FX Weekly Strategy: March 3rd-7th

Tariff decision to determine risk tone

CAD looks vulnerable on the crosses

JPY should gain against the USD in most scenarios

EUR may benefit from ECB meeting

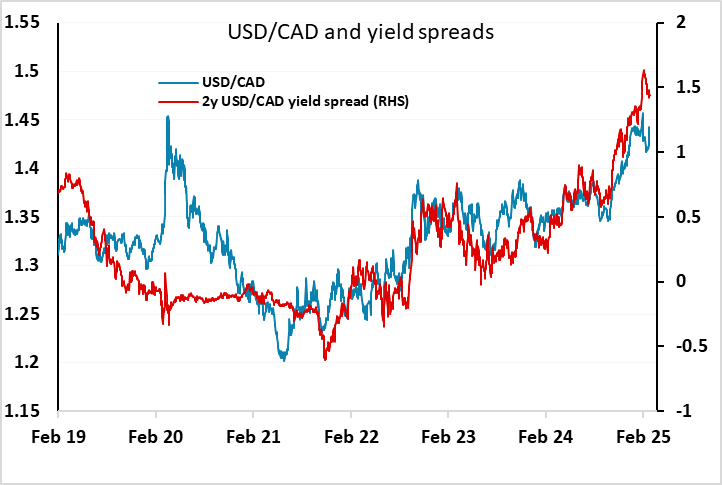

Much will depend on whether Trump follows through with his threat to impose a 25% tariff on Canada from this week. He appeared to flip-flop on the issue last week, at one point indicating that the tariffs would be delayed another month but subsequently confirming that they were set for this week. As it stands, there isn’t much tariff threat priced into the market. Even though USD/CAD rose a figure on Thursday when Trump restated the threat, it is still below the level that looks consistent with current yield spreads. And the CAD decline on Thursday wasn’t confined to the CAD, with the CAD actually gaining against the AUD and broadly holding its own against the EUR and JPY. But if such a large tariff is imposed it would certainly be catastrophic for the Canadian economy, as set out by BoC governor Macklem. While the BoC’s response isn’t entirely clear, as it would depend on government retaliatory measures, the hit to growth would likely mean easier BoC policy and it’s hard to see such tariff action as anything other than CAD negative.

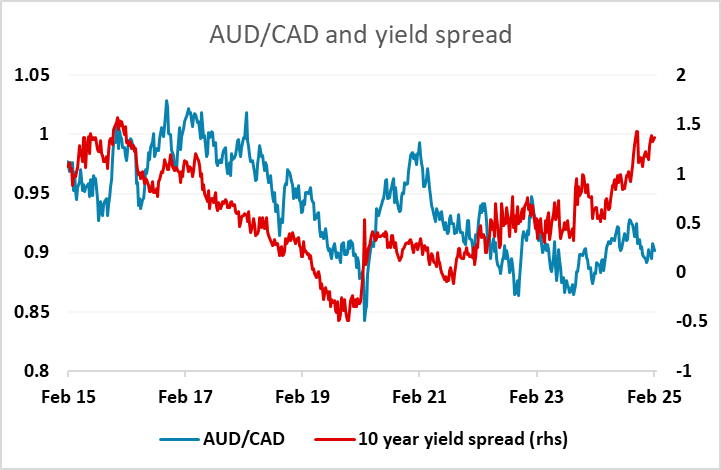

Even so, if Trump relents and cancels or delays the tariffs again, the CAD is likely to rally, at least initially. But we still see more value in other risk currencies, notably the AUD which offers better yields and growth prospects and is less likely to attract tariffs, and which fell back against the CAD on Thursday.

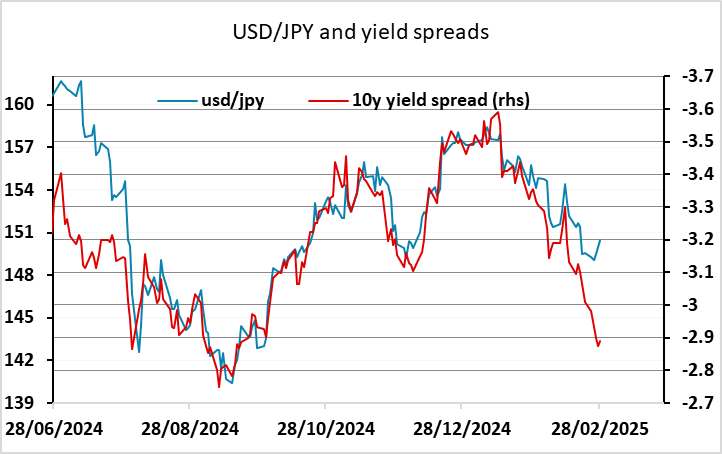

There is plenty of US data this week, notably the February employment report, but we would expect this to still show a very solid picture. The latest soft data likely came too late to impact this month’s report, and employment in any case tends to lag any slowdown. But the USD’s tone may well be decided well before Friday by the tariff decisions, while the ISM survey can also have an impact. While the USD is likely to gain against the riskier currencies if Trump imposes tariffs, we still see USD/JPY as biased strongly lower. Tariffs might mean tighter Fed policy in the short run due to the impact on prices, but any USD benefit from this against the riskier currencies may be less clear against the JPY, which is likely to benefit from any risk negative response. While USD/JPY rose at the end of February, the rise may have been partly due to end of month rebalancing flows, and yield spreads still point to potential for significant declines. Indeed, we would expect the JPY to appreciate whether or not Trump follows through with the tariff threats.

In Europe, the ECB meeting is the main event, even though there is no real doubt that the ECB will cut the deposit rate by 25bps. The bigger question is whether they will cut again in April. This is currently priced as a 65% chance, and the risks may be towards this probability being reduced as many on the council might believe that policy is already close to neutral and will want to wait to see further declines in inflation and/or growth before acting again. This could mean the EUR being biased to the upside if there are no immediate tariffs announced, with the EUR also having possibly been hit by end of month flows last week.

Data and events for the week ahead

USA

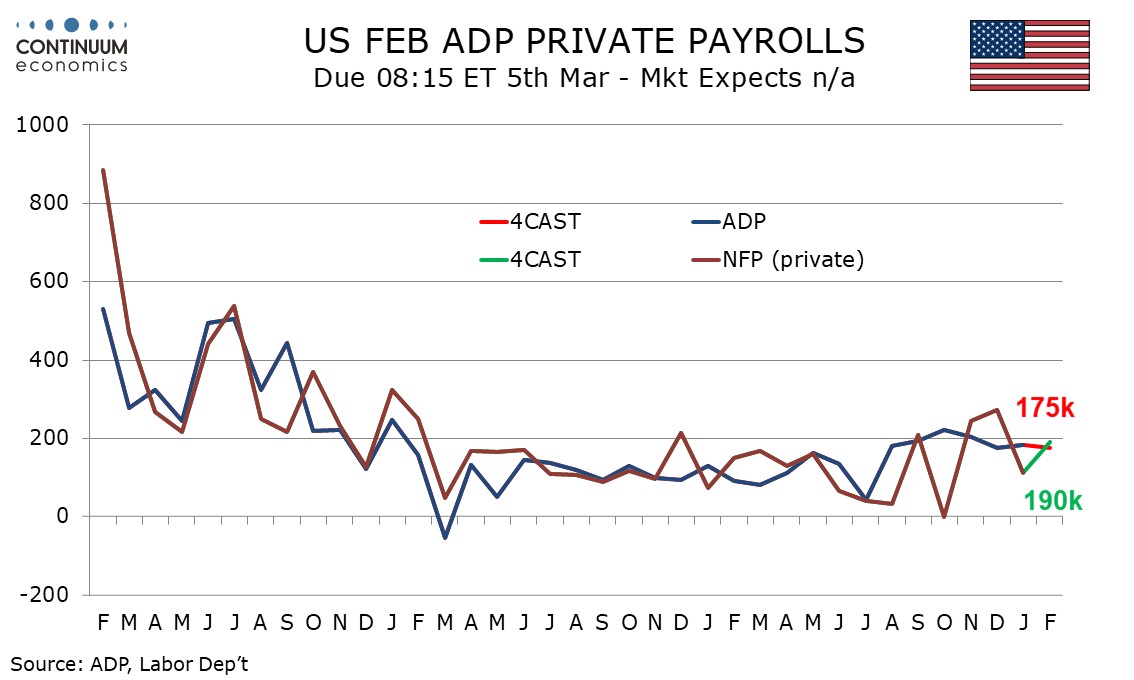

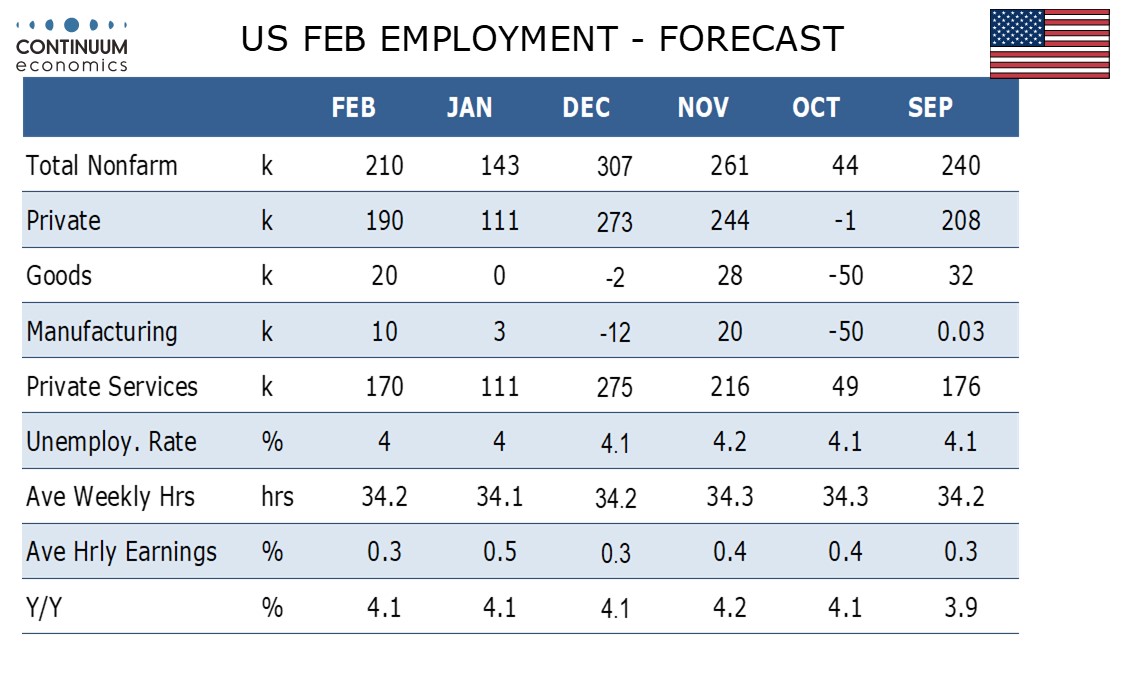

Tariff developments may end up mattering more than data, but the US does see a key data release on Friday with February’s non-farm payroll. We expect a 210k increase with an unchanged unemployment rate of 4.0% showing the labor market remaining strong, though we expect a slower 0.3% increase in average hourly earnings. For Wednesday’s ADP estimate of private sector employment, we expect a 175k increase, slightly less than the 190k we expect from private sector non-farm payrolls.

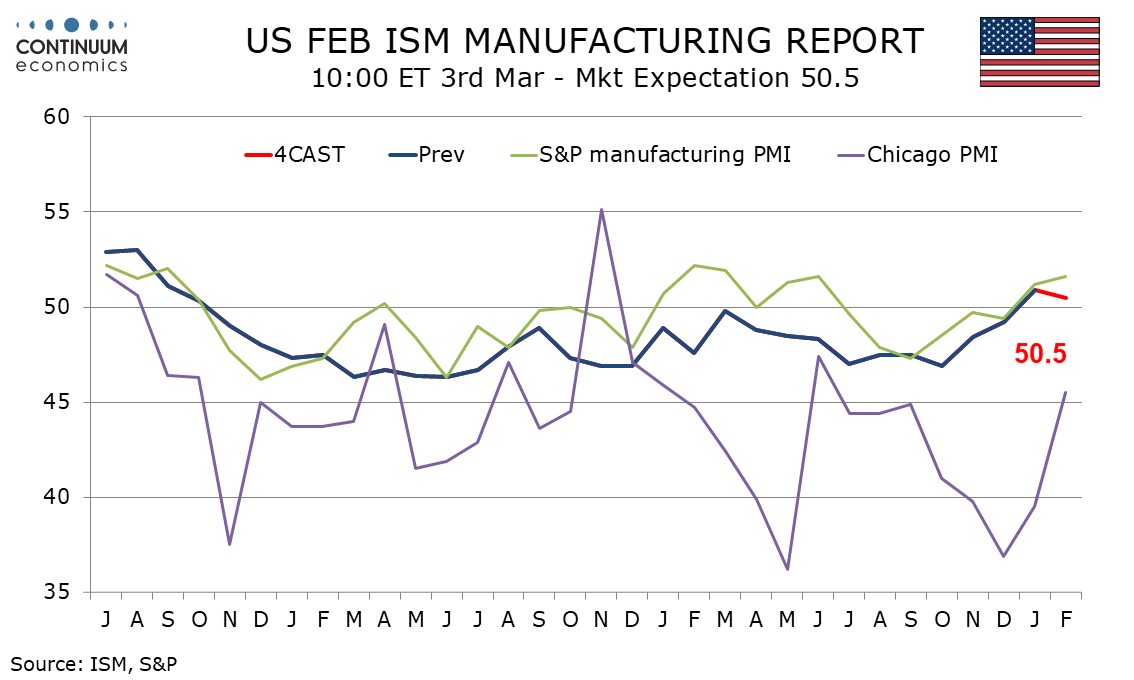

February ISM reports are also due. We modest slippage in both, Monday’s manufacturing report to 50.5 from 50.9 and Wednesday’s services report 52.0 from 52.8. Also due on Monday is January construction spending. January factory orders are due on Wednesday. Thursday’s weekly jobless claims which will be closely watched after a sharp preceding rise. Also due are January’s trade balance, revised Q4 productivity and costs, and January wholesale sales. January consumer credit is due on Friday.

Fed’s Powell is due to speak on Friday, after the payroll in what is likely to be the final significant Fed communication before the March 19 rates decision. Other Fed speakers scheduled are Musalem on Monday, Williams and Barkin on Tuesday, Waller on Thursday and Williams again and Bostic on Friday.

Canada

Canadian focus is on tariffs. The most significant data release is February’s employment report on Friday, where January strength will be difficult to match. February PMI data is also due, S and P manufacturing on Monday, S and P services on Wednesday and Ivey manufacturing on Thursday. Q4 productivity is due on Wednesday. Thursday sees January’s trade balance and Friday Q4 capacity utilization.

UK

The BoE will release its Decision Maker’s Survey on Thursday, this coming after Monday’s BoE money and credit figures. Led by the Governor, MPC members testify to parliament regarding the latest Monetary Policy Report (Wed). Otherwise, final PMI data (Mon, Wed) may highlight downside risks, the question being whether they have spread elsewhere which the Construction PMI (Thu) may reveal.

Eurozone

The week has several PMI updates, including final composite numbers (Mon, Wed) and the even weaker construction equivalent (The). Published on Monday, flash HICP February HICP inflation numbers may deliver better news and broadly so. Indeed, while February may see further energy cost rise but to be partly masked by base effects and therefore should see both the headline core and services rate down around 0.2 pp. Otherwise, an update on the consumer is due Thursday with a key focus on whether the recent but fragile retail sales recovery is sustained or not. Labor market numbers arrive Tuesday and Friday sees Q4 GDP details. German manufacturing orders numbers (Fri) are likely to see a fresh m/m correction back as there is a likely reversal in bulk orders.

As for Thursday’s ECB decision, and as has been the case at most recent Council meetings, the verdict is less important than the rhetoric. A sixth 25 bp discount rate is widely expected, to 2.5%, but how wide the door is left open for further cuts may be gleaned from any clear change in regard to how near(er) neutral policy the Council feels they are. Last time around, the ECB stressed monetary policy remained restrictive – the latter may not have been something the hawks would agree with and the debate on this issue will be the important issue this time around – alongside how vocal the Council advertises any shift. Little was made of the weaker real economy, but some downward revision regarding growth seems likely, alongside a continued below-target inflation outlook but where the near-term picture is raided on account of energy costs.

Rest of Western Europe

There are key events in Sweden, most notably on Thursday which sees the monthly flash CPI data which surprised on the upside in January. Norway has high-profile Industrial production data (Fri) and finally, in Switzerland, Thursday sees labor market figures and (largely stable) consumer price data arrives the day before.

Japan

Mostly tier two data for Japan. Labor data on Tuesday and PMI on Wednesday, neither would be market moving.

Australia

Q4 GDP will be released on Wednesday and is expected to be leaning on the soft side as domestic demand remain soft. We also have the RBA meeting minutes where could likely cue the next step in RBA policy making. Else, we have retail sales on Wednesday and trade balance on Thursday.

NZ

No significant data release.