FX Daily Strategy: N America, December 13th

FOMC the focus, dots to move dovishly

Powell nevertheless likely to play down chances of an early cut

EUR/USD biased higher but with limited scope

GBP may have more downside on UK GDP

FOMC the focus, dots to move dovishly

Powell nevertheless likely to play down chances of an early cut

EUR/USD biased higher but with limited scope

GBP may have more downside on UK GDP

Wednesday’s focus will be on the FOMC meeting, even though there is no expectation of any change in policy this time around. However, the tone of the statement will be important. The November employment report and November CPI are unlikely to have had a significant impact on Fed thinking, although at the margin they were on the strong side of consensus. Chairman Jerome Powell will make it clear easing is not yet on the agenda but the dots are likely to move in a dovish direction, and this will sustain market hopes for easing by mid-2024.

Since the Fed's last Summary of Economic Projections seen in September Q3, GDP has surprised to the upside, while inflation has fallen faster than expected. This is likely to see a significant upward revision to the 2023 GDP forecast and significant downward revisions to 2023 inflation forecasts. Forecasts for 2024 and beyond will however be more important, and we expect the Fed will see the Q3 2023 GDP strength as unsustainable and make little adjustment to their forecasts for 2024 GDP, of 1.5% Q4/Q4, or to their 1.8% forecasts for both 2025 and 2026. On inflation however, we believe the Fed will now have a greater degree of confidence that the improvement is inflation is sustainable, and forecasts for 2024 and 2025 will also be revised lower. They may even see the 2.0% target being achieved in 2025 rather than 2026 as was the case in September. Despite the likely upward revision to GDP, unemployment forecasts look set to be fine-tuned marginally higher.

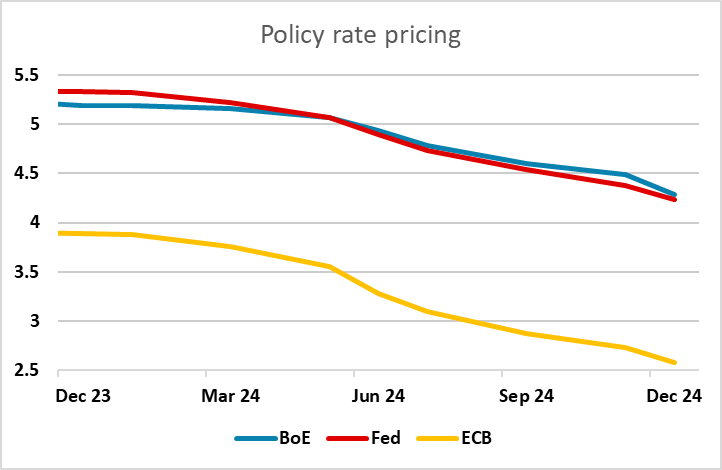

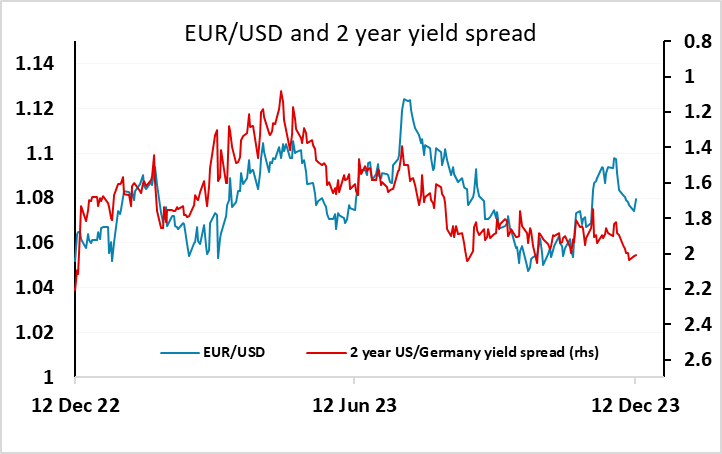

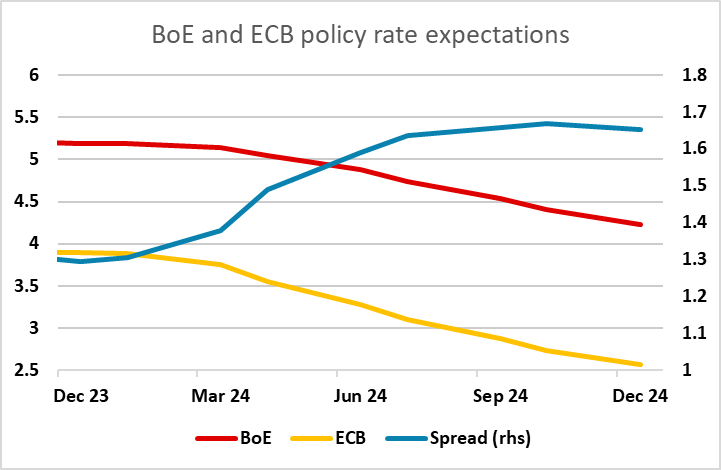

In practice, the dominant factor may be lower dots in the FOMC projections, especially if there isn’t any upgrade to 2024 growth as we suspect will be the case. This suggests some modest downside risks for USD front end yields, but this may be offset by Powell’s comments, in which he is likely to lean against expectations of early cuts. As it stands, the market is pricing 110 bps of Fed easing through 2024 against 133bps of ECB easing and 95bps of easing from the BoE. This relates to the expectation of much weaker Eurozone growth and more persistent UK inflation. However, in practice, we suspect that policy decisions are likely to be fairly closely aligned, as the ECB tends to have a hawkish bias and UK growth is likely to be similarly weak to the Eurozone with rates starting at a significantly higher level. This suggests there may be downside risks for short term US/Eurozone yield spreads, which ought to mean modest upside risks for EUR/USD. But EUR/USD is starting from a level that looks a little high relative to current yield spreads, so we wouldn’t expect any substantial EUR gains.

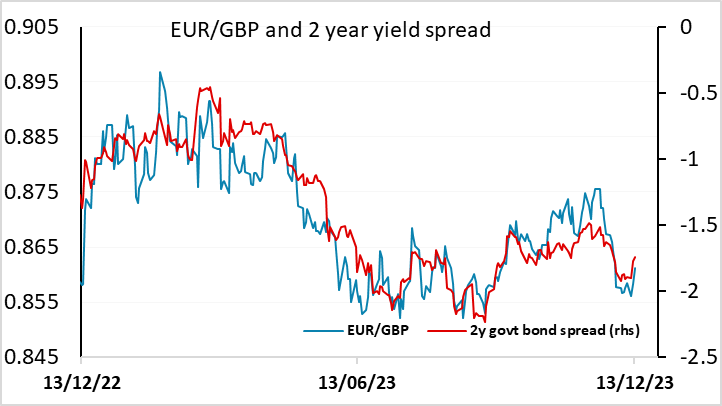

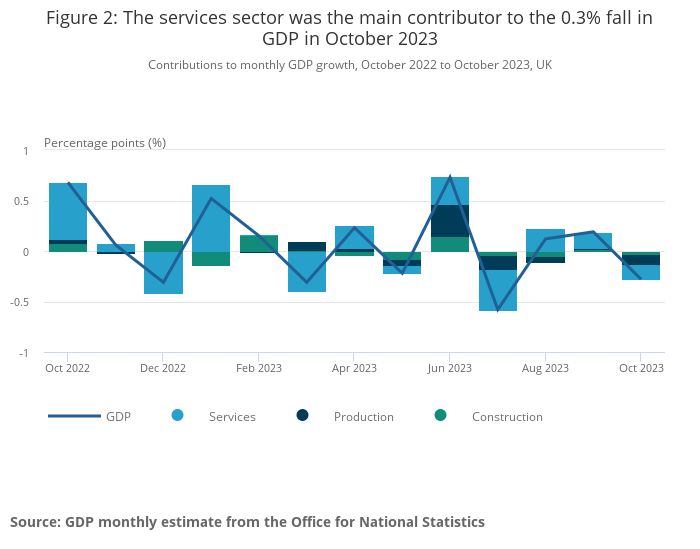

Much weaker than expected UK GDP in October has sent GBP lower, although the initial reaction has been quite modest. EUR/GBP has popped above 0.86, but we suspect there are more gains to come as the 0.3% decline in GDP is likely to impact expectations of Q4 GDP as a whole and convince at least one of the three hawkish dissenters on the MPC to switch their vote to no change at tomorrow’s meeting. EUR/GBP is already slightly on the low side relative to the recent yield spread correlation, and with the market pricing almost 50bps more cuts from the ECB in the next year relative to the BoE, there is scope for the yield spread to narrow in the EUR’s favour.

The data itself was clearly on the weak side, with services, industrial production and construction all falling in October. The market may be taking some comfort from the strength of the November PMIs which suggests there could be some rebound next month, but the decline in October sets a base that will make it hard for Q4 to show positive growth.