USD, EUR, JPY flows: JPY staying soft, USD firm

JPY remains under pressure, USD firm despite softer yields

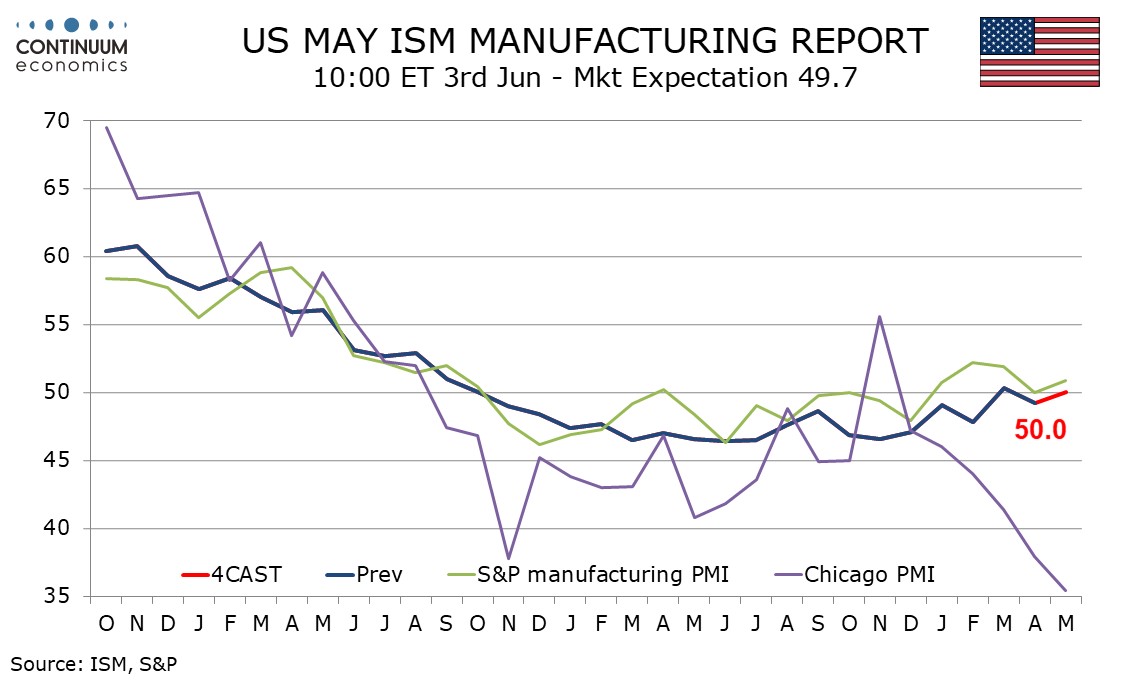

The US ISM manufacturing survey is the main data in what is otherwise the usual quiet Monday. The ISM data takes on slightly greater significance after the surprise strength of the US S&P PMI last week. Although the surprise was more in the services than the manufacturing survey, there will be attention on the ISM survey to see if we see similar strength, with the weakness of the Chicago PMI suggesting there are some downside risks. Nevertheless, we expect the ISM manufacturing to be well behaved and match the modest rise in the S&P PMI, limiting USD reaction.

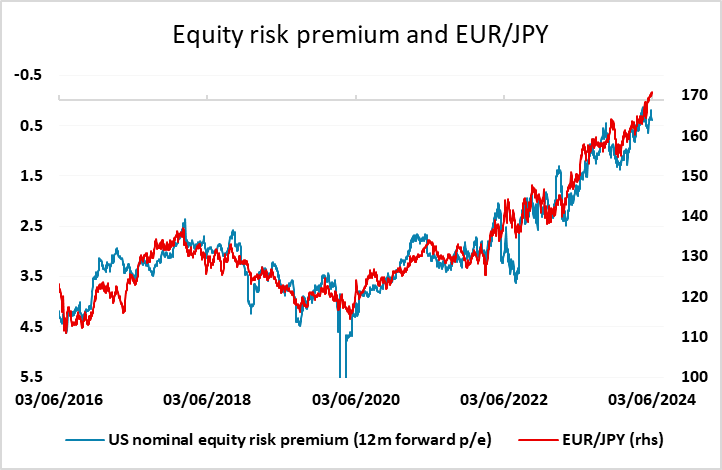

Otherwise there isn’t much else on the calendar. Overnight saw some mild extension of JPY weakness, with EUR/JPY hitting another post-BoJ intervention high at 170.89 as equities firmed up, helped by a 2 year high reading in the Chinese Caixin PMI index. Nevertheless, US equity risk premia are fairly steady at low levels, and don’t really support more JPY weakness, while US/Japan yield spreads continue to point towards a JPY recovery. Despite the better equity tone and slightly softer US yields the USD showed a modest bid across the board, but it will require a strong ISM report to sustain this through the day.