JPY flows: JPY weakness extends further

More post August highs for USD/JPY as US yield rise continues. Short term JPY weakness hard to oppose while US equity sentiment holds firm, but longer term levels are overstretched

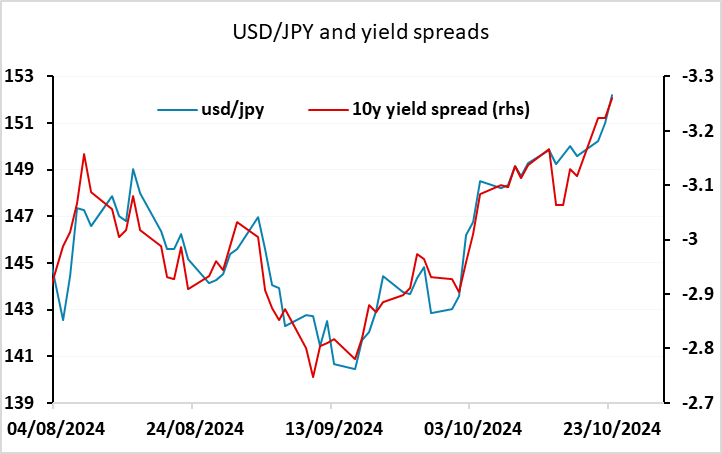

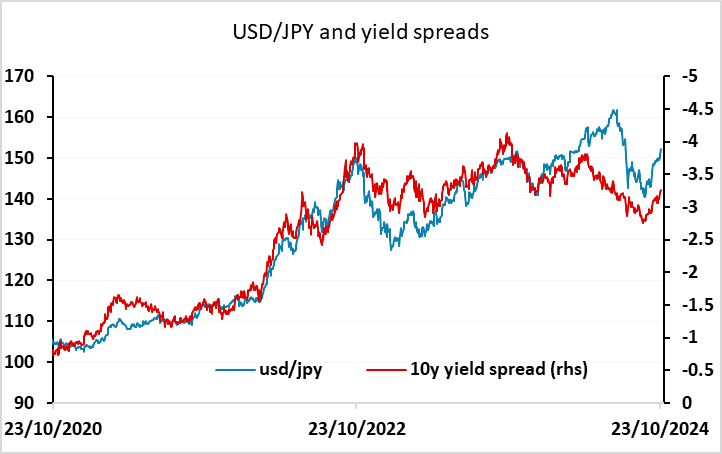

JPY weakness has once again been the theme overnight, with the rise in USD/JPY still being driven by rising US yields. The short term correlation between yield spreads and USD/JPY remains very strong, and USD/JPY is moving in line with the spread moves we have seen in the last couple of months, even though it started from levels that were much higher than have previously consistent with current yield spreads. It is hard to see the current corelation breaking unless we see significant weakness in the US equity market resulting from rising yields. While intervention would have a short term impact, the Japanese authorities will be reluctant to intervene until or unless they see a turn in the trend in US yields and US/Japan yield spreads.

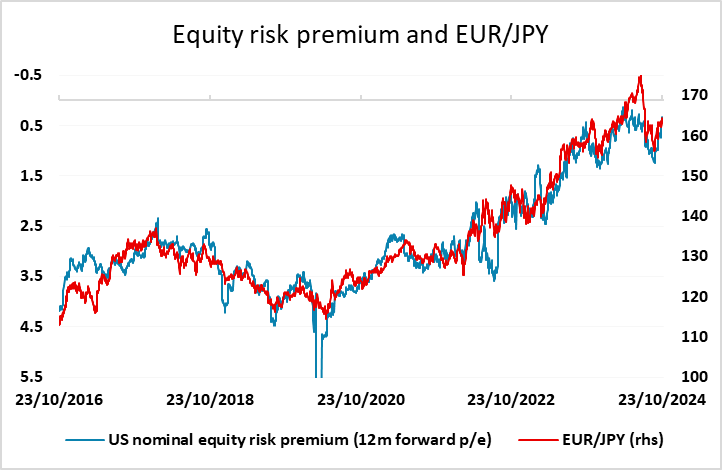

The JPY is also weak on the crosses, as the resilience of US equities in the face of higher yields is driving lower equity risk premia which typically correlate well with JPY crosses in general and EUR/JPY in particular. While we would regard the current level of risk premia as unrealistically low, given that US earnings growth is unlikely to be above trend starting from this level of low unemployment, evidence of weaker US growth is likely to be necessary to turn the trend.

Alternatively, there could of course be an impact from the election. Currently it seems that the market is seeing an increased probability of a Trump victory and this is driving higher US yields. This could go wrong either because Trump doesn’t win or because his policies don’t prove significantly stimulative or inflationary, which is more likely if the Republicans fail to gain control of the House. The trend remains hard to oppose at this stage, and technical studies remain USD positive/JPY negative, helped by the break above the 200 day moving average. There is no data today to change the picture, and while we may be approaching the limits of the US yield rise, the USD/JPY performance in the last few years has typically seen extensions even after the yield spread has turned. So we are likely to see higher levels, with 153.40 a retracement target. But there would once again be dangerous levels for USD bulls longer term.