FX Daily Strategy: Asia, April 4th

Markets likely to market time ahead of US employment report…

…but underlying risk positive tone favours riskier currencies

CHF CPI to be a focus as CHF is increasingly the preferred funding currency

NOK has scope for further gains

Markets likely to market time ahead of US employment report…

…but underlying risk positive tone favours riskier currencies

CHF CPI to be a focus as CHF is increasingly the preferred funding currency

NOK has scope for further gains

It’s unlikely we’ll see a lot of action on Thursday given the US employment report comes on Friday and the calendar is largely bare except for the usual jobless claims data and the US and Canadian trade numbers. However, there is Swiss March CPI, and this could have some impact given the weakness of the CHF since the SNB rate cut last month.

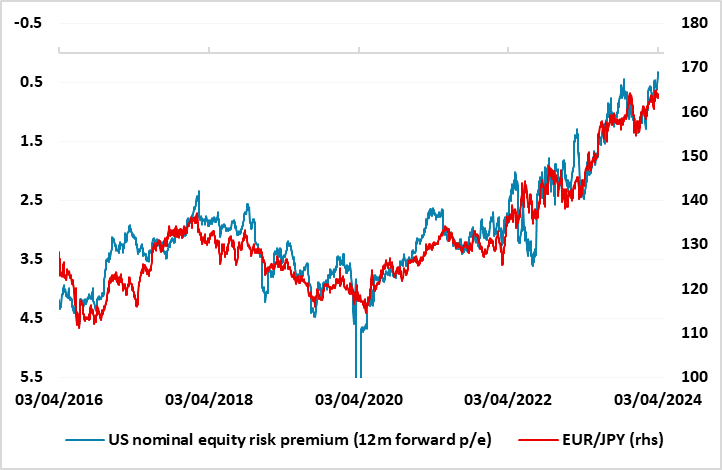

Declining equity risk premia still supporting EUR/JPY

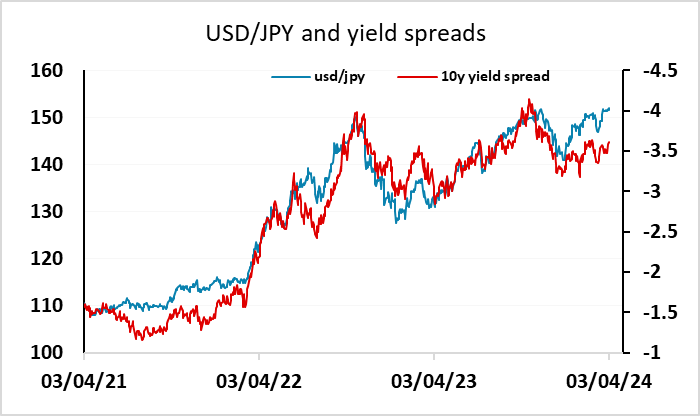

The theme on Thursday was risk positive, with the JPY falling back across the board and EUR/CHF retesting the levels above 0.98 after its corrective recovery last Thursday. Declining equity risk premia and low volatility continue to support gains for the riskier currencies, particularly against the JPY and the CHF due to low yields. But the scope for USD/JPY gains is more limited, both because yield spreads don’t match levels seen at the previous highs, and because the Japanese authorities continue to hint at the possibility of intervention if we see further significant gains.

This suggests the CHF should be the preferred funding currency, with the SNB much more tolerant of CHF weakness. Declining risk premia nevertheless suggest there is scope for further gains in EUR/JPY, so there should similarly be scope for substantial gains in EUR/CHF beyond 0.98. For Thursday, much will depend on the Swiss CPI data, which has been weaker than expected for the last couple of months. The consensus expects a minor bounce in the y/y rate to 1.3% from 1.2%, but it will take more than this to undermine the negative CHF sentiment seen since the SNB decision.

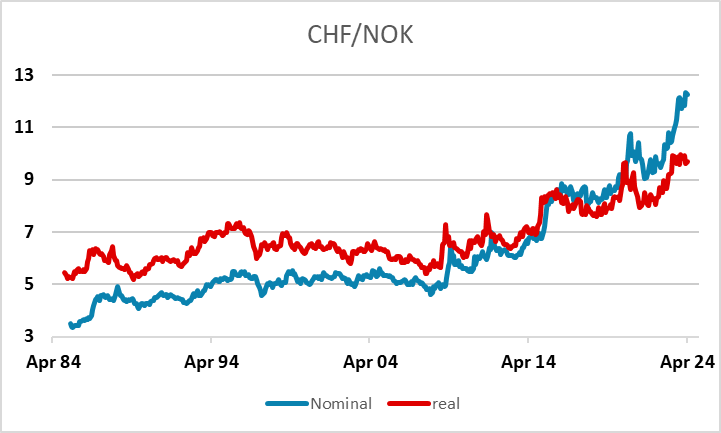

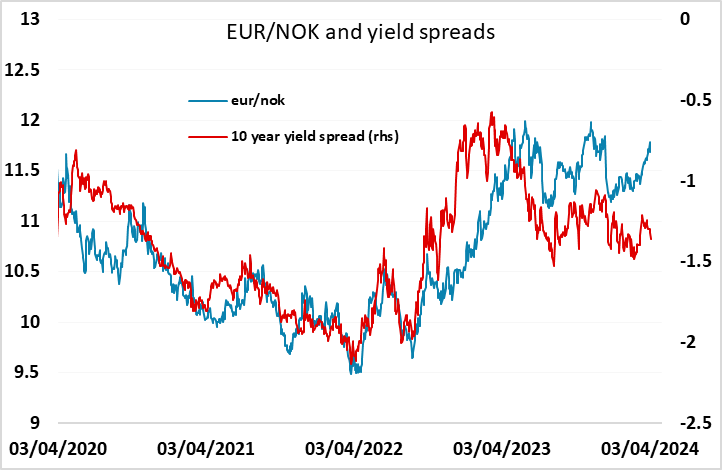

The EUR also probably shouldn’t be the main beneficiary in a risk positive environment, with the commodity currencies offering better growth, higher yields and in some cases better value. The NOK has been trading weaker than suggested by yield spreads for much of this year, and fell sharply through the second half of March without much rationale, but has started to recover this week and EUR/NOK should have scope to trade back to close to 11 medium term. CHF/NOK should have even more scope for gains given the big CHF appreciation in both real and nominal terms in recent years.

As far as the other commodity currencies are concerned, the AUD performed well on Wednesday, but looks a little stretched relative to yield spreads, and remains vulnerable to sentiment around China. The 0.6450-0.65 area remains good support for AUD/USD, but there shouldn’t be scope to test 0.66 in the near term.