FX Weekly Strategy: July 7th - 11th

USD focus switches back to tariffs

All outcomes possible but USD may be less vulnerable than it was

JPY weakness looks overdone

AUD may get mild support from RBA

Strategy for the week ahead

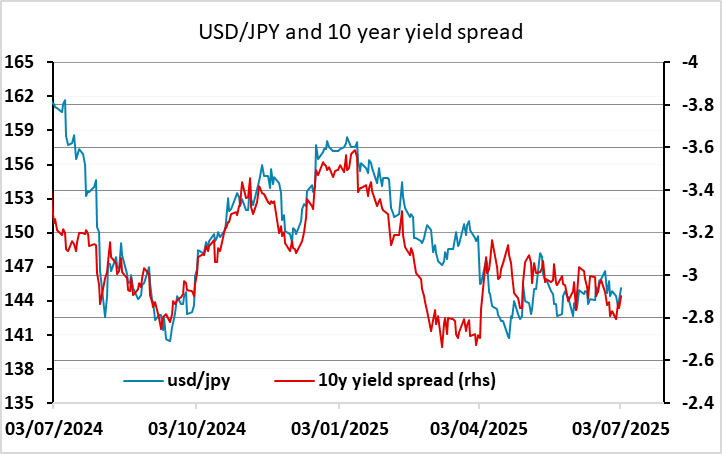

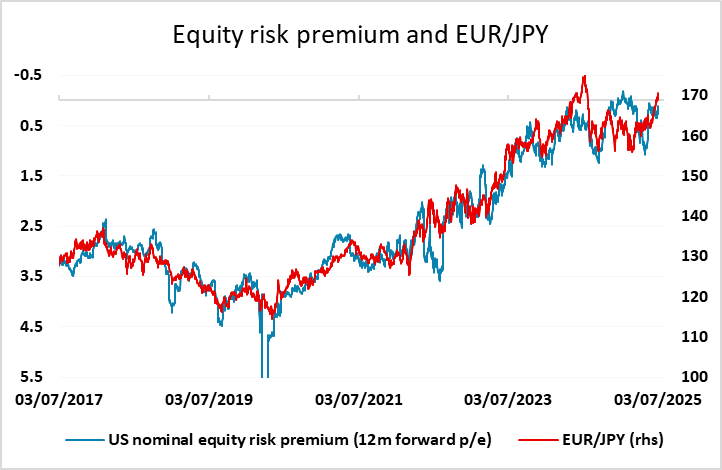

The USD broadly stabilized at the end of last week after the mildly stronger than expected employment report, and coming into this week the USD downside bias is now less clear. It is already the case that USD/JPY has been confined to a 140-148 range for the last three months, so the USD decline against the European and commodity currencies over the last few months can be seen as a risk positive move as much as a USD negative one. While the CHF has been one of the strongest currencies over this period, we would see this as something of an anomaly. The weakness of the JPY on the crosses is more descriptive of the underlying market sentiment, which has been generally risk positive with the S&P 500 hitting a new high and risk premia generally moving lower. While there was talk of a negative impact from geopolitics, this never really impacted markets significantly, and fading concerns about tariffs appear to have been more relevant.

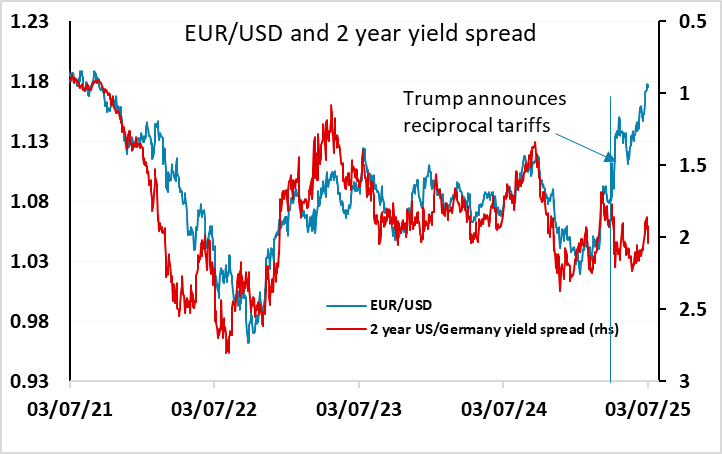

This week there isn’t a huge amount of data to move markets, and the main focus is likely to be back on the tariff issue, with July 9th representing the end of the three month pause on reciprocal tariffs. All outcomes still seem possible, with potential both for announcements of big punitive tariffs, further extension of deadlines and some trade deals. However, the market is unlikely to take any immediate tariff imposition entirely at face value, given Trump’s track record of negotiating away from most of the punitive tariffs announced so far. At this stage it seems very likely that a high tariff will remain on Japan, with little optimism than any sort of trade agreement can be reached near term. There has been less clarity on the likely outcome for the EU, but the lack of recent negative commentary suggests that we may see an extension of the deadline or only moderate tariffs. If so, it could allow some further gains for equities and further weakness for the USD and JPY. However, the USD reaction to tariff announcements is far from certain. While higher tariffs have thus far tended to be USD negative, particularly against the lower yielders, it may be that anything that undermines equity confidence could support the USD against the higher yielders this time around.

However, JPY weakness is increasingly becoming extreme, both against the USD and on the crosses, while gains for the EUR against the USD have substantially exceeded the levels suggested by yield spreads. While EUR/USD is unlikely to reverse lower without some recovery of confidence in the USD or some clear negative news on the EUR, there is potential for EUR/JPY – and consequently USD/JPY – to move lower if we see some weakening in the strength of the equity markets. There may well be some equity market nerves ahead of the tariff announcements, and at these levels there is already a lot of good news priced into equities, so initially at least we see scope for some JPY recovery. Datawise the Japanese wage data on Monday will be of interest, with strong numbers in line with strong household spending numbers released last week potentially providing some early JPY support.

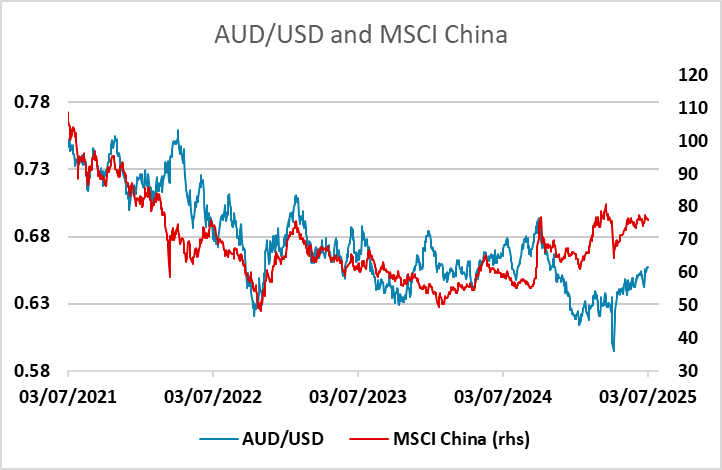

The RBA meeting is the only central bank activity of interest. The market is essentially fully pricing a 25bp rate cut from the RBA and two more rate cuts this year. It would be a major surprise if we don’t see a rate cut this time, but the risks may be that the RBA are more cautious about future cuts than the market currently prices. This could be mildly supportive for the AUD, but AUD/USD is still likely to be driven more by the general USD tone and regional equity market performance than the RBA.

Data and events for the week ahead

USA

US focus will be on Wednesday’s expiry of Trump’s three month pause on reciprocal tariffs, which brings risk of tariffs being increased, though past experience has shown that any decisions taken on Wednesday may not persist for long, particularly if the market reaction is adverse.

It is a quiet week for US data. Tuesday sees June’s NFIB survey of small business optimism and May consumer credit. Wednesday sees May wholesale sales. Thursday’s weekly initial claims may be the most significant release of the week but could be distorted by the 4 July holiday. Friday sees June’s budget statement.

FOMC minutes from the June 18 meeting on Wednesday should be closely watched with FOMC speakers having given a variety of opinions since the meeting. However, we feel that a clear majority will be supportive of a wait and see stance, given risk of tariffs feeding into inflation in Q3. Thursday sees Fed’s Musalem and Daly speak.

Canada

Canada’s most significant data release of the week will be June’s employment report on Friday. Monday sees June’s Ivey manufacturing PMI while Friday also sees May building permits.

UK

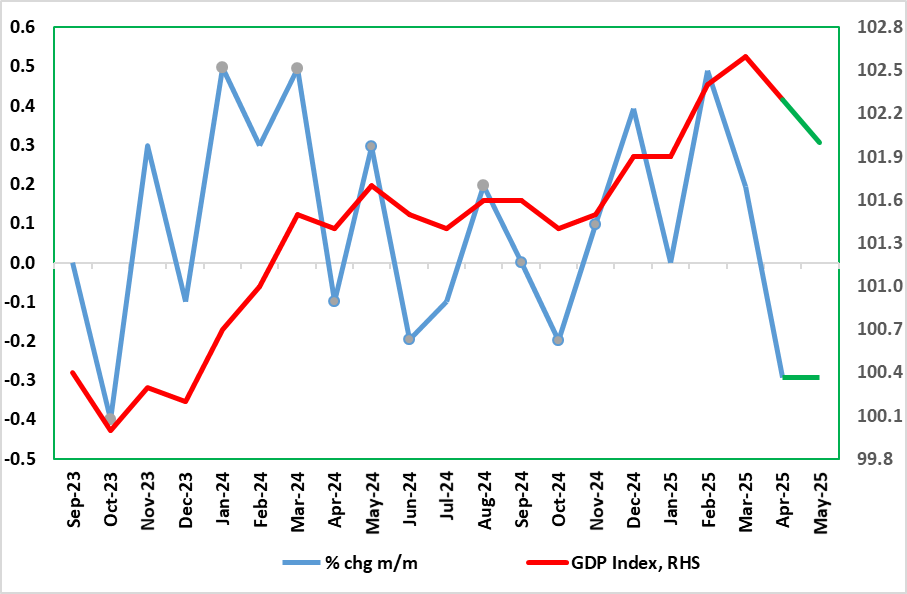

Friday sees GDP data for May. After two successive upside surprises, a correction back in monthly GDP was not entirely a wholesale surprise for April GDP. But we see that 0.3% m/m drop being repeated in the looming May numbers (Figure 1), thereby adding to a gloomier economic backdrop most recently highlighted by growing signs of labor market weakness. Indeed, there may even be downside risks to that projected 0.3% May drop. Otherwise, Thursday sees what may be gloomier housing market news from the RICS survey.

GDP to Fall Again?

Source: ONS, CE, projection in green

Apart from a speech by Dep Gov Breeden (Thu), the BoE appears via its Financial Policy Committee Report. Back in April’s update it noted that the global risk environment had deteriorated, and uncertainty had intensified. A range of risky asset prices, led by those denominated in US dollars, have declined sharply. The probability of adverse events, and the potential severity of their impact, had risen.

Eurozone

There are a series of individual ECB Council speakers, with Holzmann and Villeroy offering likely contrasting views on Tuesday and Thursday. Otherwise, a far from busy week data-wise sees retail sales data (Fri), important to assess to what extent the consumer may be helping shore up recent solid EZ GDP numbers. But cracks remain as may be seen in Construction PMI data (Thu) they coming a day after the revised composite figures. Germany sees May industrial data where production figures (Mon) which may see a further reversal after the boost anticipating the US tariff imposition.

Rest of Western Europe

There are few key events in Sweden, most notably flash CPI data for June (Mon) notable as April and May figures added to signs that the inflation pick-up early in the year may have been a blip. We see the downside surprise being partly reversed with CPIF inflation up a notch at 2.4%, albeit with the ex-energy measure offering an upside risk. But the main interest may be in Thursday’s monthly GDP indicator where the already-reported slump in retail sales suggests a very soft outcome

Otherwise, in Switzerland, Friday sees what may still be soft consumer confidence figures.

Japan

Labor Cash Earning on Monday will be the most important release for Japan next week. Household spending has jumped in May and would be further supported in June if we see another decent wage hike. Anything above 2% will be generally positive but for real wage to get closer to positive, the cash earning need to grow above 3%. POPI on Thursday will be of less importance. The only market moving nom economic release will be any progress of trade agreement between Japan and the U.S.

Australia

The RBA interest rate decision will be on Tuesday. Market expectation are seeing another 25bps cut and we feel it is well supported by latest inflationary figure and we forecast one more 25bps cut in 2025. If the RBA signal more rate cut, it will be to market surprise and could see a significant impact towards the Aussie. There are also tier two data scattered throughout the week.

NZ

The RBMZ will meet on Wednesday. They will likely be on hold but cannot rule out a final 25bps cut along their OCR path. One thing to watch out is any further revision for NZ economic forecast, which could also shift market positioning.