FX Daily Strategy: Asia, November 7th

FOMC to cut rates but risks that expectations of a December cut are reduced

USD to extend gains, particularly versus the EUR

GBP vulnerable to increase in BoE easing expectations

FOMC to cut rates but risks that expectations of a December cut are reduced

USD to extend gains, particularly versus the EUR

GBP vulnerable to increase in BoE easing expectations

Thursday is dominated by the Fed and BoE rate decisions. Although there is little uncertainty about the immediate decision, with both expected to cut the policy rate by 25bps, any indications about future policy will be important for the USD and GBP.

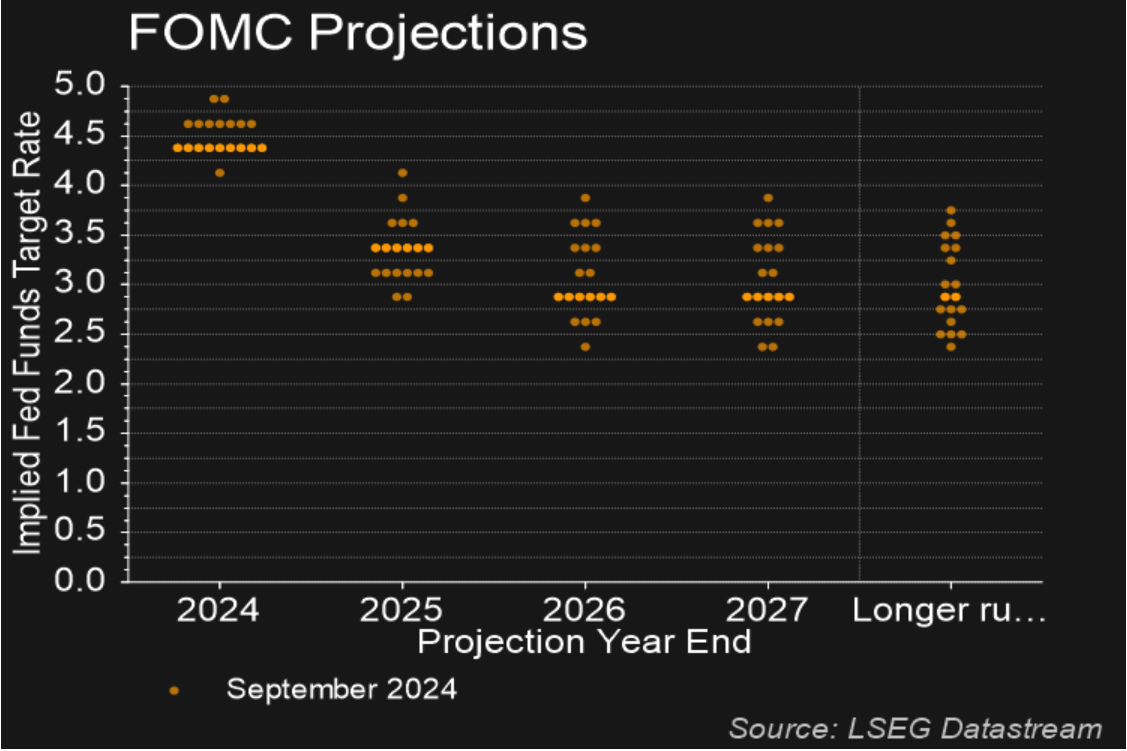

For the FOMC, we expect a 25bps FOMC easing to a 4.5% to 4.75% range. With the dots from the September 18 meeting relatively evenly split between one and two more 25bps easings this year and data since September 18 on balance being relatively firm, the debate is likely to be between no change and a 25bps easing, but there is no real doubt the latter will be chosen after the subdued October employment. While September 18 saw the FOMC commence easing with a more aggressive 50bps move, the FOMC was clear that this did not signal the likely magnitude of future moves. The dots released with that meeting showed two respondents favoring no more moves this year, while seven favored only one more 25bps move. Nine favored two more 25bps moves, and one dove favored a total of 75bps in the year’s two remaining meetings. The dots will not be updated until December and we do not expect that the FOMC’s views have changed much since the September meeting, but if anything the data could be seen as on the firm side of expectations.

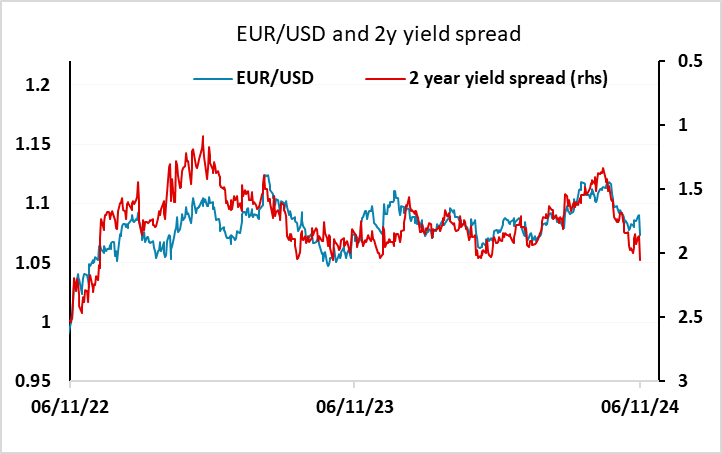

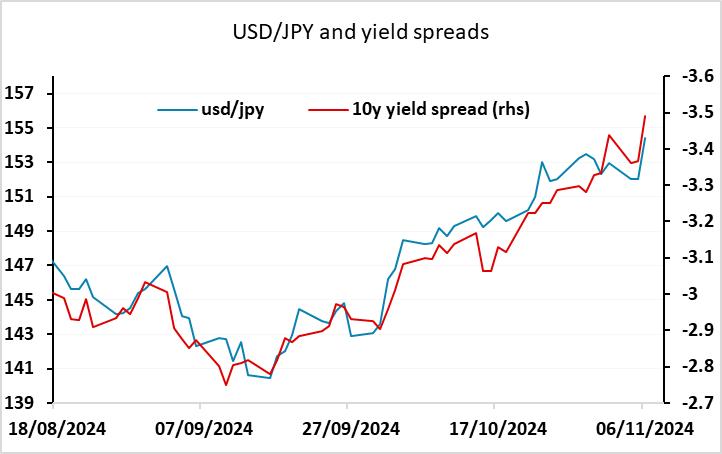

That being the case, there is some risk that the statement leads to the market reducing their expectation of a rate cut in December. Currently a 25bp cut in December is around 70% priced in. Given the general strength of the data, there is likely to be some reluctance to commit to further easing in the short term, especially given the uncertainty about fiscal policy in the wake of the Trump election victory. This suggests there are USD upside risks, with scope for a further rise in US front end yields. EUR/USD tends to be more correlated with front end yield spreads than USD/JPY, so the EUR may be more vulnerable, with USD/JPY tending to move more with back end yields. These are also likely to rise if expectations of near term Fed easing are reduced, but typically by less. As it stands, yield spreads already suggest EUR/USD could see a test down to 1.06. For USD/JPY, there is scope to move up to 155, but the Japanese authorities are also likely to be more resistant to further JPY weakness and this might reduce the JPY downside risk.

In the UK, the Nov 7 policy decision will also be more important for what is said than done, especially as it seems that even a further projected undershoot of the inflation target may not placate the MPC hawks! A 25 bp cut to 4.75% is highly likely but the question is whether there is a formal shift away from the gradualist approach, and the extent to which there may be dissent against any cut as well as any change in guidance. Indeed, against Chief Economist’s well advertised policy caution outlook, it will be interesting to see if Governor Bailey’s pointer to a possible more activist policy outlook is instituted. We do not think that the recent Budget boost will have a material impact on MPC thinking, with it likely that recent soft data and higher market rates should still mean an inflation target undershoot is projected from mid-2026 onwards in the updated Monetary Policy Report (MPR). But this does not make the December MPC meeting outlook any less uncertain.

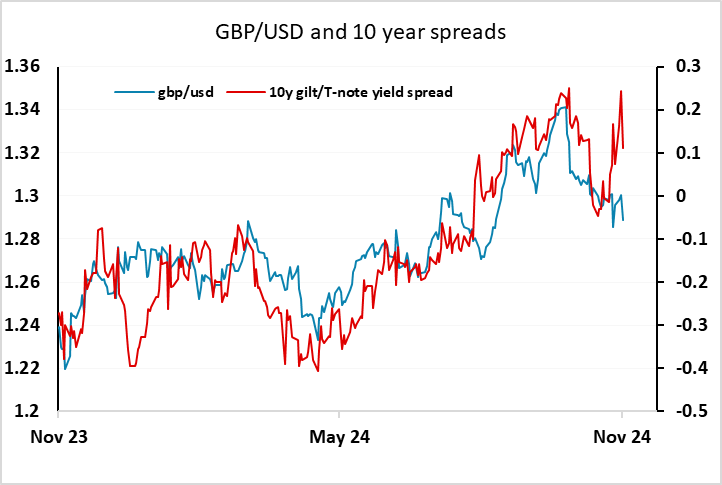

While Thursday’s rate cut is near enough fully priced in, December is only currently priced as around a 30% chance. The Bank is unlikely to provide a conclusive signal on the December decision, but given Bailey’s recent statements and the soft data there looks to be more scope for an increase in expectations of easing than a decrease. This is in contrast to the Fed’s situation, and suggests Thursday holds downside risks for GBP/USD. GBP was comparatively resilient to the USD’s gains on Wednesday, but may now be vulnerable. Even though the rise in UK yields after the Budget makes GBP/USD look well supported by yield spreads, any increase in BoE easing expectations and/or reduction in Fed easing expectations from here could be expected to weigh on GBP/USD.