FX Daily Strategy: N America, September 11th

US CPI the focus

More risk of market reaction on stronger data

GBP focus on GDP with firm tone intact

CHF strength reaching limits

US CPI the focus

More risk of market reaction on stronger data

GBP focus on GDP with firm tone intact

CHF strength reaching limits

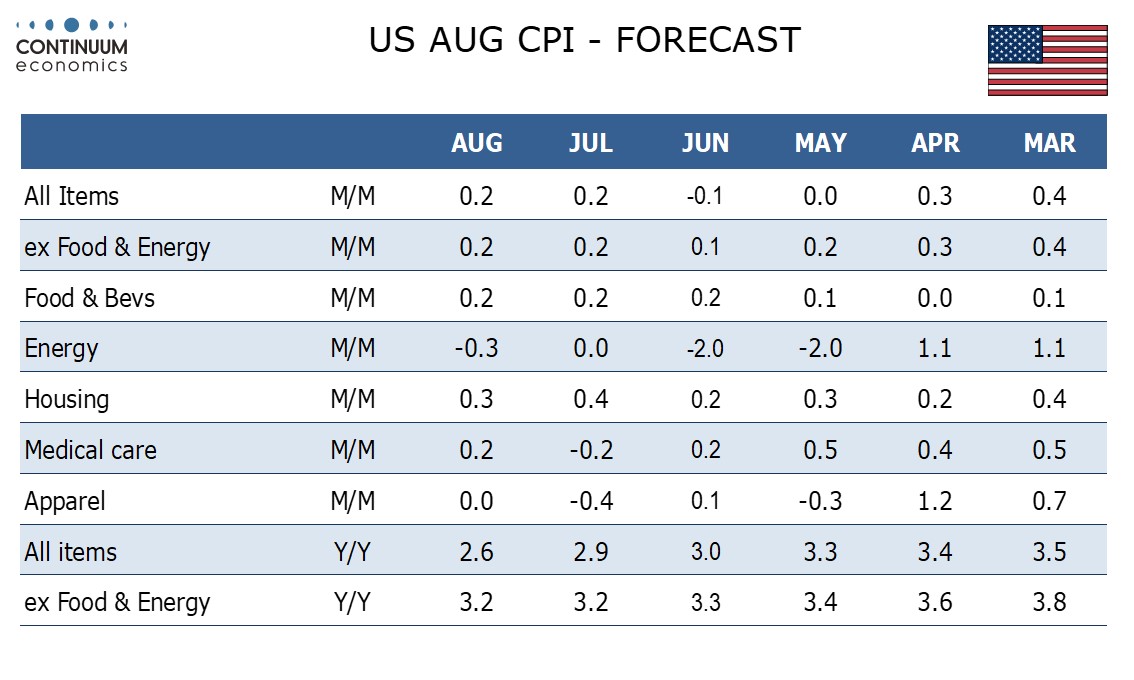

Wednesday sees the main release of the week in the form of US August CPI. We expect August’s CPI to increase by 0.2% both overall and ex food and energy, with the respective gains before rounding being 0.18% and 0.21%. Such an ex food and energy rate would be slightly stronger before rounding than in the preceding three months, though not strong enough to trouble the FOMC. Our forecasts are in line with the market consensus, so we wouldn’t anticipate any significant reaction. Market risks are probably greater on a strong than a weak number, as the chances of a 50bp cut from the Fed likely hinge on weaker real sector data rather than weaker CPI, while stronger CPI data would kill hopes of more aggressive Fed easing and consequently potentially trigger a risk sell off. Softer data might trigger a mild risk positive reaction. However, even in this scenario we might well see lower US yields so that the USD weakens against the lower yielders ads well as the riskier currencies.

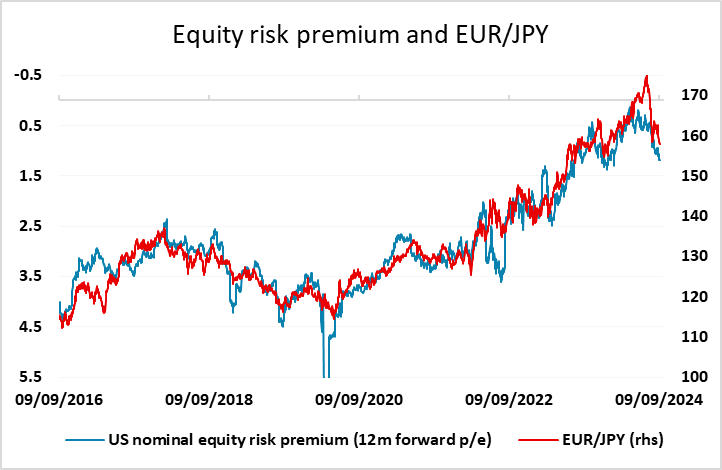

Tuesday saw another strong JPY performance in the US session as equities turned lower. US equities held up better than Europe, and the JPY gained more on the crosses than against the USD, with EUR/JPY hitting its lowest since August 5. While yield spreads suggest there is some upside risk for EUR/USD, both USD/JPY and EUR/JPY continue to be biased lower due to yield spreads and declining risk premia, and in a weak risk environment EUR/JPY and other JPY crosses are likely to remain the most vulnerable. Soft US CPI might allow some reversal of Tuesday’s JPY strength, but if CPI is at or above expectations the JPY is likely to stay firm on the crosses.

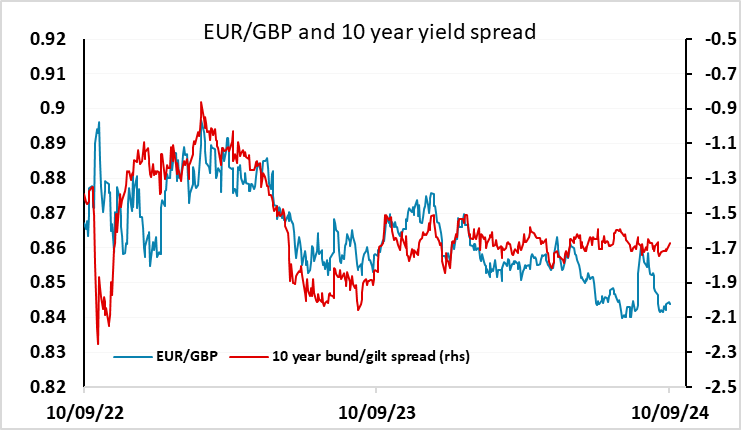

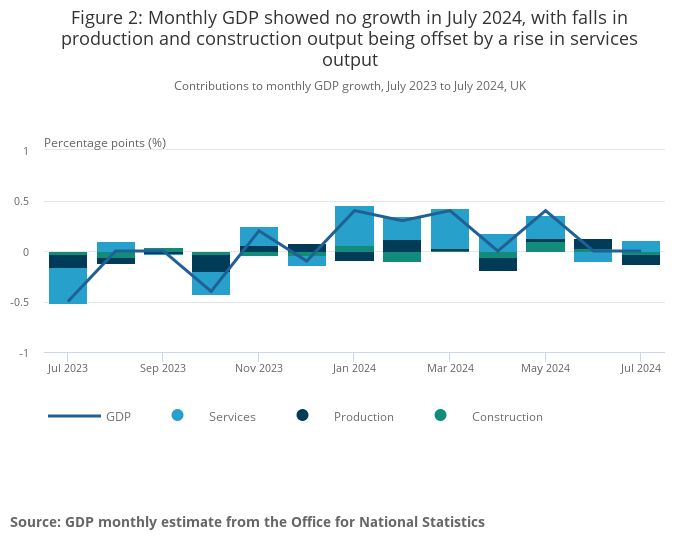

GBP has dipped after UK July GDP came in weaker than expected at unchanged m/m. This follows a similarly unchanged number in June, and suggests that the stronger momentum to the economy seen in H1 is fading. Whether it is enough to convince the BoE to cut rates next week is less clear. The BoE is focused more on inflation trends and the labour market than short term GDP indicators, and yesterday’s labour market data was mixed. The dip in average earnings growth in the official ONS data to 4.0% y/y in the 3 months to July was encouraging, but due largely to base effects, and the more up to date HMRC data showing a pop higher to 6.2% y/y in August. Against this, the HMRC data showed a second consecutive month of decline in payrolled employment, and vacancies declined for the 26th consecutive month.

The market prices a 25bp cut at next week’s meeting as only a 22% chance, and this looks a little too low in our view, suggesting there is scope for UK yields to edge lower and EUR/GBP to edge higher before the meeting. Next week’s August CPI data may be key, and we see some downside risks, with the July data having shown weakness in the key services measure and already below BoE projections. EUR/GBP should have scope to press back up to 0.8450 near term, especially since the risk environment continues to show signs of weakness.

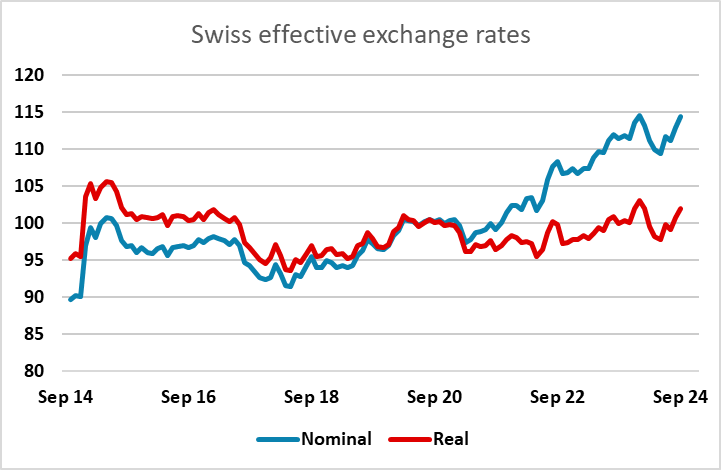

The weaker risk tone on Tuesday also saw the CHF continue to make gains against the higher yielders, but EUR/CHF is now getting into territory that the SNB is likely to see as too strong, testing the post-2015 real terms highs seen earlier in the year. Unlike the JPY, there is no case of undervaluation of the CHF, and unless we see a clearer case for a risk sell off, EUR/CHF should be near a bottom close to 0.93.