EUR, JPY, SEK flows: Firm USD tone hard to justify, SEK in focus

USD firm overnight without an obvious rationale. German production data EUR positive. JPY softening but BoJ risks rising. Riksbank meeting in focus.

While revisions mean that the March German industrial output numbers were much as expected, the 3m/3m trend now looks to be clearly improving, with Q1 managing nearly a 1% q/q rise. The EUR has firmed up slightly early in the session, which may partly be related to the data, although may also simply be a correction to the overnight decline.

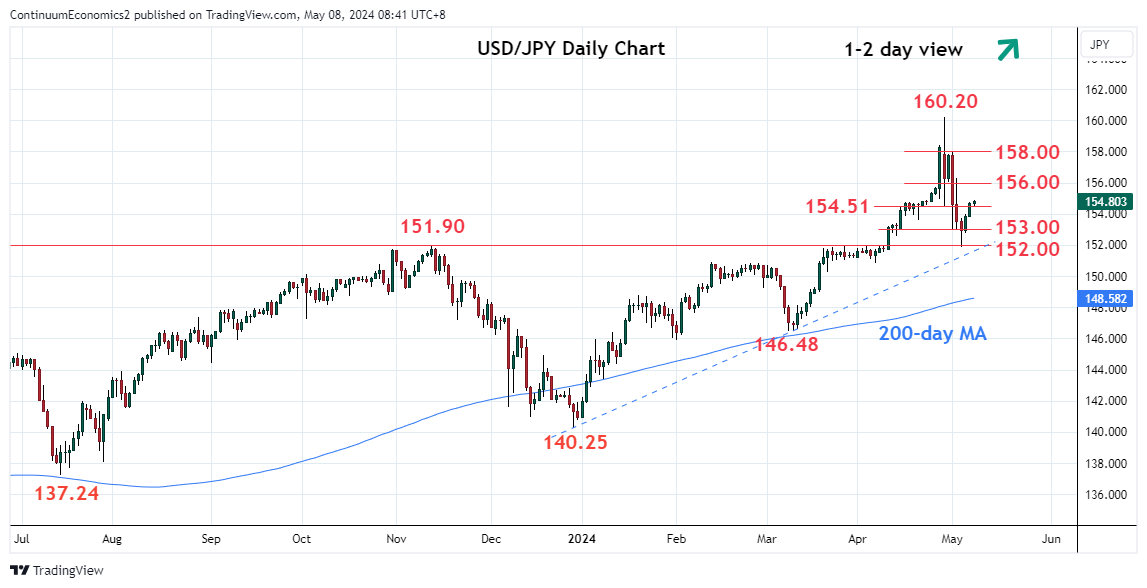

The USD has been generally strong overnight, particularly against the JPY, but without an obvious rationale. US yields are not significantly changed and equities have also been fairly steady. USD/JPY still looks somewhat extended relative to yield spreads, and the risk of BoJ intervention remains. Technically, corrective activity could lead to a move as high as 157, but it’s hard to see what the motivation for JPY sellers is here, given the risks of a sharp decline on BoJ intervention.

This morning’s main event is the Riksbank meeting, and we continue to see risks being weighted to the EUR/SEK downside given the starting point of 11.70, which looks significantly higher than suggested by yield spread correlations, and the general market expectation of a rate cut.