FX Daily Strategy: APAC, January 16th

Little impact seen from US retail sales

AUD has potential to extend gains on solid employment data

GBP is vulnerable to any further evidence of weakness in GDP

Focus shifting to Trump inauguration and any early announcements on tariffs in particular

Little impact seen from US retail sales

AUD has potential to extend gains on solid employment data

GBP is vulnerable to any further evidence of weakness in GDP

Focus shifting to Trump inauguration and any early announcements on tariffs in particular

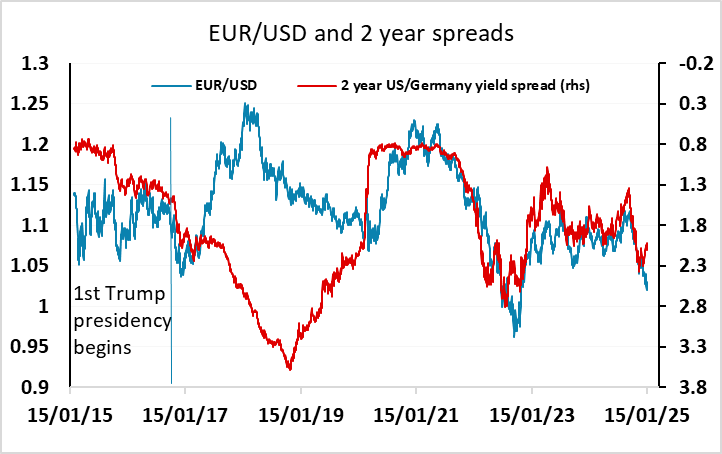

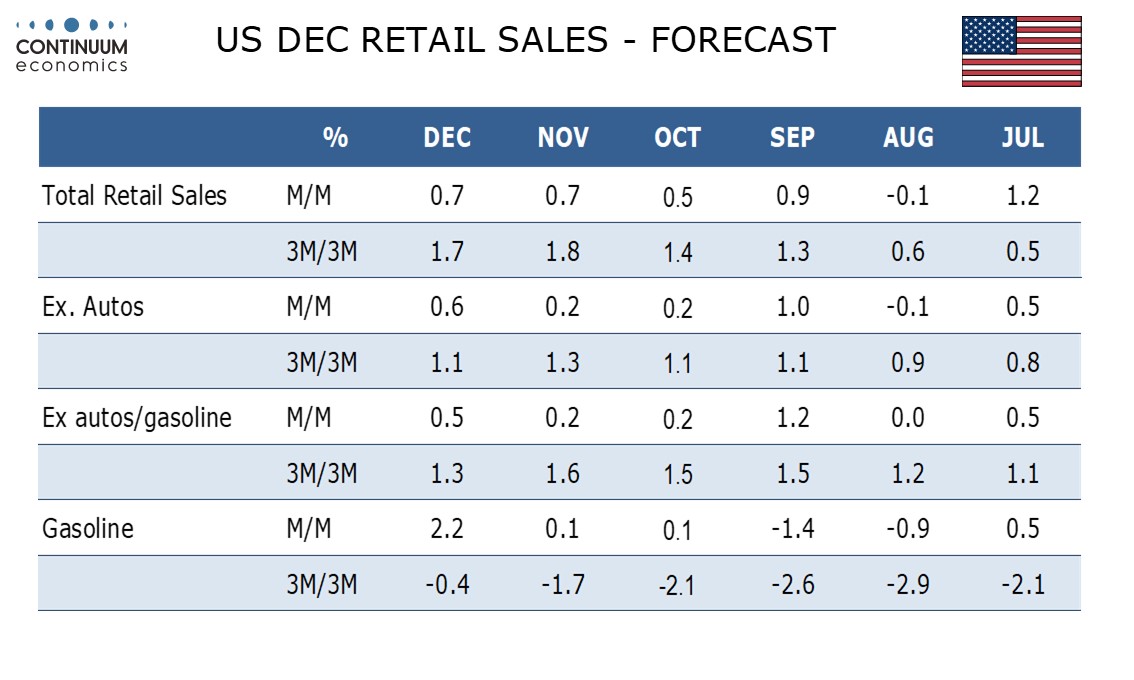

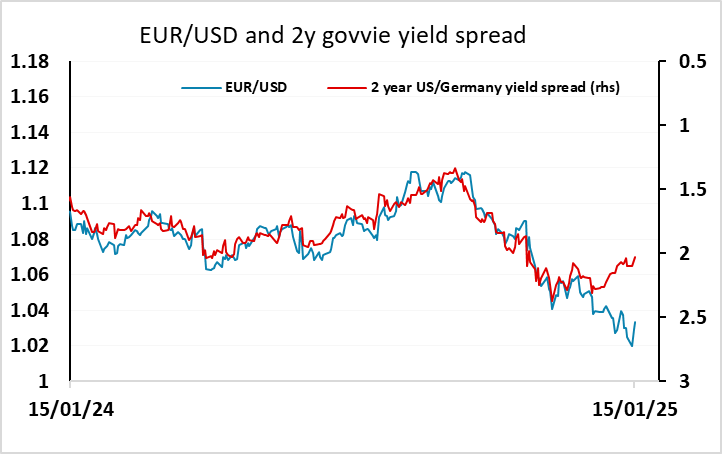

US retail sales provides the last significant US data of the week, with the USD generally under a little pressure after marginally softer price data. We expect US retail sales to finish Q4 on a solid note with a 0.7% rise overall, matching November’s gain, with a 0.6% rise ex autos and a 0.5% increase ex autos and gasoline, the two core rates picking up after both saw modest 0.2% increases in both October and November. Our forecasts are in line with consensus, so don’t provide any major reason for USD reaction, and after the softer tone to the USD over the last couple of days, the froth should have been taken off the USD’s strength, and as expected data should allow some stabilisation. Even so, we still see scope for USD weakness bigger picture, as yield spreads still point to USD declines and there is still quite limited scope for US yields to rise further in the short term with only one rate cut priced in for 2025. USD strength against the riskier currencies may now only emerge if we see some weakness in equities.

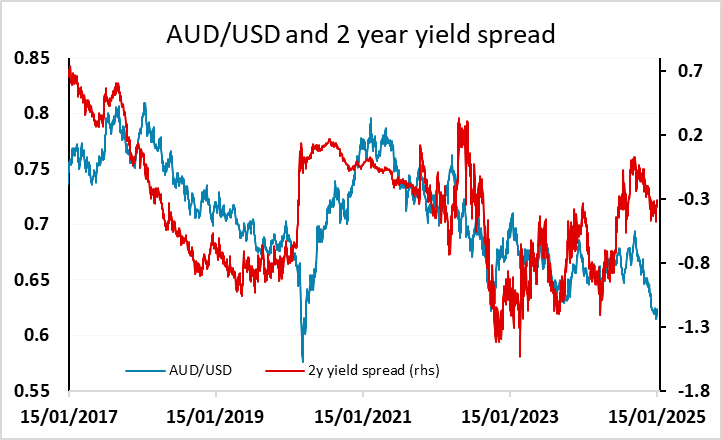

Before the US data there is Australian employment data and monthly UK GDP data. The AUD has bounced strongly after hitting post-pandemic lows at 0.6131 on Monday, and we still feel the AUD has a lot of potential to recover provided that global risk appetite remains reasonably positive. Yield spreads are favourable, and alone in the G10, the Australian economy has come close to matching US growth since the pandemic. Only concerns about China have dragged it back, and these will remain an uncertainty ahead of any Trump initiatives on tariffs, but we feel the AUD represents good value here and can make further significant gains if the employment data wither beats or is in line with consensus.

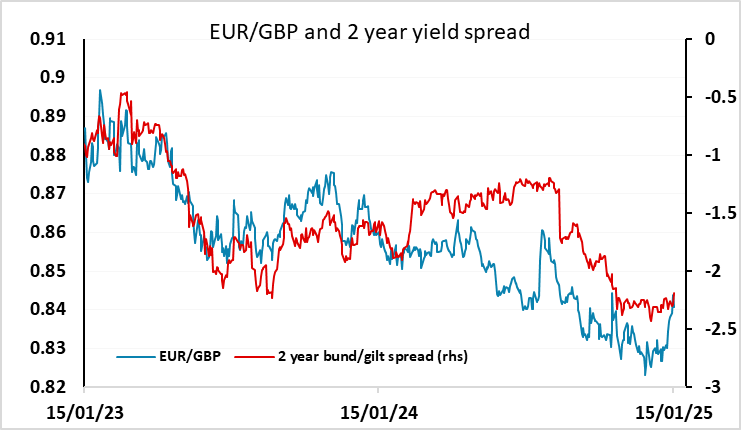

GBP has struggled in the last week as the market appears to have lost some confidence in the prospects for the UK economy. Unusually, there has been a positive correlation between UK bond prices and GBP, so that lower yields have actually correlated with GBP gains, and vice-versa. This suggests the pound is being driven by foreign buying and selling of gilts, or that it is reacting to confidence in the UK’s fiscal position rather than any relative yield attraction. The dip in yields after the weaker than expected CPI data on Wednesday actually led to a stronger pound. However, when it comes to real GDP data the reaction is likely to be different, and we would expect a positive GBP reaction to strong data, as stronger data will tend to improve the UK’s fiscal position. The consensus is for a 0.2% rise in November after a 0.1% decline in October, but we see risks of further weakness with just a 0.1% increase and possibly some downward revisions, suggesting renewed downside risks for GBP.

The focus may now shift towards Trump’s first policy initiatives after his inauguration on January 20. There are likely to be a string of executive orders from the White House in the first week of his presidency, with immigration probably the main focus, but it is possible that tariffs will also be an early announcement. Trump’s threats of a 25% tariff against Mexico and Canada suggest a transactional approach to achieving concessions on the border or enhancing a trade deal. Reports suggest some Trump supporting economists favor an across the board tariff for certain sectors, which could be more economically damaging to trade and boost inflation. We still feel that China will be the first target starting with demands for an enhanced trade deal and then an average 30% tariffs being implemented against the current 20%. China will be reluctant to quickly capitulate to the U.S., which will mean a H1 2025 trade war with China. We also feel that Germany and the EU are at high risk of tariff threats and actual tariffs in 2025. But the impact of all this on the USD is uncertain. In the first Trump presidency, the USD weakened through 2017/18 after initial strength post election, perhaps in part due to tariff policies, although a direct Trump preference for a weaker USD was also a factor. This may also be expressed this time around, with this week’s comments from Japanese officials suggesting USD/JPY could be a focus. All in all, there is potential for volatility, and the high level of the USD and the post-election gains suggest to us that the biggest USD risks are on the downside.