FX Daily Strategy: APAC, February 29th

European CPI data may trigger some EUR yield decline…

…but there is limited scope for EUR/USD to weaken

US PCE price data also a focus

CHF still has downside risks

JPY may benefit from softer US/Europe inflation picture

European CPI data may trigger some EUR yield decline…

…but there is limited scope for EUR/USD to weaken

US PCE price data also a focus

CHF still has downside risks

JPY may benefit from softer US/Europe inflation picture

It has generally been a quiet week in the FX market with little data, but Thursday sees a lot of significant numbers released. In Europe, the biggest focus will be on the German, French and Spanish CPI data. The Eurozone HICP data is on Friday, but Thursday’s numbers will provide a strong lead. Underlying inflation in the Eurozone has been falling faster and more broadly than the ECB had expected, now encompassing not only falling core rates but also softer persistent inflation signals, the latter a key consideration for the ECB. For the Eurozone, we see the headline down to a 31-month low of 2.5% and the core down to a 22-month low of 2.9%, the latter encompassing softer y/y services inflation. For the German inflation data we see the HICP rate easing further in the February data, to a 32-month low of 2.7%, probably with core down too as services inflation succumbs to base effects. Our forecasts are in line with consensus, but should nevertheless lead to some increase in expectations of ECB easing this year, give the rise we have seen in front end EUR yields in recent weeks. Much of this has been driven by strong data in the US rather than in Europe, and a reminder of the declining trend in Eurozone inflation ought to allow some increase in the market pricing of 90bp of easing that is currently in the market.

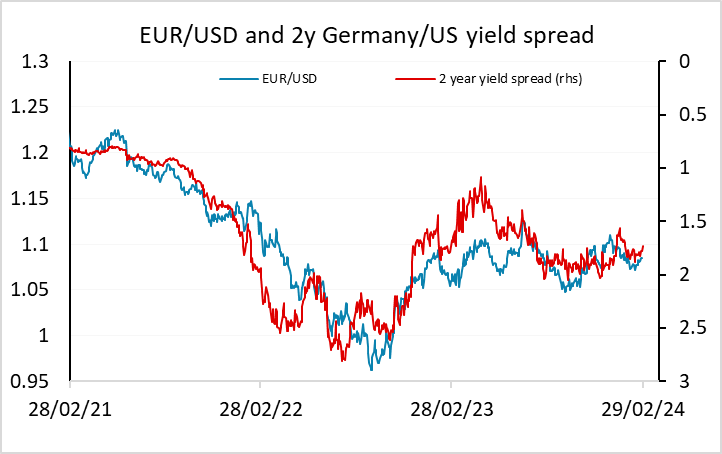

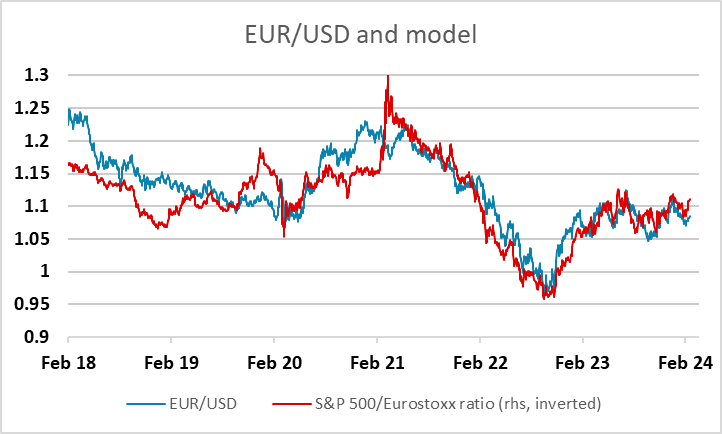

The impact on EUR/USD may, however, not be very large, with the EUR currently trading slightly soft relative to our models, driven by a modest decline in front end yield spreads in the last few days. The picture will also depend on other data due for release. The German retail sales data released early in the European session won’t typically have a big impact, but after two consecutive months of declines, another weak month might undermine the EUR. But for EUR/USD there will also be a focus on the US PCE price data for January. The consensus expectation is that this matches the 0.4% m/m rise in CPI, but we see a 0.3% rise which could be expected to lead to some modest decline in US yields. So even though we see some risks of lower yields in Europe, we suspect this will not lead to significant EUR weakness, partly because US yields may also fall, and partly because lower yields may prove supportive for equities, which will tend to support EUR/USD. Dips below 1.08 in EUR/USD are therefore unlikely to be sustained.

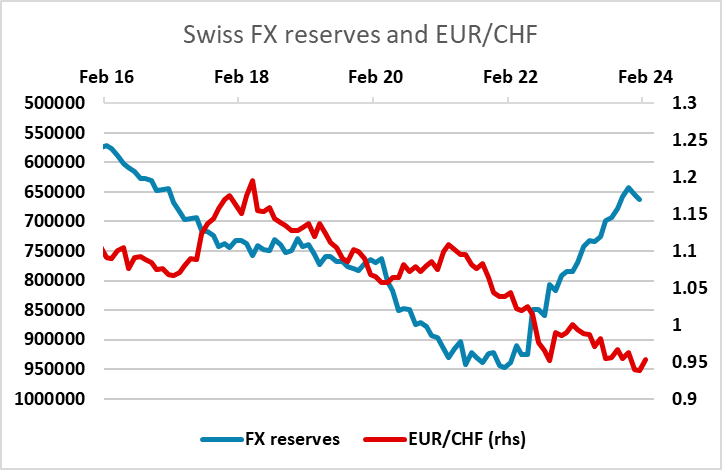

There is also other European data in Thursday, with Swedish and Swiss Q4 GDP data. The consensus is for a 0.1% gain in both, but we see the risks as being slightly to the downside. EUR/SEK looks likely to remain fairly static near 11.20 unless we see a bigger miss, but there is scope for the CHF to decline further. EUR/CHF has been in a 5 year downtrend, and while some of this is justified by the relatively low Swiss inflation rate over the period, it has also been supported by various risk concerns and the building of the SNB’s FX reserves over the period. Now that this build has been reversed, there is scope for the CHF to follow lower.

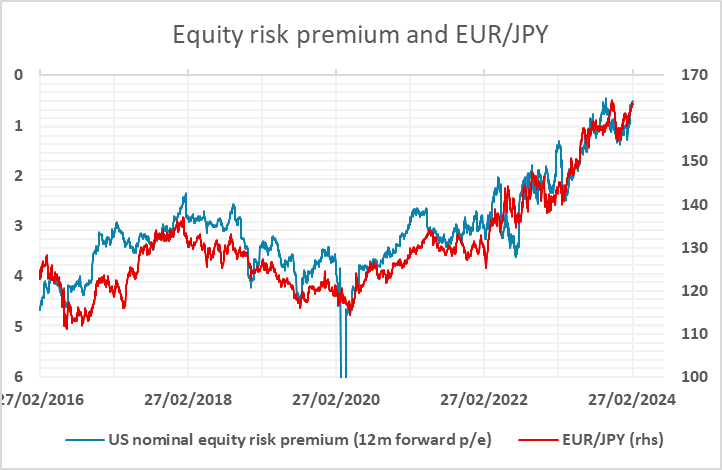

If we do see some softer inflation numbers from Europe and the US, the JPY may be the currency that benefits the most. Lower yields in Europe and the US would support the JPY via reduced yield spreads, but the JPY hasn’t been particularly responsive to yield spread moves this year. Rather, it has been continuing to follow the declines in equity risk premia, but any yield decline will also typically mean a rise in equity risk premia, as equities will typically not react fully to the yield decline.