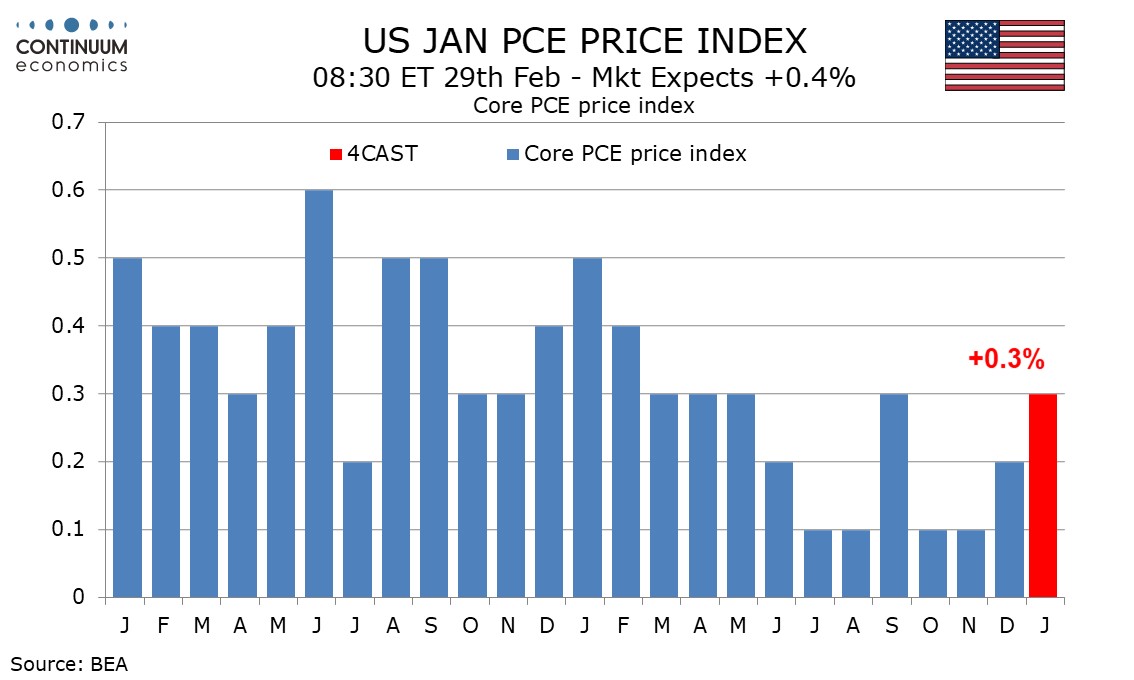

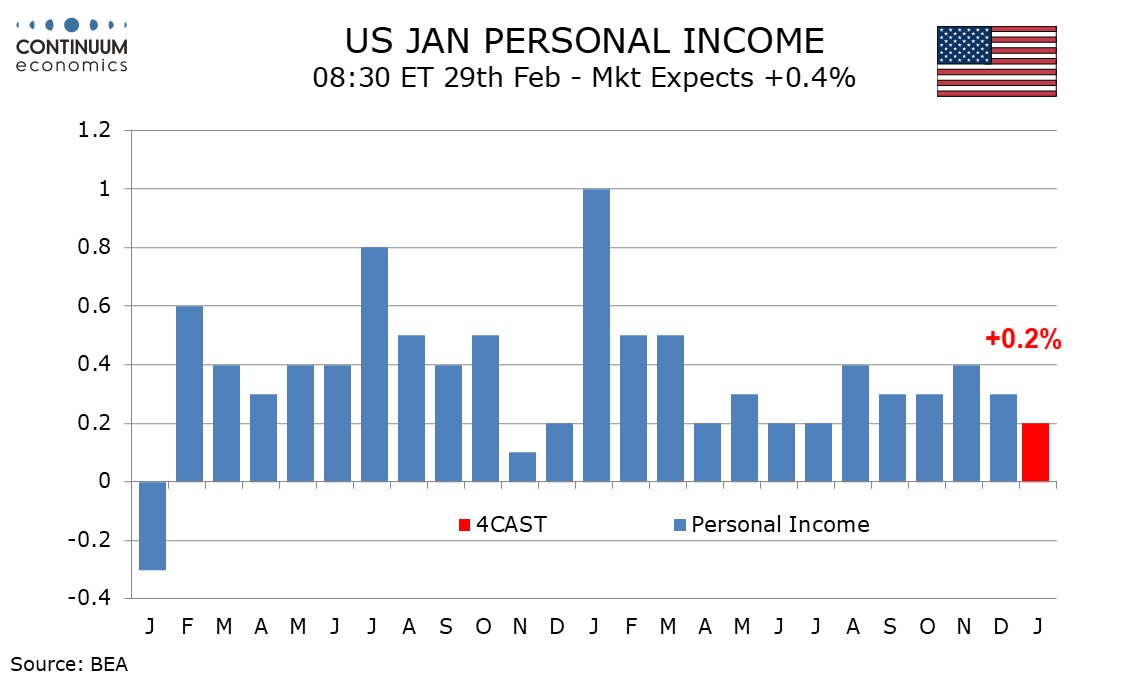

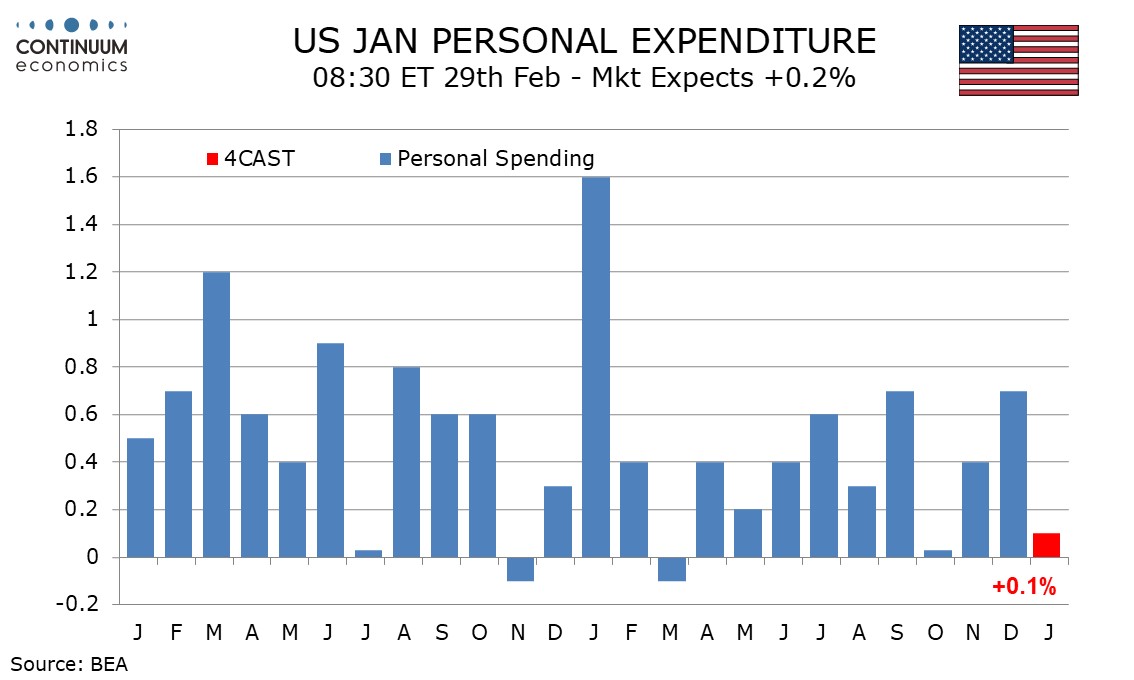

We expect January to deliver a 0.3% increase in the core PCE price index, above recent trend but slower than the 0.4% increase seen in January’s core CPI. We expect subdued gains of 0.2% in personal income and 0.1% in personal spending, with weather probably behind the weakness.

The strength of the core CPI was led by services with goods prices declining, and some components of services are measured differently in the core PCE price data, which has been increasingly underperforming the CPI in recent months. Q4 PCE prices were however revised marginally higher with the revised GDP data.

We expect overall PCE prices to rise by 0.2%, also softer than the 0.3% seen from overall CPI. This would see yr/yr PCE prices slip to 2.2% from 2.6% while the core rate slows to 2.7% from 2.9%, reaching its lowest since March 2021 despite the strong monthly gain.

The non-farm payroll and average hourly earnings both saw strong gains in January but with a significant fall in the workweek, probably due to bad weather, the payroll breakdown implies only a 0.2% rise in wages and salaries. We expect the other components of personal income to remain subdued, but with a slightly stronger gain than in December, bringing a 0.2% rise in overall personal income. Q4 personal income was revised marginally lower with the GDP revisions.

Retail sales fell by 0.8% in January, probably in part due to weather. We expect a 0.7% rise in services to bring a marginal 0.1% rise in overall spending, though most of the gain in services will come from prices. Eating and drinking places, included in services, was one of the few positive components of the retail sales report. Q4 consumer spending was revised higher, on services.