JPY, EUR, USD flows: Tariff news weighs on EUR, JPY favoured

30% tariffs on the EU and Mexico announced at the weekend put downward pressure on EUR, support JPY

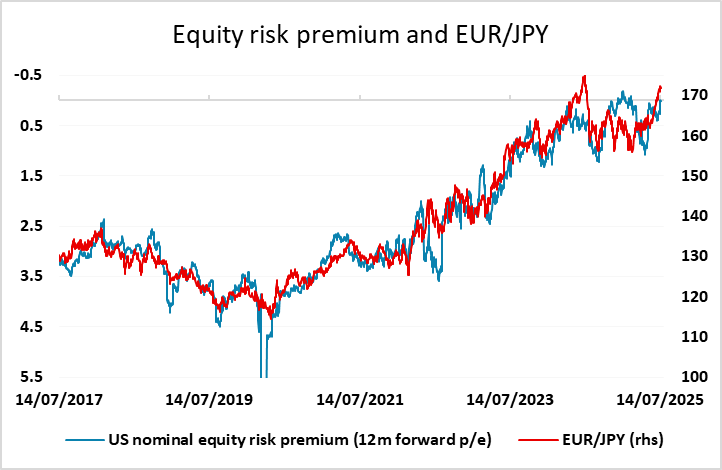

Trump’s announcement of 30% tariffs on the EU and Mexico at the weekend is the main driver of trade this morning, with EUR/USD edging lower in response and equity indices also slipping lower. While few believe this will be the final landing spot for tariffs, Trump’s aggressive approach suggests that the EU tariff will be substantially above the 10% minimum, and concerns about the tariff impact on the US and global economy have returned. Equity indices are very stretched at current levels, with the nominal risk premium reaching its lowest level since February on Friday, and we would expect some extension of the early losses.

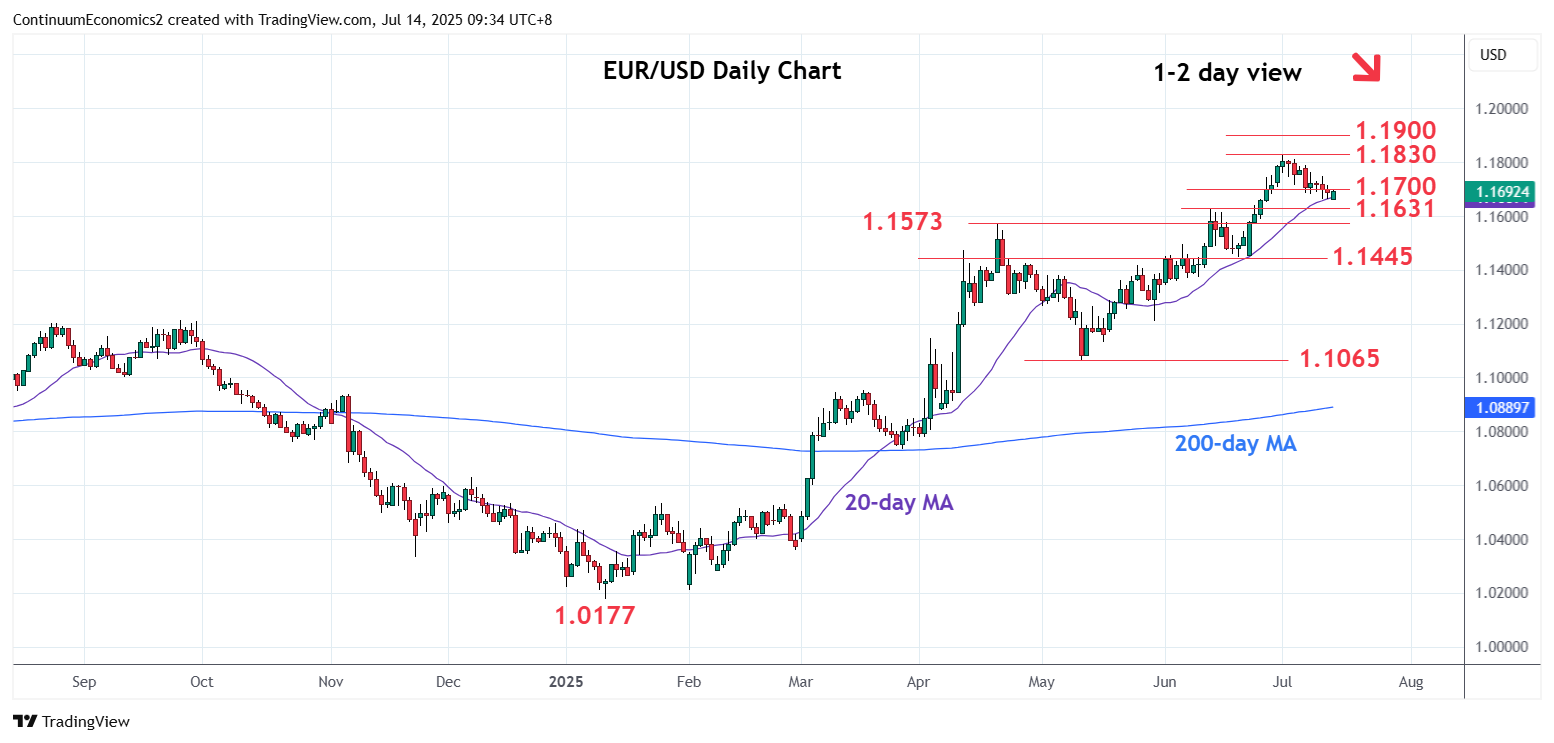

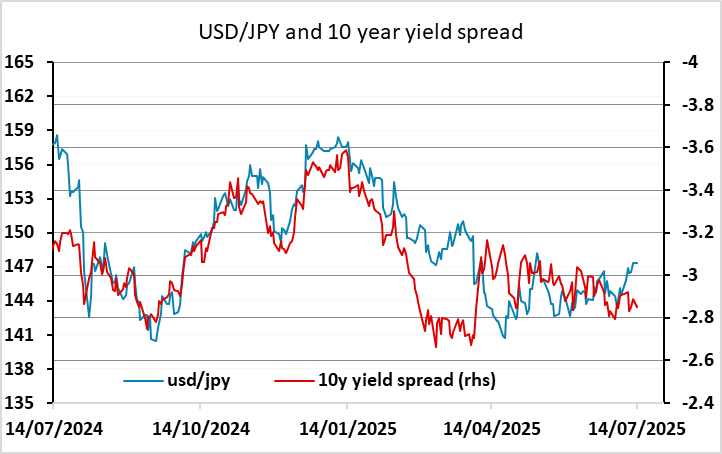

From an FX perspective, we should see some more risk negative trading, with scope for more JPY gains on crosses in particular, although higher Japanese yields also suggests scope for gains against the USD. The EUR and riskier currencies in general are starting soft against the USD, and given the sharp gains since April there is scope for a EUR correction lower, but we doubt that higher tariffs will be seen as a sustained USD positive. Newswise the focus will be on any further news on trade and tariffs. There is little data of significance due, with this morning’s final Swedish June CPI data showing a mild downward revision from the upside surprise in the provisional data, but not a substantial enough revision to have a significant FX impact.