JPY flows: JPY weakness extends

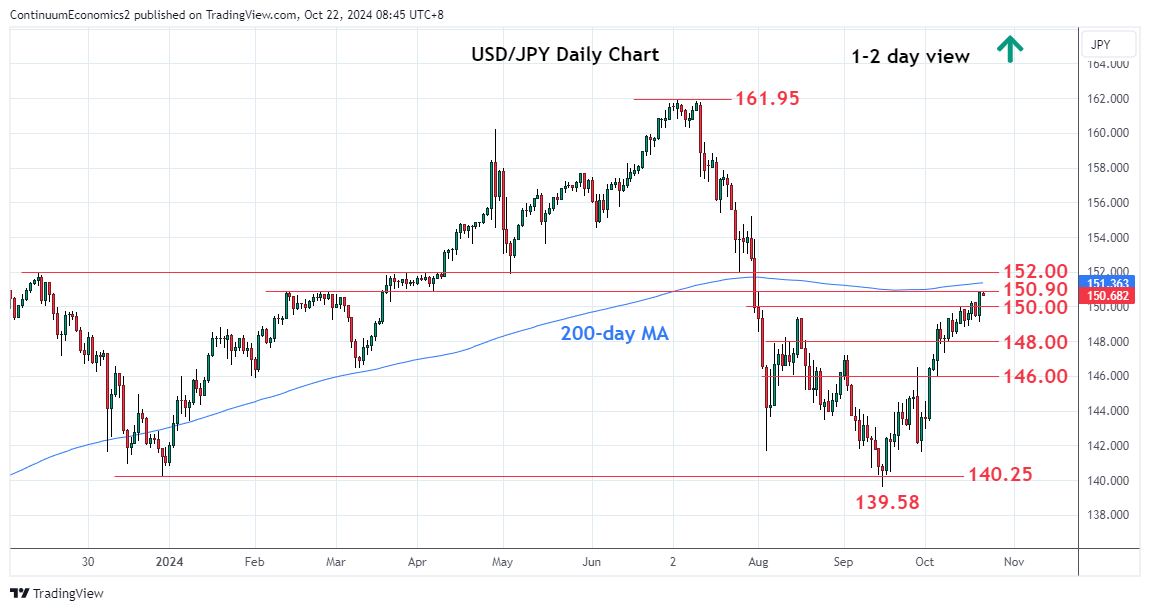

More post August highs for USD/JPY as US yield rise continues. Short term JPY weakness hard to oppose while US equity sentiment holds firm, but longer term levels are overstretched

JPY weakness was once again the main theme overnight, with USD/JPY hitting another post-July high at 151.10. The lack of verbal intervention from the Japanese authorities appears to have encouraged the JPY bears, along with the further rise we have seen in US yields. The US yield gain has also supported the USD elsewhere, but the JPY has bene the biggest loser, while the CHF, which is similarly low yielding, has actually outperformed the EUR, perhaps because of some geopolitical concerns or possibly reflecting some loss of confidence in European growth prospects since the more downbeat assessment at the last ECB meeting.

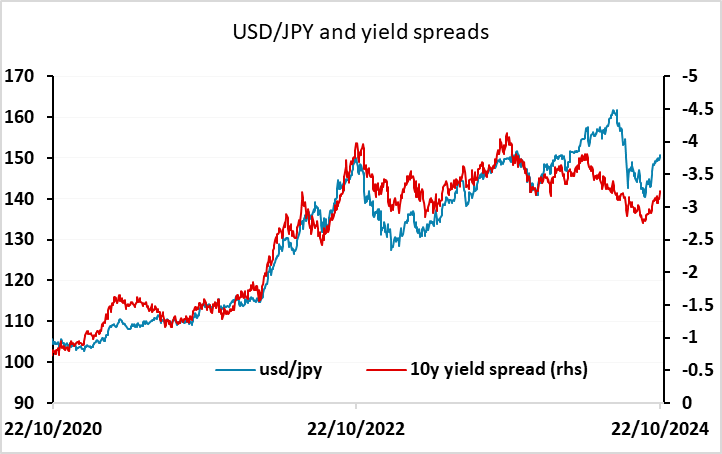

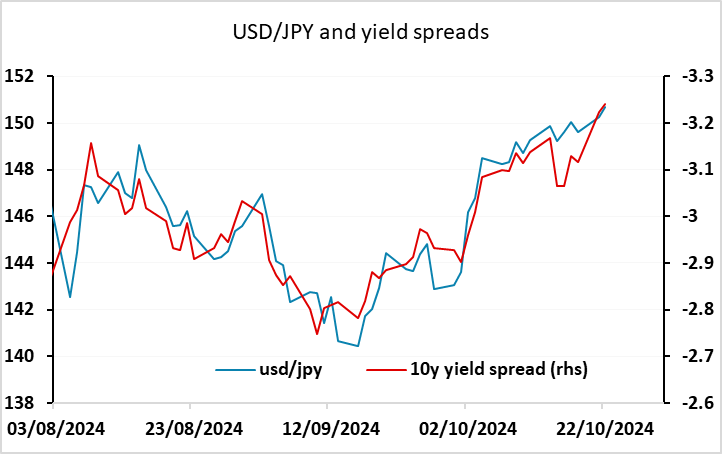

USD/JPY continues to trade well above the levels that would be consistent with then long term correlation with yield spreads, and even further above any fair value estimate which would also take account of the bigger real JPY depreciation we have seen in recent years due to relatively low Japanese inflation. But the moves in USD/JPY since early August, following the sharp summer decline, have correlated well with moves in the yield spread we have seen since.

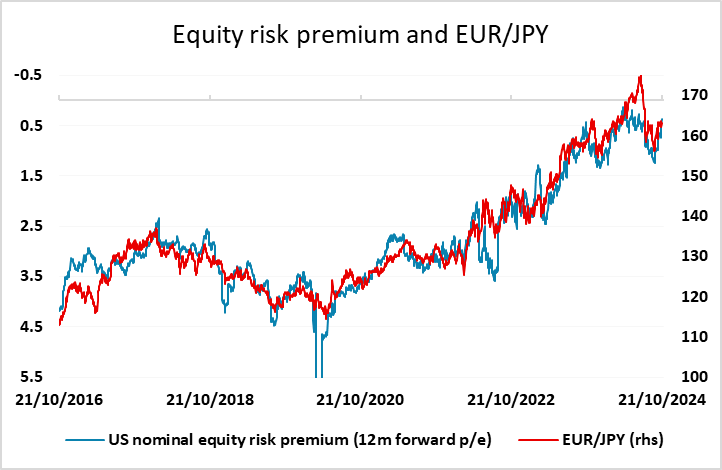

This short term correlation is likely to continue until or unless we see some deterioration in risk sentiment reflected in some rise in US equity risk premia. EUR/JPY continues to track this metric, and while EUR/USD still looks biased slightly lower based on the correlation with short term yield spreads, a significant break below 1.08 looks like it would require a further reassessment of Fed policy prospects to fully remove one of the two rate cuts which are still 80% priced for the next two meetings. There is little on the calendar today to change things, so JPY weakness may continue to extend slightly, but the elastic is getting quite stretched.