USD, EUR, AUD flows: USD firm, EUR and AUD under pressure

Stronger US data, a downward revision to German Q2 GDP and weaker equities put the USD on the front foot against the EUR and AUD

The USD has been firm overnight, and this morning’s downward revision to Q2 German GDP to -0.3% from -0.1% q/q ought to maintain the positive USD tone, particularly against the EUR. The strength of the USD reflects yesterday’s strong US PMI data and concerns that Powell might play down the prospects for Fed easing at his Jackson Hole speech. The probability of a September rate cut is now priced at only 70%, down from over 80% yesterday, and the expectation of future rate cuts has also declined, but there are still 120bps of rate cuts priced by the end of 2026, so there is plenty of scope for a further decline in rate cut expectations.

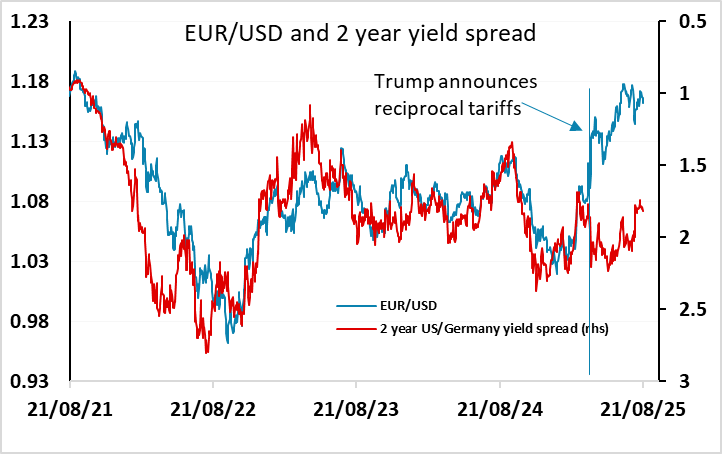

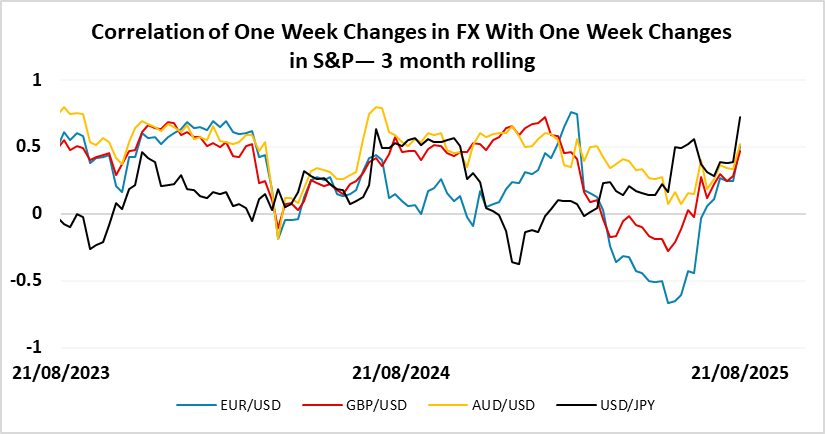

EUR/USD hasn’t shown a good correlation with yield spreads since April, having surged higher after the initial reciprocal tariff announcement helped by international investors reducing USD weightings in their portfolios. But the combination of rising expectations for US Q3 growth after the PMI data and the downward revisions in German Q2 growth suggests the EUR is vulnerable. The AUD is also under pressure as a result of higher US yields and the negative impact that is having on global equity markets. The 0.64 level has been important support for AUD/USD, but will come under pressure if Powell sounds hawkish.