FX Daily Strategy: Asia, November 21st

PMIs may put downward pressure on the EUR

GBP risks on the downside on retail sales

JPY continues to make new lows despite verbal intervention…

…so that actual intervention risks are now very high

PMIs may put downward pressure on the EUR

GBP risks on the downside on retail sales

JPY continues to make new lows despite verbal intervention…

…so that actual intervention risks are now very high

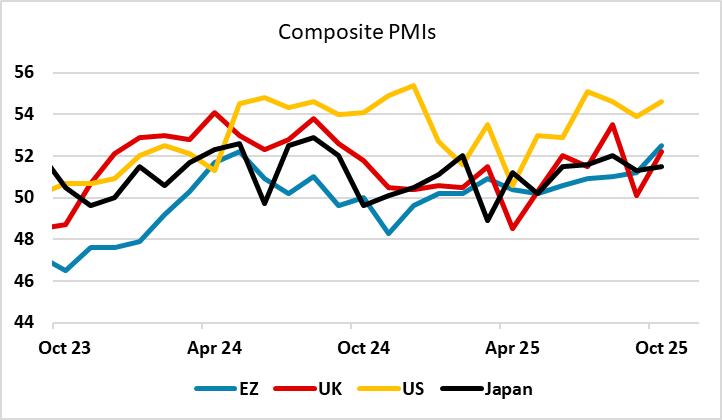

Friday sees the preliminary PMIs for November, along with UK October retail sales data and the final University of Michigan confidence numbers. The PMIs should set the tone, but are likely to see some decline from the strong October numbers both in Europe and the US. While the level is still likely to be consistent with solid growth, we expect lower indices in both Europe and the US than the consensus, and that may mean some correction to the risk positive tone seen through Thursday. The markets tend to take more notice of the Eurozone than the US S&P PMIs, so we could see EUR/USD slip to test 1.15 on softer numbers.

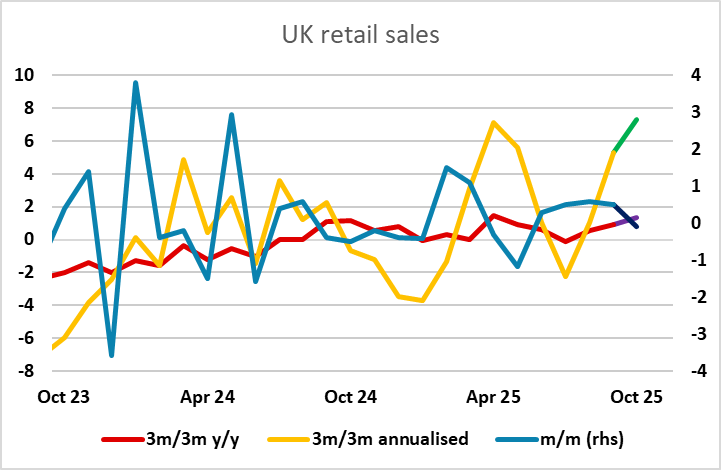

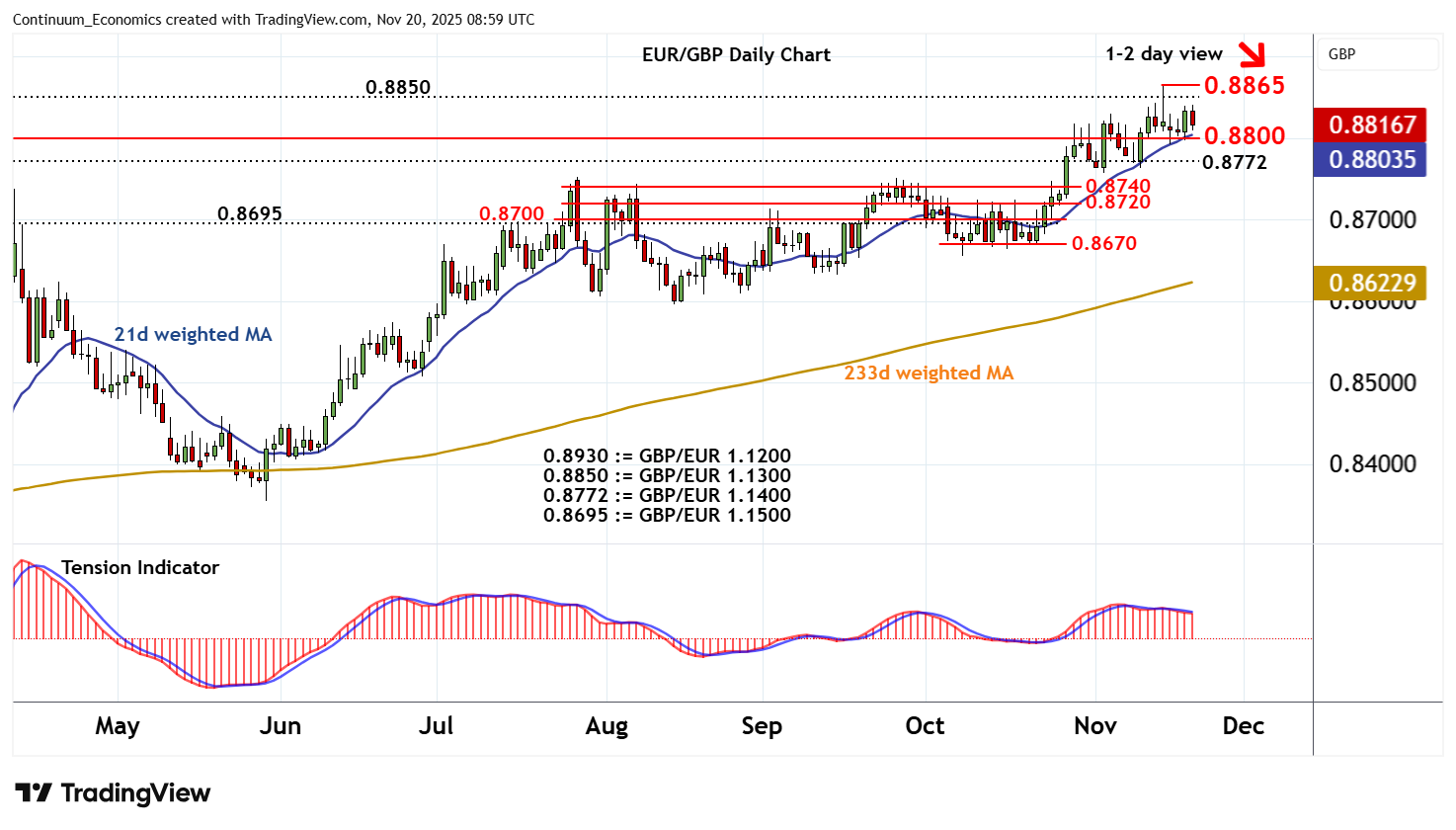

The risks may also be on the downside for UK retail sales which also look to be due a correction from recent strong numbers. While the underlying trend may be solid, the market consensus estimate of a 0.1% decline would put the 3 month annualised trend above 5%, which looks a little out of line with the general tone we are seeing from the UK data. Risks for GBP may therefore be on the downside, but EUR/GBP still looks well capped at 0.8850 near term, so only a modest foray above 0.88 seems possible.

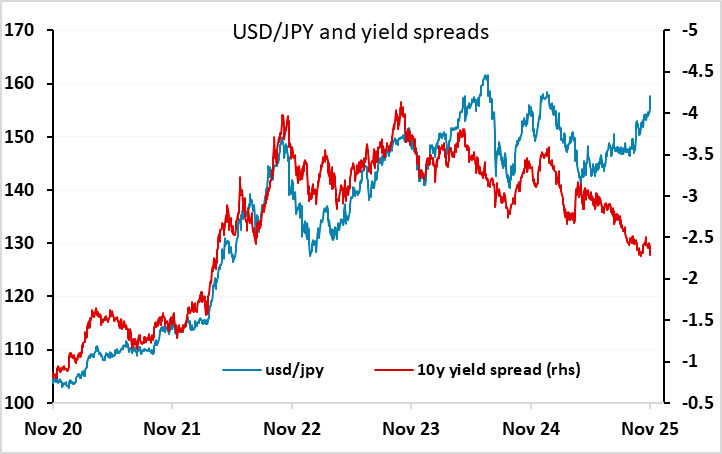

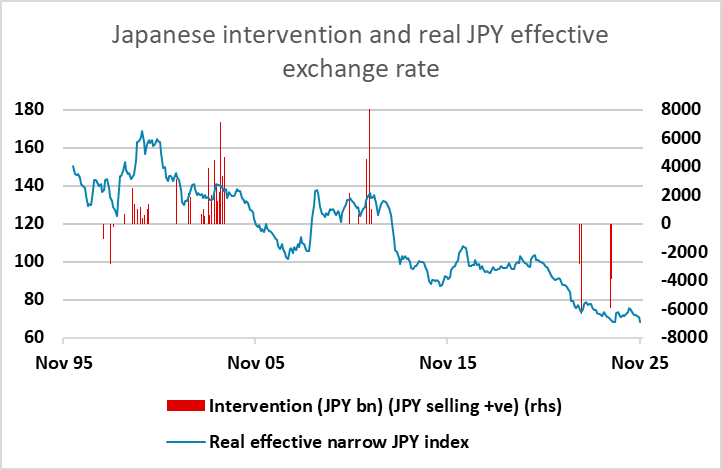

The JPY remains the currency with the most potential for volatility. The lack of action from the Japanese authorities to halt the recent downtrend is being seen by the market as a green light to sell JPY, with the copious verbal intervention being completely ignored. Many are saying that intervention is unlikely this side of 160 in USD/JPY, because the BoJ didn’t intervene until above 160 last time around. But this looks a little too USD centric. The latest JPY decline has seen it fall to new lows against the EUR and we are at the lows seen last July on a real trade-weighted basis. The JPY is also weakening without an obvious rationale, and is a long way below the levels suggested by the normal metrics like yield spreads and risk premia.

We would consequently see the threat of intervention on Friday as very real if the JPY continues to make new lows. While people question whether this would be effective, history does suggests that serious BoJ intervention has always marked the JPY extremes in the last 20 years, and with other indicators also pointing to scope for a JPY recovery, we would see BoJ action as currently both necessary to stabilise the market and likely to be effective in setting a bottom for the JPY longer term. It would be even more effective if the Fed were to join in intervention, but we suspect that US treasury secretary Bessant will want to see a rate hike before offering any help, even though the US administration certainly favours a higher JPY.