USD, JPY, CHF flows: JPY recovery has legs, CHF under a little pressure

Quiet start, CHF softer, JPY has potential to gain more longer term

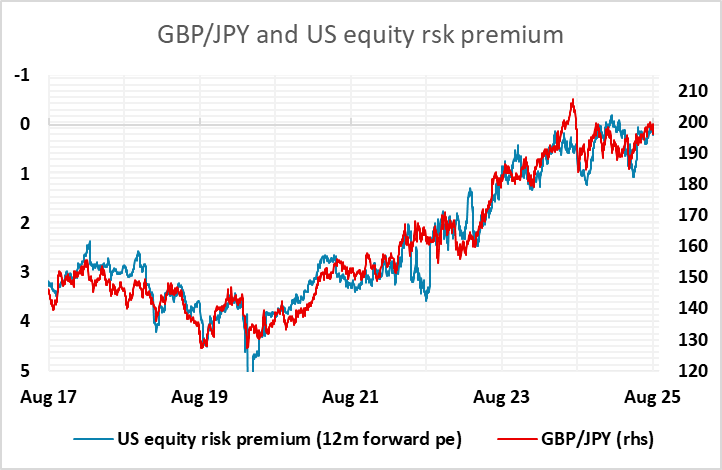

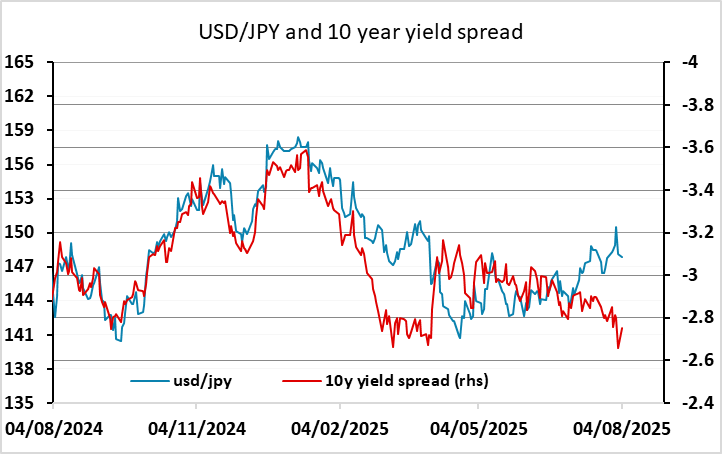

A fairly quiet start in Europe. Swiss July CPI has come in a little stronger than expected, and triggered a brief CHF rally, but EUR/CHF quickly reversed higher and is now trading at its highest level for a week at 0.9345. Equities have been generally a little better bid overnight after Friday’s sell off, and with little on today’s calendar and minimal news at the weekend, we may be in for a quiet session. Whether risk sentiment can recover after Friday’s US employment data is unclear in the short term, but we do see Friday’s sell off as likely to be the beginning of a bigger risk decline. We would expect to start to see some impact from tariffs on prices and demand in the coming months, and this should mean further equity declines. Consequently, we also see the JPY recovery seen on Friday as just the beginning. USD/JPY continues to have scope on the downside based on yield spreads, but JPY crosses are still likely to require more equity weakness – or more US yield declines – to extend Friday’s decline.