FX Daily Strategy: N America, Sep 16th

US retail sales unlikely to move market

BoC set to cut even without CPI decline

GBP steady after UK labour market data

US retail sales unlikely to move market

BoC set to cut even without CPI decline

GBP steady after UK labour market data

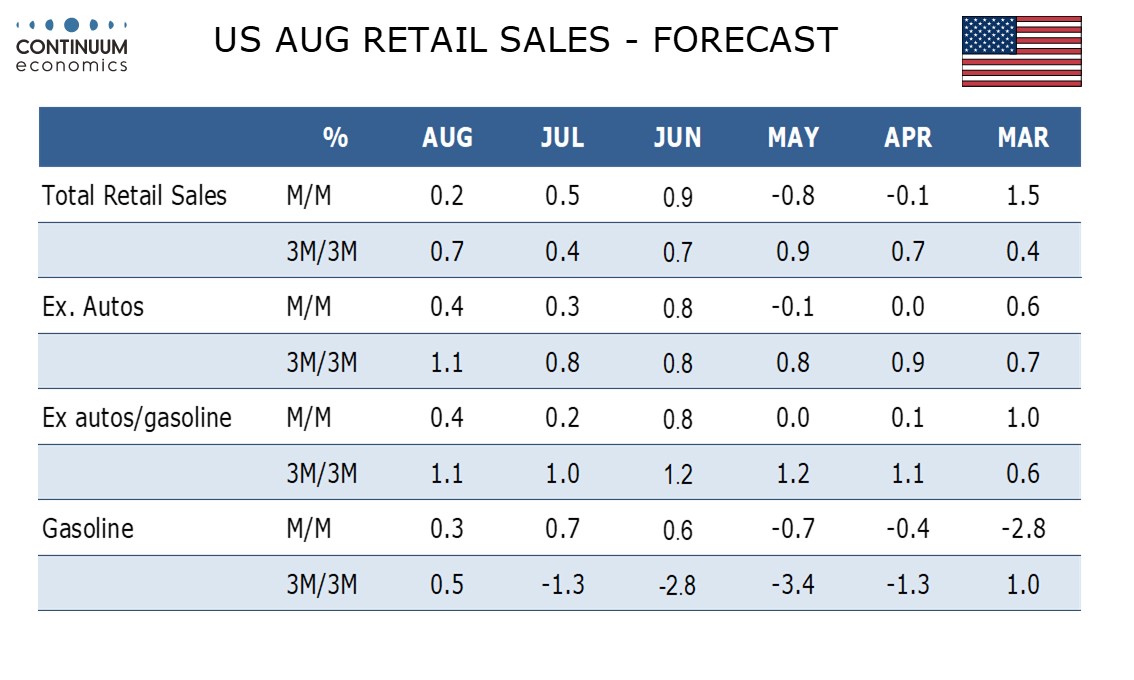

Tuesday sees US retail sales, UK labour market data and Canadian CPI. The US data is unlikely to change the market expectation of a 25bp cut from the Fed this week, but could affect expectations of future actions. We expect a modest 0.2% increase in August retail sales restrained by a correction lower in auto sales. However we expect the core rates ex autos and ex autos and gasoline to maintain trend with gains of 0.4%. Our forecasts are in line with consensus, so shouldn’t have a significant market impact. The underlying trend has been fairly steady, and is unlikely to change significantly even if we see a fairly large miss, so any reaction is likely to be knee jerk and shouldn’t be sustained.

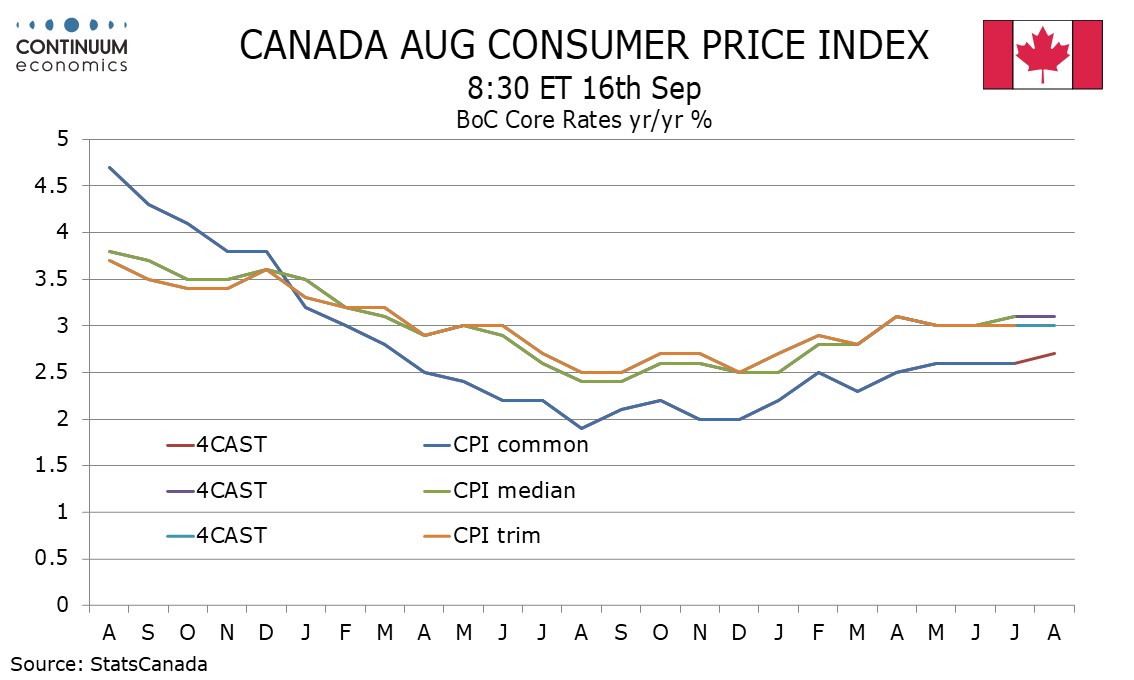

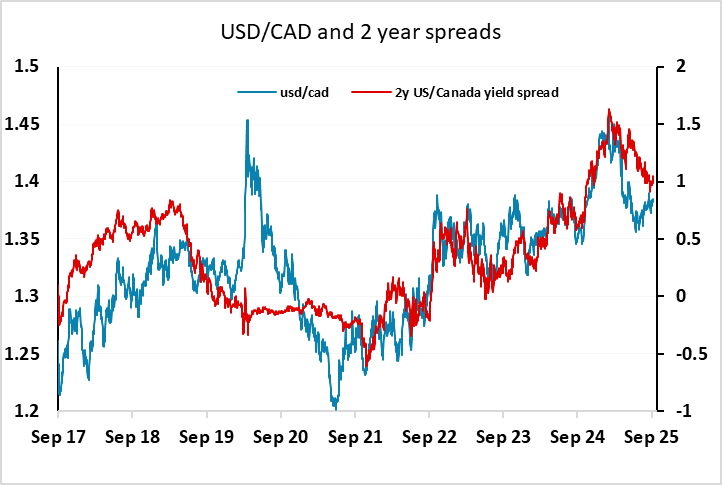

Canadian CPI is potentially significant, although after the latest weak employment data the market has now fully priced in a BoC rate cut. Weakness a year ago is likely to see August Canadian CPI picking up on a yr/yr basis, we expect to 2.0% from 1.7%. The Bank of Canada’s core rates are likely to remain fairly stable, and above the 2.0% target, but won’t prevent the BoC from responding to labour market weakness. USD/CAD continues to have potential to move higher if the USD shows any general recovery, but the CAD should in any case be soft on the crosses with the Canadian economy underperforming.

GBP is very little changed after a very much as expected UK labour market report. This showed average earnings growth for July in line with consensus at 4.7% including bonuses (up from 4.6% in June) and 4.8% excluding bonuses (down from 5.0% in June). The employment data from HMRC for August showed a small decline in payrolled employment in August and a small rise in earnings growth. The data is all in line with consensus but suggests a slight stabilisation in employment and earnings growth after the decline seen in recent months, perhaps reflecting the modest pick up in GDP growth seen at the start of the year. EUR/GBP is likely to remain in the centre of the 0.86-0.87 range ahead of the BoE meeting on Thursday.