FX Daily Strategy: Europe, Sep 19th

Japanese CPI unlikely to have much impact, but JPY weakness is extreme

BoJ Kept Rates Unchanged

GBP risks on the downside longer term but EUR/GBP range to hold for now

CAD may see further weakness

Japanese CPI unlikely to have much impact, but JPY weakness is extreme

BoJ Kept Rates Unchanged

GBP risks on the downside longer term but EUR/GBP range to hold for now

CAD may see further weakness

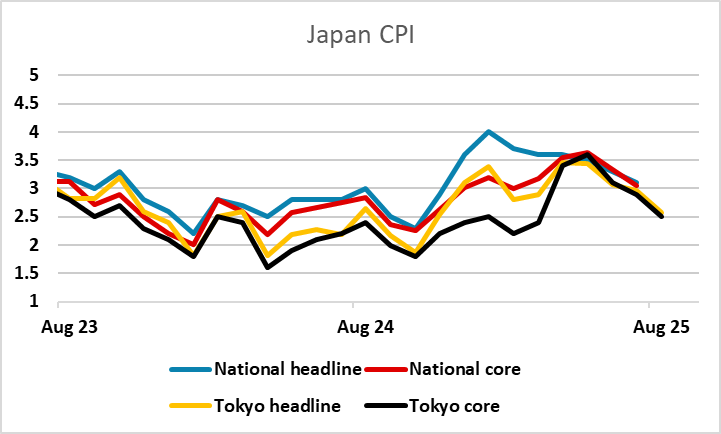

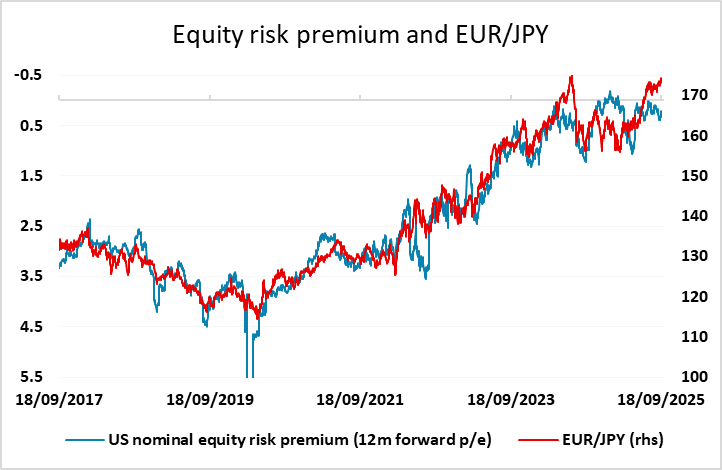

After a week of central bank meetings, Friday is a relatively quiet day, with Japanese CPI and UK and Canadian retail sales the only notable data. As usual, Japanese CPI is well trailed by the Tokyo CPI data already released. The national numbers have been generally slightly higher than the Tokyo data, and the market expectation is that they will remain 0.1% above the Tokyo y/y at 2.7% this month. In practice, we doubt the numbers will have much impact on the JPY, which continues to struggle against a background of strong risk sentiment and rising equity markets. USD/JPY is now a long way below the level normally associated with yield spreads, and even on the crosses is now below the levels that correlate with the moves in risk premia. EUR/JPY is threatening its all time high of 175.42 from July last year. But as long as equity markets continue to perform well, it’s hard to see a significant JPY recovery, despite its extreme undervaluation. If CPI is significantly stronger than expected and created a real expectation of an early BoJ tightening, there could be some temporary relief for the JPY, but this is unlikely to disturb the underlying trend.

The Japan August headline CPI treads below 3% to 2.7% with ex fresh food also at 2.7%. However, ex fresh food and energy remain elevated at 3.3%, suggest underlying inflation remains solid. Such data is unlikely to sway the result of the BoJ meeting as they are unlikely to move before the October LDP election.

The BoJ has kept rates unchanged at 0.5% in the September 19th meeting with two votes of dissent. It came as no surprise for the BoJ as there is current political uncertainty until the October 4 LDP election. However, current inflationary dynamics are supportive and the clarity from the U.S.-Japan trade front seems to have free the BoJ's hand for some indirect tightening. They have announced the "disposal" of ETFs and J-REIT at approximately 0.05% of trading values in the market or equivalent to "stocks purchased from financial institution". While the beginning date is to be announced, it is the first change to BoJ's holding of ETFs and J-REITs since the March 2024 meeting. While it is not as direct tightening as selling JGB, it is still a kind of shrinking of the bank's balance sheet and drains some liquidity.

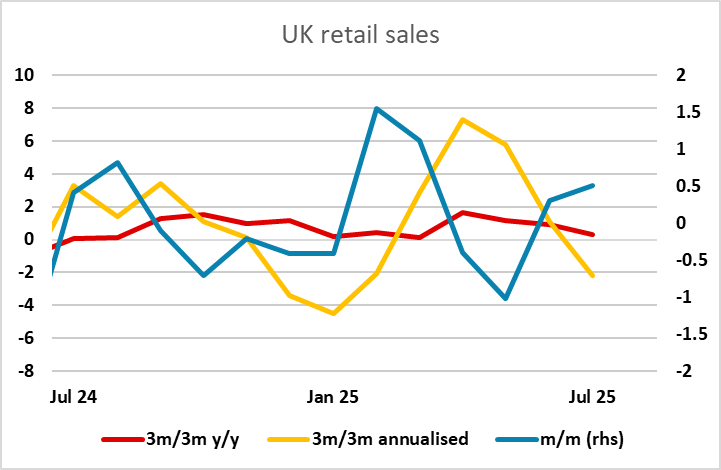

UK retail sales are out on time this month, after a delayed release last time, but seem unlikely to change the market’s view of the UK economy. The trend in sales on a y/y basis has been steady and slightly better than flat for the last year, but has been edging a little weaker in the last few months. The market consensus of a 0.4% rise would suggest a slightly improvement in the trend, but nothing that would change expectations of policy.

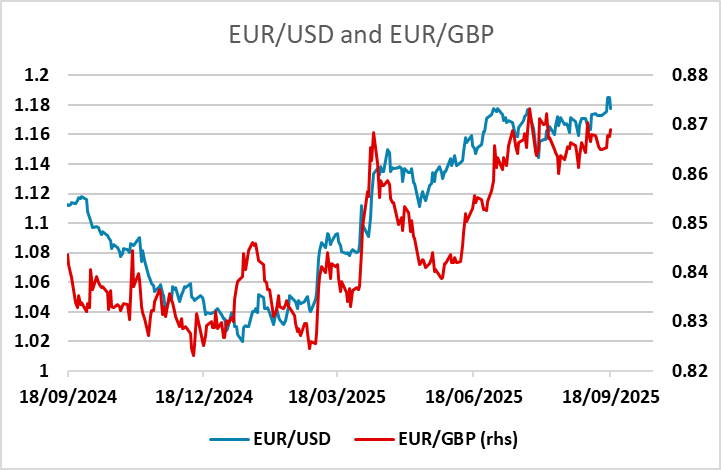

EUR/GBP remains confined to an 0.86-0.87 range, but has been testing the top end of it in the last week, driven mostly by EUR strength/USD weakness. There is a short term positive correlation between EUR/USD and EUR/GBP, so if EUR/USD presses back above 1.18, there is potential for EUR/GBP to continue to test the upside of the range. We also prefer the upside longer term, as real EUR/GBP tends to follow real short term yield spreads with the EUR, and these are likely to converge over time. However, this is only likely to happen slowly, with little chance of any significant increase in UK rate cut expectations this side of the November budget. So we would expect EUR/GBP to remain rangebound until then unless EUR/USD manages renewed gains, which looks less likely after Thursday’s recovery in US yields.

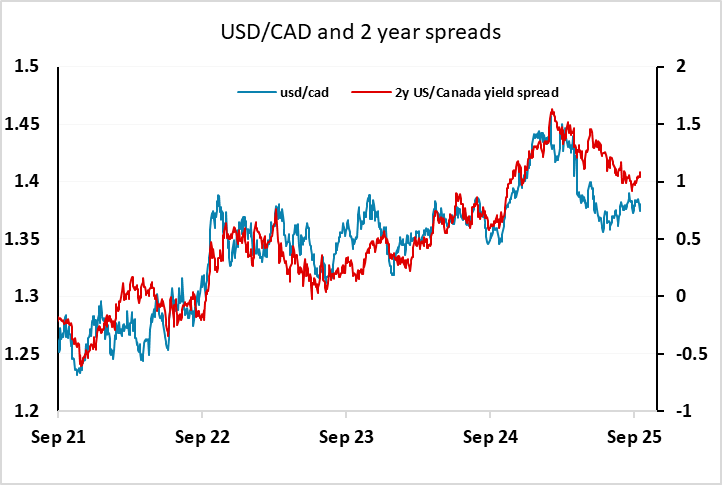

There isn’t normally much interest in Canadian retail sales, partly because the data is somewhat out of date, these numbers being for July (although there is an indication for August included). However, the recent weakness of the Canadian data and the data sensitivity of the BoC means there may be more interest than usual. The rise in US yields on Thursday did trigger a general USD recovery after softness in the last week, and this may signal further gains for USD/CAD if the perception of economic weakness persists. Yield spreads suggest scope for a move towards 1.40.