FX Daily Strategy: Europe, February 27th

More data on Thursday, albeit second tier

Some mild upside risks to the US numbers

European data likely to be mixed

USD may also benefit from end of month demand

More data on Thursday, albeit second tier

Some mild upside risks to the US numbers

European data likely to be mixed

USD may also benefit from end of month demand

After a quiet start to the week, Thursday sees some slightly more important data, with US revised Q4 GDP and January durable goods orders, while Europe has provisional February CPI from Spain and Eurozone money and credit data, as well as the February European Commission survey. In truth, we doubt any of this data is going to significantly change market sentiment, with the focus more on the potential for Trump to impose tariffs on Canada and Mexico come next week. But in view of the recent softer tone to US data and the decline in US yields that has resulted, there is potential for a reaction to the US data.

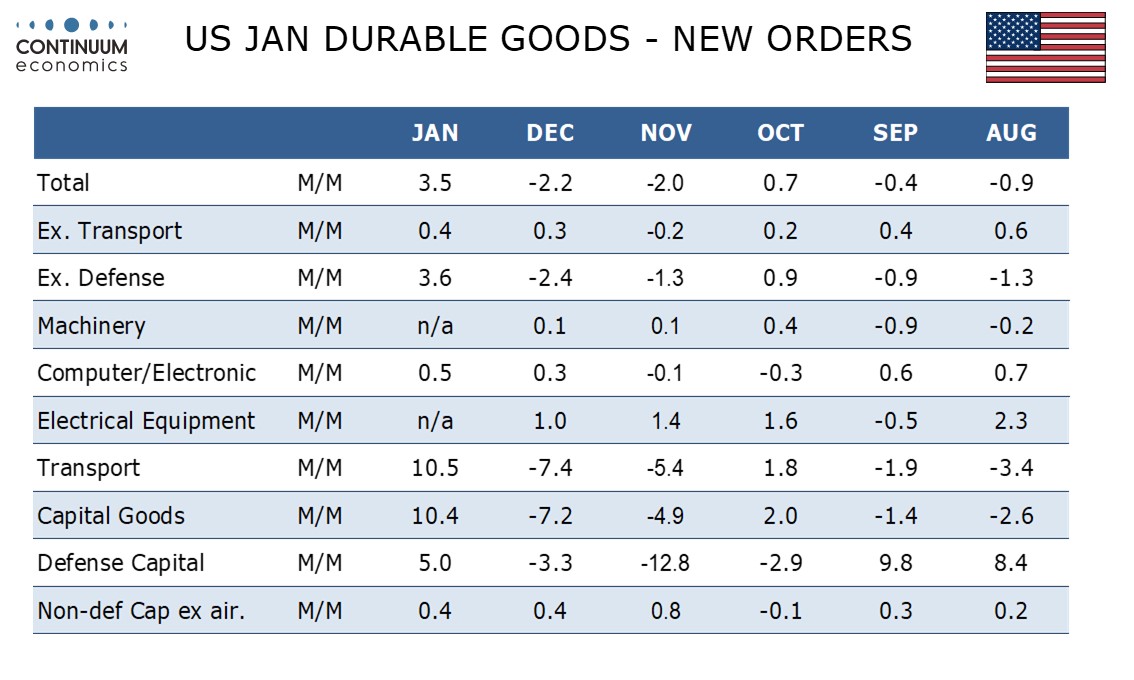

We expect January durable orders to increase by 3.5% overall with a 0.4% increase ex transport. The rise is likely to be led by civil aircraft in a rebound from a weak December, though we expect orders ex transport to sustain a recent improvement in trend. Our headline figure is well above the market consensus of 2.2% but the ex-transport consensus is 0.3%, so minimally different from our forecast. We expect the preliminary (second) estimate of Q4 GDP to be unrevised from the advance (first) estimate of 2.3%, which is in line with market consensus, so the net impact of the US data should be mildly USD positive, although we wouldn’t expect the impact to be large as the headline durables strength is likely to be due to the volatile aircraft component.

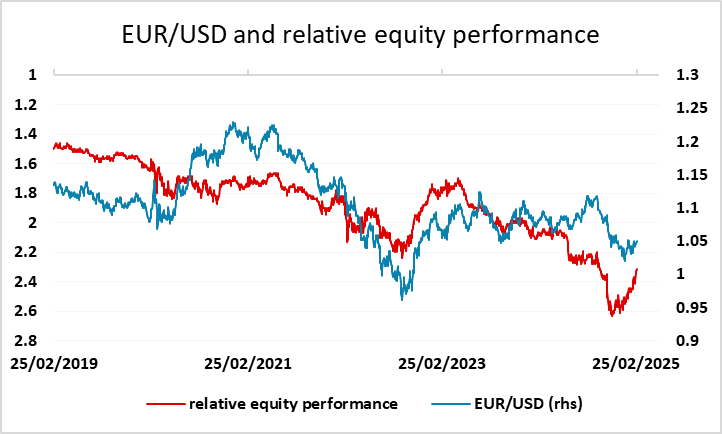

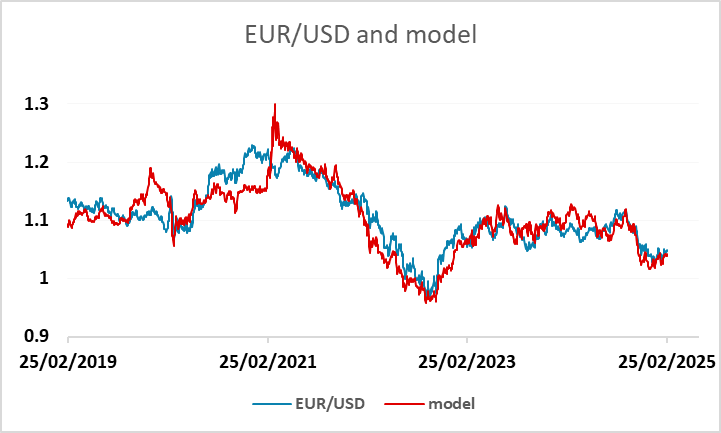

As for the European data, the risks look to be mildly on the upside for the Spanish CPI and Eurozone money data, but probably on the downside for the Commission survey after the softer German confidence data released on Wednesday. EUR/USD has continued to press on the 1.05 resistance area this week even though there hasn’t been a universal risk positive tone to the FX market, with commodity currencies generally under pressure. Strong European equities on the back of some hope of a Ukraine peace deal is par of the reason for EUR resilience, but with Europe next in line for tariffs it still looks hard for the EUR to manage any sustained strength without some more concrete evidence of European economic improvement.

As we had towards the end of the week and end of the month, there may be some end of month effects on the FX market, particularly around fixing times. Most models are suggesting these effects will be USD positive due to the recent underperformance of US equities. This tends to mean US funds’ currency hedges on European equities need to be increased, meaning some selling pressure on EUR/USD around fixing time. Along with the mildly positive view we have on the US data this suggests to us that Thursday may be a slightly more positive day for the USD.