Preview: Due December 10 - U.S. Q3 Employment Cost Index - Stable trend

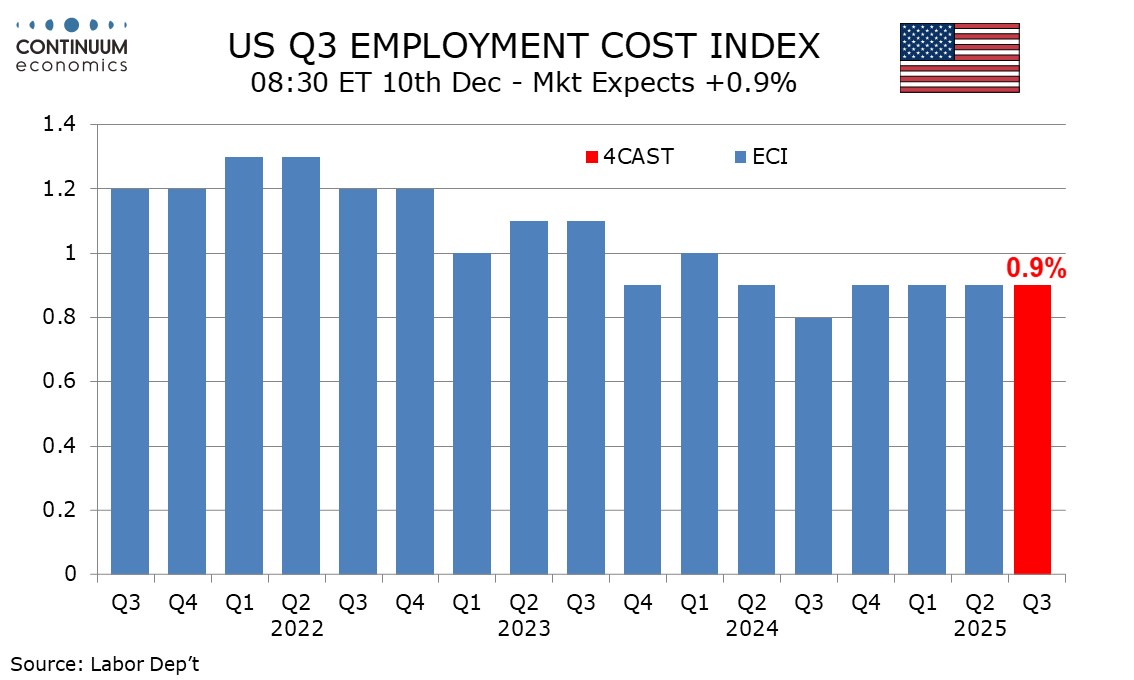

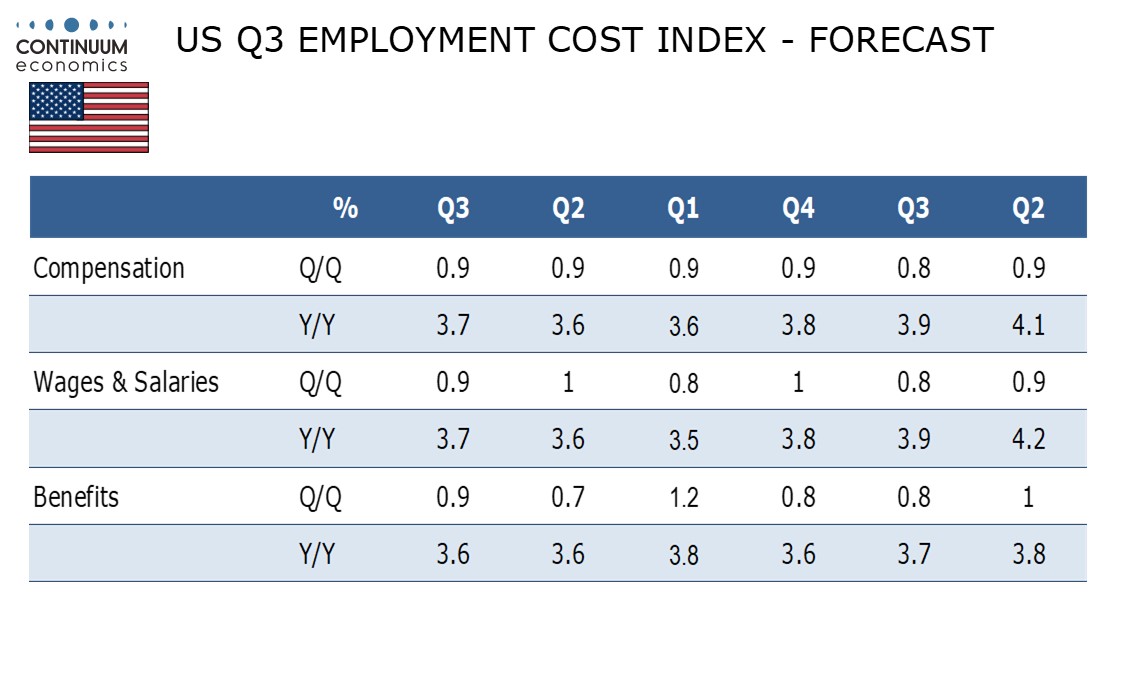

We look for the Q3 employment cost index (ECI) to increase by 0.9% for a fourth straight quarter, with gains of 0.9% in both wages and salaries and benefit costs.

Risk on wages and salaries may be marginally on the upside with non-farm payroll average hourly earnings having risen by 1.0% in Q3, though slowing employment growth argues against an acceleration. Trend appears to be 0.9% per quarter, with gains of 1.0% in Q2 and Q4 2024, and 0.8% in Q1 and Q3 2024.

The last two Fed Beige Books have suggested rising health premiums lifting are labor costs, but this is probably more of an issue for Q4 and Q1 2026 than Q3. Q2’s 0.7% rise however was below trend after an above trend 1.2% in Q1. Q1 is the quarter in which annual health premium updates tend to be reflected.

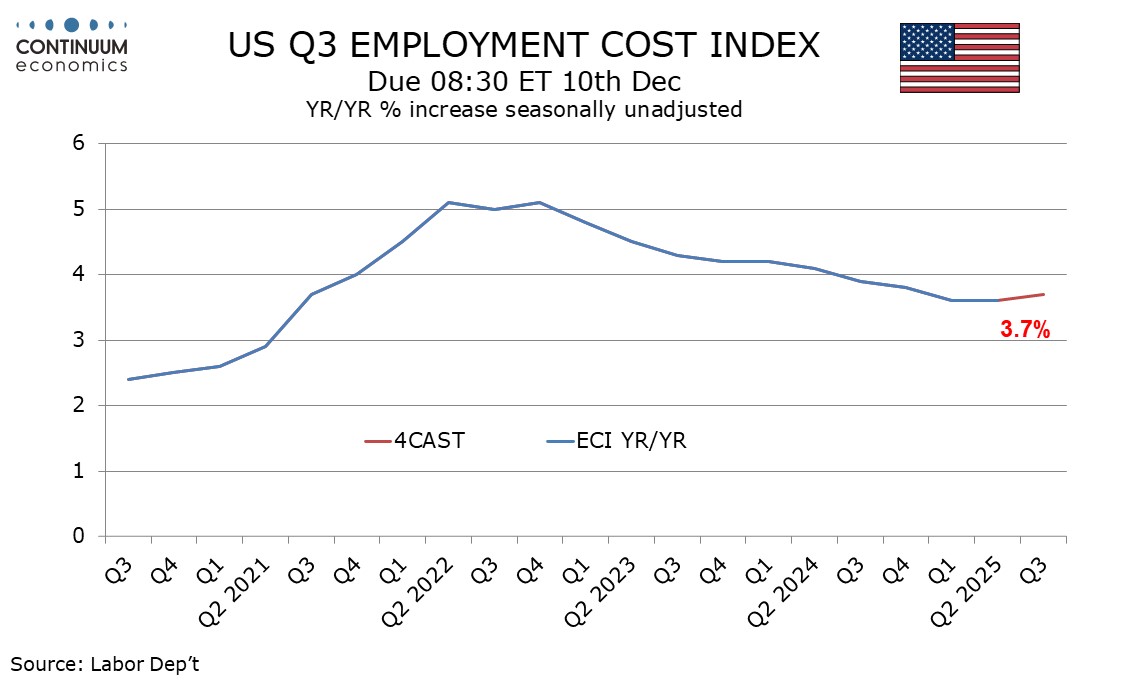

We expect yr/yr growth of 3.7%, slightly up from two straight quarters at 3.6% with wages and salaries also rising to 3.7% from 3.6% but benefits stable at 3.6%. A recent slowing in trend may be stabilizing above the pre-pandemic trend that was slightly below 3.0% on a yr/yr basis.