FX Daily Strategy: N America, March 6th

Powell testimony to be the main market focus

Mildly hawkish risks seen, but little action likely in EUR/USD or USD/JPY

ADP will probably be ignored

CAD has some limited upside scope on BoC

Powell testimony to be the main market focus

Mildly hawkish risks seen, but little action likely in EUR/USD or USD/JPY

ADP will probably be ignored

CAD has some limited upside scope on BoC

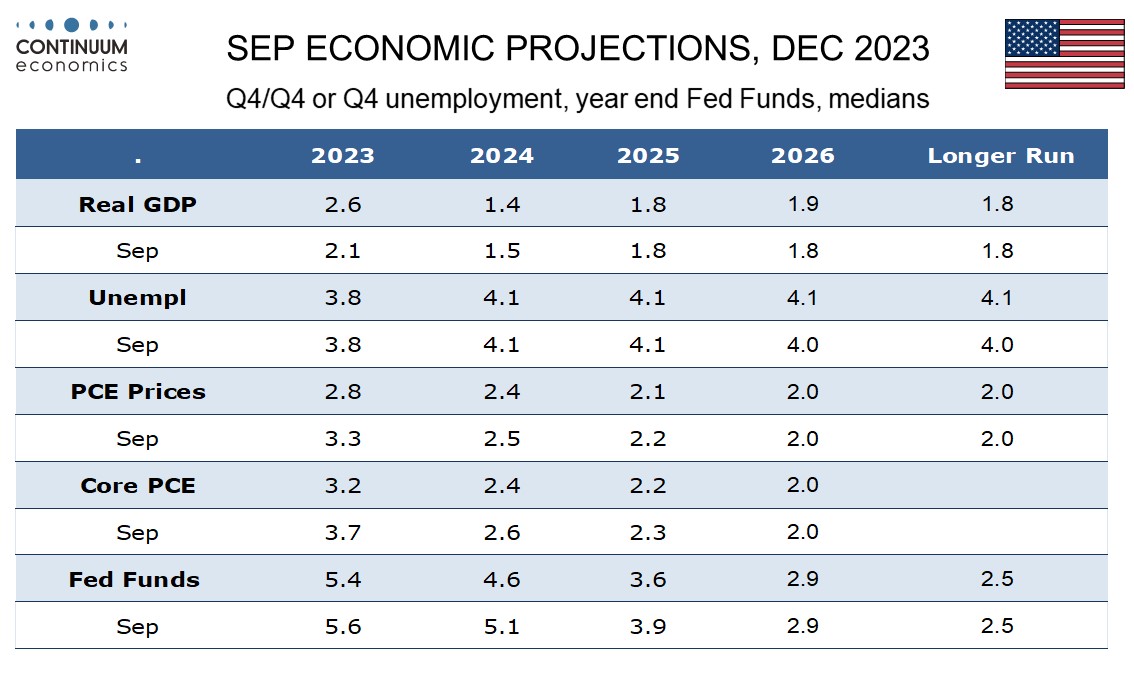

Powell’s half yearly testimony will probably be the main focus for the markets on Wednesday. The message looks sure to be consistent with that given by most Fed speakers and Friday’s Monetary Policy Report, a cautious optimism that falling inflationary pressures will persist but no urgency to cut rates. Friday saw the Fed’s Monetary Policy report, prepared in advance of Powell’s testimony, released, and the lack of market response showed few were surprised by its content. It noted that core PCE inflation had risen by a 2.5% annualized rate over the six months ending in January, which incorporates both the strong January and the preceding six months which ran at a pace close to the 2.0% target, putting January’s data in perspective. It saw the labor market as relatively tight and noted 2023 GDP growth exceeded that of 2022, with solid consumer spending but slowing business investment. Banking stress was seen as having receded since March of 2023, but a few areas of risk were seen as warranting monitoring. Moving onto monetary policy, the report stated that the Committee does not expect to reduce rates until it has gained greater confidence that inflation is moving sustainably to target.

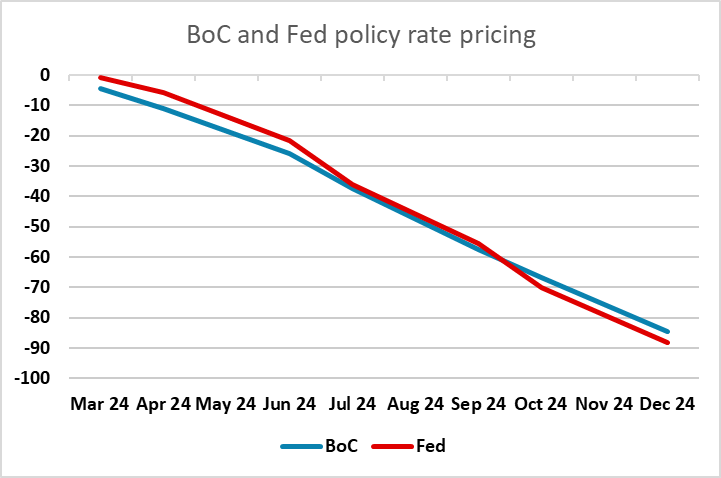

With this background, it’s hard to see the market having a big reaction to the testimony, but the risks are likely towards a hawkish response given that there is a rate cut around 90% priced in for June and a further 2 ½ priced in for the rest of the year. In view of the strong January data on employment and inflation, it is hard to see Powell suggesting any move before June a possibility. But we would expect him to try to minimise market reaction by hedging his comments, and if there is a USD positive reaction it is likely to be relatively modest. Expect EUR/USD to hold the 1.08-.1.09 range. USD/JPY might have potential to recover back above 150 after the dip on Monday, but we see very limited upide as yield spreads suggests there is plenty of downside risk for USD/JPY, and anything hawkish Powell says that pushes up US yields might also undermine risk sentiment and help the JPY.

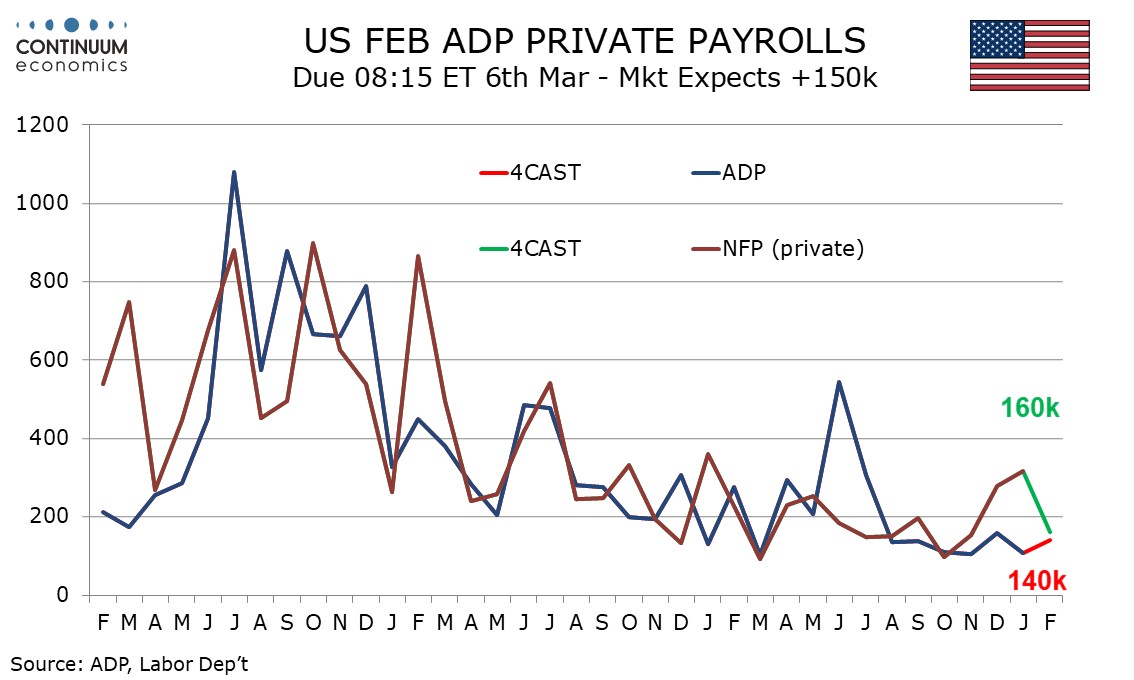

There is also US ADP data which as usual will be seen as providing a very imperfect indication for the employment report, with two sharp underperformances of payrolls in the last two months. We expect a 140k increase in February’s ADP estimate for private sector employment growth, which would be on the high side of a recent quite subdued range, but still a marginal underperformance of our 160k forecast for private sector non-farm payrolls (we expect overall payrolls to rise by 200k). The last six months have seen ADP gain by between 104k and 158k, that marking quite a sharp slowing from where trend was before August. Underperformances of the non-farm payroll was quite modest from August through November, but the last two months have seen payrolls outperforming sharply, particularly so in January when ADP saw a rise of only 107k while private non-farm payrolls surged by 317k. The market is therefore unlikely to take a huge amount of notice of the data, especially if close to our forecast which would not materially affect market expectations for payrolls.

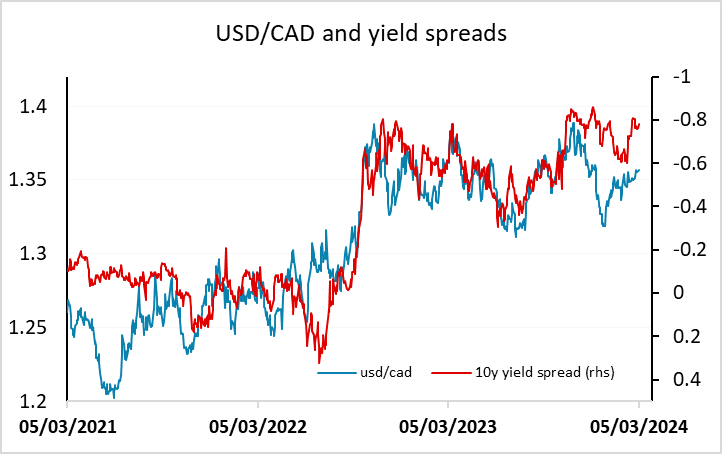

The BoC meeting is the other main calendar event on Wednesday. We doubt that views have changed much at the BoC since its last meeting on January 24. We expect rates to be left unchanged at 5.0% with few hints that easing is close to be given. January saw the BoC moving in a more dovish direction, dropping a tightening bias and seeing the economy as having moved into modest excess supply. However, the BoC remained concerned about the outlook for inflation, particularly the persistence in underlying inflation, concerns which were made clear by minutes from the meeting released on February 7. Since the last meeting the BoC will have seen an encouraging January CPI release, where the 2.9% yr/yr pace was below a January BoC forecast of 3.2% in Q1, with dips in the BoC’s core rates seen too. However the January CPI, particularly in coming after a disappointing December, does not make a trend and all three core rates remain above 3.0%, while the BoC’s target is 2.0%. However, since there is almost a 50% chance of a rate cut priced into the market for the April 10 BoC meeting, a steady as she goes sort of statement would likely be viewed as mildly hawkish, and might provide the CAD with some support. Even so, it would take a fairly sharp rise in CAD yields to suggests significant downside for USD/CAD, as yield spreads have moved significantly in the USD’s favour this year.