FX Daily Strategy: Europe, April 23rd

PMIs expected to fall, but consensus is for the decline to be modest

USD might rally modestly on consensus data, but risk of bigger decline on weak numbers

Underlying USD negative tone remains hard to oppose given history of Trump’s first term

Equity market risks on the downside suggest JPY risks remain on the upside on the crosses.

PMIs expected to fall, but consensus is for the decline to be modest

USD might rally modestly on consensus data, but risk of bigger decline on weak numbers

Underlying USD negative tone remains hard to oppose given history of Trump’s first term

Equity market risks on the downside suggest JPY risks remain on the upside on the crosses.

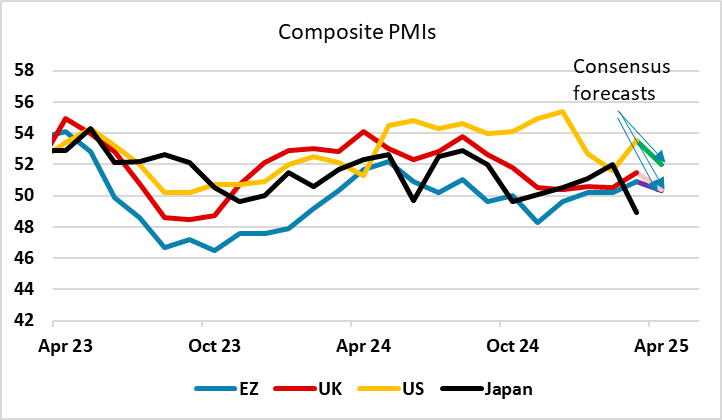

Wednesday is PMI day, and composite PMI indices are expected to fall in both Europe and the US in response to the tariff concerns that have emerged in the last month. However, the decline is expected to be quite modest, with the composite measures remaining above 50 for the US, EU and UK. The risks look weighted towards a more substantial decline, and if we were to see an outcome in line with the consensus, the market might see this as mildly encouraging, suggesting that the impact of the tariffs may only be enough to create a slowdown rather than a recession.

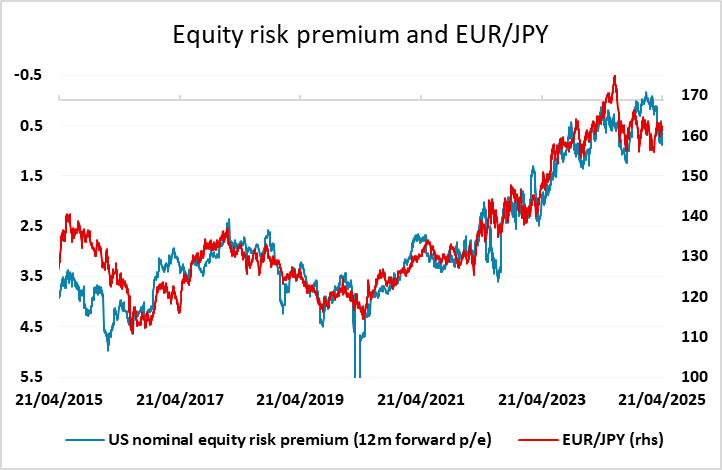

However, equity markets remain priced for a reasonably strong economic performance in the US, with risk premia still low by historic standards, so even if we see a short term rally on less weak data than feared, longer term prospects don’t look encouraging. European markets look more reasonably priced, but are also unlikely to advance if we see a slowdown due to tariffs. So while we may see a small risk recovery in the event of consensus or above consensus numbers, it may not last long or go far. The bigger risk is that we see weaker than expected data which triggers another round of sharp equity market weakness, which could also be expected to weaken the USD.

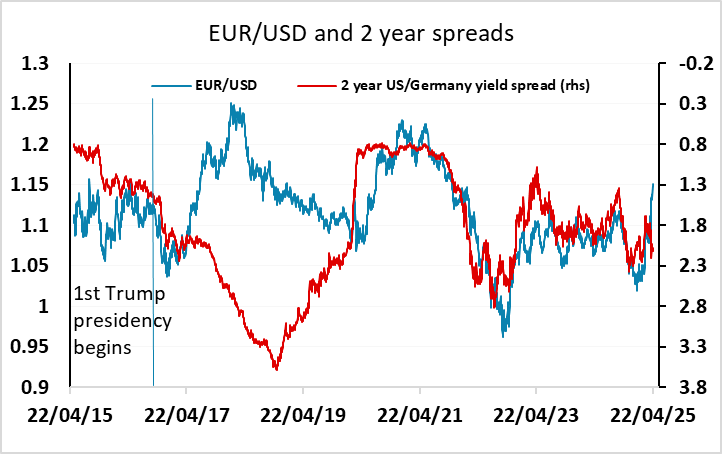

From an FX perspective, USD weakness has been the main feature of the last few days, reflecting concerns about Trump’s potential attempt to sack Fed chair Powell. As long as this hangs over the market, it will be hard to see much USD recovery, and even of Trump decides to back away from this fight, we doubt this will lead to more than a modest USD rally. Tariffs still hang over the market’s head, and the performance of the USD in Trump’s first term makes it hard to oppose USD weakness given all the potential risks. In Trump’s first term, EUR/USD rose 22 figures from its low at the start of 2017 to its high in early 2018, in spite of yield spreads moving in the USD’s favour. The move in the last couple of weeks looks like it could be the start of a repeat of that USD decline, and USD weakness is consequently very hard to oppose, even though yield spreads are moving in the USD’s favour.

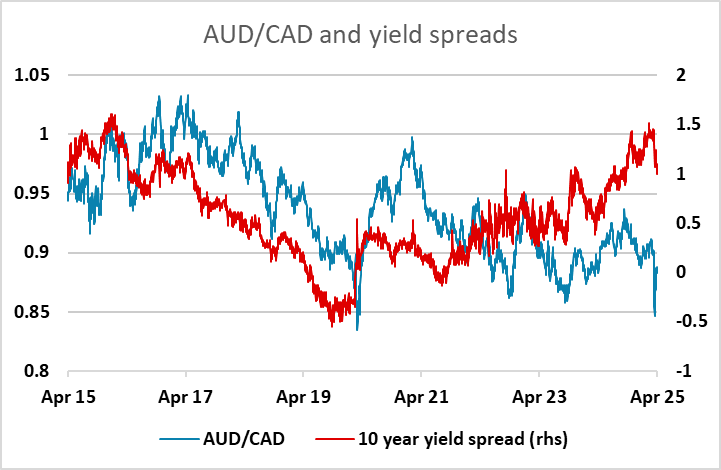

There hasn’t been a lot of movement in the crosses in the last week with USD weakness being seen fairly evenly across the board. However, it still looks likely that the JPY will outperform if we see further equity weakness, particularly if it is accompanied by further declines in US yields. However, the EUR may outperform relative to usual metrics if the USD continues to show general weakness, as the EUR has a status as the second reserve currency. As far as risk currencies are concerned, we still see the CAD as having outperformed in recent weeks as the Canadian economy is likely to suffer more from the tariff problems than most of the other G10 currencies, and the CAD may consequently still be vulnerable on the crosses against both the safe havens and the other risky currencies.