U.S. August Industrial Production - Autos lead bounce, though revisions negattive

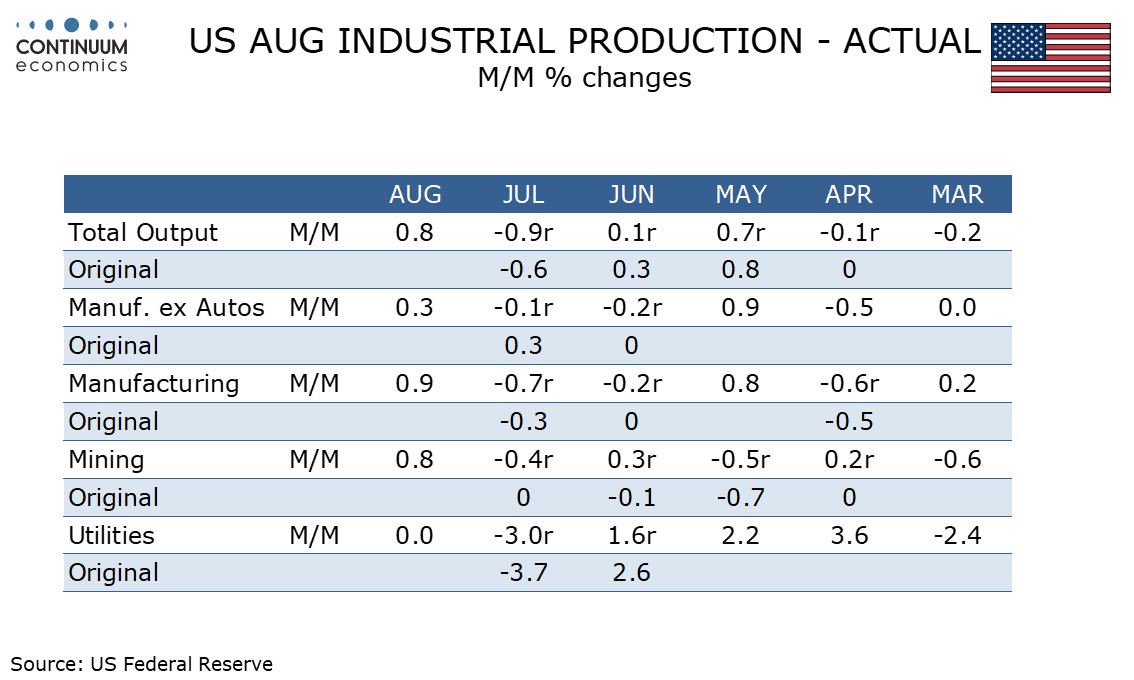

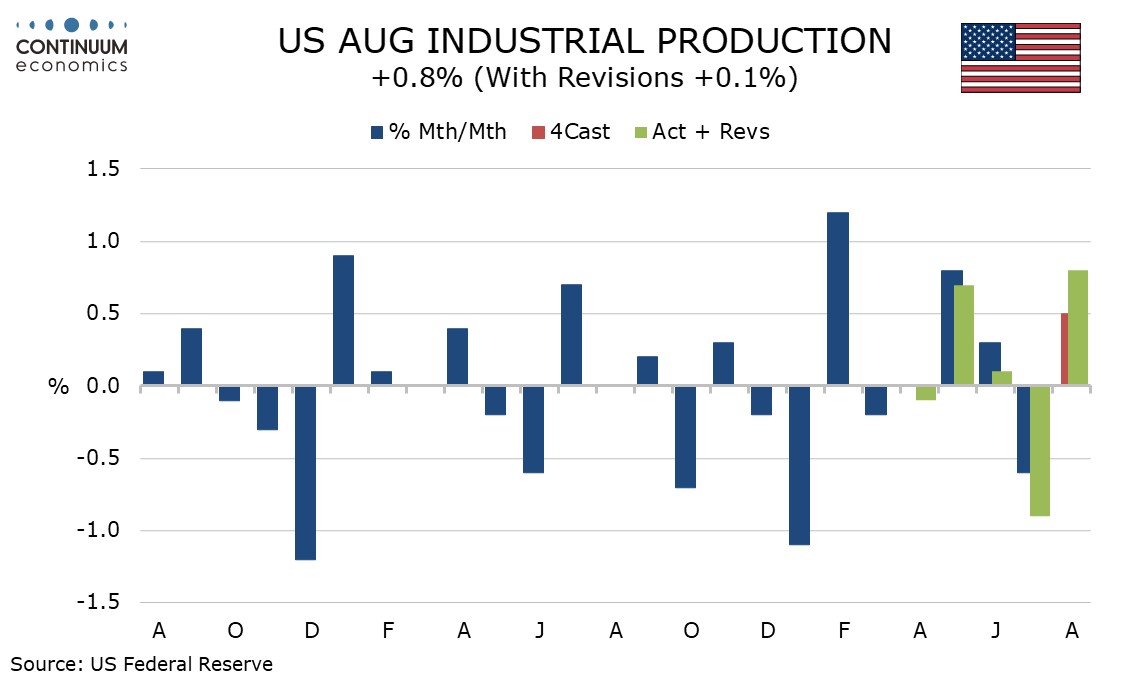

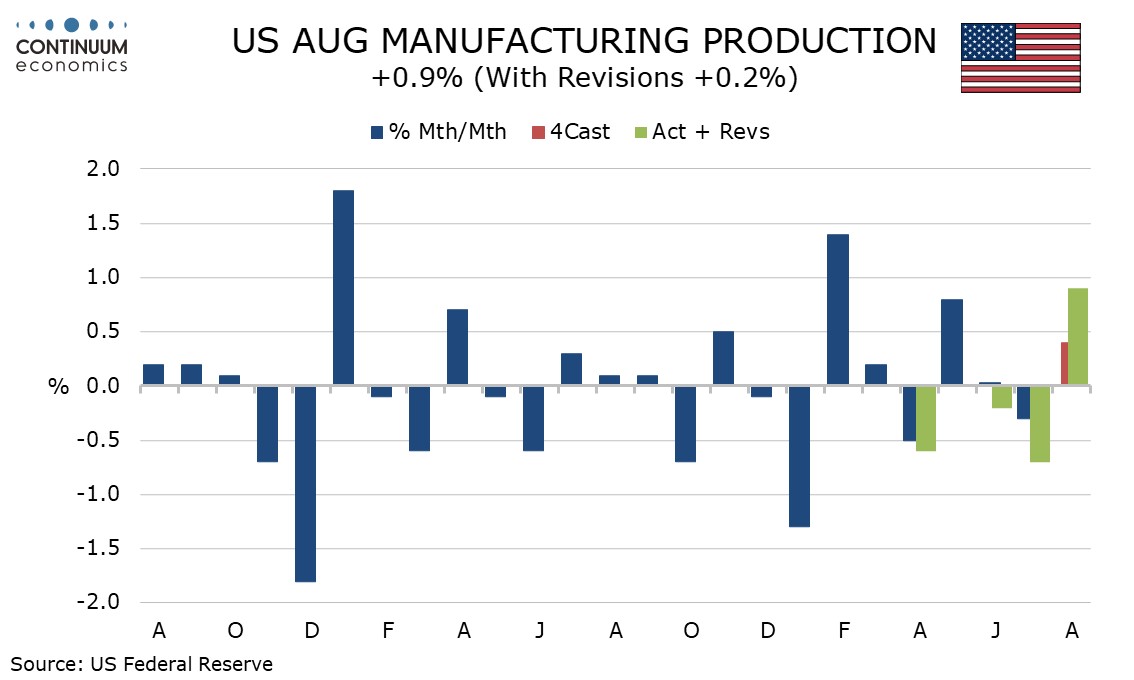

August industrial production with gains of 0.8% overall and 0.9% in manufacturing has surprised clearly on the upside. The gain was led by a rebound in autos from a weak July but manufacturing ex autos saw a 0.3% increase to erase two straight preceding declines.

The upside surprise was offset by negative back month revisions, July by 0.3% to -0.9%, June by 0.2% to up 0.1%, and May and April both by 0.1% to up 0.7% and -0.1% respectively. Capacity utilization at 78.0% was only marginally above expectations, with July revised to 77.5% from 77.8%.

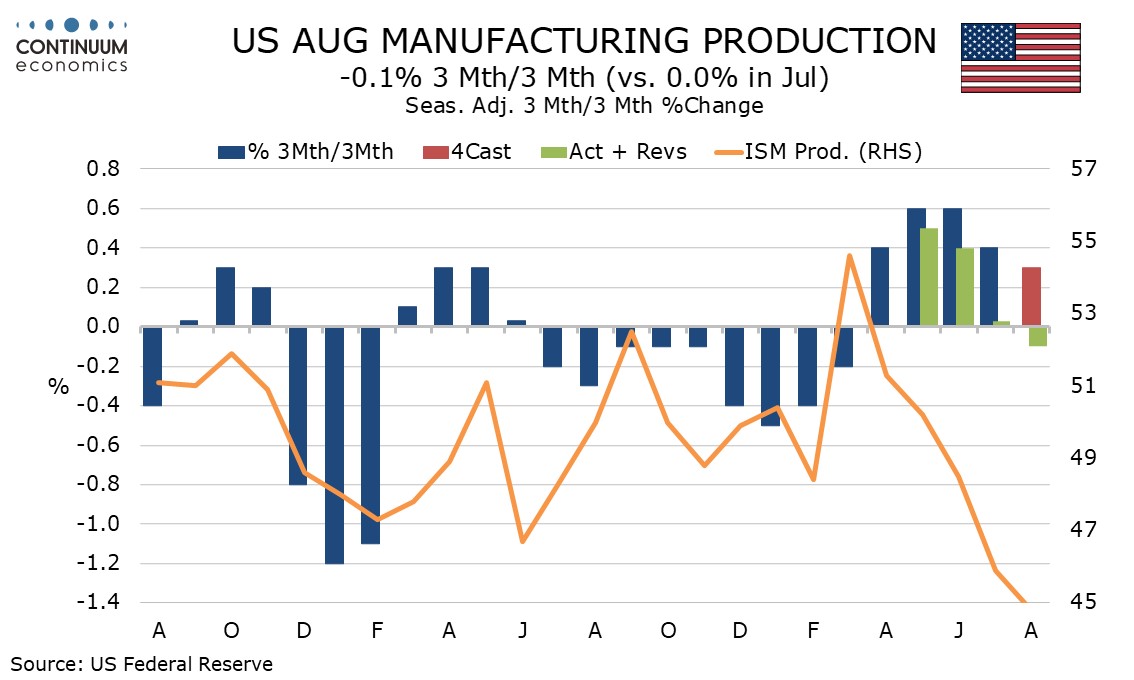

Still, August manufacturing ex auto data looks stronger than August manufacturing payrolls and ISM manufacturing data had implied even if 3-mopnth/3-month data has turned marginally negative.

Autos output surged by 9.8% after a decline of 8.9% in July. July often sees volatility in auto output given annual retooling shutdowns that take place in that month.

Mining output rose by 0.8% more than fully erasing a 0.4% decline in July, but utilities were unchanged after slipping by 3.0% in July.