FX Daily Strategy: APAC, February 7th

Mild USD downside risks on US employment report

JPY continues to look the most attractive currency

CAD needs a strong Canadian employment report to prevent a renewed decline

AUD still looks attractive

EUR/GBP looks set to stabilise near term

Mild USD downside risks on US employment report

JPY continues to look the most attractive currency

CAD needs a strong Canadian employment report to prevent a renewed decline

AUD still looks attractive

EUR/GBP looks set to stabilise near term

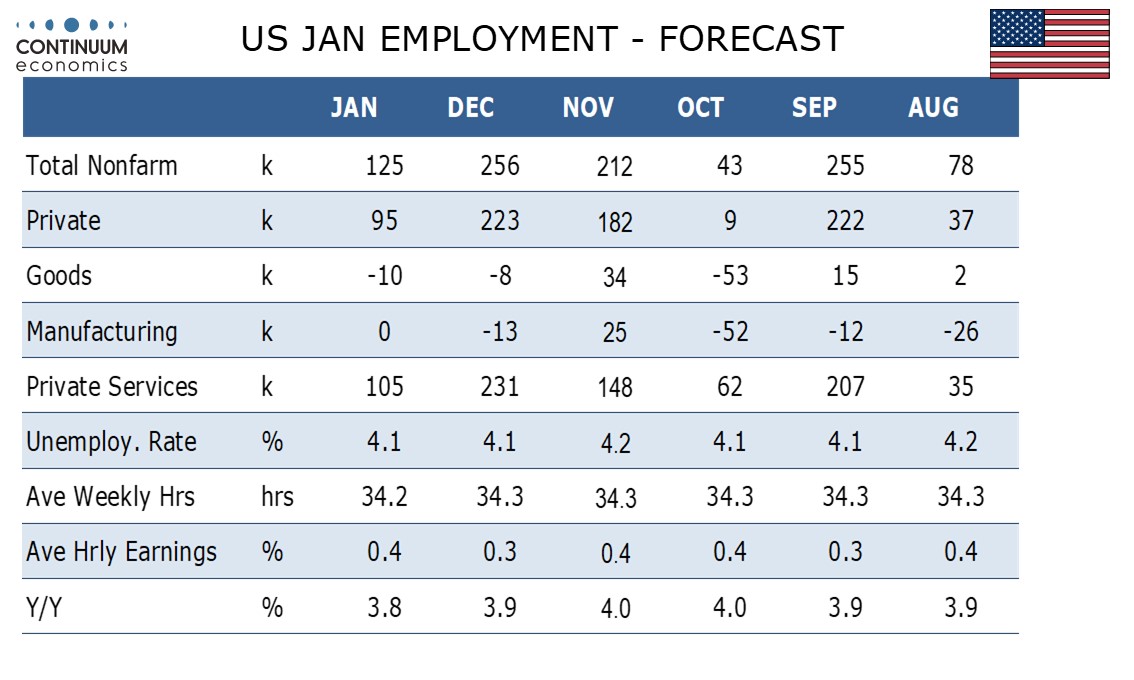

Friday is US employment report day. Unless President Trump decides to institute new tariffs or springs some other surprise, the US employment report will be the dominant focus.

We expect a below trend 125k increase in January’s non-farm payroll, with a 95k rise in the private sector. The data is likely to be restrained by bad weather and a possible correction from an above trend December. The workweek is likely to fall on bad weather but we expect unemployment to be unchanged at 4.1% and we see a slightly above trend 0.4% increase in average hourly earnings. Our payroll forecast is below the market consensus, which is probably taking less account of the weather, but the consensus is looking for a slightly lower 0.3% rise in average earnings, so the reaction to our forecast might not be particularly dramatic. Even so, the payroll numbers will tend to dominate the reaction so the USD risk should be slightly on the downside.

The JPY has been the best performer this week, with USD/JPY trending lower in line with the move in the yield spread as US yields have edged lower and JGB yields have gone in the opposite direction. The decline in US yields may partly reflect a relief trade as the Canada/Mexico tariff proposals have been delayed (or likely cancelled judging by market pricing), but may also reflect a growing belief that getting tax cuts through Congress will prove more difficult than previously thought. Rising JGB yields take account of the stronger Japanese wage data for December and some hawkish BoJ comments. Either way, it will need significantly stronger US employment data to justify any reversal in JPY strength, as even below 152 USD/JPY looks to have further to go to match the move we have seen in yield spreads.

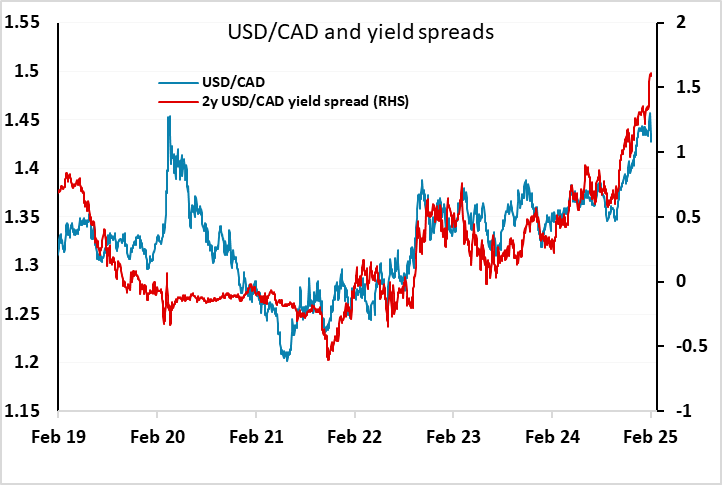

The picture for other currencies is less clear-cut. USD/CAD has been in focus due to the flip-flopping on tariffs, and has reversed sharply after the spike to 1.4793 – its highest since April 2003. But yield spreads still suggest some upside risks for USD/CAD. Canadian yields haven’t reversed the decline seen in recent weeks, and this suggests to us that a strong Canadian employment report is needed to prevent USD/CAD moving back up to 1.45. Some of the decline in USD/CAD that we have seen in the last week likely reflects the unwinding of short CAD positioning. The CFTC data has indicated that this is extended for some weeks. But unless there is some data to justify a halt to BoC easing, These positions may be re-established and USD/CAD may head back up.

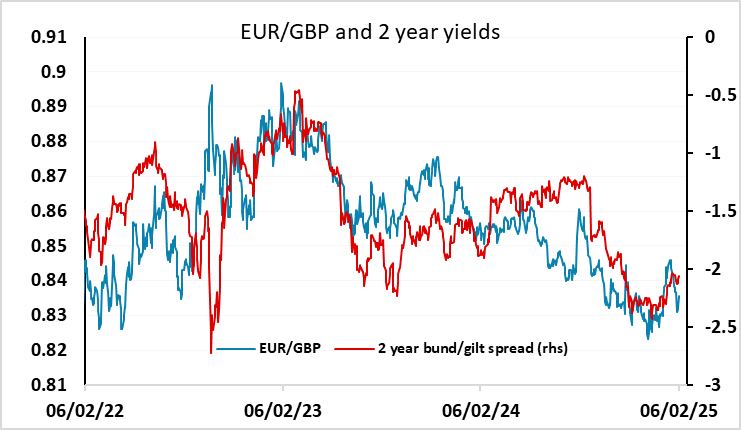

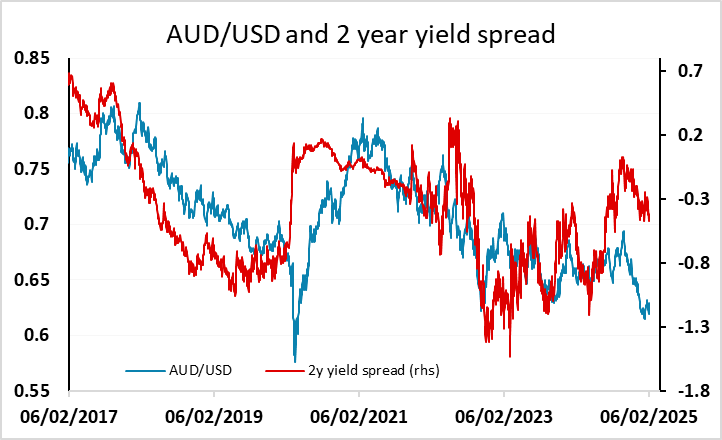

Elsewhere, we still see the AUD as attractive at current levels, having underperformed yield spreads in the past year and helped by China seeing no more of a tariff increase than expected. GBP fell back on Thursday both before and after the BoE decision, but in spite of the two votes for a 50bp cut, the underlying story for policy looked biased towards a slightly more hawkish picture, with BoE inflation forecasts being raised. Against this, the BoE also cut growth forecasts, so the story for UK sentiment wasn’t particularly encouraging, and the GBP outperformance of the EUR seen in the past couple of weeks may be at an end. But it will likely require some more clear-cut positive news for the EUR or negative news for GBP to push EUR/GBP above 0.84. An 0.83-0.84 range looks likely to hold near term in the absence of major news.