FX Daily Strategy: Asia, Sep 17th

FOMC likely to cut 25bps but dots may disappoint the doves

USD risks consequently on the upside

BoC may be more dovish than expected, suggesting USD/CAD upside risks

UK CPI risks on the upside, but GBP has very limited scope for gains

FOMC likely to cut 25bps but dots may disappoint the doves

USD risks consequently on the upside

BoC may be more dovish than expected, suggesting USD/CAD upside risks

UK CPI risks on the upside, but GBP has very limited scope for gains

Wednesday is a very busy day, with the FOMC decision the highlight, but also a BoC rate decision and UK CPI as a focus for the European morning ahead of tomorrow’s BoE meeting.

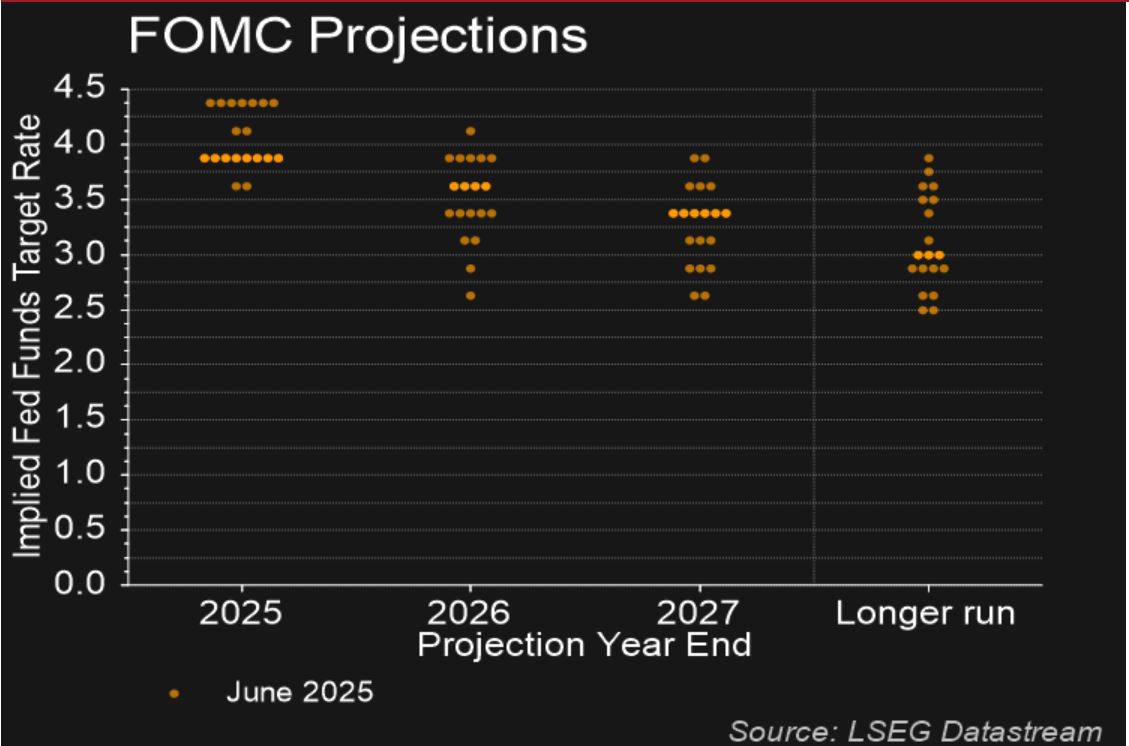

We expect a 25bps easing to a 4.0-4.25% Fed Funds target range at the FOMC meeting. The FOMC will continue to see similar upside risks to inflation but increased downside risks to the labor market. The dots are likely to continue to expect only one more move in 2025, but three moves in 2026 rather than one as was the case at the June FOMC, which would take the rate close to neutral. The risks to this view look to be towards a less dovish Fed than expected, as the extra 50bps of easing in 2026 is not necessarily easily justified by the most recent data despite the softer employment data we have seen. The market is pricing in 146bps of easing by the end of 2026, which is (nearly) an extra 25 bps over our expectations, and 75bps more than easing seen by the median dots at the June meeting.

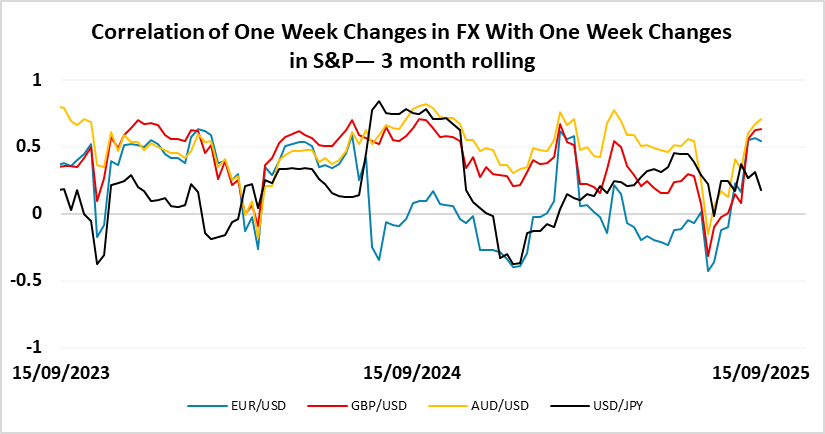

The USD has been weakening in the run-up to the meeting, with EUR/USD hitting a new high for the year on Tuesday, even though there wasn’t much movement in US yields. Indeed, the US retail sales data was on the strong side, and didn’t encourage expectations of more aggressive Fed easing. The risks therefore look to be towards a USD recovery on Wednesday, albeit not necessarily a large one, as the market is likely to cling on to a more aggressive easing view than the Fed dots suggest. If we do see somewhat higher US yields, there could also be a negative impact on the equity market. The S&P 500 hit another new all time high on Tuesday, and looks ripe for a correction. The riskier currencies, which have been the main beneficiaries of USD weakness this week, could therefore be then most vulnerable.

We also expect to see a 25bp rate cut from the BoC, in line with market consensus. While surveys only have a little below 80% of forecasters looking for a rate cut, the market is pricing a cut as a 95% chance, and some of those calls may now be out of date. After the Bank of Canada’s last meeting on July 30 we expected rates to be left on hold in September before easing resumed in October. However, data since that meeting having been mostly weak, so a 25bps easing to 2.5%, the first move since March, now looks likely his time. We expect two more easings from the BoC, in Q4 2025 and Q1 2026, which would take the rate down to 2.0%. The market is slightly less aggressive, pricing a total of 60bps of easing by the end of next year, so the CAD may suffer if the BoC presents a dovish stance along with the rate cut.

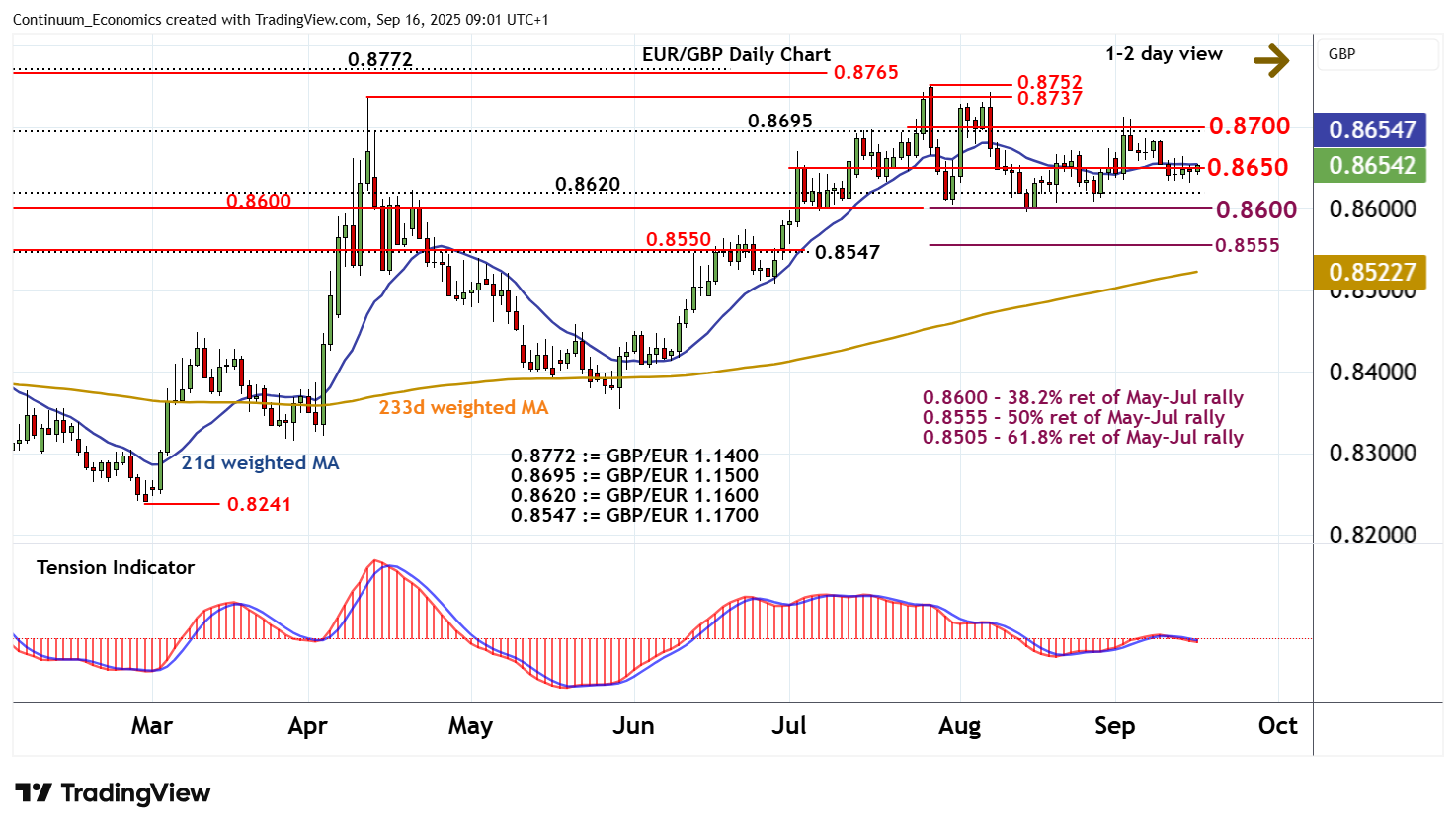

The BoE meeting is on Thursday and there is no expectation of a rate cut. Indeed, there is only seen to be a 40% chance of a rate cut this year. The UK CPI data seems unlikely to be weak enough to change that view. Indeed, our forecast is slightly above the market consensus. We see the headline rate rising to 3.9% and the core rate steady at 3.8%. Nevertheless, there is very little scope for any further rise in UK front end yields given the very limited expectations of rate cuts priced into the market. So the risks for GBP are for a modest rise, but we would not expect a serious test of the 0.86 support area in EUR/GBP.