FX Daily Strategy: N America, Sep 5th

US August employment data likely to be similar to July

USD downside risks on weak data likely greater than upside risks on strong data

Japanese wage data could impact BoJ expectations

UK delayed retail sales data needs to beat consensus to sustain better trend

US August employment data likely to be similar to July

USD downside risks on weak data likely greater than upside risks on strong data

Japanese wage data could impact BoJ expectations

UK delayed retail sales data needs to beat consensus to sustain better trend

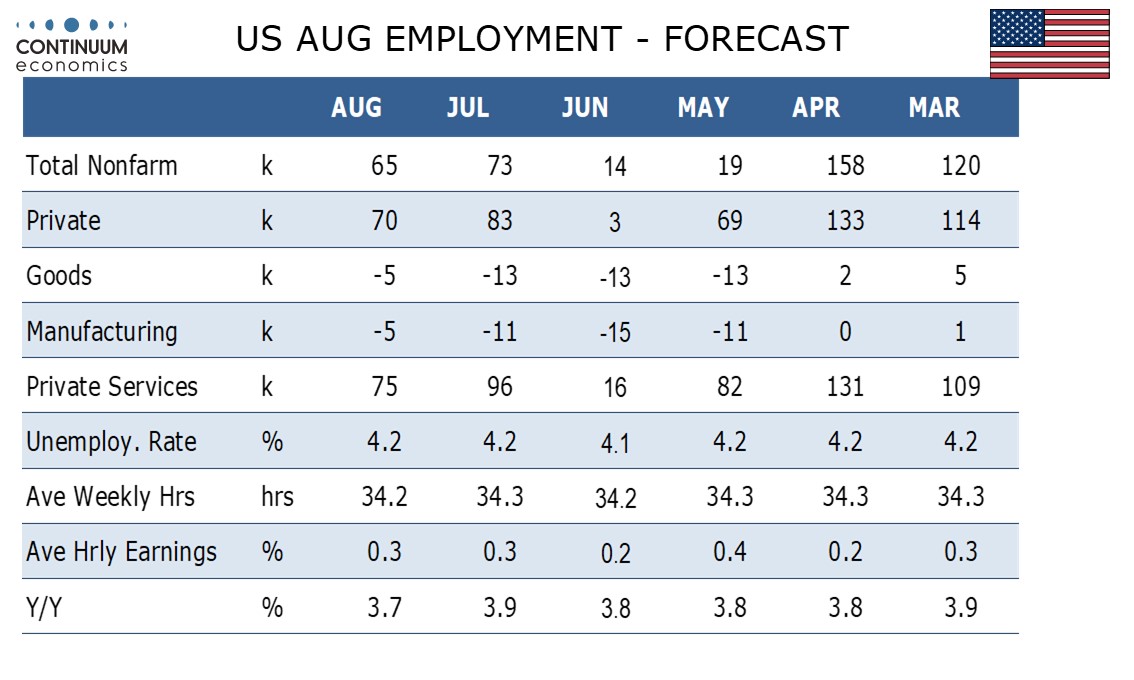

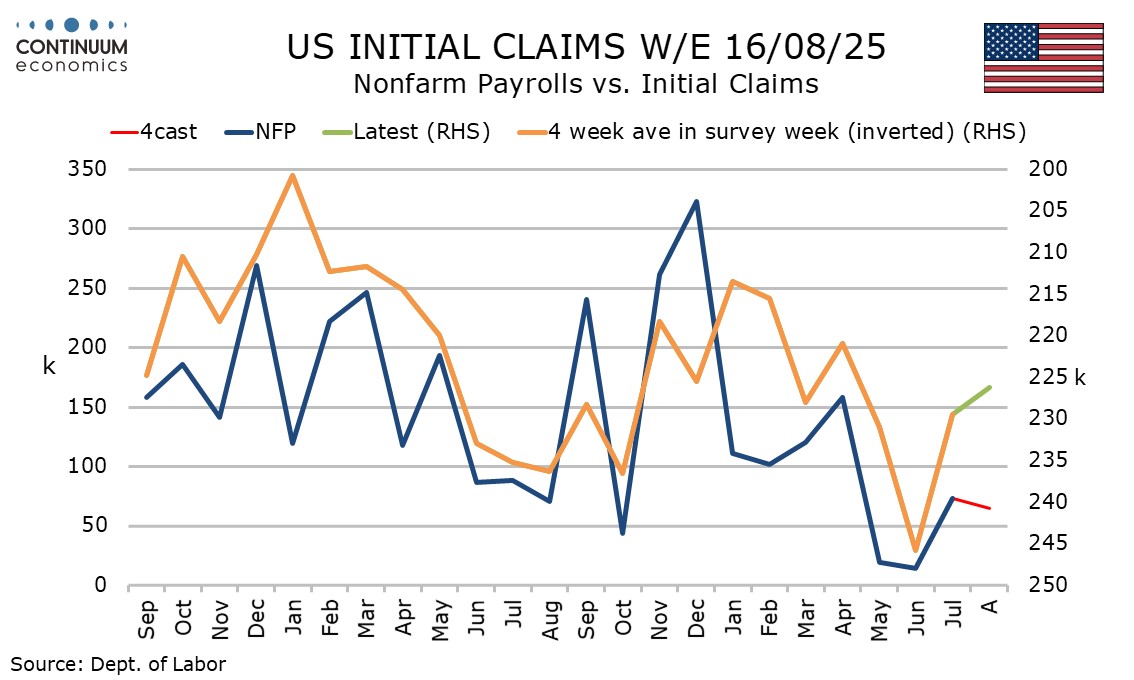

The US employment report will be the main focus on Friday. We expect August’s non-farm payroll to look similar to July’s, with a rise of 65k versus 73k in July, above the 14k rise of June and the 19k rise of May but well below the trend that was running above 100k through April. We also expect unemployment to remain at July’s 4.2% rate and a second straight 0.3% increase in average hourly earnings. July’s data was most notable for the dramatic downward revisions to May and June. We are assuming limited revisions this time with the recent payroll data looking fairly consistent with initial claims. The 4-week average for initial claims slipped in July and further into August’s survey week, though the weekly number did increase in August’s survey week.

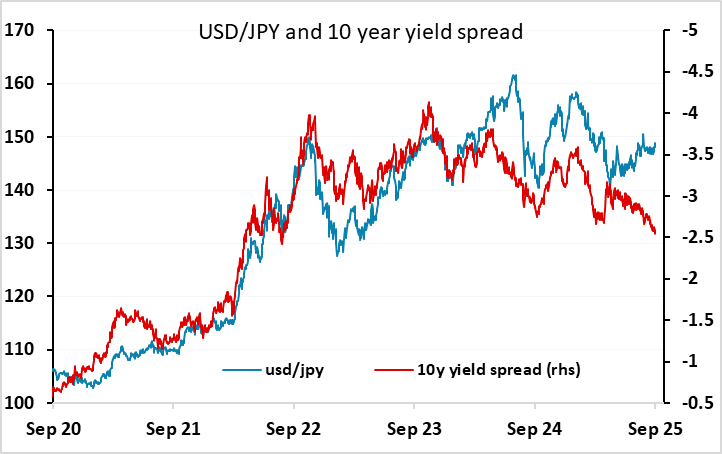

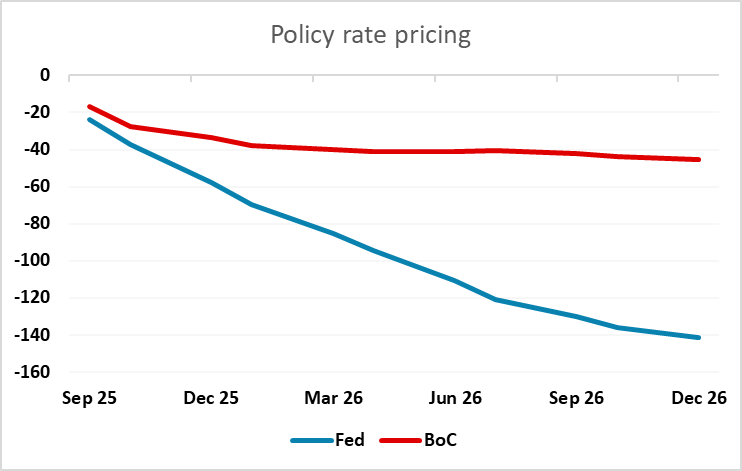

Given the volatility of the data, anything 15k-100k should be considered neutral, although the market will no doubt react even on a 20k miss. The market consensus is slightly above or forecast at 75k, but the difference is negligible, and it is perhaps more significant that the consensus for the unemployment rate is 4.3%, slightly above our forecast. Neutral data might be seen as mild USD positive, as there is already a lot of Fed easing priced into the market, and in a scenario of slow growth but no rise in unemployment, the 140bps of easing priced in by the end of next year may be on the high side. However, there is likely to be more reaction to a significant downside miss than a significant upside miss, especially if we see a negative number, because the trend has been weak and significant weakness would put pressure on the Fed to act aggressively. We continue to see potential for sharp JPY gains in the event of a weak number, with scope for gains in the riskier currencies much more limited, as weak employment data could be expected to trigger some weakness in equities and a rise in the implied equity risk premium, which remains highly correlated with JPY crosses.

We also have the release of the Canadian employment report, which could have a significant CAD impact if we see another negative number after last month’s 40k decline. At this stage a BoC rate cut in September is priced as slightly less than a 70% chance, against around a 94% chance for the Fed, so another weak employment number would trigger declines in CAD yields and likely push USD/CAD up to 1.39.

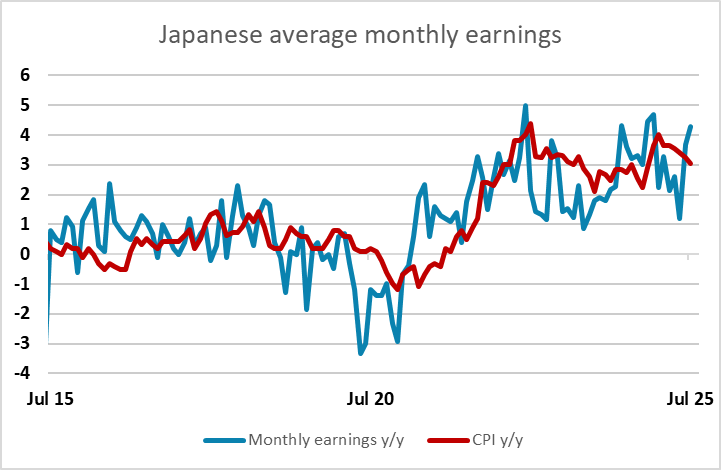

Japanese wage data overnight was stronger than expected, taking real wage growth positive for the first time since January. One of the main reasons the BoJ have been holding off tightening has been the lack of real wage growth over the first half, so these numbers, along with the more hawkish comments recently from deputy governor Himino, suggests there is a strong chance of a 25bps hike this year, perhaps even earlier than the December meeting. As it stands, there are only 13bps priced in for December, and 7bps for the October meeting. This looks too little if we see similar strong wage data in the next couple of months and the global economic picture remains stable.

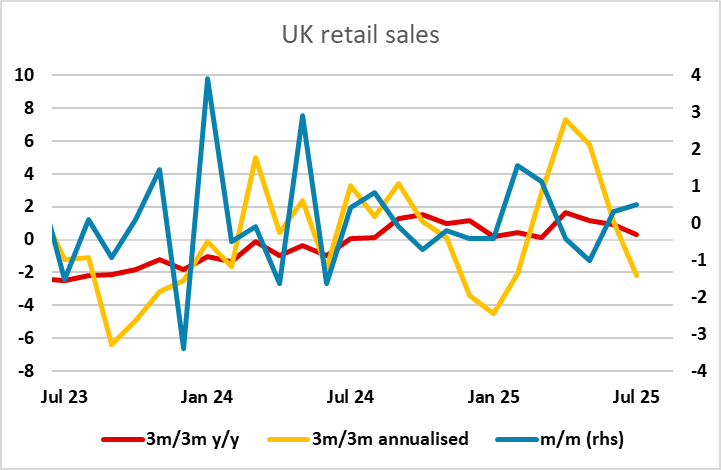

In Europe, GBP is a little firmer after the UK retail sales data, with a slightly larger m/m rise than expected at 0.6%. However, there have been significant revisions to previous data due to some errors in seasonal adjustment, so that the previously reported sharp gain in April followed by an even sharper decline in May have been smoothed out. Consequently, the trend still looks reasonably steady, although there are some signs of weakening in the last few months. GBP gains seem unlikely to extend with the revisions meaning the y/y data came out weaker than expected at 1.1% against the 1.3% consensus. The focus will now likely be more on the global risk tone around the US employment data.