FX Weekly Strategy: January 15th-19th

Reactions to US inflation data suggest limited upside for US yields

Period of consolidation likely in EUR/USD

Scope for GBP to weaken given less dovish market pricing of the BoE

JPY still the stand-out value play

Strategy for the week ahead

Reactions to US inflation data suggest limited upside for US yields

Period of consolidation likely in EUR/USD

Scope for GBP to weaken given less dovish market pricing of the BoE

JPY still the stand-out value play

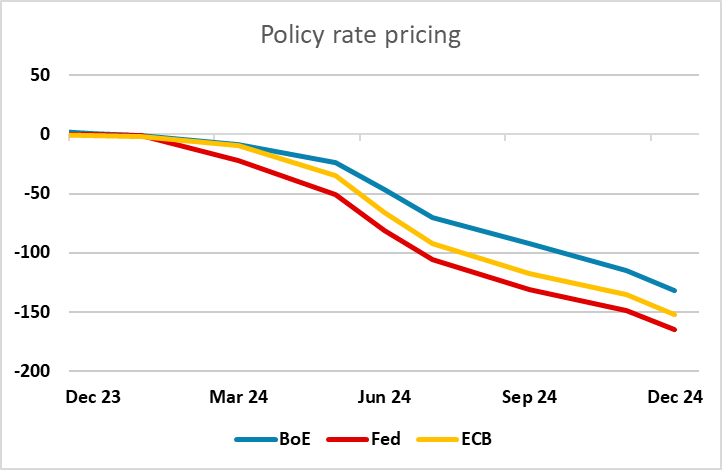

There was a stronger downward move in US yields and the USD in reaction to the soft US PPI data last Friday than there was an upward move in reaction to the strong CPI data on Thursday. This suggests that the market is still inclined to err towards lower US yields, with 10 year yields looking likely to struggle to rise above 4% having failed to sustain those gains after CPI. Even so, with the market already pricing 165bps of Fed easing over the next year, it’s hard to see front end yields going a lot lower. With the curve still inverted and the economy still managing decent growth, according to the latest data, this makes it hard to see a lot of downside in 10 year yields as well. All of which suggests that while the market is looking towards lower US yields, we may be in for a period of consolidation.

This also likely means a period of consolidation in the USD against the EUR, as EUR yields have tended to move in lockstep with US yields of late, and the comments from ECB chief economist Lane last Friday suggested that the ECB was not inclined to do anything on policy near term. The EUR does tend to be positively correlated with equities, but with yields steady, equities highly valued and US economic data indicating stable growth, it’s hard to see a big equity move either unless we see a bigger impact from the current geopolitical risks. Nevertheles, the recent decline in US yields does suggest EUR/USD risks are on the upside.

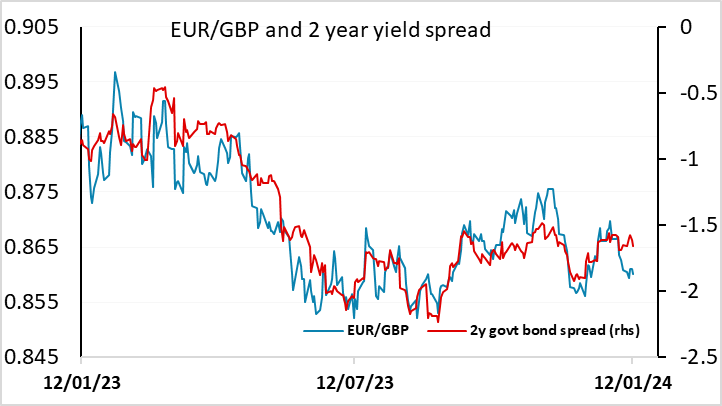

However, there may be scope for USD moves elsewhere. This week’s main data is from the UK, with CPI and labour market data both due. We can see some downside risks for GBP here, as we expect to see more evidence of weakening in both wage and price growth. Importantly, GBP is starting from slightly elevated levels against the EUR, relative to the recent moves in short term yield spreads, even though the market is pricing in less easing from the Bank of England in the next year than from the ECB. Given the starting point of relatively high UK rates, and similarly weak growth prospects, we see some prospect of UK rate expectations becoming aligned with the US and Eurozone. For now, the BoE is still officially biased towards tightening, with three hawks on the MPC, and this is helping to restrict market expectations of easing. But this week’s data could start to shake this belief.

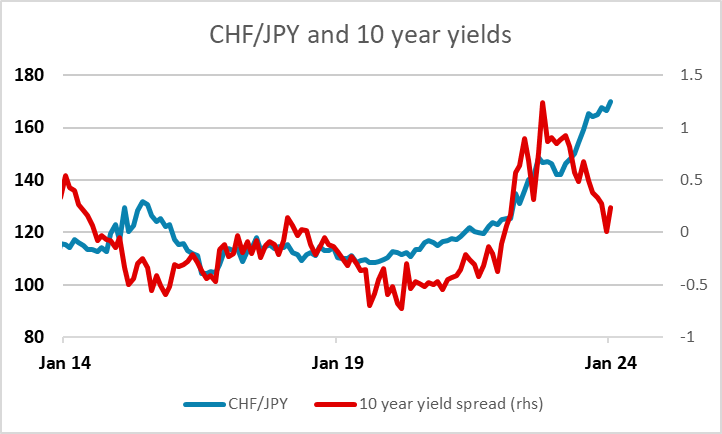

There is also some prospect of action in the JPY. If 4% 10 year yields are going to act as a ceiling for US yields, as last week’s trading suggests, there should be significant downside risks for USD/JPY. As it stands, yield spreads already suggest USD/JPY is a little stretched here, with something closer to 142 more consistent with the historic yield spread correlation. A major move up in the JPY still looks likely to require some more imminent prospect of BoJ tightening or a big turn lower in risk sentiment. But risks for JGB yields do look to be on the upside from current levels, and there is still a strong case for value trades in favour of the JPY, which remains close to all time (floating era) lows in real trade-weighted terms. We continue to note that the value case for JPY strength is most obvious in CHF/JPY, where real values and nominal values are similar, and which has risen 44% in nominal terms in 3 years without much support from yield spreads.

Data and events for the week ahead

USA

Monday sees U.S. markets closed for the Martin Luther King Day holiday, and Tuesday sees January’s Empire State manufacturing survey.

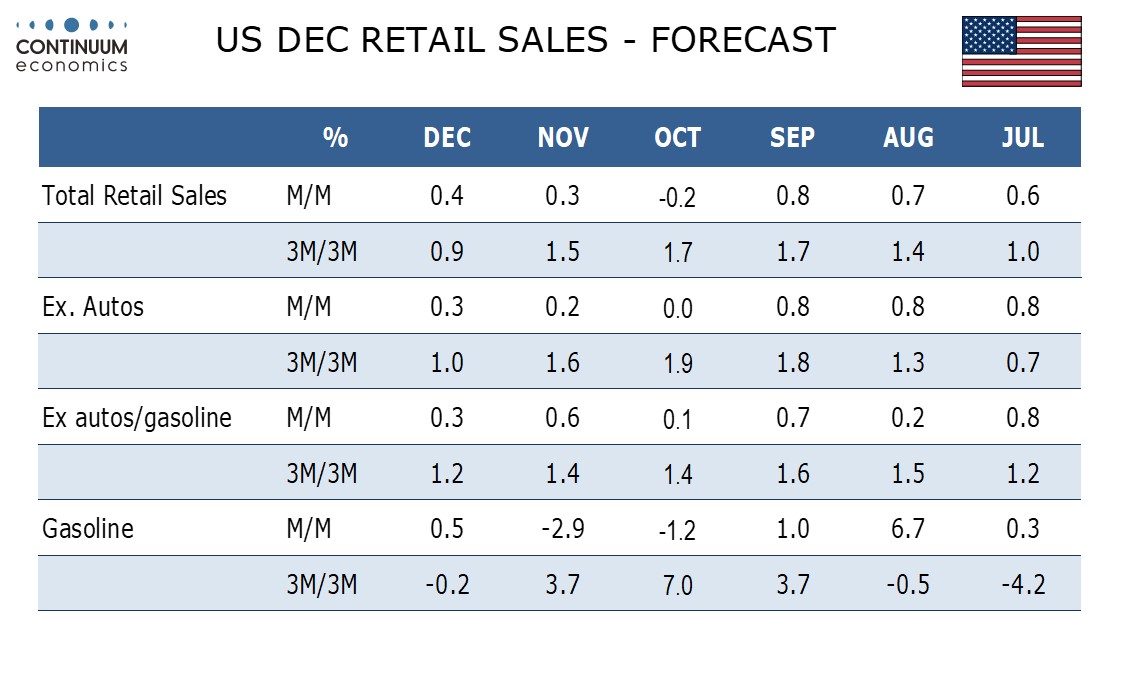

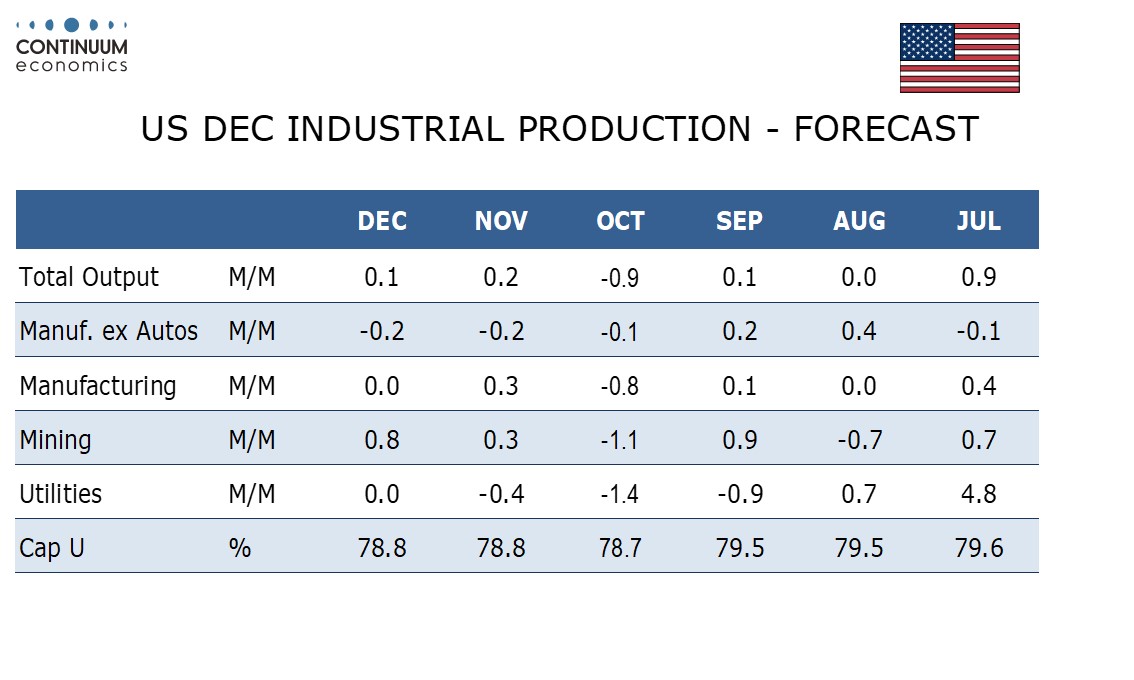

On Wednesday we expect a 0.4% rise in December retail sales, completing a slower but still respectable Q4, with 0.3% gains ex autos and ex autos and gasoline. December import prices are due at the same time. December industrial production follows, where we expect a marginal 0.1% increase, with manufacturing unchanged. Next up will be November business inventories and January’s NAHB homebuilders’ survey. The Fed’s Beige Book is due in Wednesday afternoon.

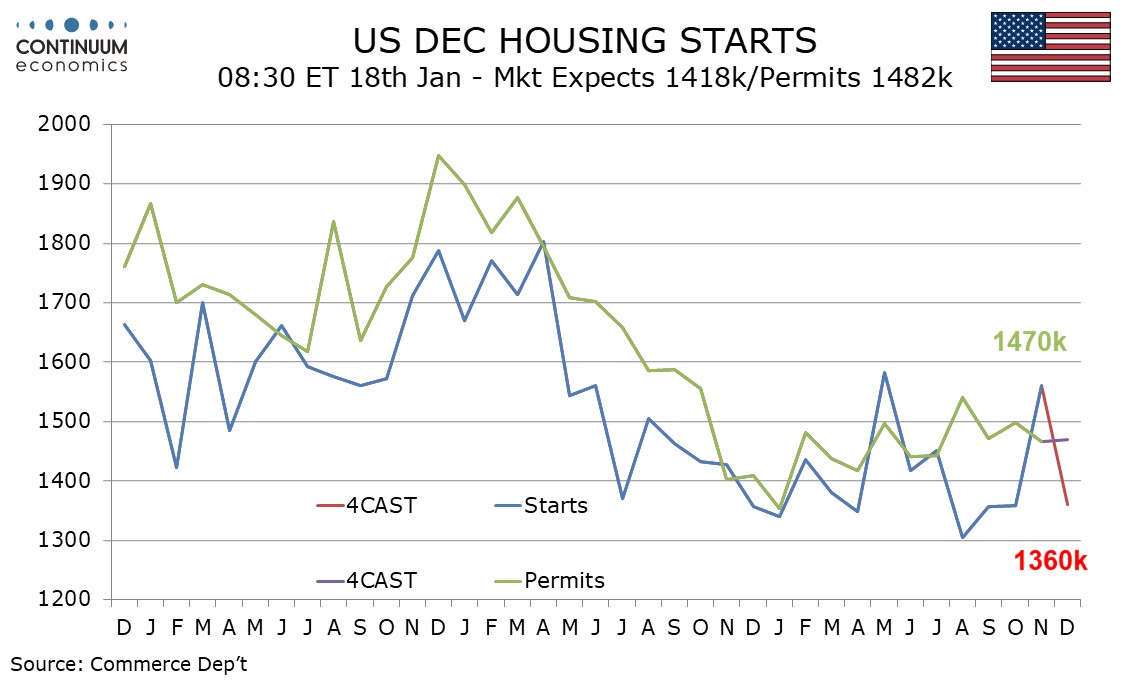

On Thursday we expect December housing starts to largely reverse a 14.8% November rise and fall by 12.8% to 1360k while permits rise by a marginal 0.2% to 1470k. Weekly jobless claims and January’s Philly Fed manufacturing survey are also due. On Friday we expect December existing home sales to rise by 0.8% to 3.85m. Preliminary January Michigan CSI data is also due.

Canada

It is a busy week for Canadian data, with Monday seeing November data for manufacturing and wholesale sales. Preliminary estimates were for respective gains of 1.2% and 0.8%. December existing home sales follow, as does the Q4 Bank of Canada business outlook survey.

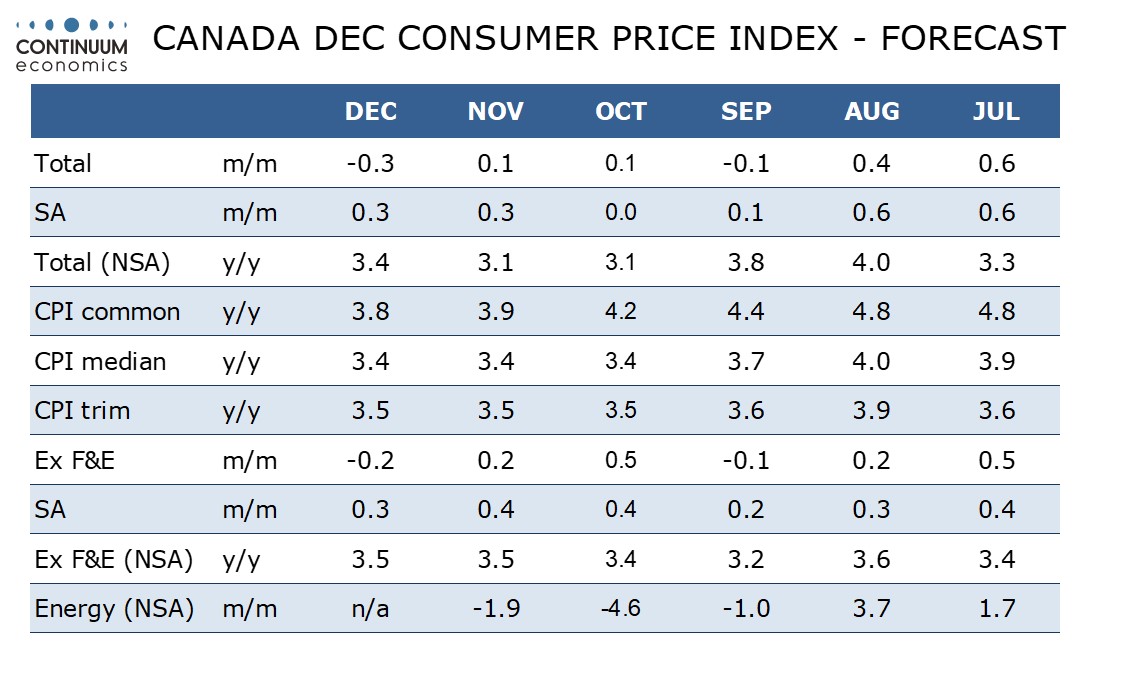

December CPI is due on Tuesday, and we expect yr/yr growth to pick up to 3.4% from 3.1% with little change likely in the BoC’s core rates, showing that inflation remains stubbornly high. January housing starts are also due December’s IPPI and RMPI are due on Wednesday. Friday sees November retail sales, for which a preliminary estimate of unchanged was made with October’s data.

UK

Figure 1: Further But Smaller Fall in in Headline and Core Inflation Beckons

There are a series of important data releases this week. Most high profile are the CPI figures (Wed). A clear disinflation trend continued in November as the headline fell markedly to a 27-month low of 3.9% but where the core slid lower by a further 0.6 ppt to 5.1%, a 23-month low. In the looming December CPI figures we see both slipping further but by only 0.1 ppt for each but with both downside risks for the latter and where more disinflation signs may be evident in the accompanying PPI numbers.

As for perhaps even more important labour market data, once again to be presented on a piecemeal basis amid continuing concerns over the accuracy of figures, arrive next Tuesday. We see more signs of a loosening, with the jobless rate already up 0.5 ppt in the last three months but where data on employment and activity will still be missing and where the ONS will make estimates based on HMRC numbers. However, the average earnings figures will be released and may still be the most closely watched and where we see regular pay growth (3 mth mov avg) slowing clearly to well under 7% but the headline rate down around to just under 7%. Regardless, with even the BoE (belatedly) casting doubt on the validity of these numbers, more attention may be paid to the PAYE pay data where a clear(er) slowing has already been seen.

Thursday sees the monthly RICS survey and one likely to show some signs that lower mortgage rates are filtering through but where supply issues continue. There is also the BoE Credit Conditions Survey (CCS) and again likely to suggest no serious supply issues. It may again suggest that consumer may be taking on added credit that they may not be able to service. The CCS may again suggest more signs of rising demand for unsecured credit, this probably being a reflection of households trying to make ends meet amid rising costs. Finally on Friday, amid unusually warm weather though December, we see retail sales undergoing a marked correction to the 1.3% m/m November jump.

Eurozone

German data start the week with the 2023 national account data due on Monday, numbers likely to suggest a 0.2% contraction last year which would imply a similarly-sized q/q drop in the yet-to-be released Q4 figure. The same day sees EZ industrial production numbers which may show the fifth m/m fall in the last six months of data, led by more German weakness. The latter may help pull the German ZEW survey back down in numbers due Tuesday.

But the stand out event is the December ECB Council meeting account. These minutes should make it clearer that policy has peaked, the question being how unanimous this line of thinking may be and the extent to which rate cut thinking surfaced. But the extent to which markets are pricing in rate cuts may have driven the ECB into the surprise move to end PEPP reinvestments early and the full rationale behind this will be interesting.

Rest of Western Europe

There are key figures in Sweden, with the CPI update (Mon) where a clear fall is likely to just above the 2% target for the December CPIF inflation. This would be very much as the Riksbank has factored in but also where a bounce back toward 3% may occur early this year.

Japan

Following this week’s Tokyo CPI, we will have the National CPI on Friday, Jan 19. We forecast headline and ex fresh food to cool down faster than ex fresh food and energy but does not expect any surprises. BoJ’s focus is on wage and unless we see a significant deviation from our forecast, the CPI figure should have limited market impact. The rest for the week is tier 2 data.

Australia

Labor data will be the highlight for the Australian calendar next week on Thursday. The Australian labor market has stayed surprisingly strong even capacity seems to have peaked months ago. The continual strength in employment will no doubt accelerate wage growth, though the magnitude may be slower than previous forecasted. We also have private inflation data on Monday which should show further moderation and consumer confidence on Tuesday.

NZ

Business confidence on Tuesday, and Business PMI on Friday would be the only impactful release for Kiwi next week.

Highlights from the last week

https://admin.continuumeconomics.com/articles/9b12a558-2a61-47c9-9504-b7c10b1a3290